Discl: Not Held IRL and in SM

Part 3 - Competitors, Domestically and Globally

In summary, at this point, my thinking on KYP:

- Not an obvious monopoly/semi-monopoly in the workforce compliance space - it looks like it has direct competitors. Its acknowledgement that their “Serviceable Obtainable Market” of 60-70% of TAM might be explicit admission of this.

- Has clear and largish global competitors with their own international reach

- Appears small, size-wise, vs its global peers

- Not seeing an immediately obvious path to international expansion - is KYP merely an ANZ play, despite the noises it is making on “international expansion”.

- The $10m cash on hand does not seem like much to work with at all, given the on-paper scale of the global players - I would expect a capital raise to accompany any M&A

Need to peel the KYP announcements to confirm or debunk this continued scepticism.

Would appreciate any input/feedback from anyone who has followed KYP more closey and for longer as I am unsure if I am off course with my thinking thus far ...

DOMESTIC COMPETITORS

Kinatico sits in the workforce-compliance / compliance-management / RegTech niche. competitors fall into three groups: specialist workforce/credentialing platforms; broader compliance/GRC vendors; and general workforce/HR platforms with compliance modules. Representative competitors (examples with sources):

- Rapid Global — safety & compliance / contractor management solutions

- SafetyCulture (iAuditor) — operations & compliance inspections widely used across industries (competes on operational compliance)

- Donesafe / SAI360 / Donesafe-like GRC vendors — broader compliance and risk platforms used by enterprises.

- CredEntry / other credentialing vendors — focused on credential verification / visitor & contractor credentialing (very direct overlap).

- Large HRIS / HCM vendors (Workday, SAP SuccessFactors, ADP, Oracle) — not direct substitutes for deep compliance workflows but important competitors/partners because many customers rely on HRIS vendors’ modules or integrations. Kinatico lists many of them as integration partners.

(Industry listings and competitor aggregates also show Kinatico compared to Rapid Global, Nakisa, Redzone and others in third-party directories.)

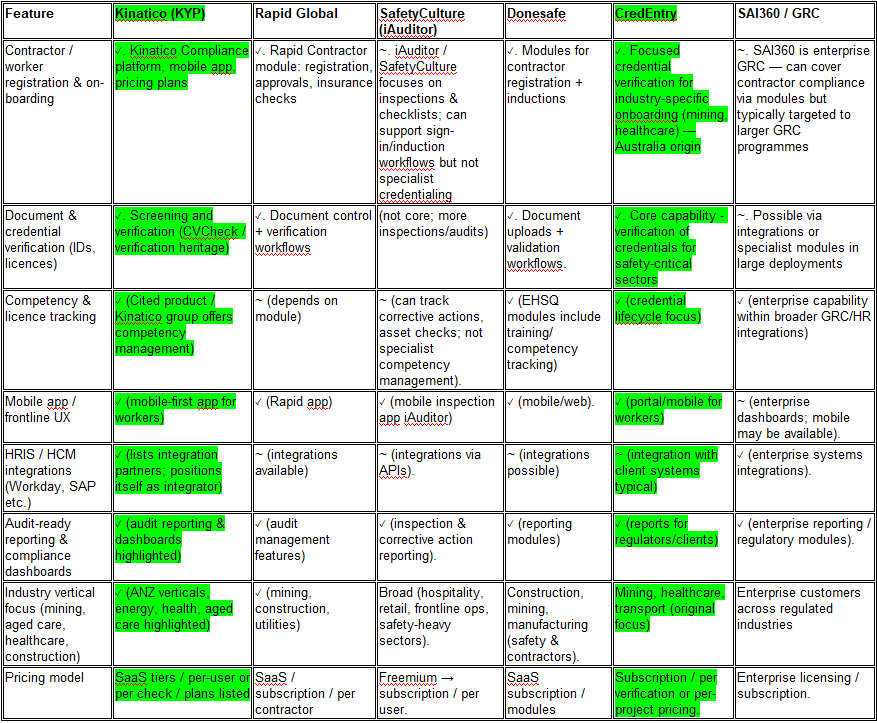

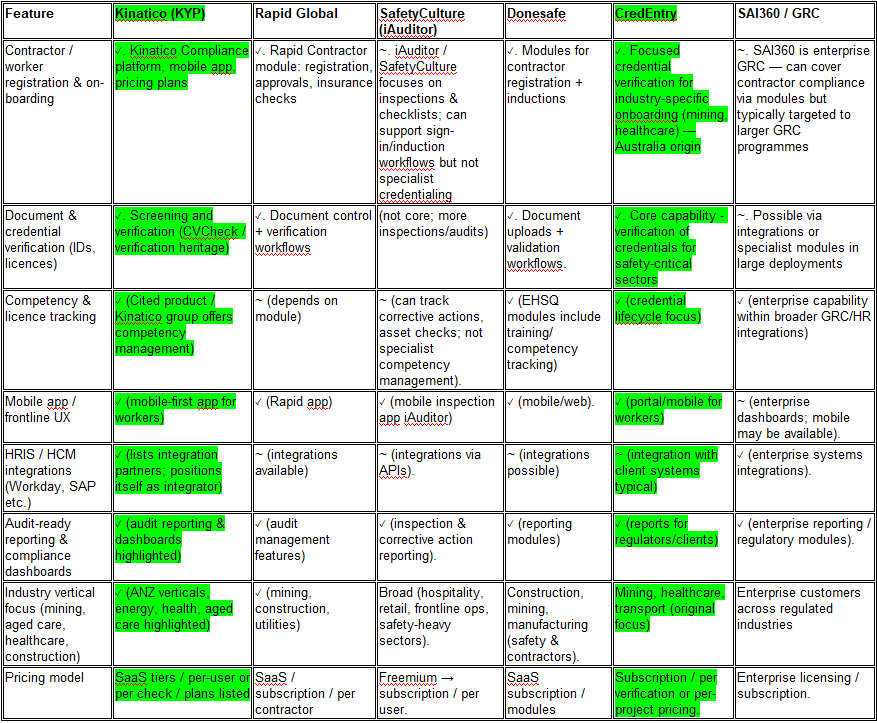

COMPETITOR FEATURE MATRIX (TOP 6)

Takeaway from Matrix

- Kinatico’s strengths: integrated screening history (CVCheck heritage), mobile worker UX and explicit HRIS integrations — good fit for regulated industries in ANZ

- Kinatico competes most directly with specialised ANZ credentialing/worker-compliance vendors (CredEntry, Cited within Kinatico group, Rapid Global, Donesafe)

- SafetyCulture and SAI360 compete on adjacent functionality (inspections, enterprise compliance) and may win customers via broader operational or GRC footprints

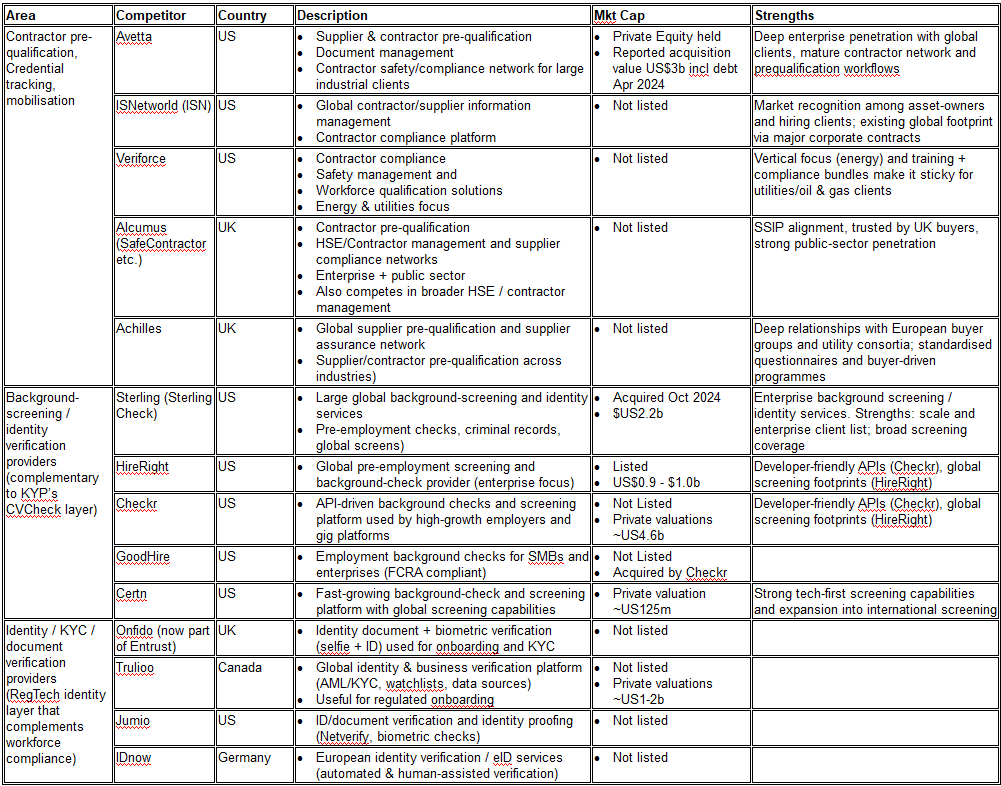

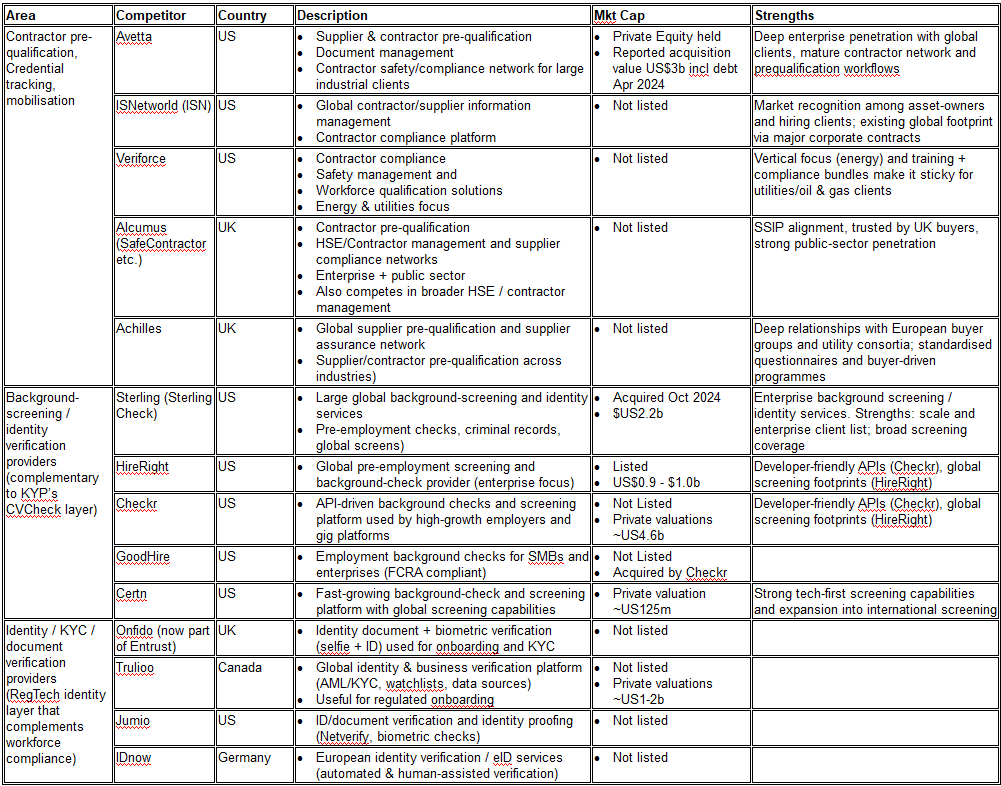

CLOSE OVERSEAS COMPETITORS

Below is a focused list of non-Australia / New Zealand companies that offer products comparable to Kinatico (workforce compliance, contractor pre-qualification, credential verification, ID/KYC, background screening, mobilisation/logistics). For each I give the primary country (HQ) and a one-line note on the comparable product area.

Key Notes

- Region matters: Avetta / ISN / Veriforce / Alcumus / Achilles already operate in many countries and have strong relationships with large corporates and asset-owners — they’re the firms a global miner/utility will ask about first.

- Partnership vs direct competition: Some identity and screening providers (Onfido, Jumio, Sterling, Trulioo) often partner with contractor management platforms rather than compete directly on full workforce-compliance stacks. Kinatico could integrate with (or white-label) these providers when entering new markets.

- Regulatory & data localisation: entering EU/UK/North American markets typically requires local data-handling, chain-of-custody and compliance with local background-check laws — existing local players have operational advantage

- Africa & Middle East - higher barrier to entry due to local rules - must partner locally or buy licences; direct entry without local partnerships is high friction

- India - large TAM, but regulatory and fragmentation challenges

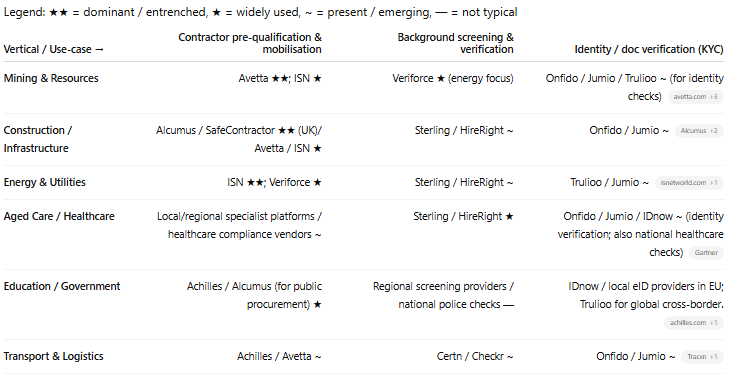

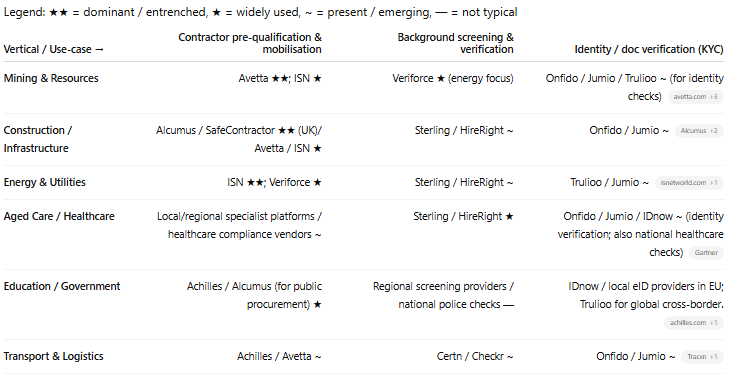

COMPETITOR MAP BY VERTICAL

Go-to-market competitor map by vertical and who dominates which vertical.

Vertical Competitor Map Takeaways

- Large asset-owners in mining, energy and infrastructure typically contract with Avetta/ISN/Veriforce/Achilles/Alcumus — these players are entrenched because they operate buyer-led networks or are aligned with procurement standards

- Background screening for hires and contractors is dominated by specialist screening firms (Sterling / HireRight / Checkr / Certn) that focus on speed, global data sources and API integrations. They are complementary to (and sometimes partners of) contractor-management platforms

- Identity/KYC providers (Onfido, Trulioo, Jumio, IDnow) dominate the document + biometric verification layer — often integrated into contractor platforms rather than replaced by them.

CHAT’s “ADVICE” ON WHERE KYP CAN REALISTICALLY WIN INTERNATIONALLY

Adding this for completeness - not placing any reliance on these “suggestions”

- Target mid-market and regional subsidiaries of global firms first. Large miners/utilities typically use Avetta/ISN — but their regional operations and subcontractors can be won with faster onboarding, lower cost and better local integrations. (e.g., KYP’s ANZ vertical templates are a selling point)

- Partner rather than compete on screening / identity in new markets. Integrate with global screening (Sterling/HireRight/Certn) and KYC (Onfido/Trulioo/Jumio) instead of building local screening networks from scratch — this substantially lowers time-to-market and regulatory burden

- Focus on niche verticals where buyers value local/regulatory fit. Aged care, healthcare and regulated education environments prize local compliance fit (national police checks, healthcare registers) — win these by pre-baking local checks and workflows.

- Use a two-track approach: (A) land-and-expand with mid-market clients via fast deployments and modern UX, (B) pursue 1–2 strategic global anchor customers (regional units of multinationals) to build credibility and integrations.

MY TAKEAWAYS

Domestically

- Appears KYP has direct competition, with various companies dealing with some or all aspects of the workforce compliance management space - need to peel what KYP’s market share is and KYP’s differentiator from its competitors

- KYP’s own Serviceable Obtainable Market of ~60-70% of TAM also suggests that KYP’s is not quite in a monopolistic/semi-monopolistic situation

International

- There are big international players in KYP’s space in the US, UK, Europe and Canada with seemingly huge valuations in the US$b, and “relatively entrenched” positions, most of which sound like they have a global offering - prima facie, these look completely out of KYP’s reach to acquire given KYP’s market cap of ~A$164m. If anything, it raises the risk of KYP being acquired for the globals to geographically expand to ANZ - with those valuations, acquiring KYP would appear to be well within reach

- The smaller non-English speaking countries could be white space for KYP’s international expansion but these will come with its significant operational challenges - language, lack of standardisation, need for deep local knowledge etc

- I can’t quite see an immediately obvious and viable pathway to KYP’s international expansion - this was my very first risks when looking at KYP for the very first time. The evidence in this superficial dive seems to confirm this thinking rather than debunk it

QUESTIONS TO ASK

Q6. What is KYP’s thinking and plans around international expansion? In what space, region?