This is just a start in re-understanding BOT…

I am starting with understanding GTN both % and $. I think we can learn something useful from yesterdays presentation about this, unlike the other important disappointment regarding patient and prescription numbers which has a lot of fog to lift.

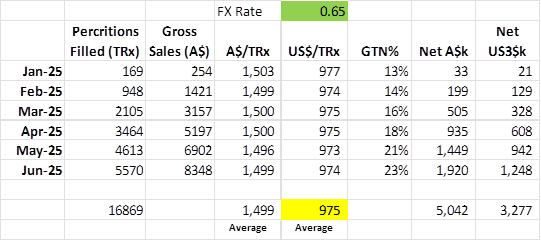

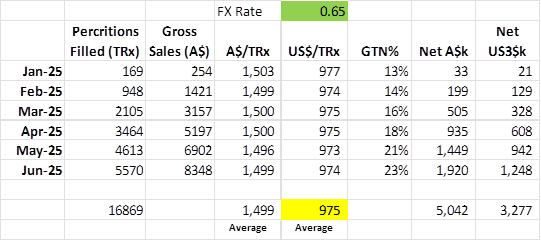

So what is the Gross Sales per script.

Matt had indicated that the Gross sale price was between US$500 and US$1,000 but closer to US$1,000. So US$750 to US$1,000

Based on the presentation the Gross Sales per customer is US$975, this is an average but one with very little variability – suspicious? maybe, or just a fact from initial launch and single distribution channel (welcome input on how these prices are agreed with insurers from anyone who knows, or there is something wrong with my calc).

So what is the GTN% profile and likely Net.

Initially Investors were told to expect approximately US$450 per prescription as net revenue. This was talked back recently to US$400, but analyst EUROZ still had the US$450 per prescription back in May.

Assuming they knew the gross price of US$975 at the time (which is reasonable given insurer negotiations were mostly done), that would be an average GTN% of 46.2% at US$450 net sales. They would have taken into account some element of deductibles would eat into a fully reimbursed margin, so we can probably assume that Fully Reimbursed GTN% is over 46.2%.

The subsequent talk down to US$400 (41.0% GTN), was probably in response to early indication on higher deductible impact and the sales approach effect of Non-Reimbursed sales or sales prior to authorisation ending up not being authorised.

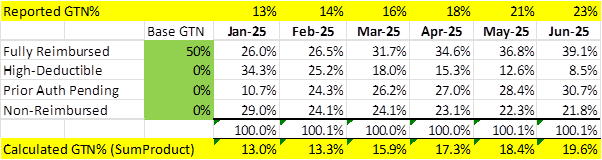

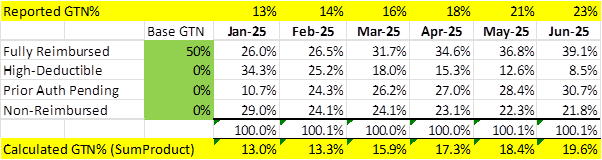

The presentation sets out the types of reimbursement status that impact GTN. It also shows the weight but not what the GTN% of each group was. So here is my attempt to unravel the confusion on what each group represents in terms of GTN:

Full Reimbursed Units: These are full margin, highest GTN% sales which should only be offset by patient rebates (co-pay coverage), which on slide 10 is 50%. I am assuming the “Managed Care Rebates” of 21% are not included or any wholesale costs due to cutting that out. So may be 50% GTN% for these sales.

High-Deductible Units: BOT will cover the deductible for patients, which added to the other out of pocket coverage is the total price. Hence, I expect these are all 0% GTN%

PA Pending Units: This is messy, BOT would get nothing until they receive authorization, which they say 70% get approved, so 30% they get nothing ever and presumably stop (or become non-reimbursed). The rest may start to be reimbursable later, I assume those issued prior to authorisation don’t get reimbursed later. So at best they get 70% of the Full Reimbursed, but with a delayed – so I don’t think we see revenue until later and at a lower average GTN%.

Non-Reimbursed Units: They should just call these “Free Samples”…

So let’s assume a 50% GTN% for only Fully Reimbursed and zero for everything else and see how it lines up with the reported GTN%. Below you will see it starts on the money but a gap opens up to be 3-4% low by June.

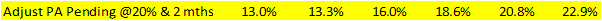

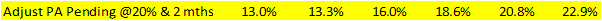

So I played around with the % for Prior Authorisation Pending and delayed the impact by a few months and got a good fit at 2 months delay and average GTN% of 20%.

While not conclusive, it indicates to me that the GTN% for Fully Reimbursed sales is likely around 50% (from both this calc and the inference from the US$450 expected net on extrapolated gross US$975).

Given it is very early days, I think we can expect the weight of PA Pending and Non-Reimbursed to drop steadily as a total %, also the High deductible will be seasonal. So GTN% should improve, but how quickly and to what steady state I am unsure. To get to a US$400 net per script, they would need to get to an average of just over 80% of scripts being Fully Reimbursed as an example.

Conclusion

1. I am comfortable that GTN% will improve steadily, the rate of growth in patients will impact this significantly. Faster growth will hold GTN% back given the low base, but as the patient base matures we will see much higher Fully Reimbursed % and so higher GTN%

2. A 50% GTN% for Fully Reimbursed scrips seems to be reasonable given the current distribution model. Hence this is a cap, but a high cap, so we may see 30-40% GTN% in the next year, but over 40% will be a way off and challenging.

3. It is also clear that as much as we as investors are struggling to understand the economics of the business, those in the company are also challenged…

Disc: I own RL+SM