The Atomos (ASX:AMS) share price reached an all-time high of $1.43 last week, before closing the week at $1.34. Will Atomos’ be able to maintain its strong growth?

What does Atomos do?

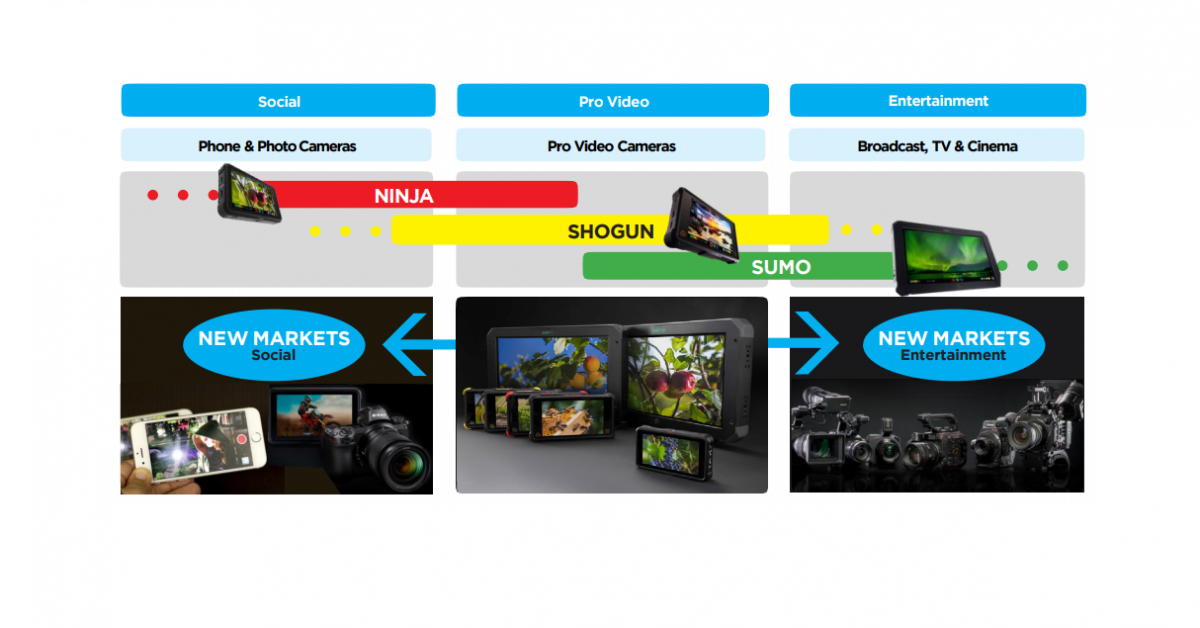

Founded in 2010, Atomos is a global software and hardware technology company supporting the rapid ‘democratisation’ and expansion of high-quality and accessible video content creation. Atomos created the world’s first video monitor-recorder. Atomos currently partners with a wide range of technology providers including Apple, Adobe, Sony, Canon, JVC Kenwood, Nikon, FUJIFILM and Panasonic.

Upgrade to FY19 Guidance

Last week Atomos announced to the market that it anticipated FY19 revenue to be in excess of $50 million (compared to its prospectus forecast of $42.2m). Atomos attributed its strong revenue and EBITDA performance to several factors including —

- Ninja V – sales from Ninja V substantially exceeded forecasts. Launched in September 2018, Ninja V is the first product launched on Ninja; a highly leverageable new technology platform incorporating a redesigned operating system, that will underpin a new suite of products in the next few years.

- Shinobi Device – two Shinobi devices achieved stronger than forecast sales. The 5-inch HDMI and SDI monitors target the rapidly growing ‘Social’ segment of the video market.

Other key achievements

Apart from its strong financial performance, the organisation has also achieved some important milestones in FY19, as highlighted in its early May 2019 Investor Presentation —

- Finalised license agreement with RED.com

- Released four new products: 2 versions of 5” Shinobi monitor only device, AtomX SDI module, Shotgun VII 7” monitor recorder

- Won multiple awards including the prestigious Red Dot Design Award for Ninja V

- Announced license agreement with Dolby Vision and collaboration with Pond5 (world’s largest video marketplace).

What is Atomos’ long term prospects?

One must not forget that Atomos only had its IPO at the end of 2018. Since then, its share price has nearly tripled supported by strong growth in original content spending (expected to reach US$ 23 billion in 2022). With the company already targeting another key growth market — the social video content market — can you expect continued growth in the company’s share price?

The Strawman consensus valuation currently sees the stock as undervalued by 41%. Click the button below to see what the Strawman community is saying about this stock:

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223