Pinned straw:

For me the concern / risk with BOT was always in the performance / expectations around digital / DTC.

My background / experience is in digital having run marketing / digital agencies for the past 15+ years. I have also been involved with businesses that operate on a similar model in the mens health space (ED, hair loss, weight management etc) so I have a rough grasp of expected funnel conversion rates when path to purchase involve telehealth.

From the change in messaging I suspect that they had very high expectations on the DTC channel and were hoping this would provide a high percentage of the patient acquisition. This in turn would prove out the "platform", keep reps (and commissions) to a minimum, and make greater margins. This would also enable them in theory to plug in similar underperforming products to the platform and "supercharge" their returns.

I think they were sold the dream from their agency and significantly underestimated digital CAC. They gave it a few months and are now having to pivot to a much more traditional sales model based on boots on the ground. Matt mentioned DTC was low and CAC was high in his Strawman interview a couple of months ago and the presentation this week left it out completely.

Whilst it has been mentioned here that the creative hasn't been great (which I agree with), the main issue is going to be ability to target their audience effectively. Outside of the very high quality (but low size) audience they get through the International Hyperhidrosis Society they are going to have very few digital segments to go after. A sufferer of HH is very unlikely to list this as an interest on social and search volumes for HH related terms are very very low. The slide they showed at launch around targeting was complete marketing BS, its just not the way audience segmentation works in reality, its spin by their agency.

With DTC they are not just aiming at "active switchers" as there aren't really enough of them they are looking to educate an entire segment both on the product and also on the platform to prescription. This is a long and expensive play with very low conversion rates and very very high CAC.

If this is the case it might explain the slow start and may also suggest that performance to date is not indicative of future performance its just that they backed the wrong channels at launch. If so it does however blow a bit of a hole in the platform and its potential to "turn around" additional products moving forward.

The site going down this week may indicate that they have fired or have changed the scope with their agency. If the agency are still managing the site then they should be bloody fired, there is no excuse for a site to be down for that long and if the site was indexed during that time it would have undone any organic gains since launch. We would expect to be sued if a site under our control was down for more that a few minutes let alone hours / days. They will have uptime guarantees (usually 99.9%) in any of their agreements.

I still hold (a lot) of shares in BOT. My hope is that they hire as many sales reps as possible, in as many regions as possible, as quickly as possible and focus on "what they know" i.e. how to sell a pharma product through traditional channels to really give Sofdra success a chance. I don't think we have any idea of potential performance moving forward however I think we can guess their marketing / launch strategy to date has been a bit of a train wreck.

@Tom73 Yes I was waiting for a post mortem to start, I have fully digested the shit sandwhich I choked down yesturday and have been attempting to square many circles and snapped about 12 biro's.

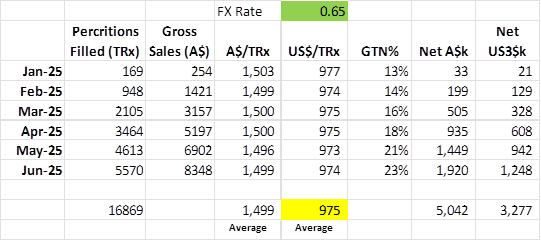

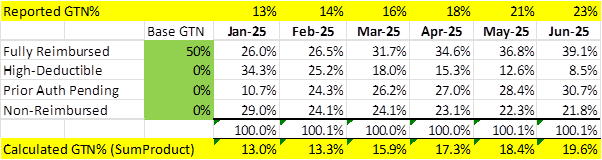

When you look at the HDC going to zero and you would have to think the freebies stop after 12 months? 35 % GTN seems achievable and it is trending that way.

I have been processing the mish mash of data..

Based on the new data this is a bust if they can't:

- Add net 1000 total users per month (you would think doable considering a doubling of the sales force) fk knows what the digital is doing.

- move up to 35% GTN.

GTN must hit 30-35%, if it is more towards 30, really need more than net 1000 users added per month

On the current growth path, cash available doesn't appear to be a massive issue with more revenue hopefully flowing by end of year. We will see.

as noted in the presentation, they should get good ROI on additional reps.

*COGS - 50USD / unit

*Bodor Royalty , 5% net sales

look to potentially be cashflow positive Q4 next year provided above is true.

TLDR - not a rocket ship but cashflow positive still looks possible off what appear to be achievable targets.

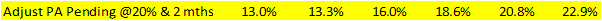

GTN table - They are all trends where in italics so don't tally perfect to 100% but the takeaway here is if it doesnt trend to 35% its a big issue. Assuming a bit of a dip on the CY reset, but hopefully offset by a drop in the free units...

With all the murkiness around the users my new target will be a minimum of 1200 added to the active base each month (if it continues downward and the june low wasn't a one off that is a major issue.

*edited to put script gross price in AUD, all in AUD now.

cashflow -

added in additional reps at 225k USD per rep broken down to quarterly costs, added in 2 x tranches.

COH, was 28m end of April + the raise + the debt facility for total of 111m, less op costs Q2 COH end of Q2 94m ( I am counting the undrawn debt as COH)

**COGS isn't factored into the cashflow costs, it is taken out of the income line, they had a boat load made up already so shouldn't need to build an excess of inventory, only replace what is used..

Other outcomes,

If GTN peaks at 30%, still cashflow positive, but barely in Q3 CY26