Discl: Held IRL 0.85% and in SM

Very nice deal announced today, amidst a sea of read ...!

From Wikipedia, LeoVegas is:

- A Swedish mobile of online casino and sports betting services such as table games, video slots, progressive jackpots, video poker and live betting to a number of international markets founded in 2011

- Areas served: Nordics, UK, Europe

- Products: LeoVegas Casino, LeoVegas Live Casino, LeoVegas Sportsbook

- Revenue: EUR327.8m, 930+ employees

- A subsidiary of MGM Resorts International, was acquired in 2022

- LeoVegas experienced rapid growth due to the overriding increase in smartphone use and the "mobile first" mentality of its founders. Hagman stated that the company "was born out of the smartphone, which today is the fastest-growing channel for entertainment."

There were no numbers but key for me:

- Looks like another Tier-1 company, given that LeoVegas is a subsidiary of MGM Resorts International

- Won through global tender and due dilligence - further evidence that RTH's products are world class

- It is wide scope deal with 2 RTH pillars at play - Data, Analytics + fully Managed Trading Services, taking over the delivery of the Racing service for its brands in the UK

- Extends the UK racing reach to Sweden, Norway, Denmark and Sweden - LeoVegas’ core markets outside of the UK

- My buddy Chat notes that other than the UK, Sweden has a “relatively strong horse market”

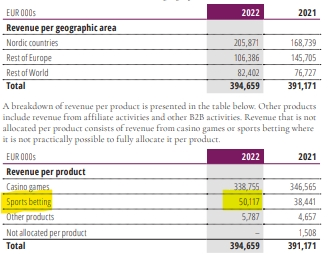

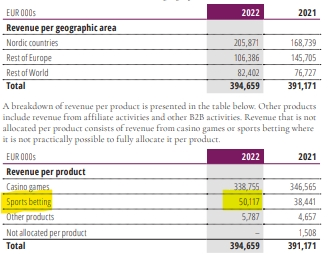

- LeoVegas’ last publicly available financial statements was FY2022 - it did EUR50m in Sports Betting as a whole, growing 30% YoY from FY2021’s EUR38.4m

I can see how the deal makes sense to LeoVegas: (1) Sports Betting is ~13% of its revenue, but growing at a fast clip, horse racing will be a further fraction of that - not big but not small either (2) RTH has the data products and the MTS expertise for LeoVegas to farm these out, possibly saving them cost.

It is also further evidence of RTH’s strategy playing out nicely - Data, Data Analytics, then MTS ...

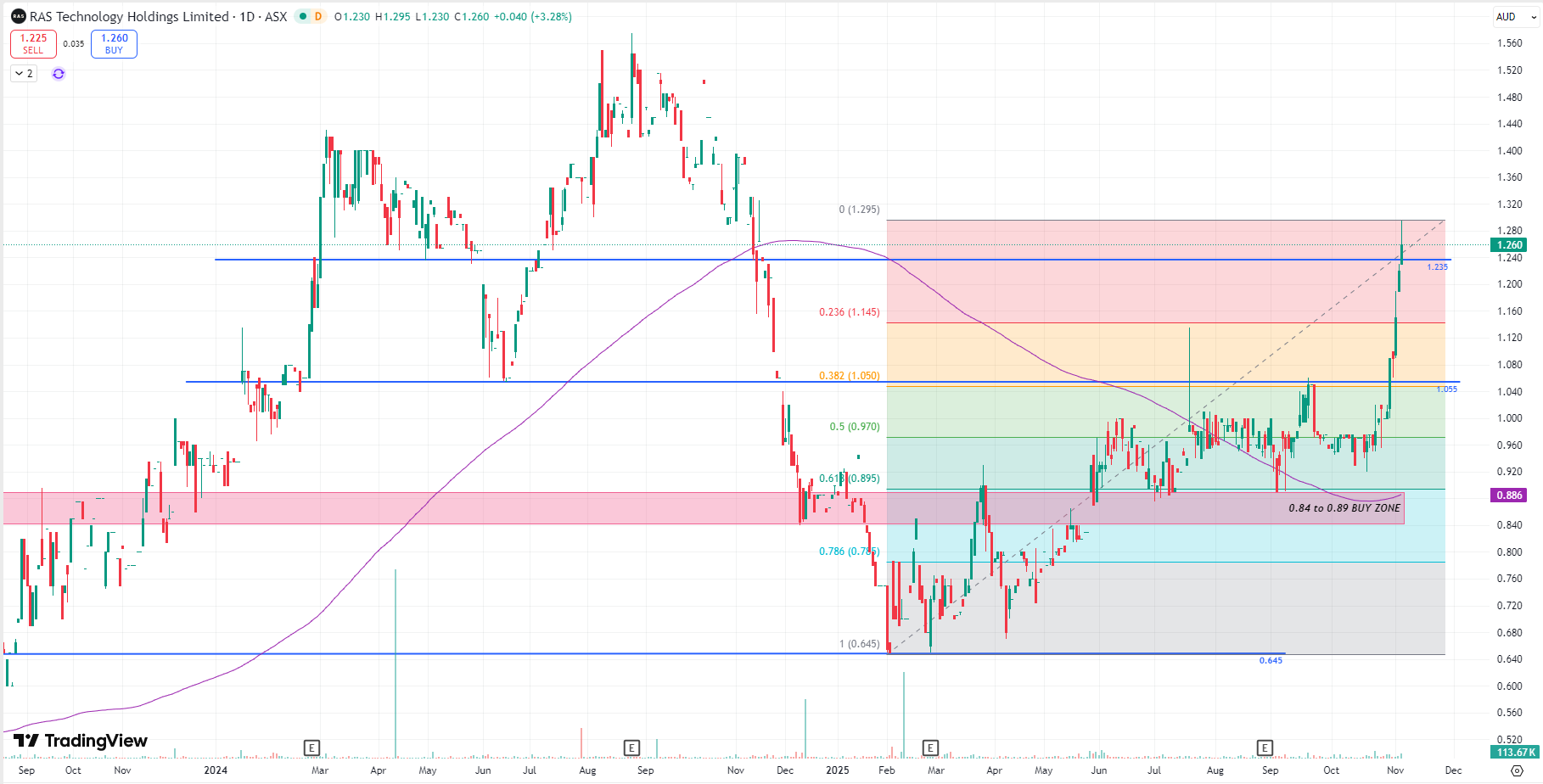

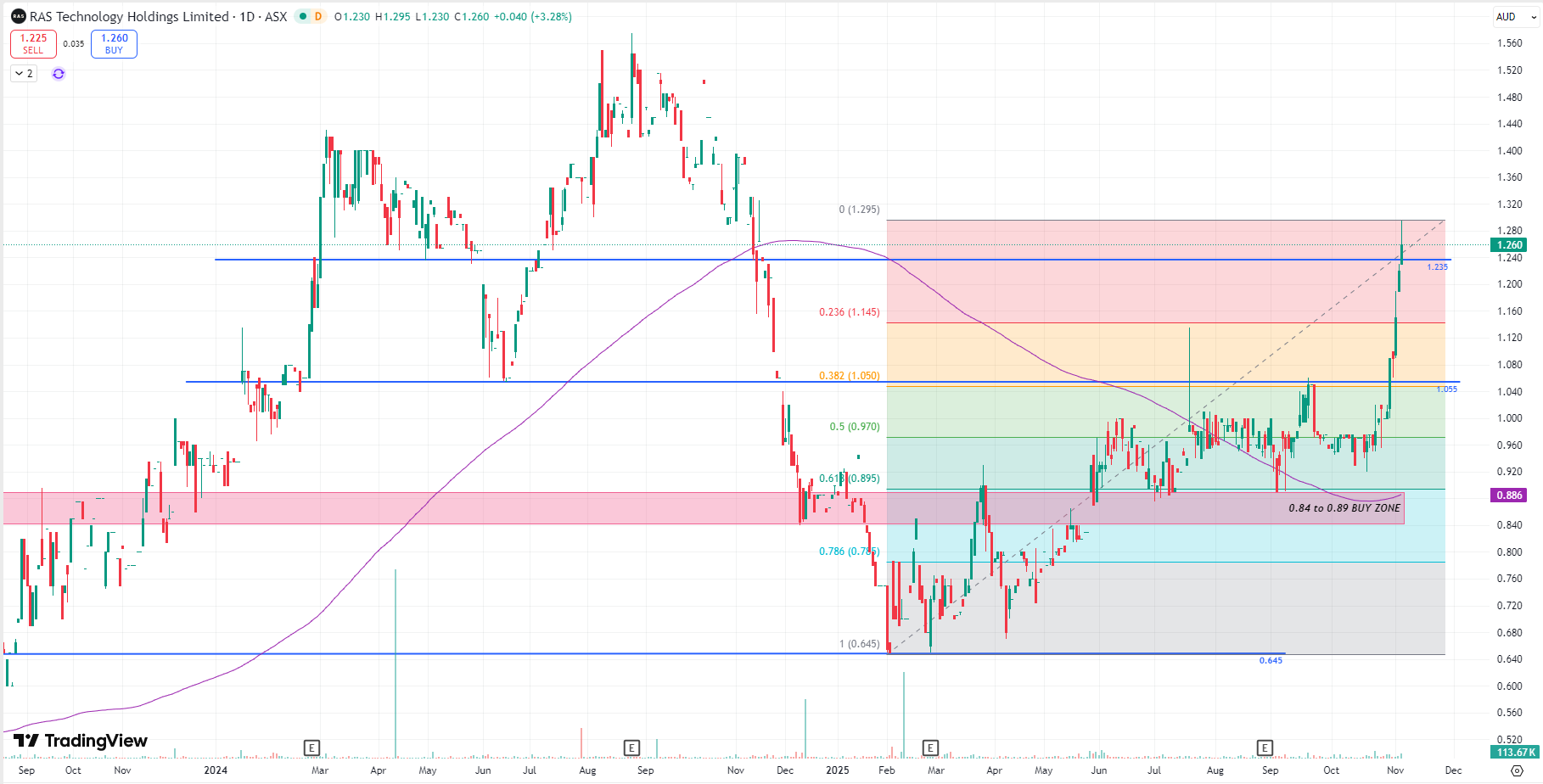

Chart Review

Share price was relative muted amidst a not-great day for tech stocks. News of the deal must have leaked as RTH has moved a good ~20% in the past week ahead of the deal.

Bit of heat in the price now. Staying above 1.235 will be a bit of a challenge I suspect, support should be good around 1.055 and any sideways consolidation between these ranges would be healthy indeed.