Pinned straw:

My thoughts first

There are not too many businesses on the ASX that look cheap at the moment. However, Grady Wuff from Bell Direct and Howard Coleman from Team Invest agreed Austin Engineering could be one of them. I tend to agree with them, and have been accumulating ANG for our IRL portfolios at the current share price.

What I like about ANG is the clear turnaround in the business. Margins have been improving, revenue and profit is growing and the international TAM is large. Grady believes the margin issues in Chile have already been addressed by the new CEO, Sy van Dyk.

I think ANG has a niche in the shear size in what it manufactures. It would not be easy for a competitor to come in with the scale of buildings, machinery, equipment and know-how needed to produce these mammoth dump truck trays and shovels. They also have some patents on lighter weigh trays to increase pay load for its clients. Then there is the logistics moving these things around the globe. They need to be manufactured close to where the demand is required. This is why ANG ran into trouble in Chile with margins. They called on the Indonesian factory to partly fill the orders they were committed to with blue chip clients in South America.

It’s the shear size, the logistics and capital that is needed that provides ANG with a small moat allowing them to increase margins. Their ROE has also been steadily increasing over several years, now sitting around 20%. This indicates to me they have some control over the pricing of their products.

I also like that their products are not tied to specific sectors of the mining industry. I can’t think of too many metals or minerals that don’t need big shovels and dump trucks in the operation.

However, they do rely on the mining industry for revenue. It’s interesting to hear what Howard had to say about this. He believes ANG do better when it gets tough for miners because they replace and repair trays and shovels rather than buying new equipment. When you think about this there is always some sectors of the mining industry that are doing it tough (eg lithium) and some that are booming (eg gold). The worst scenario is world wide economic recession. Then ANG should do OK using Howard’s reasoning.

Howard also mentioned ANG’s very low PE of 8. In fact the PE is even lower than that at just over 7 times, based on FY2025 statutory earnings (4 cps) and yesterday’s closing price (29.5 cps). Looking forward, analysts are forecasting double digit earnings growth with consensus FY2026 earnings of around 4.7 cps. Even on a PE ratio as low as 7 that puts ANG on a forward valuation of 33 cps. Considering ANG is trading on the lowest PE it has for several years, while at the same time the business fundamentals continue to improve just makes no sense. I think we will see further margin improvements once the issues in Chile are fixed and the figure demonstrate this.

Despite the ugly chart I don’t see much downside to buying ANG at 30 cps. However, I can see plenty of things I like, including improving revenue and margins, a solid balance sheet, good cash flows, huge TAM, a proven CEO at the helm who has been adequately incentivised to improve the fundamentals further. I like the 5% fully franked dividend going forward, and that I get paid well (7% yield including franking credits) to wait for Mr Market to realise what’s going on here at Austin Engineering!

Using a conservative PE of 8 and consensus Fy2026 earnings of 4.7 cps, I get a valuation of 37.6 cps. I think this is the bear case. Base case is 40 cps and bull case would be 50 cps (in line with Bell Potter’s share price target). Using McNiven’s Valuation formula and a required annual return of 15%, I get a valuation of 42 cps.

In summing up I see very little downside in buying ANG shares at 30 cps. However, the proposition here for upside looks very attractive. It may take some time because the chart looks ugly at the moment. However there does seem to be some support around 29 cps. I believe Mr Market follows the herd most of the time, and he thinks ANG should trade on 7 times. ANG needs to prove itself in FY2026 under Sy Van Dyk’s leadership. If this happens I can see a twelve month return of between 20% to 70% return (including PE appreciation, dividends and franking credits) as the PE adjusts to reflect the underlying business.

Held IRL and SM

Austin Engineering (ANG) - Transcript from “The Call”

“It's the global engineering company. And well, in fact, it's got a presence, obviously, here in Australia, but it has expanded into the Americas and Asia Pacific more broadly as well. The last result there, profit was up 70%.

It did have some good margin growth there, particularly in the Asia-Pac region. Some also, some revenue gains there in North America, although I gather that sort of offset some lower earnings that they saw in South America. Grady, what are your thoughts?

Grady Wuff

Yeah, we have a buy on them at the moment. So this is one opportunity in the market that I was talking about today, very few, but we're pretty optimistic about what we see. There's been a pretty strong turnaround in the company.

The operational challenges in Chile have been addressed, as we said, with the new CEO stepping in, they're implementing a turnaround plan. So it's kind of a bargain buy at the moment for what you're looking at. The results you mentioned, underlying profit increased 70% to 40 million, so back in the profit territory, which is really strong.

They've got good cash flow and working capital. They've worked through their ramp-up in capital at the moment. They're working through costs there.

Again, the implementation of a strategic turnaround. It often doesn't look good to say strategic review, but this is actually seeing a material turnaround in what they were doing. They've got strong revenue growth.

They're executing well, and we see that at the moment, they're trading in an attractive valuation. So yeah, we like what we see, and there is upside potential with growth on the horizon. So yeah, a buy rating for Austin.

Howard Coleman

if you look at this company, they do well when miners are short of cash. Why do they do well when miners are short of cash? Because when miners are flush with cash, they don't replace the buckets that they're using, they buy new ones instead of refurbishing them.

They don't worry about putting a new tray on the back of the truck, they buy a whole new truck. When they're short of cash, they want to repair everything. And that's where Austin Engineering makes its money.

It doesn't make its money from selling new equipment very much. I mean, they make some money from that. But the real margins that Austin makes is when miners are short of cash and they have this fleet of trucks or buckets that they're using to scoop things up, and they say, can't we manage to fix this?

And Austin lands up then fixing them at very high margins, which is cheaper for the mine than buying new ones. So if you believe that commodity prices are likely to be low and miners are going to be strapped for cash, it's a great time to be investing in it because it's only on a PE of eight. If on the other hand, you think that commodity prices are all going to go up because the American dollar is under pressure or whatever, then it's probably not a good time to buy it.

But we were talking about earlier that everything's in a bubble. We're looking at that graph. It's the opposite of a bubble.

It's been going down while everything else has been going up. So I wouldn't personally own Austin Engineering because it's too hard to predict. But if you are going to be looking for a company to buy that's not in a bubble and that's likely to benefit if mining does worse, Austin Engineering's dirt cheap at the moment.

Oh, we push you across the line there. Are you calling this a buy? I know not for you.

Well, not for me. And I don't think Teaminvest members would buy it. But for people out there who want some exposure.

Yeah. You wouldn't go probably terribly wrong if you bought it on a P of 8 when mining is likely to have some bad news in the near future.”

From The Call from ausbiz: the call: Thursday 16 October, 16 Oct 2025

https://podcasts.apple.com/au/podcast/the-call-from-ausbiz/id1506523664?i=1000732078884&r=861

This material may be protected by copyright.

Shapeshifter

I'm not so sure of Howard's assertion that Austin Engineering would do well "when miners are short of cash". In fact ANG's history seems to say the exact opposite.

After weathering a downturn in the mining industry and sustaining a statutory loss of $40.5m in 2016 in 2017 ANG were forced into what looks like an urgent capital raise which almost quadrupled the share count to manage balance sheet debt.

Rick

@Shapeshifter Yes, I’d take Howard’s assertion with a grain of salt! Personally, I think Austin has more to gain in a thriving mining industry than a struggling one. There will be more replacements needed. It makes economic sense for customer's to use Austin replacements after the trays are worn out due to increased payload efficiency, and they continue to work on improving these efficiencies. The other thing to consider is the total addressable market as the mining industry flourishes and grows. Austin estimates TAM to be 7x current Austin production levels. It’s a huge market!

Due to strong growth in the US, truck bodies now make up 71% of Austin’s sales.

In regards to Austin’s history, leading up until 2017 there appeared to be numerous adhoc acquisitions which led to a disjointed business model with very little focus.

Since 2017, Austin seems to have consolidated and refocused on its competitive strengths. It is now a much simpler business to understand…quality, lightweight, truck bodies and shovels. They appear to be developing a competitive edge with their truck bodies which make up 71% of the business. There is also plenty of scope for growth (up to 7x). The turnaround is demonstrated in the fundamentals of the business since 2017. It’s been a slow and tedious journey, and I think there is still more improvement in sight. I’m hoping this will be become evident over the next 3 years under Sy Van Dyk’s leadership.The key metric for me will be ROE. If Austin can maintain ROE at 20% or higher, this will demonstrate to me that Austin has a competitive edge, a sustainable business model, and has become a high quality business. Time will tell!

Shapeshifter

I am naturally drawn to these small cap industrial companies and I can see the appeal of this one.

For balance it did recently receive a double sell/ avoid by Luke Winchester and Ben Richards on The Call.

Luke said Austin Engineering restating its FY24 financial statements to correct an accounting error in its Chilean subsidiary is a red flag. The error resulted in the overstatement of revenue and profit for the FY24 year. This restatement will cause a decrease in the reported FY24 figures, but an increase in FY25 revenue and EBIT projections, as transactions are reallocated to the correct period. Luke also mentioned the cost blowouts in the South American division affecting margins.

Ben said it has always looked cheap and is not really executing as it should. He also mentioned management turnover as a red flag.

In defence of ANG, Sy van Dyk was appointed as CEO and MD on on July 1 2025 but prior to this he was a Non-Executive Director on the board since 2018. The former CEO and Managing Director David Singleton remains on the board as a Non-Executive Director. The CFO has been there since September 2021, the COO July 2022 and the Company Secretary since Jan 2023.

The accounting error involved the incorrect recognition of revenue for tray production transactions in its Chilean subsidiary. ANG does not expect the error to materially affect its overall financial position because it primarily involves reallocating revenue to the correct financial year. Although companies should not be making these kinds of accounting errors this one strikes me as a non-malicious unintentional accounting mistake not related to the running of the business. Maybe I am too naive on this?

Rick

Thanks @Shapeshifter. These are valid points, and the reallocation of earnings from FY2024 to FY2025 concerned me at first. I agree ASX companies should not be making accounting errors like this. Like you I put this down to a non-malicious unintentional accounting error. It does however erode your trust in management when this sort of thing happens, especially when it makes the current year look better than it did previously. If I bought ANG on the FY 2024 results announcement I would not be happy with this accounting correction! I think this is an orange flag!

As for the Chile factory cost blowout, I think this will be fixed. I believe this resulted from not properly matching orders with production capacity and the company needing to use expensive labour and partly fill the order from the Indonesian factory. I am working on this being a one off. If it’s not, Luke (@Wini) is correct in calling this a red flag and it will be time to get out. Again we won’t know until we see the FY2026 financials, and it might be prudent to wait until then to consider the business.

I don’t agree that ANG has always looked cheap. When you look back on the PE ratio over the last 4 years, it was on a much higher multiple most of this time. The last time it traded on a 7x multiple was mid-2022.

Source: Simply Wall Street

I think the issues Luke and Ben have raised have been the reason for the loss of trust in the business resulting in some serious selling, particularly by Wilson Asset Management who sold off $15.7 million worth of shares @ 31 cps on 15 August 2025. On the other hand, Thorney Investment Group are seeing this as an opportunity and have been adding significant number of shares. Thorney now hold shares in 20% of the business. I don’t know what Thorney’s track record has been as contrarian investors? Good I’m hoping! ;)

Rick

About ANG’s biggest shareholder - Thorney

Considering Thorney has been increasing their holding in ANG and now own 20% of the business, I thought I’d investigate their approach. This is what they do according to their website. It sounds like they might be intending to ‘stir the possum’ at Austin?

“When Thorney’s Founder and Chairman Alex Waislitz OAM established his investment company in 1991, he had a vision of being a “thorn in the side” of complacent company managers not delivering full value to their shareholders.

From Thorney’s very beginnings, we took an active role in the companies we invested in. We get to know boards and management, as well as work actively with them to improve shareholder returns. Thorney has always been prepared to agitate for change when warranted. This remains part of our DNA today. At Thorney, investing is never a static game. We work with an ethos that “the more we roll up our sleeves and get involved, the more we will ensure success”.

While Alex Waislitz prefers the term “constructivist” to “activist” when describing Thorney’s investment style, the Thorney name is a constant reminder that we will always strive to improve shareholder returns and fight against complacency wherever it is evident.

Thorney Investment Group is the private investment group of Alex Waislitz. Alex has established himself as a leading investment and stock picker in Australia, presiding over the experienced investment management team at TIG.”

https://www.thorney.com.au/about-us/

Bear77

@Rick - we've discussed Thorney a few times here - Alex runs two LICs - TOP (Thorney Opportunities Fund) and TEK (Thorney Technologies). TIG is normally referred to as TIGA which stands for Thorney Investment Group Australia.

They are "Subs" for a number of ASX-listed companies, which includes owning

- 21.55% of ANG

- 17.58% of VBC

- 9.82% of 1CG (not eye-see-gee, but one-see-gee)

- 13.4% of SXE

- 14.54% of EPX

- 5.69% of FLX

- 6.76% of XF1

- 12.27% of RCL

- 10.81% of CXL

- 27.51% of DOC

- 7.32% of NXS

- 5.05% of RFG

- 14.88% of AMA

- 17.96% of SVR (formerly Money3)

- 23.12% of QFE

- 30.5% of GAP

They were also formerly "Subs" for other companies including IMU, SSM, DUG and MRM.

He's just gone through a divorce with Visy heiress Heloise Pratt. See here: https://www.afr.com/rich-list/pratt-settlement-keeps-waislitz-in-control-of-thorney-empire-20250903-p5ms0a

So there was some forced company share selling to pay her out - that AFR story said that Alex Waislitz had agreed to pay Pratt $325 million over two payments, and their children will be the beneficiaries of payments from a trust associated with Thorney, which has traditionally not paid significant distributions. Waislitz will also be permitted to provide for himself and his family through Thorney.

The settlement brings to an end a long-running dispute between Pratt and Waislitz that began more than a decade ago. While the pair appeared to have an amicable relationship in public, that soured last year after Pratt filed a lawsuit against Waislitz in November.

As I understand it, Alex was originally employed by Anthony Pratt to invest the billions that Pratt made through his Visy Packaging empire - Alex married Anthony's daughter Heloise Pratt either before or after that arrangement between her father and Alex had been inked, and then the public got a chance to invest alongside Pratt through the two LICs TEK and TOP, however because the bulk of the money (virtually all of it) that was used to start the Thorney/TIGA investment business came from Anthony Pratt, his daughter Heloise Pratt was always going to get a good payout if Alex and Heloise split, which they now have.

Thorney has been known for a lot of poor-performing investments, and a few winners, as well as high fees and poor shareholder returns from the LICs.

You can find some stuff SM members have written about the man and his companies here:

TOP - The Loveable Mr Waislitz: https://strawman.com/forums/topic/10891

Which includes this:

Scoonie - Added 7 months ago

There are a number of posts on Strawman on Thorney Opportunities (TOP), highlighting the management fee rip-off scams Mr Waislitz has been running for many years at TOP (and TEK, and anywhere else regular investors have been unlucky enough to encounter him).

Maybe spend your time more usefully and don’t read all the following AFR article. However in summary the article points out how the delightful Mr Waislitz is currently involved in legal action with Nic Bolton (“corporate raider”), Tim Gurner (Melbourne property developer) his future sister-in-law and his ex wife Heloise Pratt.

Alex Waislitz on Thorney, the Pratts, Nick Bolton and Tim Gurner

What was interesting was in relation to Mr Waislitz and his dispute with his ex-wife, the article says:

"Its’s an investment he (Waislitz) has turned into $1.6 billion and is now at the heart of an ugly court dispute with Heloise, which threatens the control of his business, the Thorney Investment Group. The couple split in 2015, but the divorce is still being finalised. The details are messy but in essence, Waislitz says Heloise left the running of Thorney to him. Heloise says she legally owns half and was deliberately excluded.

There are fears on the Pratt side that Waislitz could counter-claim for a share of Heloise’s fortune, estimated to be $4.84 billion by the Financial Review’s Rich List team.”

So Heloise is worth $4.8 billion, but clearly must be running a little short on cash and is now going ex-hubby another billion or so. Wow, what sort of a world do these people live in.

No wonder she is just referred to as “Hel” by many. As for Mr Waislitz, as we used to say when we were younger: “It could not have happened to a nicer bloke”.

PortfolioPlus - Added 7 months ago

Yep…in any 50 - 50 deal, he wants his 50, your 50 AND the hyphen in between.

Best avoided, but clearly, his investment companies adhere to the old PT Barnum belief ‘there’s a mug born every day’

stevegreenycom - Added 7 months ago

Did you guys get an invite to the dinner party, mine was lost in the mail unfortunately.

Bear77 - Added 7 months ago

He does like to waste money undefinedundefined - including on a lavish lifestyle - I'm not sure if you'd also classify the following in the same category (wasted money):

- 4-March-2025: Exercising $102,398.40 worth of options in ReadCloud (RCL) to take TOP/TIGA's stake from 10.92% to 12.27% (Link)

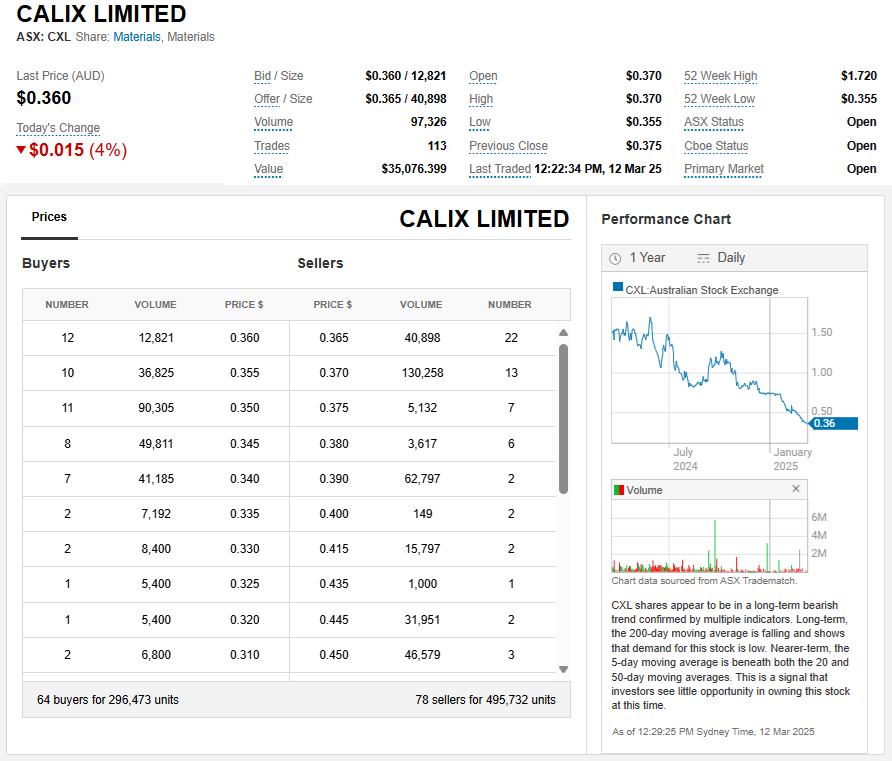

- 3-March-2025: Buying millions of dollars worth of shares in Calix (CXL) from 4th September through to 3rd March with the largest three purchases being $602K, $412K and another $1,765,000.50 in a placement in December. This has moved TOP/TIGA up from 8.67% to 10.81% of CLX (link)

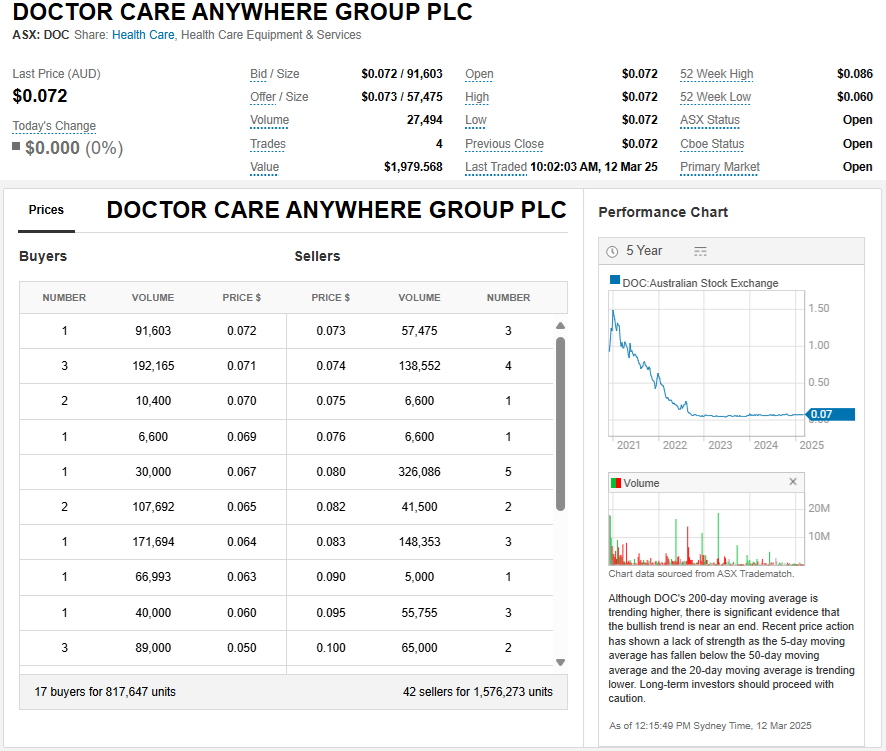

- TIGA/TOP also now own 27.51% of Doctor Care Anywhere Group (DOC), and were accumulating shares through to 12th Feb (Change-in-substantial-holding-from-Tiga-Trading-Pty-Ltd-(TIGA-TOP).PDF + Previous buying notice link here for July and August)

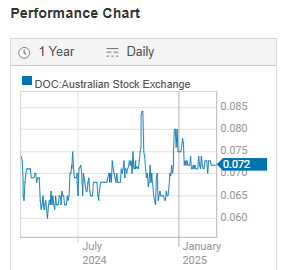

Looks like it's going nowhere fast on a 5 year chart (above) however, it's been rising during the past year (below):

Well, it looks like it's been rising, but it's actually just below where it was exactly 12 months ago...

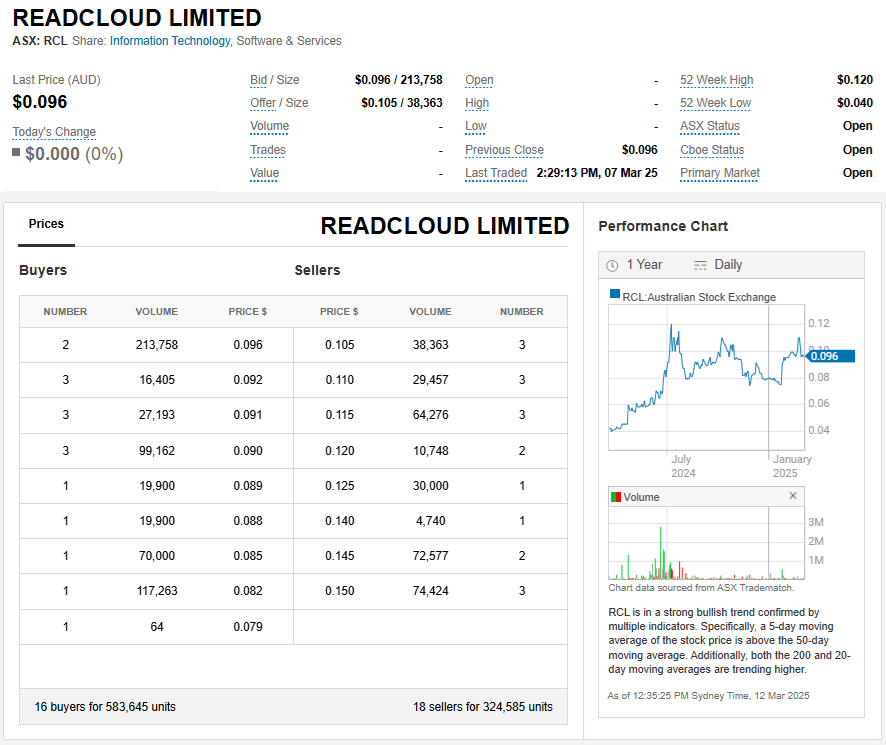

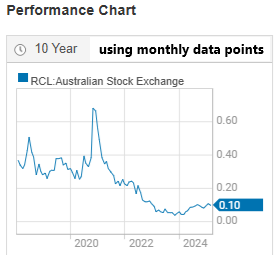

ReadCloud (RCL) actually has been rising more than falling over the last 12 months (see below):

But over longer periods they haven't been a great investment:

Also, look at that liquidity (above, 2nd image up); the lowest offer (@ 10.5 cps) is +9.4% above the highest bid (@ 9.6 cps), which is likely why zero RCL shares have changed hands today (@ 12:35pm Sydney Time).

[EOD result was 4 trades in RCL for a total of $20.3K and the buy/sell spread still @ 9.6 vs 10.5 cps, i.e. still a 9.4% difference, less liquidity than a dead dingo's...]

I would posit a theory that anybody investing millions of dollars of other people's money is going to struggle to make money for their investors consistently at the nanocap end of the market, unless they are excellent stock pickers and those nanocaps turn into microcaps and then mid-caps over time, which hasn't been the experience generally with TOP and Thorney Investment Group Australia (TIGA). It gives Alex something to do clearly, because to accumulate positions or to reduce them, it does take time and a lot of trades, but he hasn't been a very good stock picker, so there's that...

TOP/TIGA own 10.81% of Calix (CXL), 12.27% of ReadCloud (RCL) and 27.51% of DOC.

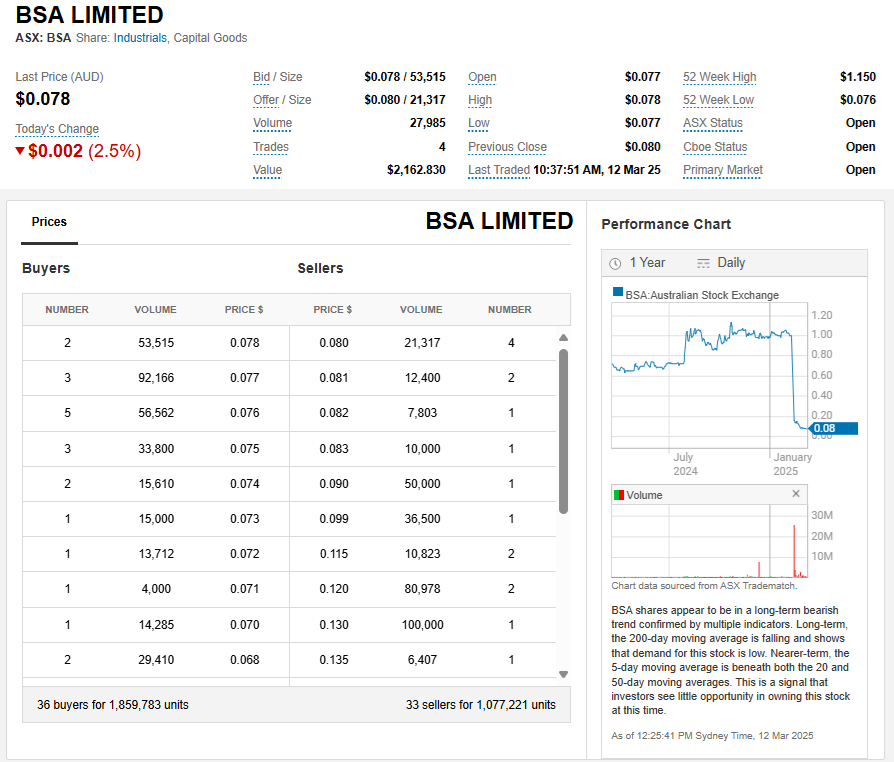

Another company that has far too many "investments" that crash and burn is NAOS Asset Management. I note that NAOS are still listed as the largest shareholders of BSA with 32.72%, and here's BSA's graph:

BSA's market cap has gone from $75.45m just 4 weeks ago to just $6 million today, all on the back of losing their services contract with the NBN (or "nbn" as they like to be known). Now that's a lobster pot!

Also - there's this: TOP - Bear Case: https://strawman.com/forums/topic/7412

And this: TEK - Bear Case: https://strawman.com/forums/topic/7484

And this: RFG - Perspective: https://strawman.com/forums/topic/10640

I do remember doing a bit of a shallow dive into TIGA's Subs Notices (for what they owned) and what they were selling due to Alex's divorce and payout to his ex, and that was reasonably recently, and I typed up what I found and posted it here as either a straw or forum post, but I can't remember what company it was posted under, and I had a bit of a look tonight and can't find it.

My recollection is that for the most part Alex appears to hold onto his losers forever and sells out of his winners way too early - like SSM.

Rick

Wow @Bear77! What a story! I find all this stuff about the super rich interesting and intriguing! Makes you never want to go there if that’s how it’s all going to turn out!

Thank you for generously pulling all this together and providing the links to previous discussions on SM. It looks like Alex Waislitz is a bit of a random investor at best! I did look at the long term return for TIG and it wasn’t much better than the ASX 200.

UlladullaDave

Hi @Bear77

Just an FYI, NAOS sold down back in July. Announcement here: https://announcements.asx.com.au/asxpdf/20250730/pdf/06mb6wbl78hc6y.pdf

Bear77

Thanks for the update on NAOS selling out of BSA in July @UlladullaDave - that post of mine was from 7 months ago (see here: TOP - The Loveable Mr Waislitz: https://strawman.com/forums/topic/10891) so back in March this year when NAOS still held 32.72% of BSA. I was copying that post into this forum thread to give a little background on TIGA/Thorney and their investments, and NAOS' holding in BSA was just something I had thrown in at the end of that post back in March to underline that fundies who focus on smaller companies do so at their own peril - it's a dangerous end of the market to have large exposures when things turn pear-shaped.