Pinned straw:

17th September 2025: Timing-to-finalise-CTM-FY25-Financial-Statements.PDF

Source: Timing-to-finalise-CTM-FY25-Financial-Statements.PDF [17th September 2025]

See also:

Opinion: Could the long fight over Corporate Travel be reaching its denouement?

Jamie Pherous has been battling short-selling hedge funds for most of his life, as chief executive of the business travel specialist. Now his stock is suspended.

Jonathan Shapiro, Senior reporter, AFR, Aug 31, 2025 – 8.49am

When the shares of Corporate Travel were placed in a trading halt around lunchtime on Friday, August 22, it seemed as though the moment of vindication for the company’s legion of sceptics had arrived.

Jamie Pherous, founder of the ASX-listed company and a former accountant, floated the travel agency in 2010. And for the first five years, he enjoyed the status of a celebrated founder. But for the past decade, he’s been at war with short sellers and cynics, who have continuously questioned his bookkeeping and the share price that has been guided by the numbers he presents.

Corporate Travel Management founder and managing director Jamie Pherous. The boss’ war with short sellers went nuclear on a sleepy Sunday in October 2018, when hedge fund VGI Partners alleged aggressive accounting and poor disclosure. [image: David Rowe]

So when the Friday lunchtime announcement revealed a dispute with its auditor Deloitte that would delay the release of its full-year accounts and lead to material corrections, hearts began racing on all sides. Was this long-running market stoush finally reaching a definitive resolution?

Since that day, Corporate Travel’s ASX updates have suggested that any potential fallout from the auditors’ concerns may be less significant than feared – relating to a quibble about jurisdictional revenue recognition.

The outcome is that previous years’ profits will have to be adjusted upwards at the expense of this year’s profit, the company has since said. But we won’t find out exactly what the issue is for some time.

That creates an unusually long stand-off in a war that saw its opening salvo fired way back in November 2016, at the first Sohn Hearts & Minds investment conference. In the final session of the day, Perpetual portfolio manager Anthony Aboud told the audience why he was shorting the travel agency after its share price had increased 18-fold since its 2010 listing.

Corporate Travel, Aboud explained, was a classic roll-up play, using its high market valuation to buy the earnings of other businesses that in turn are revalued at the higher value, lifting the share price. The company’s growth therefore relied on continuously buying other businesses.

“The PE magic only works for so long,” Aboud said at the time.

The war with short sellers went nuclear on a sleepy Sunday in October 2018, when VGI Partners dropped a 178-page presentation that alleged aggressive accounting, poor disclosure and phantom locations.

The rare activist campaign divided the market and left scars on all sides as Pherous countered the hedge fund’s claims.

Fending off short sellers was arguably easier than dealing with the existential threat of a global pandemic in 2020 that completely shut down all forms of travel. While the likes of Flight Centre and Webjet were forced to raise hundreds of millions of dollars to survive the lockdowns, Pherous miraculously avoided an emergency capital raise. The bespoke travel needs of governments and businesses meant higher-margin contracts, and both the business and its share price proved resilient.

Pherous also used the global shutdown to make deals, flying to Omaha in September 2020 at the height of the global lockdown to ink the $274 million acquisition of Travel & Transport.

If ever there was a moment to declare victory, it was in the post-pandemic glow, with Corporate Travel’s shares topping $25 in April 2022.

But despite all the clear air, Corporate Travel has failed to entirely rid itself of cynics. The company and its enigmatic founder have left the market as divided as ever.

Questions about its accounts have lingered, and short sellers have refused to go away. Among the most divisive issues are the company’s confusing disclosures about the materiality of its United Kingdom asylum seeker contracts, and a highly unusual share transfer to former executive Laura Ruffles.

The accounts have also got short sellers trying to work out exactly what game Corporate Travel is playing. Why did they really abandon reporting total transaction volumes in 2023? And what explains the big swings in profit and margin from its European business over the past five years?

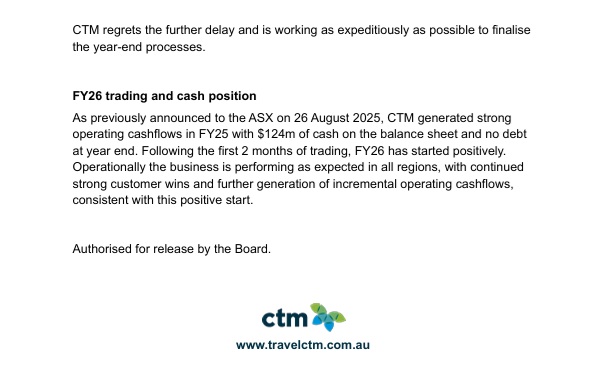

There also appears to be a hole in Corporate Travel’s earnings. The company has made two major acquisitions in the past five years, with little increase in profit. Two years ago, analysts had expected earnings in the 12 months to June 30 this year to come in at $300 million. Last year, that was revised to $250 million, and this year, consensus was closer to $160 million.

According to some brokers, cash and accounting profits matched each other for a decade – until 2022. That’s when the relationship broke down, ultimately creating a gap that has now stretched to $200 million.

Corporate Travel naturally sees things differently. A spokesperson said the two acquisitions – Travel & Transport and Helloworld’s corporate unit, purchased for $175 million in April 2022 – are contributing to earnings in its non-European division. This part of the business, the company says, is growing its earnings at a healthy clip, and will continue to do so.

Corporate Travel says it is also converting revenue and profit into cash. Its cash conversion target – between 80 per cent and 90 per cent of operational profit – is being met, as evidenced by its $124 million cash balance.

To explain the profit swings in Europe, Corporate Travel pointed to previous statements that the business had been in a state of transition while lucrative war-related travel projects came to an end. It was also winning new customers at a record rate, it said, and the current year had started well.

“In the absence of FY26 guidance until we report, the May 2, 2025 commentary states the new customer wins will be a positive contributor at group and Europe regional level in FY26,” the spokesperson said.

The new customer wins, along with reports from global airlines that activity was picking up, lured buyers to Corporate Travel’s stock heading into reporting season.

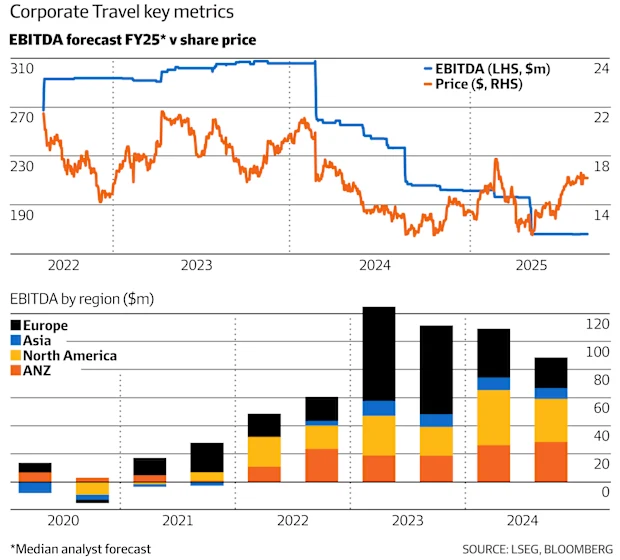

Short interest also edged higher. More than 10 per cent of the share register had been loaned out to hedge funds, a four-fold increase since the start of the year. This put Corporate Travel among the 10 most shorted stocks on the local sharemarket by mid-August.

Then came the trading halt.

The company had recently switched auditors, replacing PwC with Deloitte. Corporate Travel has since hired KPMG as a third party to help resolve the accounting issue, which relates to the timing of revenue recognition.

It’s not the first time an ASX-listed travel agency has found itself in a dispute with Deloitte. And there are some complex accounting rules regarding whether to book revenues at the time of ticketing or the time of travel, which some say may hold the key to understanding Corporate Travel’s bookkeeping mysteries.

Word is that the situation is resolvable. The consequence would be that earnings from prior years increase, but the current year’s decrease. The changes were non-cash-related, and an update like that would seriously reduce the stress levels of fund managers holding the stock.

But the lengthy delay does complicate life for them, at least in theory. Will they value Corporate Travel at the last traded price of $16.07 for any investors seeking to subscribe, or to redeem their funds, or will they apply a discount?

We’ll have to wait until Corporate Travel get its books in order to know the current earnings capacity of the business, and the premium or the discount that the market applies to the stock.

But there is a bigger, lingering question. Will we be able to declare a winner in the long-running war between Corporate Travel and its sceptics? That’s unlikely: Jamie Pherous’ power to divide the market remains as strong as ever.

--- ends ---

Source: https://www.afr.com/markets/equity-markets/could-the-long-fight-over-corporate-travel-be-reaching-its-denouement-20250827-p5mq51 [31st August 2025]

Data sourced from: https://www.shortman.com.au/stock?q=CTD

The shorters are not always wrong.

Discl: Not held.

Bear77

Friday 17th October 2025: 8:25pm: CTD have now been suspended from trading for the past 8 weeks over their auditor's refusal to sign off on their FY25 full year accounts unless they restate revenues in previous years which would result in what would obviously be a material downgrade to their FY25 revenue.

The company has not said anything since their announcement exactly one month ago on September 17th: Timing-to-finalise-CTM-FY25-Financial-Statements.PDF in which they said: "CTM has engaged KPMG to conduct a detailed review of FY23-25 financial statements for the European region and is working with its auditors to complete the audit of the FY25 accounts. Despite progress being made, it has become clear that the significant amount of work being undertaken by KPMG and management and the subsequent audit work required cannot be completed in time to finalise the financial report by 25 September 2025, as previously targeted. CTM expects to be in a position to provide a further update in November 2025."

I have already posted a straw about this here (this is a comment tacked on the end of it) however upon reflection this appears to be more than just shifting a little revenue recognition from this year back to some prior years if it's going to take KPMG at least 2 months to "conduct a detailed review of FY23-25 financial statements for the European region" and to work with CTD's auditors to complete the audit of the FY25 accounts.

And CTD are only guiding for a "further update" from them to the market in November, so it could take longer. They haven't given any guidance about how long they expect to remain suspended from trading, but clearly it's going to be until after they've complied with the ASX listing rules by lodging their fully audited FY25 accounts AND satisfied the ASX (and possibly ASIC) with their responses to the inevitable "Please Explain" emails (from the ASX to CTD) that the ASX will want answered to their satisfaction before lifting the trading suspension.

It would appear that this might go to the heart of CTD's revenue recognition practises that underpin their business model that were the subject of hedge fund VGI Partners' 176-page short report on CTD back in 2018 - see here: https://www.smh.com.au/business/companies/corporate-travel-management-rebuffs-short-seller-bombshell-report-20181031-p50d1m.html

Other accusations and issues raised by VGI Partners at the time included that CTD had overstated its global office footprint by listing a string of "phantom offices" on its website, questions about its cash payments to staff, its discount compression in goodwill testing, and low-interest received on its cash balances.

But the core of VGI Partners' short thesis on CTD in 2018 was that the travel booking group's earnings in the previous year were significantly boosted by a change in the way it recognised revenue.

And here we are in 2025 with CTD's new auditors (they changed auditors last year) having issues with their revenue recognition in prior years.

Sometimes the shorters are on to something, even if their timing is off. That was back in 2018 and CTD appeared to win that battle. The shorts largely evaporated, but look at how they've been rising again from October 2022 through to August 2025 (when CTD last traded):

Source: https://www.shortman.com.au/stock?q=ctd

That update in November that CTD have promised to supply to us should make for interesting reading.

Discl: Not held.

JohnnyM

I do love a good accounting scandal… Burn the bean-counters at the cross — well, except me of course.

For personal reasons, I’ve been waiting for the CTD announcement, and it absolutely delivered the train-wreck I expected. The only surprise was how the train left the tracks. It turns out CTD’s UK customers actually paid the erroneously recognised revenue — and are now due refunds — rather than overcharged invoices sitting quietly as an “Asset” in debtors waiting to be written off.

Which means someone on the customer side also signed off ~£80m they didn’t need to pay.

To state the obvious this is not a one-off human error. This is what a systematic, multi-year process failure looks like. And CTD’s governance disclosures give us the first clue:

???? Both CTD and FLT state in their Corporate Governance disclosures, here, that they “do not have an internal audit function.”

Even to us normal bean-counters Internal Audit are known as the Fun Police, but when they’re empowered, they’re one of the few teams in a company designed to go looking for exactly this kind of thing. When I was at Brambles, IA was tremendously powerful, they would run “ride-alongs”: take a high-performer from Marketing, Ops, whatever, and drop them into a site audit in another country which usually takes a week or two. They’d learn more about controls, risk, and finance in that week than you could at Uni for a year. More importantly, fresh eyes help spot process failures and or unethical behaviour quickly.

That’s the point here: If CTD had even a modest internal audit capability, this would have been found years ago — or someone would have flagged the behaviour of the now-suspended P&L leader long before they needed to refund £80m to customers.

When a board decides it doesn’t want any internal police — fun or otherwise — you only ever find these cracks after they’ve become canyons.

I’m genuinely curious where the share price reopens, when it finally does. Huge shareholder destruction coming up, Jamie Pherous has just said to Oleg… Hold my beer!

Disc: not held and I don’t know anyone at CTD. Just an interested onlooker watching a preventable mess play out in slow motion.

Cheers,

JM

Karmast

Well said @JohnnyM

I flagged my concerns with this Board on SM after the AGM last year. Couldn't guarantee what / when something was going to happen. Just that we had a small and soft Board overseeing Jamie and the business. And the Chair had form missing big stuff when at Westpac. I sold my small holding at that point.

It's a shame...but not a surprise and one of the rare but valuable times showing up and asking some questions "normal" questions, can give you a valuable insight.

Mujo

Any fund managers that own this would probably be a red flag at this point.

The short report a few years ago should have put them all on notice.

Interesting that Doug Tynan, who hardly ever shorts was short CTD - GCQ funds - Corporate Travel accounting scandal deepens; still no release date for annual accounts

“We warned Mr Crouch back in 2018 that he unwittingly sat atop an unsustainable Jenga tower. Five CFOs later, glimmers of truth are shining through to such a degree that even an accounting layperson can no longer turn a blind eye."

FLT will get a look in at some of their current customers.

Actually may go look at financial myself and see if i would have spotted anything.

Jimmy

Something I've been mulling over is that with how seemingly serious the situation is won't most if not all of CTD customers be looking for a new home and which company/companies could stand to benefit from such a significant opportunity?

Bear77

30-Nov-2025: The obvious name that might benefit from this implosion at CTD would be FLT @Jimmy and they had a decent uptick on Friday as people digested CTD's Financial-Statements-November-Update-(28-Nov-2025).PDF

And they're coming off a low base (around $12/share) with plenty of headroom to return to the top of their previous trading range of $14 to $23 during the past 3 years (as shown on their 3 year share price graph above). Not saying they will return to the top of that range, but if they hold no skeletons in their own closets then it's a possibility.

I don't think CTD's CEO for CTM UK and Europe, Michael Healy, is enough, in terms of rolling heads; I do agree with some of the fundies and analysts quoted in the following article that say Jamie Pherous (MD & CEO) and Ewen Crouch AM (CTD's Chairman ) will also have to go, at least from their current positions. Crouch also missed a bunch of things when he was a non-executive director of Westpac (WBC) from 2013 to 2019, including as Board Remuneration Committee chair from 2014 to 2016 and WBC's Board Risk and Compliance Committee chair from 2016 to 2019. His form in terms of corporate governance is... poor.

And he's a speaker at the Australian Institute of Company Directors' (AICD's) 2026 Australian Governance Summit - see here: https://www.aicd.com.au/about-aicd/authors-speakers/a-g/ewen-crouch.html

Here's the two AFR articles from Friday (Nov 28) relating to Friday's revelations by CTD, plus an article from 2 years ago about the UK barge that appears to be at the centre of these accounting issues, followed by an article from today (Sunday 30th Nov) about the UK Government's response to CTD's overcharging them by such a huge amount:

Hedge fund calls for Corporate Travel chair and CEO to resign

by Ayesha de Kretser, Jonathan Shapiro and Edmund Tadros

Updated Nov 28, 2025 – 6.16pm, first published at 10.36am (28-Nov-2025)

A leading hedge fund has called for Corporate Travel Management’s chairman and chief executive to resign, after an embarrassing admission that the company owes £80 million ($162 million) to customers in the United Kingdom who were overcharged.

The chief executive of Corporate Travel Management’s Europe and UK business, Michael Healy, was temporarily stood down pending the outcome of an investigation by KPMG, as accounting failures at the travel agency were shown to run far deeper than previously thought.

Doug Tynan, co-founder of GCQ Funds Mangement said of Corporate Travel Management this was a “catastrophic failure both of board responsibilities and of management”. Eamon Gallagher

CTM’s shares have been suspended since August, after the company disclosed it had found material errors that could go back years – an issue detected only after the company changed auditor to Deloitte after more than 14 years with PwC.

CTM has also delayed the release of its 2025 financial year accounts multiple times.

KPMG’s UK arm advised CTM that it had overcharged customers over three separate financial years, and could not rule out finding more issues.

Analysts have raised concerns about CTM’s ability to repay its UK customers $162 million from its existing cash pile of $148 million, which has shrunk by $20 million since the company told investors it expected to issue long-delayed results in November.

Instead of releasing its results on Friday, CTM revealed it could be forced to refund the money with interest.

Doug Tynan, co-founder of GCQ Funds Management, which has a short position in CTM, has been one of the company’s most vocal critics for many years.

“Even if the company survives, there is no scenario where either [chairman] Ewen Crouch and [chief executive] Jamie Pherous are in their seats this time next year,” Tynan said. “A fish rots from the head, and this is a catastrophic failure both of board responsibilities and of management.”

Corporate Travel Management CEO Jamie Pherous apologised to shareholders and affected UK clients for the accounting issues, which have seen an extended delay in the group finalising its annual results. Attila Csaszar

“We warned Mr Crouch back in 2018 that he unwittingly sat atop an unsustainable Jenga tower. Five CFOs later, glimmers of truth are shining through to such a degree that even an accounting layperson can no longer turn a blind eye.

“Meanwhile, Mr Pherous has played the role of pied piper of the ASX for the last 15 years. Investors will be far less inclined to dance to his tune once this chapter is over.”

CTM’s chief financial officer, James Spence, said the $162 million would be adjusted to account for tax already paid, expressing confidence that the beleaguered travel agent could service its debts from cashflow.

“There will be time taken to determine what refunds are due, during which we will continue to generate further cash,” Spence told AFR Weekend.

“I don’t want to understate it – it’s a major financial burden, but we are in a position that we have a strong balance sheet, so we can manage that.”

Spence would not say whether banks would call in their undrawn lines of credit given the uncertainty, with CTM unable to say when – or if – its shares would resume trading.

Crouch would not comment on specifics of the investigation into the issues. “We have a process to follow, and that is under way. It must take place with due fairness and confidentiality to all involved,” he said.

Pherous and Crouch defended previous market updates in which CTM had assured investors that the issues related only to the timing of revenue recognition and would have no cash impact.

“We act on the basis of what we know, and we engaged KPMG in September to undertake a detailed forensic review, and we are reporting to the market as soon as we became aware,” Crouch said.

He said the board was reviewing its own role in the scandal, but defended CTM’s processes.

“I think you can have confidence in the governance structures of the company,” Crouch told AFR Weekend.

In a tense 45-minute conference call with analysts, Pherous, Crouch and Spence were grilled about the revenue writedown, whether the customers who had been overcharged were UK government agencies, and what it meant for the company’s cash position.

The company did not name any customers who had been overcharged, but focus has centred on a controversial contract CTM won last year to house asylum seekers on floating barges in England’s south-west. The policy was reversed under the Labour government, casting doubt on future earnings under the contract.

A source with direct knowledge of the situation, who was not authorised to speak publicly, confirmed the UK government is due a refund, raising concerns about the company’s ability to win ongoing work from an important customer. This source also said that CTM management continues to downplay the extent of the issue.

Investors still in the dark

Spence described CTM’s balance sheet as “very strong”, adding that the refunds would take time to process, allowing the company to keep generating more cash.

CTM warned on Friday that further restatements and adjustments to its accounts may be required, withdrawing guidance for its still unreleased annual accounts provided on May 2, in which it claimed its Europe business was performing “significantly above” targets.

No new release date for the accounts has been given, with the company to provide a further update by December 19. Its shares remain suspended.

Analysts were left in the dark on precisely how and why customers had been overcharged. “We’re not in a position today to talk about the underlying drivers that have been identified at this point,” said Spence.

Deloitte took over from PwC as the company’s auditor in October 2024, and Corporate Travel has since brought in KPMG in the UK to run a separate forensic investigation into its accounts.

KPMG has reviewed around 47,000 documents and analysed data from over 1.5 million sales and purchases, representing aggregate transaction values exceeding £400 million, the company said on Friday.

RBC Capital Markets analyst Wei-Weng Chen said the update was “far worse” than expected and contradicted CTM’s previous statements.

“Up to a third of European revenues from FY23-25 may need to be restated and possibly refunded which could lead to significant cash impacts (where the company previously claimed there would be no cash impact),” he wrote in a note.

“Australia and New Zealand are impacted too – Corporate Travel had previously said issues were isolated to Europe only.”

Corporate Travel had previously suggested the prior years could see their numbers boosted when restated, but now says its accounts for the 2023, 2024 and 2025 financial years all appear to be impacted.

--- ends ---

AFR Chanticleer

Corporate Travel ripped off customers. It’s now fighting for its life

The scandal that has engulfed Corporate Travel Management is a governance train wreck that will do a lot more damage before it’s finished.

Nov 28, 2025 – 1.14pm

Jamie Pherous, the founder and chief executive of Corporate Travel Management, famously fought off an attack by short sellers in 2018. It will take a miracle if the company survives ripping off its British customers, which are believed to include the UK government, in its current form.

While the company insists its solvency is not at risk – it appears to have overcharged customers to the tune of £80 million ($162 million), but has $148.3 million in the bank and no drawn debt to meet refunds – the fallout from this scandal will rock the business for years.

Whether Jamie Pherous can remain at the top of Corporate Travel Management is now an open question. Attila Csaszar

Pherous insists the issues are quarantined to the UK, and CTM is doing everything it can to reassure its major customers about the quality of its services. But the reputational damage of this disaster will be felt for years.

Every one of CTM’s competitors will be trying to poach customers. And all those customers will surely be asking themselves a key question: Can I really trust this company?

CTM shares have been suspended from trade since August, and chairman Ewen Crouch was unable to provide a timeline for the company to return to the ASX. The company’s auditor, Deloitte, is still a long way from completing its task, and CTM will need to issue a new prospectus to return to the bourse. Just imagine how long the section on risks will be.

On paper at least, CTM has a market capitalisation of $2.3 billion. But when it does finally return to the market, its shares will inevitably be smashed. The shareholder class action will follow quickly, and it will immediately become a takeover target for a rival ready to pick off the salvageable parts of its business.

Shareholders have been horribly let down by Pherous and the board, led by Crouch. While CTM has immediately stood down the head of its British and European operation, Michael Healy, what has been uncovered here are “irregularities” stretching back to 2021.

They were not picked up by CTM’s systems processes, the regular audits CTM says it does for its customers, and the external audit that was conducted by PwC until October 2024, or by any management or board reporting. How on earth does that happen?

Indeed, if we are to take the board and management at their word, CTM’s top brass had absolutely no idea what was going on as recently as August 26, when it first told the market that it would have to make “adjustments” related to the recognition of revenue and costs in prior accounting periods, and reduce the 2025 financial year earnings.

The board reassured investors that any changes would be “non-cash in nature” and primarily reflected mere “timing differences” across accounting periods. This raised plenty of questions with analysts, including RBC Capital Markets’ Wei-Weng Chen, who questioned whether investors now had to reconsider what the true earnings base of CTM actually looked like. But Chen, like others in the market, took some comfort from the company’s assurance that these were non-cash issues.

Crouch, Pherous and the board then appointed KPMG to start going through the books of the British and European operations. The firm’s report arrived at CTM headquarters on Sunday, and the brutal reality was made painfully clear – these were not non-cash timing issues, but CTM had very clearly ripped off some of its British customers, and would have to make refunds.

Immediately, CTM chief financial officer James Spence was dispatched to London to start talking to affected customers. Why it wasn’t Pherous or Crouch getting on the plane and fronting up, given the seriousness of these matters, wasn’t clear on Friday.

Spence says these conversations were uncomfortable, but he told a tense 45-minute call with analysts on Friday, that he’d been reassured by the “amount of positive feedback that I have received from those customers about the quality of service that we continue to provide”. We’re sure they’re absolutely thrilled, by jove.

What was clear from that investor call is that there is still so much that CTM’s board and management don’t know, or aren’t prepared to tell the investors, who have been kept in the dark for months.

Exactly how big will the customer’s refunds need to be? Not clear. Will there be penalties and interest involved, given some of the refunds relate to clients no longer with CTM? Not clear. How much of CTM’s cash balance will be eaten up by this mess? Not clear. Did the clients involved here include the UK government? Won’t say. By what mechanism were customers actually overcharged? Not going to comment.

Crouch says that procedural fairness to CTM’s former UK boss dictates that he can’t comment on the irregularities KPMG has uncovered while investigations continue. “We have a process to follow, and that is underway. That process must take place with due fairness and confidentiality to all involved, and when it’s completed, we will be in a position to make further announcements.”

But that creates an obvious problem: investors can’t be sure that this scandal won’t now grow. Spence says he’s reassured by the depth of the investigation that KPMG has undertaken, which we are told involved 47,000 documents and 1.5 million transaction lines. But this is the same management team which, just a few months ago, thought these were all non-cash timing issues.

While the British issues were front and centre on Friday, analysts were quick to point out the sharp fall in CTM’s cash levels, from $168 million at September 30 to $148.3 million at present. Spence described that as nothing out of the ordinary, but analysts and investors will be keeping a close eye on CTM’s cash position. RBC’s Chen says expects those cash refunds the business will need to make in the coming months “could potentially result in significant balance sheet risk”.

And while the repeated message from management is that CTM’s issues are quarantined to Europe, Chen notes Friday bought $13.9 million of additional provisions related to the ANZ region as a result of “year-end and subsequent events reviews and due primarily to an expected credit loss provision on receivables arising in 2022-24 where doubt over collectability exists.”

Pherous was mostly silent on Friday’s calls, other than to express his remorse and disappointment for the British scandal, and to emphasise how much work is going into trying to calm the horses.

“Clearly, we remain focused upon just reliable delivery and quality service. And as you’d appreciate, we have long-standing and trusted relationships with our current clients. And as you’d expect, we’re communicating with our major customers around the world as we speak.”

But whether Pherous can continue to lead this business must now be an open question. In the past five years, he’s presided over a series of CFO changes; a series of issues around the disclosure of share deals and loans with a former executive, and, we’ve now discovered, a major issue in one of CTM’s most important divisions.

Crouch wouldn’t comment on whether Pherous needs to go on Friday, saying only that he’s ordered “an external review of our overall governance and our risk management framework, and that will benchmark us against other appropriate organisations”. It’s unthinkable that such a review would give CTM a “pass” mark, and investors have every right to demand accountability from the board and management team.

Pherous is a fighter who has stared down naysayers before. But this time, he can’t point the finger at dastardly short sellers throwing rocks from the outside. This is a problem entirely of CTM’s making, and its investors will eventually pay the price for a governance failure of epic proportions.

--- ends ---

Source: https://www.afr.com/chanticleer/corporate-travel-ripped-off-customers-it-s-now-fighting-for-its-life-20251128-p5nja7 [Nov 28, 2025 – 1.14pm}

See also:

Corporate Travel faces fallout over UK refugee barge

by Liam Walsh and Ayesha de Kretser

Aug 20, 2023 – 4.39pm (over 2 years ago)

Amid a sombre violin soundtrack, the blonde Ukrainian woman spoke fondly of her time aboard a cruise ship docked at Scotland, housing war refugees such as herself and her son.

“I will remember it with gratitude and with good thoughts,” she said on the video, as refugee families, some draped in Ukrainian flags, looked over a chilly sea at the departing vessel. The video was recorded for a charter company and thanked partners including Brisbane-headquartered business travel arrangement outfit Corporate Travel Management.

The Bibby Stockholm immigration barge in England, part of a contract for Australia’s Corporate Travel Management. Getty

Posted only weeks ago, the sentimental video contrasts with the storm entangling Corporate Travel’s separate work housing 500 adult males on a utilitarian barge on England’s southern coast, part of its $3.2 billion asylum seeker contract.

That barge, the Bibby Stockholm, has attracted headlines in the United Kingdom as a potential “floating Grenfell” – a reference to the London high-rise fire that killed 72 people – and for a more recent legionella scare.

Refugee advocates claim using the vessel is cruel.

The government, however, argues refugees will be allowed on and off the vessel, while having healthcare and essential accommodation. It rejects concerns such as the vessel being a fire-prone deathtrap.

But the contract has already sparked concerns from some Corporate Travel investors, who fear it is a high-risk, high-profile job that will backfire. It has triggered, for them, memories of the investment campaign against Broadspectrum (previously Transfield Services) almost a decade ago over its Australian government work housing refugees on Manus Island, although one fund manager argued the two issues were being wrongly conflated.

Arrival of refugees on the barge has already triggered short-term pain: Morgan Stanley analysts noted last week Corporate Travel’s stock had reacted “negatively” to critical news stories. It is down roughly 10 per cent since the start of this month, outpacing a 1.1 per cent decline in a small-cap index. Corporate Travel shares last traded on Friday at $18.98.

Corporate Travel was a divisive stock already, with supporters backing its strong growth amid a series of acquisitions since listing in 2010. But market sceptics have included short-sellers, who questioned issues including allegedly aggressive accounting.

This two-year, £1.59 billion ($3.15 billion) “provision of bridging accommodation and travel services contract” was unveiled in April, initially attracting a positive market reception. But as details of the barge emerged, concern followed.

“Containing people who have been through traumatising experiences, especially on a floating vessel, is cruel and inhumane,” organisations, including the Refugee Council, wrote to the owner of the Bibby Stockholm, a company known as Bibby Marine. The barge looks like a bland floating apartment block and previously housed workers building a plant off Scotland. The three-level vessel’s capacity has been boosted from 222 cabins to 506 by putting bunk beds in each room.

Its initial reception, according to local reports, has been mixed; one refugee compared it to Alcatraz and said their roommate felt like they were drowning, while others said it was good and filmed breakfast offerings including pancakes, yoghurt or Cornflakes.

Arrivals board the Bibby Stockholm, moored at Portland in Dorset. Getty

Corporate Travel told The Australian Financial Review the company was part of a “humanitarian effort” managing travel logistics for tens of thousands of asylum seekers needing crisis accommodation.

Its services were for “travel-related functions in the UK, including sourcing and managing accommodation services, transport logistics and meals”.

Refugees had comfortable accommodation and the company’s services were “subject to a robust governance framework”, with its subcontractors internally audited, Corporate Travel said. It maintained the barge only accounted for a tiny portion of its asylum-seeker accommodation.

The UK government, amid pressure from refugee arrivals, says switching from hotels to barges was “cheaper and more manageable for communities, as our European neighbours are also doing”.

“Corporate Travel Management will be responsible for managing the services on the barge [and] has a strong track record of providing this kind of accommodation,” it said.

The work is likely to be scrutinised as Corporate Travel releases full-year results this week, after it joined travel industry players updating earnings guidance, expecting to book between $165 million and $170 million in profit.

The heavy skew toward the UK as an earnings driver and relatively weak earnings from its core Australian businesses, compared with competitors like Flight Centre, surprised some analysts.

The refugee work itself did not affect Wilson Asset Management’s holding in Corporate Travel. “We’re comfortable with the contract,” Wilson portfolio manager Oscar Oberg said, although he added the market “would want to see more detail about the contract at the result to allay any concerns”.

Chris Prunty, the founder of QVG Capital, was also unconcerned about the contract. “If there was some sort of mistreatment of refugees ... that would be a different matter,” he said. “My suspicion is that because of the Australian refugee experience with Manus Island and elsewhere, there’s a heightened sensitivity from some Australian investors,” he said, adding this was probably being conflated with the UK contract.

Future Super, founded by activist and former Getup national director Simon Sheikh, confirmed reports in The Guardian that it plans to sell its $700,000 holding due to concerns about UK government policy.

ACSI chief executive Louise Davidson. Louise Kennerley

The Australian Council of Superannuation Investors, which provides recommendations for members with $1 trillion in funds under management, said the new business “has a very different risk profile to [Corporate Travel’s] traditional work”.

“We will be engaging with the company to understand how these risks are managed,” ACSI chief executive Louise Davidson said. “These issues have the potential to impact brand and reputation. Investors will want to see clear measures in place to prevent that occurring.”

Morgan Stanley analysts expected the contract’s value to increase over time “as UK arrivals show few signs of slowing”. If elected, Labour says it would try to move refugees out of hotels and barges as “quickly as possible”, although it would have initially to use available infrastructure.

Similar concerns battered infrastructure firm Broadspectrum in housing refugees on Nauru and Manus Island. Some big superannuation funds offloaded Broadspectrum shares, while local governments examined excluding Broadspectrum from any future work.

Alison George, who heads the impact and ethics division at Australian Ethical, which manages over $9.2 billion and is not invested in Corporate Travel, said Broadspectrum shares had initially spiked when its Australian government contract was won.

“It really took a long time for the reputational issues to be triggered and then to be recognised in the share price,” she said. “I do think investors are paying more attention to social issues now.”

As for the latest work, Tony O’Connor, managing director of procurement consultancy Butler Caroye, said while travel companies might occasionally handle government work removing people from a country, refugee work in itself was rarer. Mr O’Connor said one upside for Corporate Travel could be if the contract performed smoothly, it would strongly illustrate its capabilities when bidding for future government work.

The downside was the contract was taking place in a public spotlight, meaning any problems would be amplified.

“They’ve got zero margin for making errors,” Mr O’Connor said.

--- ends --

Source: https://www.afr.com/companies/tourism/corporate-travel-faces-fallout-over-uk-refugee-barge-20230817-p5dxdo [20-Aug-2023] - i.e. over 2 years ago.

UK vows to pursue Corporate Travel for ‘appalling’ overcharging

by Andrew Tillett, AFR Europe correspondent

Updated Nov 30, 2025 – 8.28am, first published at 2.42am (today, 30-Nov-2025)

London | Britain’s Home Office has launched an urgent investigation into the Australian-owned Corporate Travel Management for its overcharging of taxpayers to house migrants who entered the United Kingdom unlawfully.

The Home Office – the equivalent of Australia’s Home Affairs Department – confirmed it had been among the victims of Corporate Travel overcharging British customers £80 million ($162 million).

The Bibby Stockholm, an accommodation barge, was used to house asylum seekers under Corporate Travel’s UK contract. Getty

The revelation that UK taxpayers were among those exposed adds to pressure on the Brisbane-based company and its founder and chief executive Jamie Pherous.

Corporate Travel shares have been suspended from trading on the stock market since August after the company found “material errors” in its financial accounts going back years, following a change of auditor to Deloitte after more than 14 years with PwC.

The company has also delayed releasing its accounts for 2025 multiple times.

Last week, the trouble spread to its UK business, with KPMG telling Corporate Travel that it had overcharged customers over three separate financial years, and could not rule out finding more issues. Corporate Travel’s Europe and UK chief Michael Healy was temporarily stood down.

While Corporate Travel is best known in Australia for primarily providing travel booking services for businesses, in the UK it has branched out into the politically sensitive work of helping house the tens of thousands of migrants who cross the English Channel in small boats annually.

Most controversially, this included running the Bibby Stockholm, a barge moored in Portland near Dorset in southern England, to accommodate asylum seekers.

Labour terminated the contract within weeks of taking office last year amid alarm over the conditions for those living onboard, including the discovery of the Legionella bacteria. The barge was closed in January.

But on April 17, Corporate Travel was awarded a contract to house migrants at 14 hotels in southern England from next year, with the company selected because officials believed it offered better value for taxpayers’ money than other hotel suppliers.

That contract is valued at £552.5 million and runs until August 2029.

However, the Home Office, which controls Britain’s immigration system, was told on November 26 that it had been overcharged. The amount that Corporate Travel owes to the Home Office has not been disclosed.

“An urgent investigation is underway into this appalling overspend, which happened under the previous government. All taxpayer money owed will be recovered,” a Home Office spokeswoman said.

“Having inherited contracts that were not delivering good value for money, we have strengthened contract management and saved £700 million in hotel costs alone. By the end of this parliament [in 2029], every asylum hotel will be closed.”

The Home Office said it was unable to take any remedial action while the audit was underway.

As it has sought to bring the cost of housing asylum seekers down, the Home Office has strengthened contract management and increased staff and oversight to hold providers to account and maintain standards.

The department insists stringent performance requirements and penalties for non-conformance are built into contracts, including regular audits and reviews.

Britain’s Serious Fraud Office, which investigates corporate crime and malfeasance in the UK, declined to say whether it had started a probe into Corporate Travel.

“In line with long-established practice to avoid prejudice to law enforcement activity, we can neither confirm nor deny any investigation into this matter,” a spokeswoman said.

Unlike Australia’s system of mandatory detention for unauthorised arrivals, Britain’s asylum accommodation allows migrants to come and go as they please.

More than 36,000 migrants are currently living in about 200 hotels in the UK, according to the latest official data, with the government promising to close them down by 2029 and house people in military barracks instead.

The use of hotels has sparked protests, with communities worried about the influx of undocumented migrants across the UK.

The use of the Bibby Stockholm came to be seen as the embodiment of the failure of the British government to control the border to stop the influx of migrants.

It also evoked unfortunate comparisons to the practice of holding convicts on prison hulks in the 18th and 19th centuries, many of whom were transported to Australia as punishment.

--- ends ---

Source: https://www.afr.com/companies/transport/uk-vows-to-pursue-corporate-travel-for-appalling-overcharging-20251129-p5njht [30-Nov-2025 - today]

Disc: I am not holding CTD or FLT. I have held FLT in prior years.

As others (@JohnnyM @Karmast @Mujo @Jimmy) have pointed out already, there were plenty of orange flags over the years and now a clear red one for all to see. CTD may survive this, but they will be a different company, a lot smaller and with different management.

The share price reaction if and when they finally trade again will be savage indeed, particularly if they have to do a heavily discounted CR to fund their refund obligations relating to the massive overcharging of UK customers - primarily the UK government it seems who are not going to let this one slide.

And then there's the please explain letters from ASIC and the ASX that have to be dealt with before the ASX will allow them to trade again.

It's a huge mess and it's going to take some time to sort it out, and the damage and fall-out will be substantial.