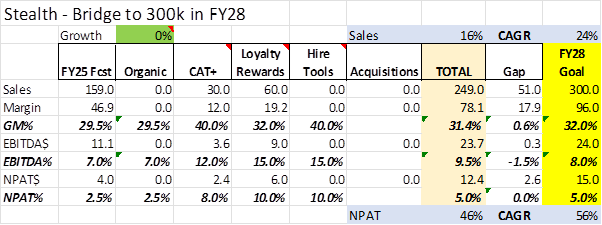

Below is a bridge of sales based on announced programmes from FY25 expected to FY28. I have only added values where SGI has provided targets to the market. There is a gap of $51m to reach the FY28m target, but there are three areas to fill this we already know of or can expect. No allowance is made for organic growth, the new hire business or additional acquisitions, plus we may see additional exclusive brand agreements over the next 3 years.

Reaching at least $250m by FY28 looks likely and the 300m target looks achievable without any heroic assumptions beyond what the company has executed on in the past.

159m: FY25 Expected Sales

60m: Loyalty Returns Program (Dec24 start, in progress)

Xm: New Hire Business ($ unidentified, possibly cannibalise sales but higher margins)

30m: New Exclusive Brands (Agreement secured, locked in)

Xm: 3-5% Organic (like for like) but store closures may offset so treat as nil

Xm: Acquisitions

249m+3X: Total FY28 Sales Bridge

Loyalty Rewards Program

· Launched Dec24

· $60m annual new sales opportunity

· From question at FY23 AGM, they are targeting 12-15% NPBT, >30% GP%

New Hire business (Hire One):

· Target 4Q25 launch (in final testing phase).

· 20 new “store-in-stores” to open by Jun25

· 13 week payback period then 100% margin – expected to grow margin.

Own & Exclusive Brand Strategy:

· EFM range (Force Technology)

· H1FY25, exclusive products represented 5% of total revenue (>10% higher margins)

· DullCo own-label mobile accessories launched in late 2024 in select IGA WA stores.

· Distribution Agreements (CAT Power Tools, Wesco Power Tools & Harden Tools): Contract sell through arrangements for $30m in sales by 2028. Wholesale margins >40% and increase retail margins by 30-50%

· RIVO (Big W & 7-Eleven) Brand: Starting with RIVO SAFETY (Collaboration with PIP Global Safety) a range of head-to-toe light industrial essentials

Disc: I own RL & SM