Market history is a graveyard of great companies that were terrible investments.

Not necessarily because that perception of ‘greatness’ proved unfounded, though that is common enough. But because people buy in at prices that are simply way too optimistic.

“No matter how wonderful [a business] is, it’s not worth an infinite price” — Charlie Munger.

The reality is that the stock market actually doesn’t reward “good” or “bad”. It rewards the gap between expectations and reality. Which is exactly why you can have a company post a succession of strong earnings results, only to see the shares underperform.

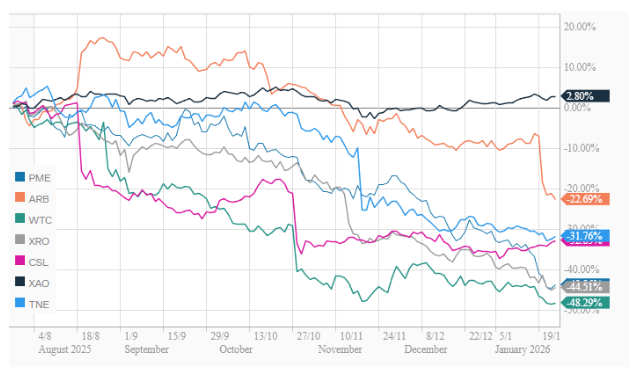

Probably the best example on the ASX in recent times is (former) market darling Pro Medicus (ASX:PME). The medical imaging specialist is undeniably a force of nature, growing profits 5-fold in the last 5 years alone, all with virtually no debt or equity funding and paying out most of their free cash flow as dividends. And the market opportunity in front of them remains huge.

And yet, shares have halved in the last 6 months, all while the broader market continues to punch new all time highs.

It’s not alone, either.

Xero (ASX:XRO), WiseTech (ASX:WTC), ARB (ASX:ARB), TechnologyOne (ASX:TNE), CSL (ASX:CSL), and others — all widely regarded as quality businesses with strong moats and a history of growth — have had a tough run of late.

These aren’t speculative, volatile microcaps either. None are facing any existential risks.

Perhaps these declines will prove temporary, and may in fact be great buying opportunities. But prior to these declines all were trading at multiples that were very much above what history might suggest was normal, even for quality growth stocks. They were, as they say, “priced for perfection”. Which is to say that delivering strong growth wasn’t sufficient to underpin good returns for shareholders as that was already seen as a given.

It’s a story as old as time.

In the late 1990s, Cisco was the backbone of the internet. It was a spectacular business. If you bought it at the peak, you were right about the technology, right about the growth, and right about the dominance. You were also down 80% a year later.

The lesson here is that investing is not just the study of business; it’s the study of value. A great company at a triple-digit multiple is a speculative gamble. A mediocre company at a basement price is a statistical advantage.

Here’s how Peter Lynch put it:

I ran $15 billion at Fidelity Magellan and the single biggest lesson I can give you is this: the price you pay is the only thing that determines whether you make money or lose money over time. Everything else is noise.

I have seen people buy the greatest companies in the world — Coca-Cola, Disney, Gillette — at 50, 60, 70 times earnings because they were convinced the growth would never end. When the growth slowed even a little, the stocks got destroyed. Quality didn’t save them. The price killed them.

I have also bought companies that were absolute dogs — companies losing money, companies in dying industries, companies nobody wanted — and made 10 or 20 times my money because I paid so little that the only direction was up. The margin of safety was in the price, not the story.

There is no such thing as a good stock at any price. There is only a good price for a stock. Pay too much and you lose. Pay little enough and you can be wrong about almost everything and still win.

I made 29 times my money in La Quinta Inns, a company nobody ever heard of. I made 20 times in Philip Morris when it was the most hated stock in America. I did not need a crystal ball. I needed a low price.

That’s been true since 1920 and it will be true in 2120. The price you pay is the only margin of safety you ever get.

Bottom line; don’t be afraid to pay up for quality. Good companies usually deserve a bit of a premium. Just don’t think that a deep moat, great management and a strong industry tailwind means you should buy at any price.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2025 Strawman Pty Ltd. All rights reserved.