Looks like I bailed out at exactly the wrong time and maybe one can rely on hope!

AFR Street Talk

US player comes calling for ASX-listed software biz Qoria

Sarah Thompson, Kanika Sood and Emma Rapaport

Feb 1, 2026 – 1.55pm

Perth’s Qoria, a provider of monitoring software for parents and schools capitalised at $454 million on the ASX, has a back-to-school surprise for its shareholders.

Qoria (née Family Zone) is working on a merger with US-based technology player Aura’s Australian arm in a deal set to be announced on the ASX as early as Monday, according to people familiar with the negotiations.

Sources said the US player is advised by investment bank Jefferies, while Qoria has Perth-based Azure Capital on the tools.

Qoria founders Tim Levy and Phil Warren have had their eyes on global expansion.

The deal, which is structured as scrip, is expected to value Qoria at 72¢ per share, more than double its last traded price. Sources said it is unlikely Qoria would raise fresh equity alongside the merger.

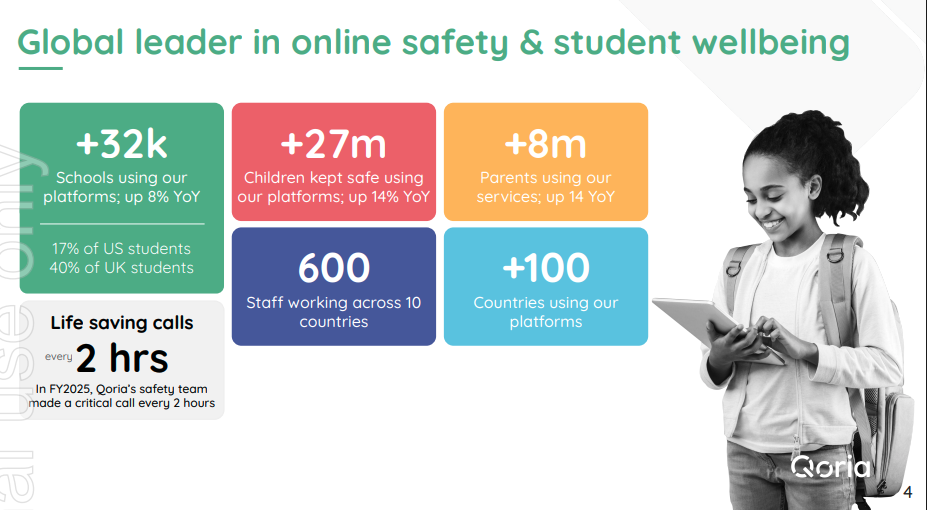

Qoria is among Australia’s best-known software companies, with its technology platform used by more than 32,000 schools and 9 million parents, helping monitor over 30 million kids. It has a 40 per cent market share of UK’s school student population and 20 per cent of the US cohort.

Its share price has been a rollercoaster ride but Qoria is a long-time fundie favourite with Regal Funds, Solaris Investment Management and Pinnacle-backed funds owning substantial stakes in the company.

Patience, child

The merger comes at a time when Qoria’s shares have halved since early October, when it punched through $1 billion market capitalisation as the federal government prepared to install a world-first social media ban for kids under 16. It ended Friday’s trading down 30 per cent over 12 months.

The company was floated in 2016 by founders Tim Levy, Crispin Swan, Ben Trigger and Paul Robinson after a wee $5.5 million IPO. Levy remains the managing director.

In April 2024, it received and rejected a 40¢ per share bid from K1 Investment Management. In its rebuttal, Qoria told K1 the bid was opportunistic and didn’t reflect its position as a global leader.

It ended the 2025 financial year with $117 million revenue and $15.4 million EBITDA. It guided to $140 million revenue and 20 per cent earnings margin for this financial year.

At its December quarter update, Qoria lifted this revenue guidance to $146 million-plus.