Pinned straw:

Atlas Pearls specializes in production of premium South Sea pearls, which are among the most valuable and sought-after pearls in the world. They operate across eight farming locations in the South Seas, they employ more than 1,200 individuals and harvests between 500,000 to 600,000 pearls annually.

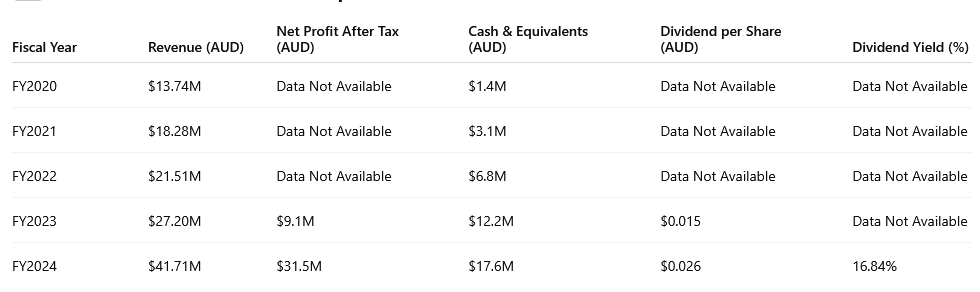

With a current Market Cap of $61m, FY24 revenue of $41m, FY24 NPAT of $31.5m, 75% profit margin, $20m cash, and no debt; the company is currently trading at a PE Ratio of only 2-3x. NOTE: FY24 was a record year for Atlas with a high volume of pearls sold and much higher that average sale price.

I expect slightly less revenue and NPAT for FY25 due to a decrease in the average price per pearl. However, the amount of pearls produced and sold are growing. Once the average pearl price normalizes and If they can continue growing earnings (as they have been since 2020) then its possible the market may re-rate the company with a higher PE ratio, (maybe 6-10x?).

Below is a snapshot of H1 25:

- Revenue: $19.1 million, a 29% increase compared to H2 FY24.

- Normalised EBITDA: $7.1 million, up 21% from H2 FY24.

- Net Profit After Tax (NPAT): $12.7 million

- Cash and Cash Equivalents: $19.4 million, representing a 10% increase from FY24.

- Operating Cash Inflow: $5.5 million.

- Dividends: An interim and special dividend totaling 1.00 cent per share (unfranked) was declared.

Key Observations:

- Consistent Growth: They have demonstrated a steady increase in cash reserves over the past five years, demonstrating good operational performance and cash management.

- Strategic Positioning: The accumulation of cash positions means the company is well positioned for future investments, potential special dividends, and navigating market fluctuations.

- Expansion in direct sales & B2B relationships: while still primarily a wholesaler, Atlas has:

- Begun developing direct sales channels (improve pricing power and reduce reliance on middlemen).

- Strengthened relationships with key jewelry and luxury buyers.

- Weaker AUD compared to USD and JPY (major buying currencies for pearls) has improved revenue when international sales are converted back into AUD

Risks:

There are so many risks with the company:

- Environmental Factors: Pearl farming is sensitive to environmental changes. Climate change and oceanic conditions can impact oyster health and pearl quality .

- Production Cycle: The maturation period for South Sea pearls ranges from 3 to 5 years, requiring long-term planning and posing challenges in responding to sudden market demand shifts.

- Market Volatility: Fluctuations in global luxury goods demand, influenced by economic conditions, can affect sales and profitability.

Let me know if anyone has any thoughts on this company.

Dominator

@GavCo I owned Atlas Pearls previously. Looks like things are still going well for pearl prices.

The profit figure for Atlas Pearls needs to be taken with a grain of salt (accounting issue rather than companies' fault). The valuation change in the oysters contributes significantly to the profit/loss (see image below). When doing my valuations previously I just removed this figure and then cross verified using the cash flow numbers to ensure they are in the same ballpark to get a "cash profit".

So, for FY24 backing out the change and account for a 30% tax rate I would call the cash profit around $15.7m and FCF is approximately $18.7m.

Looking at 1HFY25 and the auction results wouldn't be surprised at a "cash profit" in the range of $10-12m for FY25 (conservative? maybe more). With an EV of $43-44m (taking the dividend out of the cash figure) it looks very cheap again, especially if Pearl prices remain strong. Will be having another look to add a position again.

UlladullaDave

When doing my valuations previously I just removed this figure and then cross verified using the cash flow numbers to ensure they are in the same ballpark to get a "cash profit".

If there's no change in pearl prices shouldn't there be a wide discrepancy between these two numbers? Accounting profit would be much lower given most of the "profit" on the current period's revenue was recognised in a previous period.

Agree the accounting treatment makes it a bit messy.

Dominator

I won't pretend to be an expert at all on how that profit accounting works for Atlas. The revenues from sales appear to be recognised at a point in time of sale not over time from what I can tell from the accounts?

I am trying to assume no change in the "fair valuation" of the oysters to understand the real operating profits at the current time. Further inspection of my notes from when I owned, I used FCF as the primary metric to value the business. I guess I'm trying to say look at the cash flows its producing and take the $31m profit result from last year with a grain of salt as to me (a non-accountant) that appears to be paper profits rather than the real cash being produced by the business.

The fair valuation changes appear very sensitive to the inputs (image from financial report 1HFY25):

UlladullaDave

I won't pretend to be an expert at all on how that profit accounting works for Atlas. The revenues from sales appear to be recognised at a point in time of sale not over time from what I can tell from the accounts?

Yep, recognised at a point in time, but the accounting already books most of the profit on the eventual sale in the fair value gain (or loss) as the asset matures. That's based on forecasting a bunch of things like quality and price at the time of harvest. That's just how the accounting for biological assets works.

Imagine you are a farmer and you have cows that take 3 years to mature, along the way you have to feed them etc while they put on weight, the accounting is just trying to capture that sort of thing – with the unfortunate corollary of also trying to forecast future prices. It's a bit arse backward when you are used to thinking in terms of asset depreciation. Quintis is a great example of how that crystal ball can be used to manufacture (ie BS) profits.

JohnnyM

Two years ago, I invested in Atlas Pearls because the valuation was just so ridiculous and I couldn't figure out what was wrong with the company.

Mr Market and his weighing machine have said for many years now that this company is only worth between ~1 and ~4 times earnings. So cheap you can't help but wonder what other people know that you don't. Surely everyone but me knows a Dividend yield of ~18% is a trap.

I went through my usual process. A balance sheet with no debt, in fact it's net cash position of $20mil is ~25% of its Market Cap, it has great cashflow and amazing margins.

So, what is wrong with this company?

I had to admit to myself I know next to nothing about the front end of the business. The Marketing, Pricing, Sales and Distribution of Pearls. Probably because I've never actually wanted a Pearl Necklace.

I note LeBron James occasionally sports a Pearl Necklace to press conferences... good for him.. but too trendy for me...

I've heard if one oyster coughs they all catch a cold. I have no idea if that's true or not, but ATP has spread its 8 farms across the length of the Indonesian archipelago. Surely, they can't all catch a cold hundreds of kilometres apart.

OK, they are obviously a price and volume taker like all primary producers. Last years ~50% net profit margins are about to be tested as the December auction data was lower than prior year and they also warned direct channel sales were lower.. The H1 FY26 report will make for interesting reading. I can't imagine many of their costs are variable, but I'll be surprised if they don't post a decent profit.

Yes, having your business in Indonesia means currency exposure. The Indonesian Rupiah has been relatively stable for decades now, albeit they could knock off a few zeros like Turkey did (Insert Fiat currency Vs Bitcoin rant here). I lived in Jakarta for Brambles many moons ago.. Doing business in Indo is very different but you can still get things done... As ATP has proven for over 30 years now, so I don't think that's the problem.

Growing up in the NT you learn early that the Paspaley family are the richest family from Darwin because of... Pearls. Maybe I've inherited a bias!

Despite watching this company for a few years, I still don't know what makes it uninvestable.

This week I find myself in Bali doing a lap of the island on a motorbike.. because why not! So, I thought I'd pop in and do a site visit of ATP's Pearl farm in North Bali. It's very informative on operations side. They demonstrate seeding a Oyster’s gonads with a Nucleus... ouch!!

Oysters are apparently hermaphrodites.. the things you learn on holiday hey!!

After my visit I'm still none the wiser how Atlas sell Pearls at auction in Kobe for ~$80 a piece and ask ~$470 a Pearl at their onsite retail store.

Clearly the direct-to-consumer channel is far more lucrative, but I'm happy Atlas don't have a glistening flagship store in [insert bright lights and rental cost here].

I think part of the valuation issue here is due to the size of the company and stock's illiquidity. Big market participants just don't get the opportunity to form an opinion. They can't vote in short term popularity contests that might make the share price pop and more importantly they are precluded from weighing up the company's long-term prospects.

Those of us small enough to take a nibble are left wondering, what have I missed here?? After all, if it's too good to be true...

@Strawman any chance you can reach out to the CEO for a chat? They don't do any investor relations meetings that I can see. But surely your "no gotcha questions" style of chat would suit them well.

I've got a few questions... I'm happily banking my dividend cheques but still wondering why this business is so cheap!

Cheers

JM

Strawman

Great post @JohnnyM

The PE may be low but that doesn't seem to have stopped a great run in the share price over the last 5 years.

I haven't had a close look, and know zero about the industry, but I guess perceived risks (warranted or not) re aqua culture could be a factor too?

Definitely keen to learn more though, so will reach out to them for a meeting.

RMKD

I’ve had my finger hovering over the buy button the last few days but had the nagging feeling that I’m missing something. I would be really interested to know about their plans for more direct sales given how much more profitable it is.

tomsmithidg

@JohnnyM I love the idea of this company too, but have zero idea as to how to value it, what could go right or what could go wrong. I first added it to my watchlist back in June and it's up almost 36% since then so disappointed I didn't take the plunge, with maybe a little taster position. Like @RMKD , I hesitated due to wondering what I was missing, the old 'if it looks too good to be true it probably is'. Of course since June in addition to the capital growth it has also paid 10% so far in dividends based on what would have been my buy in price. So now in addition to my lack of knowledge of the business I'm contending with my aversion to buying something at a higher price than what I could have got it at when I first looked. So if you can get them on @Strawman I'd be very interested as well.

RMKD

I’ve moved myself out of limbo and taken a small position to help inspire some keener research

Bear77

I'm personally wary of any investments in Australian companies who have their operations in countries like Indonesia where the goalposts can be moved without notice. Various mining companies have lost control of assets in countries like Indonesia and PNG over the decades I've been in this game and so I can understand the market giving this company a large discount because of perceived "sovereign risk" purely because of where their operations are located. It doesn't mean the market is right but it's likely why the company looks so cheap.

Scoonie

Agree @ Bear77

It is sometimes hard for Australians to understand just how risky investment in some part some parts of the world is where there is an absence of the rule of law. We are inclined to take the law and reasonable human behaviour as a given.

Hedley Widdup from Lion Selection Group (ASX: LSX) had a very promising gold tenement in Indonesia. The Indonesian interests were initially welcoming, however as LSX spent and proved up the project they started to get heavied.

The ASX sale announcement of the Indonesian gold project reads positively but privately there was immense pain for LSX and they now publicly state they will never invest in Indonesia again. This is not an isolated experience.

(Perhaps a counter to this is the massive investment of Chinese money into Indonesian nickel laterites and smelting. Maybe these investments are so large and China so powerful they become the law. Maybe the same applies to Chinese investment in a lot of under-developed countries).

BkrDzn

I don't think Indonesia lacks rule of law per say, its that what is defined as rule of law there is different to Oz, or the US or China. And rules of law can change at any time through legislation or political will even in "safe" western countries. This is in essence sovereign risk.

Tom73

@JohnnyM , you peaked my interest with this one. I don’t mind that the price would be influenced by the bio-asset valuation issues, low liquidity, risks to stock (even noting the geographical spread) and the fact that it’s in Indonesia (defiantly some sovereign risk, but so far it has been ok – could change). However, what has broke it for me is where the price of pearls are in the commodity cycle.

Having been low for many years (like the share price up to a few years ago), the price of pearls kicked off in FY23 with Atlas getting most of the benefit in FY24 and we now see the prices come off highs, but they are still had a very good FY25. This article covers it:

Akoya Pearl Auctions and Market Trends in 2025

I don’t mind commodity cycle businesses, but it’s critical to get them at the right point in the cycle and the ultra low PE is telling us that the market believes it’s coming off the top of the cycle and earnings from the last couple of years are not sustainable. If prices return to pre FY23 levels then my guess is so does the ATP share price (ie <5c).

For ATP to be a bargain I would need to assume current prices will persist for at least 3-5 more years. The current price looks (no details number crunching – just a feel) to anticipate lower prices but still a little up on pre FY23. I am think the cash pile has also been considered.

The companies FY30 financial strategy looks nice (plan 30-50% output growth on what seems a low capex path), but it’s what happens to the price of pearls in the meantime that will be a bigger impact on shareholder returns.

If you or anyone else has any information on why the price of pearls may remain at current levels for a while (or how to analyse the cycle) then I would definitely be interested and take a deeper look.

Cheers.

RMKD

May not just be a cyclical commodity cycle issue. Perhaps the longer term decline of the Japanese pearling industry due to climate change, disease, ageing population and labour shortage may keep the prices up. I haven’t looked too far into this.

edgescape

I think Atlas and the pearl industry is perhaps too under the radar for the Indonesian govt to consider any restrictions. It's not like they are making millions from mining and taking a big fat profit offshore.