Source: Timing-to-finalise-CTM-FY25-Financial-Statements.PDF [17th September 2025]

See also:

Jamie Pherous has been battling short-selling hedge funds for most of his life, as chief executive of the business travel specialist. Now his stock is suspended.

Jonathan Shapiro, Senior reporter, AFR, Aug 31, 2025 – 8.49am

When the shares of Corporate Travel were placed in a trading halt around lunchtime on Friday, August 22, it seemed as though the moment of vindication for the company’s legion of sceptics had arrived.

Jamie Pherous, founder of the ASX-listed company and a former accountant, floated the travel agency in 2010. And for the first five years, he enjoyed the status of a celebrated founder. But for the past decade, he’s been at war with short sellers and cynics, who have continuously questioned his bookkeeping and the share price that has been guided by the numbers he presents.

Corporate Travel Management founder and managing director Jamie Pherous. The boss’ war with short sellers went nuclear on a sleepy Sunday in October 2018, when hedge fund VGI Partners alleged aggressive accounting and poor disclosure. [image: David Rowe]

So when the Friday lunchtime announcement revealed a dispute with its auditor Deloitte that would delay the release of its full-year accounts and lead to material corrections, hearts began racing on all sides. Was this long-running market stoush finally reaching a definitive resolution?

Since that day, Corporate Travel’s ASX updates have suggested that any potential fallout from the auditors’ concerns may be less significant than feared – relating to a quibble about jurisdictional revenue recognition.

The outcome is that previous years’ profits will have to be adjusted upwards at the expense of this year’s profit, the company has since said. But we won’t find out exactly what the issue is for some time.

That creates an unusually long stand-off in a war that saw its opening salvo fired way back in November 2016, at the first Sohn Hearts & Minds investment conference. In the final session of the day, Perpetual portfolio manager Anthony Aboud told the audience why he was shorting the travel agency after its share price had increased 18-fold since its 2010 listing.

Corporate Travel, Aboud explained, was a classic roll-up play, using its high market valuation to buy the earnings of other businesses that in turn are revalued at the higher value, lifting the share price. The company’s growth therefore relied on continuously buying other businesses.

“The PE magic only works for so long,” Aboud said at the time.

The war with short sellers went nuclear on a sleepy Sunday in October 2018, when VGI Partners dropped a 178-page presentation that alleged aggressive accounting, poor disclosure and phantom locations.

The rare activist campaign divided the market and left scars on all sides as Pherous countered the hedge fund’s claims.

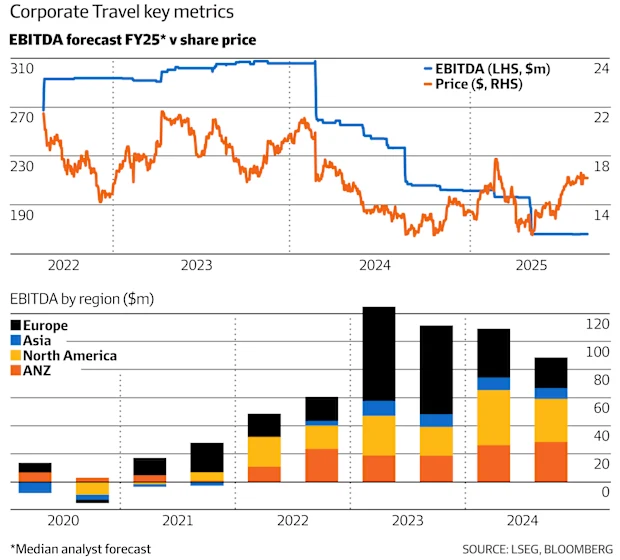

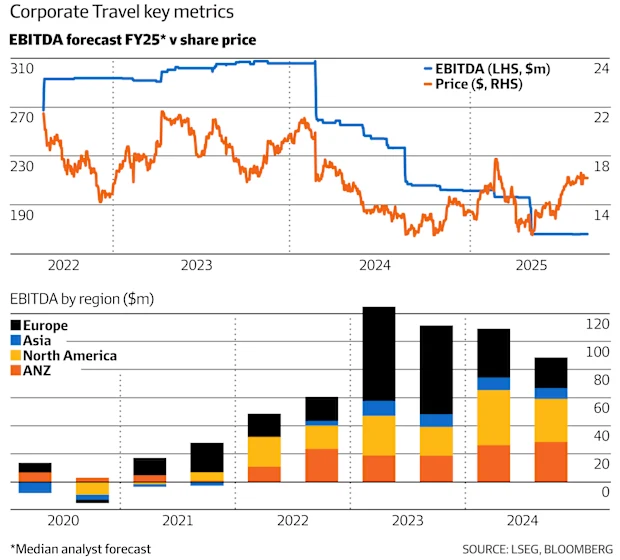

Fending off short sellers was arguably easier than dealing with the existential threat of a global pandemic in 2020 that completely shut down all forms of travel. While the likes of Flight Centre and Webjet were forced to raise hundreds of millions of dollars to survive the lockdowns, Pherous miraculously avoided an emergency capital raise. The bespoke travel needs of governments and businesses meant higher-margin contracts, and both the business and its share price proved resilient.

Pherous also used the global shutdown to make deals, flying to Omaha in September 2020 at the height of the global lockdown to ink the $274 million acquisition of Travel & Transport.

If ever there was a moment to declare victory, it was in the post-pandemic glow, with Corporate Travel’s shares topping $25 in April 2022.

But despite all the clear air, Corporate Travel has failed to entirely rid itself of cynics. The company and its enigmatic founder have left the market as divided as ever.

Questions about its accounts have lingered, and short sellers have refused to go away. Among the most divisive issues are the company’s confusing disclosures about the materiality of its United Kingdom asylum seeker contracts, and a highly unusual share transfer to former executive Laura Ruffles.

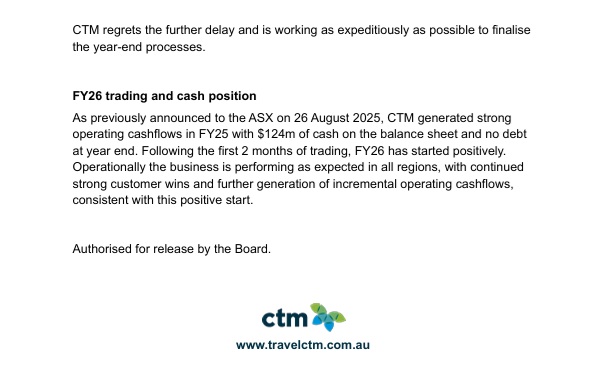

The accounts have also got short sellers trying to work out exactly what game Corporate Travel is playing. Why did they really abandon reporting total transaction volumes in 2023? And what explains the big swings in profit and margin from its European business over the past five years?

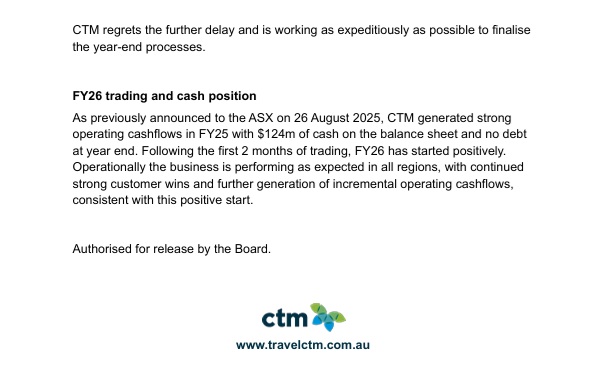

There also appears to be a hole in Corporate Travel’s earnings. The company has made two major acquisitions in the past five years, with little increase in profit. Two years ago, analysts had expected earnings in the 12 months to June 30 this year to come in at $300 million. Last year, that was revised to $250 million, and this year, consensus was closer to $160 million.

According to some brokers, cash and accounting profits matched each other for a decade – until 2022. That’s when the relationship broke down, ultimately creating a gap that has now stretched to $200 million.

Corporate Travel naturally sees things differently. A spokesperson said the two acquisitions – Travel & Transport and Helloworld’s corporate unit, purchased for $175 million in April 2022 – are contributing to earnings in its non-European division. This part of the business, the company says, is growing its earnings at a healthy clip, and will continue to do so.

Corporate Travel says it is also converting revenue and profit into cash. Its cash conversion target – between 80 per cent and 90 per cent of operational profit – is being met, as evidenced by its $124 million cash balance.

To explain the profit swings in Europe, Corporate Travel pointed to previous statements that the business had been in a state of transition while lucrative war-related travel projects came to an end. It was also winning new customers at a record rate, it said, and the current year had started well.

“In the absence of FY26 guidance until we report, the May 2, 2025 commentary states the new customer wins will be a positive contributor at group and Europe regional level in FY26,” the spokesperson said.

The new customer wins, along with reports from global airlines that activity was picking up, lured buyers to Corporate Travel’s stock heading into reporting season.

Short interest also edged higher. More than 10 per cent of the share register had been loaned out to hedge funds, a four-fold increase since the start of the year. This put Corporate Travel among the 10 most shorted stocks on the local sharemarket by mid-August.

Then came the trading halt.

The company had recently switched auditors, replacing PwC with Deloitte. Corporate Travel has since hired KPMG as a third party to help resolve the accounting issue, which relates to the timing of revenue recognition.

It’s not the first time an ASX-listed travel agency has found itself in a dispute with Deloitte. And there are some complex accounting rules regarding whether to book revenues at the time of ticketing or the time of travel, which some say may hold the key to understanding Corporate Travel’s bookkeeping mysteries.

Word is that the situation is resolvable. The consequence would be that earnings from prior years increase, but the current year’s decrease. The changes were non-cash-related, and an update like that would seriously reduce the stress levels of fund managers holding the stock.

But the lengthy delay does complicate life for them, at least in theory. Will they value Corporate Travel at the last traded price of $16.07 for any investors seeking to subscribe, or to redeem their funds, or will they apply a discount?

We’ll have to wait until Corporate Travel get its books in order to know the current earnings capacity of the business, and the premium or the discount that the market applies to the stock.

But there is a bigger, lingering question. Will we be able to declare a winner in the long-running war between Corporate Travel and its sceptics? That’s unlikely: Jamie Pherous’ power to divide the market remains as strong as ever.

--- ends ---

Source: https://www.afr.com/markets/equity-markets/could-the-long-fight-over-corporate-travel-be-reaching-its-denouement-20250827-p5mq51 [31st August 2025]

Data sourced from: https://www.shortman.com.au/stock?q=CTD

The shorters are not always wrong.

Discl: Not held.