Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

This is an absolute gem of a post on CTD today.

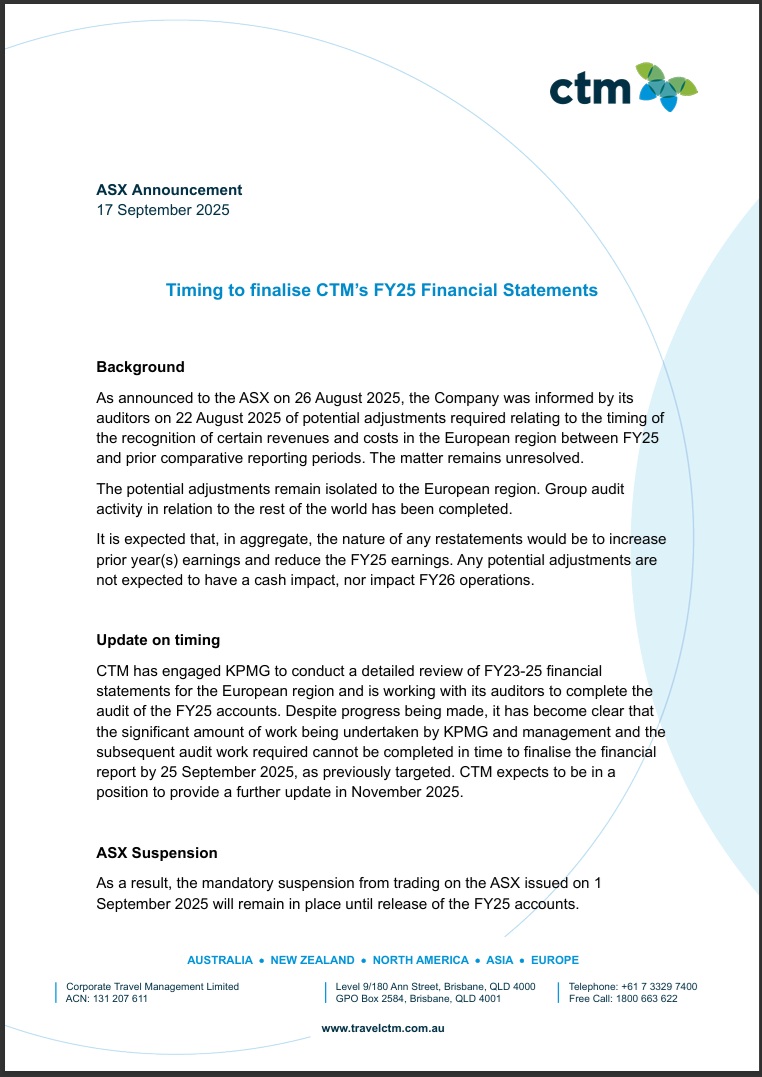

17th September 2025: Timing-to-finalise-CTM-FY25-Financial-Statements.PDF

Source: Timing-to-finalise-CTM-FY25-Financial-Statements.PDF [17th September 2025]

See also:

Opinion: Could the long fight over Corporate Travel be reaching its denouement?

Jamie Pherous has been battling short-selling hedge funds for most of his life, as chief executive of the business travel specialist. Now his stock is suspended.

Jonathan Shapiro, Senior reporter, AFR, Aug 31, 2025 – 8.49am

When the shares of Corporate Travel were placed in a trading halt around lunchtime on Friday, August 22, it seemed as though the moment of vindication for the company’s legion of sceptics had arrived.

Jamie Pherous, founder of the ASX-listed company and a former accountant, floated the travel agency in 2010. And for the first five years, he enjoyed the status of a celebrated founder. But for the past decade, he’s been at war with short sellers and cynics, who have continuously questioned his bookkeeping and the share price that has been guided by the numbers he presents.

Corporate Travel Management founder and managing director Jamie Pherous. The boss’ war with short sellers went nuclear on a sleepy Sunday in October 2018, when hedge fund VGI Partners alleged aggressive accounting and poor disclosure. [image: David Rowe]

So when the Friday lunchtime announcement revealed a dispute with its auditor Deloitte that would delay the release of its full-year accounts and lead to material corrections, hearts began racing on all sides. Was this long-running market stoush finally reaching a definitive resolution?

Since that day, Corporate Travel’s ASX updates have suggested that any potential fallout from the auditors’ concerns may be less significant than feared – relating to a quibble about jurisdictional revenue recognition.

The outcome is that previous years’ profits will have to be adjusted upwards at the expense of this year’s profit, the company has since said. But we won’t find out exactly what the issue is for some time.

That creates an unusually long stand-off in a war that saw its opening salvo fired way back in November 2016, at the first Sohn Hearts & Minds investment conference. In the final session of the day, Perpetual portfolio manager Anthony Aboud told the audience why he was shorting the travel agency after its share price had increased 18-fold since its 2010 listing.

Corporate Travel, Aboud explained, was a classic roll-up play, using its high market valuation to buy the earnings of other businesses that in turn are revalued at the higher value, lifting the share price. The company’s growth therefore relied on continuously buying other businesses.

“The PE magic only works for so long,” Aboud said at the time.

The war with short sellers went nuclear on a sleepy Sunday in October 2018, when VGI Partners dropped a 178-page presentation that alleged aggressive accounting, poor disclosure and phantom locations.

The rare activist campaign divided the market and left scars on all sides as Pherous countered the hedge fund’s claims.

Fending off short sellers was arguably easier than dealing with the existential threat of a global pandemic in 2020 that completely shut down all forms of travel. While the likes of Flight Centre and Webjet were forced to raise hundreds of millions of dollars to survive the lockdowns, Pherous miraculously avoided an emergency capital raise. The bespoke travel needs of governments and businesses meant higher-margin contracts, and both the business and its share price proved resilient.

Pherous also used the global shutdown to make deals, flying to Omaha in September 2020 at the height of the global lockdown to ink the $274 million acquisition of Travel & Transport.

If ever there was a moment to declare victory, it was in the post-pandemic glow, with Corporate Travel’s shares topping $25 in April 2022.

But despite all the clear air, Corporate Travel has failed to entirely rid itself of cynics. The company and its enigmatic founder have left the market as divided as ever.

Questions about its accounts have lingered, and short sellers have refused to go away. Among the most divisive issues are the company’s confusing disclosures about the materiality of its United Kingdom asylum seeker contracts, and a highly unusual share transfer to former executive Laura Ruffles.

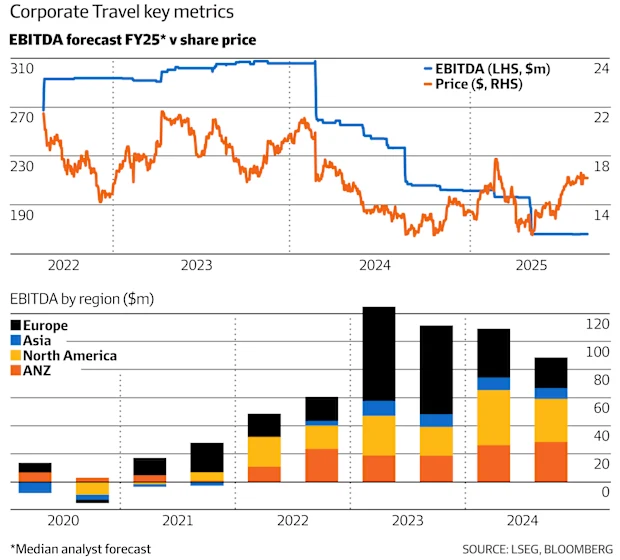

The accounts have also got short sellers trying to work out exactly what game Corporate Travel is playing. Why did they really abandon reporting total transaction volumes in 2023? And what explains the big swings in profit and margin from its European business over the past five years?

There also appears to be a hole in Corporate Travel’s earnings. The company has made two major acquisitions in the past five years, with little increase in profit. Two years ago, analysts had expected earnings in the 12 months to June 30 this year to come in at $300 million. Last year, that was revised to $250 million, and this year, consensus was closer to $160 million.

According to some brokers, cash and accounting profits matched each other for a decade – until 2022. That’s when the relationship broke down, ultimately creating a gap that has now stretched to $200 million.

Corporate Travel naturally sees things differently. A spokesperson said the two acquisitions – Travel & Transport and Helloworld’s corporate unit, purchased for $175 million in April 2022 – are contributing to earnings in its non-European division. This part of the business, the company says, is growing its earnings at a healthy clip, and will continue to do so.

Corporate Travel says it is also converting revenue and profit into cash. Its cash conversion target – between 80 per cent and 90 per cent of operational profit – is being met, as evidenced by its $124 million cash balance.

To explain the profit swings in Europe, Corporate Travel pointed to previous statements that the business had been in a state of transition while lucrative war-related travel projects came to an end. It was also winning new customers at a record rate, it said, and the current year had started well.

“In the absence of FY26 guidance until we report, the May 2, 2025 commentary states the new customer wins will be a positive contributor at group and Europe regional level in FY26,” the spokesperson said.

The new customer wins, along with reports from global airlines that activity was picking up, lured buyers to Corporate Travel’s stock heading into reporting season.

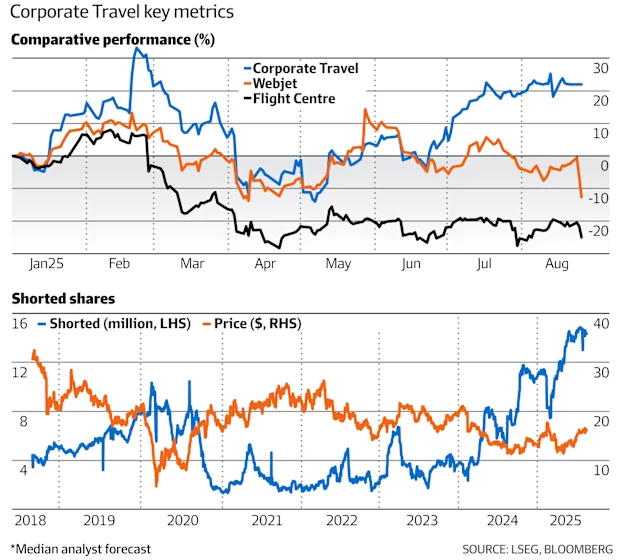

Short interest also edged higher. More than 10 per cent of the share register had been loaned out to hedge funds, a four-fold increase since the start of the year. This put Corporate Travel among the 10 most shorted stocks on the local sharemarket by mid-August.

Then came the trading halt.

The company had recently switched auditors, replacing PwC with Deloitte. Corporate Travel has since hired KPMG as a third party to help resolve the accounting issue, which relates to the timing of revenue recognition.

It’s not the first time an ASX-listed travel agency has found itself in a dispute with Deloitte. And there are some complex accounting rules regarding whether to book revenues at the time of ticketing or the time of travel, which some say may hold the key to understanding Corporate Travel’s bookkeeping mysteries.

Word is that the situation is resolvable. The consequence would be that earnings from prior years increase, but the current year’s decrease. The changes were non-cash-related, and an update like that would seriously reduce the stress levels of fund managers holding the stock.

But the lengthy delay does complicate life for them, at least in theory. Will they value Corporate Travel at the last traded price of $16.07 for any investors seeking to subscribe, or to redeem their funds, or will they apply a discount?

We’ll have to wait until Corporate Travel get its books in order to know the current earnings capacity of the business, and the premium or the discount that the market applies to the stock.

But there is a bigger, lingering question. Will we be able to declare a winner in the long-running war between Corporate Travel and its sceptics? That’s unlikely: Jamie Pherous’ power to divide the market remains as strong as ever.

--- ends ---

Source: https://www.afr.com/markets/equity-markets/could-the-long-fight-over-corporate-travel-be-reaching-its-denouement-20250827-p5mq51 [31st August 2025]

Data sourced from: https://www.shortman.com.au/stock?q=CTD

The shorters are not always wrong.

Discl: Not held.

It’s so funny when a company releases an announcement saying we are going to release our results in a few weeks and the share price shoots up. Happened today with CTD and earlier this week with MP1.

it’s almost as if the interpretation is - hey management has looked at the results and decided not to downgrade, time for shorts to exit

I attended the Corporate Travel AGM last week.

It was a shareholder friendly meeting with all questions asked and answered in the room, with Directors speaking to their elections and staying around after the meeting to chat with shareholders.

There was some tough questions about capital allocation decisions over the past 5 years and the lack of return on some of the acquisitions and tech spend. Management noted them and reaffirmed they believe they have the system in place now to double earnings over the next 5 years...time will tell on that one...

Given Jamie is a strong and entrepreneurial founder (which poses some risk as we have seen elsewhere recently), he and the Board were asked what they were doing to assess culture, ensure they were getting the full story and improve staff engagement.

Whilst there was nothing wrong with the answers given, they didn't convince me that these issues were being addressed or overseen as well as one might like.

So, I came away comfortable with my decision to exit recently. Not because I doubt Jamie's commitment to growing earnings that should see a significant improvement in the share price as a result. Simply due to concerns the current Board is not adding enough value or possibly oversight and also the mediocre numbers being seen for staff engagement and customer satisfaction.

I could be wrong but these are risks I am happy to avoid for now.

Selling Oct 2024 - Have grown uncomfortable with the governance of the company over the past month. Whilst I knew Jamie Pherous was a strong and entrepreneurial Founder CEO I had hoped the Board would offset and oversee that. Having seen the proposals at this AGM, especially the size of the Board fee pool increase and justification given, I am not sure we don't have a Board that's just "along for the ride". Given the blow ups playing out at WTC and MIN right now, who also have very strong Founder CEO's, it's a risk or hurdle that might now be too high. I could be wrong of course but it's foreseeable problem right now, so I am OK to swap for a better option. I will still prioritise Founder led businesses but their personalities and Boards are also part of that equation.

Updated Valuation in Aug 2024 based on 69.5 cents EPS for FY24 and 10% growth rate for next 10 years (less than half historical average) with PE of 18 (bottom decile of historical average).

Why do I own it?

# Top 5 global player in the travel industry focused on government and corporate clients. These customers are less likely to want to manage their own travel needs and often are on contracts. Business is nicely diversified with 50% in US, 25% ANZ, 20% EU and 5% Asia.

# Was badly impacted by Covid travel restrictions and sales/profits were smashed, which has caused negative sentiment over the past few years. Prior to Covid the business was compounding earnings at over 25% p.a. and has now returned to a higher EPS number in FY24 than pre Covid.

# Has a strong and entrepreneurial founder in Jamie Pheros running the business who owns 12% of the shares. Small Board and all have a little skin in the game too.

# Have somewhat of a trap door moat, as the hassles of switching providers and systems can be painful for governments and large corporates.

# Debt to equity ratio of only 3%. ROE / ROC is improving and should be back around 15% at the end of FY25. Net margins are now 14% and should be back at around 20% at the end of FY25.

# Big MOS at current price of $11.40 in Aug 2024 at less than half the historical growth rate. They have been buying back shares consistently in FY24, and announced up to $100 million in additional buybacks for FY25, indicating they believe there is significant upside.

# They can deliver double digit revenue and earnings growth for 5 + years so the return should exceed my 15%p.a. + target. They released a growth plan at the beginning of 2024 with the path to double earnings over the next 5 years.

What to watch

# Significant key person risk if something was to happen to Jamie Pheros - need to see who the possible successors are.

# Jamie can be "glass half full" with guidance, so need to follow actual results and not forecasts. He also has little time for analysts.

# They do "project" work at times for governments like war or asylum seeker transport etc which is high margin but very sporadic. This can cause some lumpiness in business from one year to the next. Need to follow the core business trends and take these project wins when they come as exceptions.

# Are vulnerable to black swan events that restrict global travel - want to see ongoing healthy balance sheets.

# Have acquired other travel players over the years - want to make sure they don't overpay or over extend with any future acquisitions.

https://cdn-api.markitdigital.com/apiman-gateway/CommSec/commsec-node-api/1.0/event/document/1410-02840758-5J13BAVE4OP0HQPOG8J9UU2V4G/pdf?access_token=0007ElapJLU3ePdTI2LQFuXW6ucp

CTD is described by Simply Wall St as a « Big Green Snowflake ». Growing, dividend. But the market hates it. There was an earnings miss a few months ago that the market punished the stock for. There were two issues: a UK contract miss (guidance assumed zero earnings from it after the downgrade) and variance in US corporate travel spend. But the web traffic suggests consistent uplift. In contrast to stocks like KGN and AD8 where web traffic has dropped off a cliff (probably more relevant to KGN).

Shorts for CTD are 5% - what is the short thesis? Europe conflict? Pandemic? Other?

Ewen Crouch just purchased ~20k on market @15.08. Seems he agrees they’re value at this price

Is this all just in the back of Middle East tensions? It seems corporate travel at a PE or less than 20 is a pretty good opportunity…?

CTD was smashed on Thursday after releasing half year results.

Full year results were expected to double NPAT. Announced on Thursday that full year expected to be $40m less due to weaker December and a UK contract that didn’t yield expected revenue (I think the UK is a bit of a basket case atm for a few co’s).

Reported January showed more promise.

For a still growing company paying a dividend, a forward PE of under 20 and a chart that looks like this (taking into account COVID) , I think it’s worth a look

, I think it’s worth a look

Had an interesting meeting yesterday where this came up - not a company I know much about at all but there were some strong views. Not sure if this is common knowledge or not - nor have i quantified it by actually looking at CTD.

From what I understand most of their most lucrative contracts and profits has come from government contracts. Think the repatriation flights from Israel currently (coordinating Qatar/Qantas/Emirates for Australian citizens) and the ongoing work in transporting and housing refugees to the UK - Fallout looms for Corporate Travel over Bibby Stockholm UK asylum barge contract (afr.com)

Essentially a reason they did so well during COVID and avoided a cap raise (unlike FLT and WEB) was not the narrative they did essential business travel - it was all the COVID repatriation flights that they must make massive margins on (though not disclosed for obvious reasons).

In short the narrative for this stock I think has been wrong for years - the government repatriation and other special flights are a big driver of profits - not typical business travel. This is not what they told the market of course.

Explains the empty locations and discrepancy in the financials form what they say they do that was in the short report years ago etc. As long as you think these government contracts continue then profit should continue but don't think the big driver is business travel.

Valuation is hard. At $21.60 the P/E is 92! However, forecast PBTA is $120-140 before the big contract announced. Let's ignore that since not long before EOY. A PBTA of $120-140 compares to last years ttm NPAT of about $30m. How big is the jump in profit? Depends on how much tax and amortisation they have.

I'm going to punt with $21 (just below the current share price) since surely NPAT will double from $30m to $60m bringing the P/E down to a more reasonable (but not cheap) 46. BUT there is high degree of uncertainty.