@Rick first up, thank you for your thorough and characteristically thoughtful analysis of $IPH. I have also been thinking about this one, since you first asked the question (as it wasn't really on my radar screen before then).

I wanted to make two observations here:

- The long term track record of the business, and how to consider the current valuation in that context. (Is the bottom in? Risk?)

- AI - headwind, tailwind, both, neither?

This post simply tries to capture some thoughts stimulated by your work that ahve been rattling around in my head for the last week. I've not yet reached a conclusion on whether I am going to invest in $IPH - mainly because it is not in the class of businesses that normally fit with my investing style and "circle of competence" (or relative lack of incompetence!!)

1. Performance over the long term ("Being Paid to Wait ... But Waiting for What?")

As is often the case with roll-ups, EPS growth over the long term provides a good indicator of value creation.

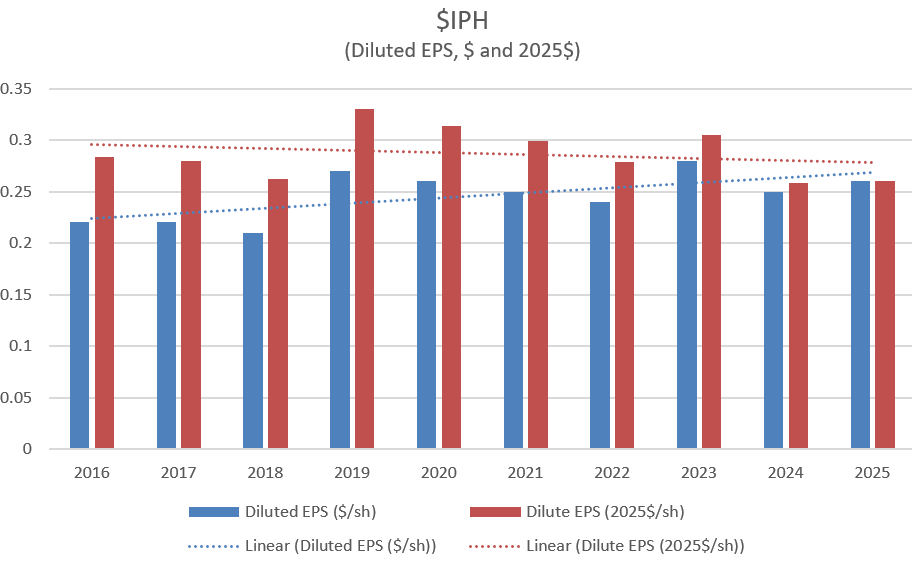

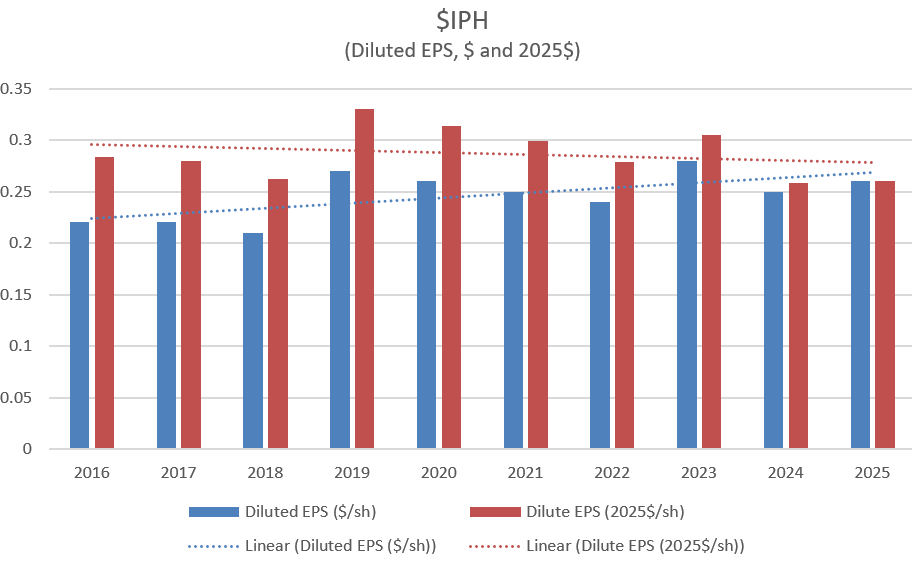

And this is where IPH can be seen to be a laggard. Diluted EPS was $0.22 in FY16, and only advanced to $0.26 by FY25, a material decline in REAL terms (as shown below).

For me, this demonstrates that $IPH is not a high quality business. It is not something I would normally consider investing in for the long term.

However, that doesn't mean that the business isn't materially undervalued today. And do I am interested in the potential thesis of whether it represents a short/medium term value recovery idea.

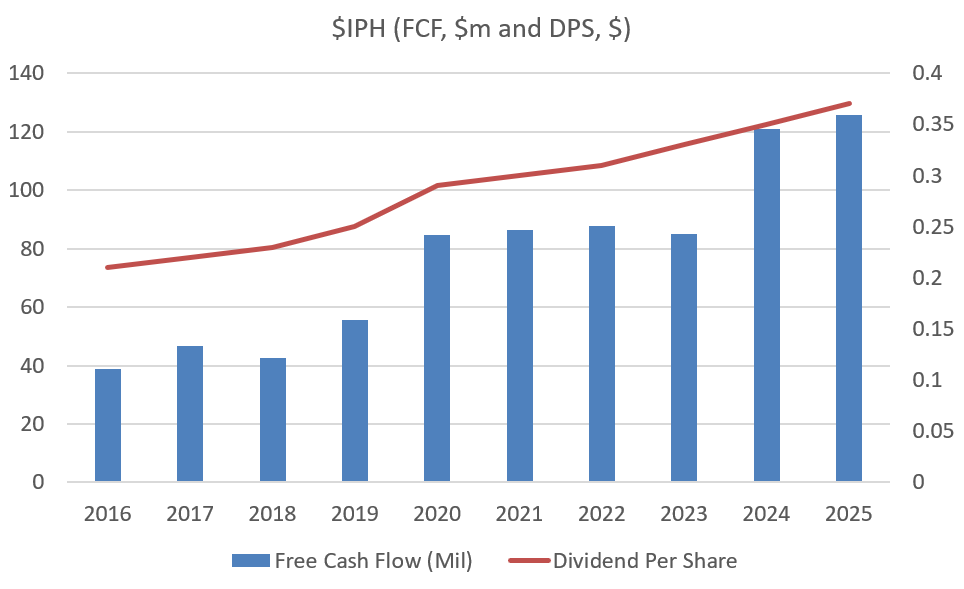

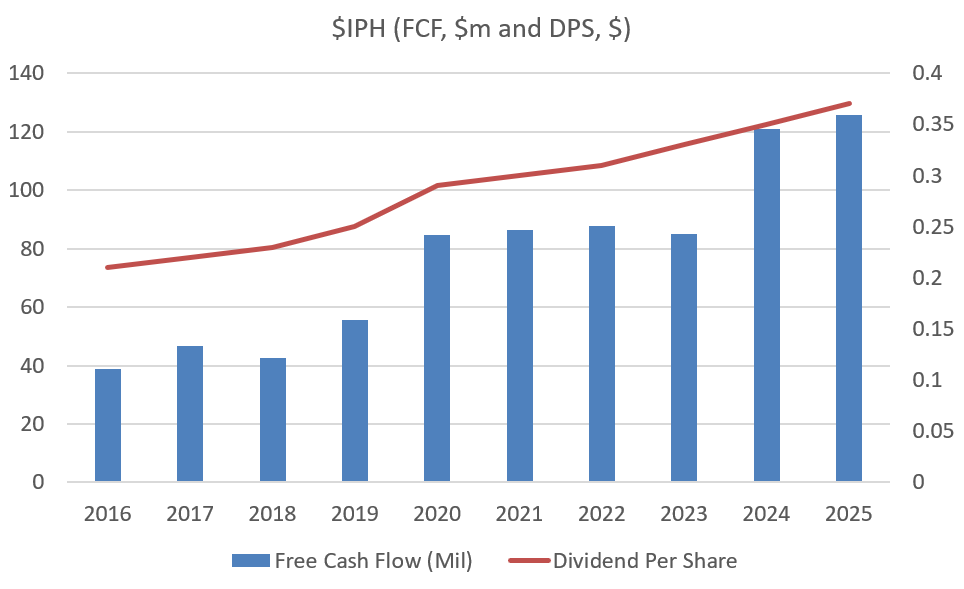

Over the last decade FCF and DPS have grown steadily - underscoring that if the furture looks like the past, then this can be expected to be a solid performer on these metrics. As you've noted, the dividend yield is attactive, and it looks reasonable secure. (The business is not unduly leveraged, and so can flex to protect the payout if needed in the short term).

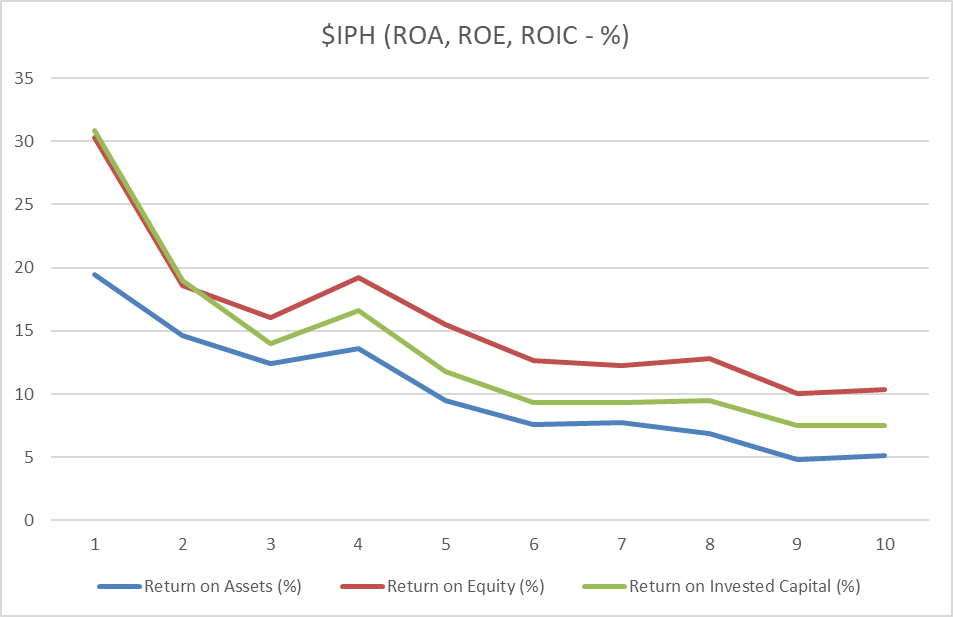

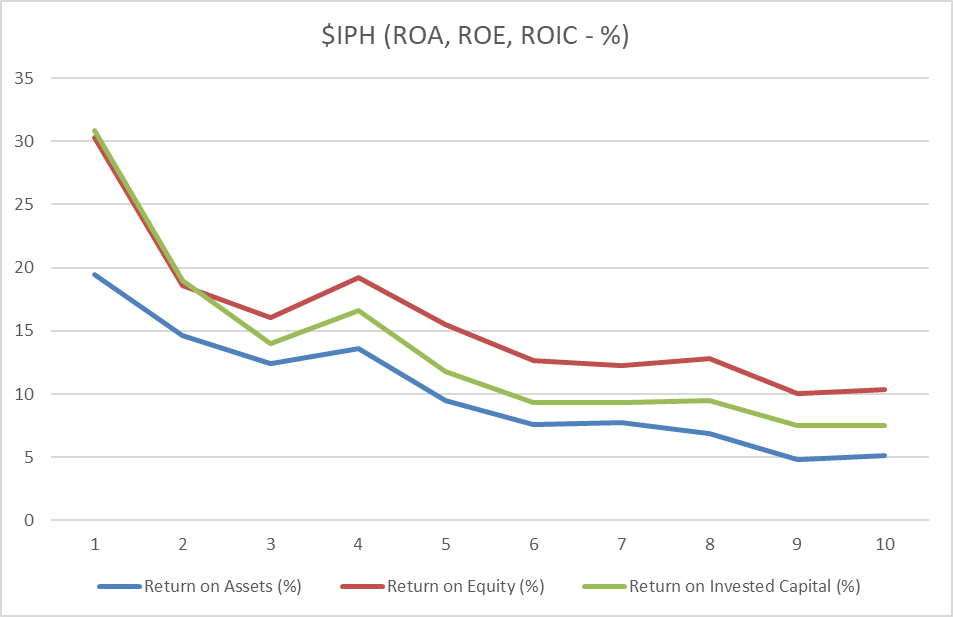

The arguable disconnect between the poor EPS progression and the cash and dividend metrics can be seen in the returns performance - a steady deterioration over time as the business has scaled through acquisition.

Arguably, management have been reinvesting rationally, until recently. If you consider that the WACC for this business is around 7.5% to 8%, than ROIC has fallen to the WACC, and so you'd expect a strong payout ratio, unless they can lift the returns of the operating business.

Note: The current ROE I have pulled from the Morningstar Quant. report (the source for all the above numbers) is 10.34, is a bit lower than yours.

I agree that this is the kind of stable business well-suited to using McNiven's Valuation method, and I note your recent valuation assumes that ROE will rise to 14%, a level which according to the numbers above we haven't see for quite a few years.

So my question, in considering this as a short/medium term recovery investment, is: are the following factors are enough to drive ROE enabling the re-rating of the business?

- leveraging #1 positions in ANZ/SG

- growing Canadian scale

- strong cash conversion and disciplined leverage

- apparent FY26 tailwinds: Asia filings, CIPO normalisation, cost-out, Canadian synergies.

I don't know the answer to these questions. But I think there are enough levers and also enough confidence from the historical performance that it is probably safe to say the bottom is in, and that indeed with a stable dividend we can "get paid to wait"?

My remaining question is therefore "wait for what"?

Which then turns me to my second point - a completely different point. And it is, how is the increased use of generative AI going to impact this business?

2. Generative AI - Headwind, Tailwind, Neither, Both?

The rise of generative AI is set to reshape demand for intellectual property services in complex, offsetting ways.

For firms like $IPH Limited, the most immediate impact will be in patent filing, where generative AI is driving a surge in new inventions and accelerating R&D productivity. This expands the pipeline of patentable ideas, while a shortage of qualified patent attorneys suggests underlying demand will continue to outstrip supply. However, AI will also automate much of the routine drafting and prosecution work, cutting billable hours and pushing clients to expect lower costs, creating margin pressure even as filing volumes rise.

Trademark services are likely to experience more modest effects. Their demand will still track overall business formation, branding activity, and e-commerce growth. AI tools will improve search and filing efficiency, and the explosion of AI-generated content may require new trademark strategies, but the overall impact is expected to be stable to slightly positive.

We can expect significant growth in IP defense and litigation. Generative AI introduces unsettled legal questions about ownership, copyright infringement, and the legality of training data, all of which are already fuelling lawsuits. As AI-related patents proliferate, so too will infringement disputes, freedom-to-operate analyses, and litigation over data use. Courts will actively set new precedents. This will drive strong demand for contentious IP work and high-value strategic advice.

For IPH, this evolving environment presents both opportunities and challenges. While overall volumes will likely grow, especially in AI-related patents and litigation, routine services will become more commoditised and margins thinner. Firms that invest in AI tools, reposition toward higher-value strategic and advisory work, and build expertise around AI-specific IP issues will be best placed to capture the upside. Done well, the growth in complex, premium work should more than offset any efficiency-driven compression in traditional revenue streams.

So, how is $IPH positioning itself in this area?

To date, it has said little. But we can glean a few clues from statements made over the last two years.

While $IPH Limited has not announced a sweeping AI strategy, it appears to be steadily positioning itself for an AI-driven future through incremental, practical steps. It has introduced a Group AI Usage Policy, begun developing in-house AI tools, and is assessing their financial impact, signalling a clear intent to embed AI into workflows to improve productivity and client service.

Alongside these moves, $IPH is advancing a broader digital transformation: upgrading case-management systems, standardising processes across practices, and expanding digital platforms like Applied Marks and IPHQ News. These initiatives will facilitate deeper AI integration over time.

Overall, $IPH’s approach appears to be cautious and deliberate. Rather than headline-grabbing announcements, it is quietly preparing its operations, services, and infrastructure to harness AI’s potential, enhance efficiency, and strengthen competitiveness in a rapidly evolving IP services market.

My Overall Conclusions

In the knowledge economy, using generative AI is going to become table stakes, if we are not already at that point.

Whether AI forms part of a value recovery thesis for $IPH in my mind depends on the interplay between two factors - external and internal:

1. The macro impact of AI driving innovation/ R&D and increasing the demand for IP services (both IP creation and IP defence)

vs.

2. The extent to which IP service providers like $IPH adopt AI to improve their own efficiency and productivity, and become able to do more for less.

The annual $8-10m cost out delivered through FY25 and flowing into FY26 contains a component of efficiency from embedding AI into workflows and broader platform optimisation. However, this seems a modest impact compared with the potential increase in demand for services that may be coming. On the face of it, it looks like $IPH is simpling putting up the table stakes, rather than creating a competitive advantage.

So, while it might not outperform its sector, if 1, (above) >> 2. (above), then we could see a marked improvement in performance over over the next few years.

No answers from me today, but I thought I'd share my thoughts.

Disc: Not Held (but considering)