Pinned straw:

Discl: Held IRL 6.56%

Had a good look at the XRO results and operating statistics. Updated my trend charts (appended below), then organised the points into positive/negative/neutral.

POSITIVES

- Subscriber Base - globally, grew 4.0% HoH and 9.7% YoY - Growth in subscribers is increasingly being driven by International - 54% of the net additions vs 46% in the previous year

- Australia grew 4.1% HoH, 8.7% YoY - still growing at a decent clip - growth reflected continued focus on supporting accounting and bookeeping partners along with increased investment in direct GTM channels

- UK grew 4.9% HoH, 12.6% YoY - continued cloud accounting adoption, early adopters of Xero Simple ahead of the Making Tax Digital for Income Tax Apr 2026 deadline

- AMMR - Crossed $2.5b for the first time, up 19% YoY CC - above trend growth - both segments contributed

- ARPU - increased 8% YoY CC to $49.63, above trend - price changes alongside payments growth

- Gross Margins - fell 0.4% YoY, fell 0.7% HoH, but grew on trend, and is still on a good growth trajectory

- Profitability - Revenue was up, slightly above trend, Expenses also increased - above trend increase, more than the revenue gap - impacted by the acquisition costs of Melio, both EBITDA and NPAT are growing on trend

- FCF - as revenue increased, FCF increased to $322k, growing on trend, FCF margin flattened at 26.9%, but the long term trend is clearly up

- Rule of 40 - 1% increase HoH and YoY to 45% - clear continuation of 2 trends - declining revenue growth % and increasing FCF margin

NEUTRAL

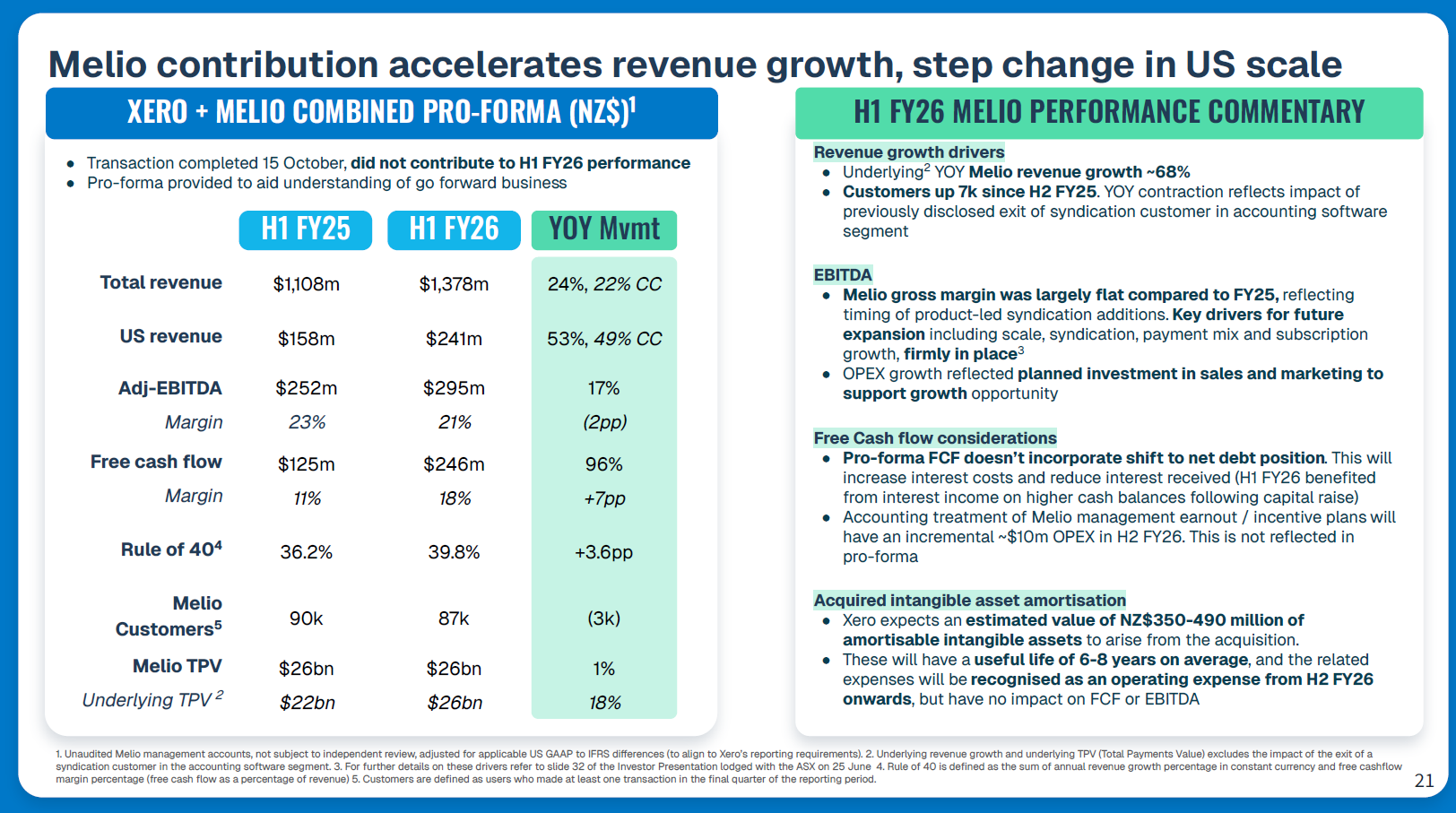

- Pre-Melio Contribution - all of this is pre-Melio as there was no contribution this half. From initial management reports, Melio seems to be trading to expectations, but there is no data to back this just yet

- Lifetime Value Per Subscriber - on trend overall - ANZ grew above trend, offsetting the below trend International growth

- Churn - slight uptick of 0.02% to 1.09% HoH - still a very low percentage, but it is creeping up

NEGATIVES

- Subscriber Base - North America grew 4.8% HoH, 14.8% YoY - this is pre-Melio, but still anaemic

- Net Subscriber Additions - while total subscriber numbers are still growing, the net subscriber additions have been trending downward

- North America - clearly the watch area - HoH net subscriber addition was not great, the down trendline was heavily impacted by the sharp drop in the 1HFY25 account cleanup exercise

- 1H is seasonally weak for North America due to the timing of the US tax year - impacts ability to engage with accountants and bookeepers

- Growth in Canada remains minimal - subdued backdrop for cloud accounting adoption, US tariff impact has weighed down on economy

- LTV/CAC Ratio - Overall ratio is 5.6x, continuing a slow decline from the peak of 7.4x in 1HFY22 - while the 5.6x is still very healthy, the trajectory is clearly down and should continue as XRO focuses on penetrating the US

In summary, “good, but ....”. The 1HFY25 result, was fully pre-Melio, was good and positive, across the financial and operational metrics. Other than still anaemic North America growth, things look operationally OK, particularly in ANZ.

But it did not make my increasing apprehension throughout 2025 that continued growth might be a challenge, go away.

THE BEAR CASE

What has made me decidedly more bearish today is the Livewire Markets article that @OxyBBear posted earlier today - many thanks for that!

I do suggest reading the article critically. It raises the key point that SAAS dominance cuts both ways. It is likely the first time that I have read about the stickiness of SAAS software AGAINST a company that I own. I am more used to reading about how the software or products that my company sells being sticky. It is completely Intuit-biased, for sure, but the points raised make good sense to me.

My key takeaway: It is awesome if you are top dog and HAD first mover advantage, as XRO had in ANZ, and Intuit in the US. But it is not great if you are the underdog needing to displace an entrenced top dog who had/has first mover advantage - Intuit in ANZ, XRO in the US. The exact same SAAS stickiness that works for you while you have first mover advantage works completely in reverse against you, if you are trying to break into an existing market.

There is no question that North America is a binary bet, as @Mujo puts it, and failure to decisively break into the US is thesis breaking.

Putting together, my inherent apprehension on XRO’s growth, the uncertainty around whether Melio will fly or not, and the Livewire Article, I have to admit that I am feeling my conviction on XRO slipping away.

The reward for penetrating the US is very high. But so is the challenge and the risk of failure - the article is a good reality check and my sense is that I may have underestimated the extent of the challenge.

INVESTMENT DECISION

XRO has been a great investment since opening the position on MF Pro instructions back in 2015. With an average cost of $17, have progressively reduced my position since Feb 2025 from a high-conviction to a medium-conviction postion. On hindsight, I am really glad I did this.

Might be time to now reduce the XRO position to a low-conviction one and top up my other higher growth companies where the probability of growth and winning is much higher - AIM, SDR, CAT, EOS to start with. There is no need to rush to the exits immediately, but I think I do need to deliberately start reducing my position slowly. Will need to let this thinking sit for a bit before the weekend.

Completely open to being challenged on this thought process as letting go of a long held position like XRO is not an easy thing to do!

TREND CHARTS

SUBSCRIBER NUMBERS

Globally, subscriber base grew 4.0% HoH and 9.7% YoY

- ANZ base grew 3.5% HoH and 7.5% YoY

- International grew 4.0% HoH and 9.7% YoY

- Growth in subscribers is increasingly being driven by International - 54% of the net additions vs 46% in the previous year

ANZ

- Australia grew 4.1% HoH, 8.7% YoY - still growing at a decent clip - growth reflected continued focus on supporting accounting and bookeeping partners along with increased investment in direct GTM channels

- NZ grew 1.4% HoH, 3.9% YoY - growth is definitely flattening as penetration has been deep

International

- UK grew 4.9% HoH, 12.6% YoY - continued cloud accounting adoption, early adopters of Xero Simple ahead of the Making Tax Digital for Income Tax Apr 2026 deadline

- North America grew 4.8% HoH, 14.8% YoY

- ROW grew 4.7% HoH, 12.8% YoY - mostly South Africa

- While total subscriber numbers are still growing, the net subscriber additions have been trending downward

- This makes sense for Australia and NZ, both highly matured markets

- UK - downtrend, but bar 1HFY25, net subscriber additions are above trend - no dramas there

- North America - clearly the watch area - HoH net subscriber addition was not great, the down trendline was heavily impacted by the sharp drop in the 1HFY25 account cleanup exercise

- 1H is seasonally weak for North America due to the timing of the US tax year - impacts ability to engage with accountants and bookeepers

- Growth in Canada remains minimal - subdued backdrop for cloud accounting adoption, US tariff impact has weighed down on economy

ANNUALISED MONTHLY RECURRING REVENUE (AMRR)

- Crossed $2.5b AMMR for the first time, up 19% YoY CC - above trend growth

- ANZ grew 16% CC - continued subscriber growth and price changes and platform revenue growth such as Xero payments

- International grew 21% CC - strong platform revenue growth in each region, impact of price changes

AVERAGE REVENUE PER USER (ARPU)

- ARPU increased 8% YoY CC to $49.63 - price changes alongside payments growth

- Both International and ANZ, and Total ARPU grew above trend

CHURN

- Slight uptick of 0.02% to 1.09% HoH

- “Increased use of the direct channel, and higher contribution from International, both of which have structurally higher churn but deliver higher ARPU customers

- Still a very low percentage, but it is creeping up

LIFETIME VALUE PER SUBSCRIBER

- On trend overall - ANZ grew above trend, offsetting the below trend International growth

- Driven by growth in ARPU and subscribers, partly offset by an increase in churn

LTV/CAC RATIO

- International remains flat at 3.3x

- ANZ sharply down YoY (14.0x 1HFY25), less so HoH (2HFY25 11.6x) at 10.7x

- Overall ratio is 5.6x, continuing a slow decline from the peak of 7.4x in 1HFY22 - while the 5.6x is still very healthy, the trajectory is clearly down and should continue as XRO focuses on penetrating the US

- Driven by “deliberate decisions to increase sales and marketing spend to XRO’s key markets to support our focus on the value of each subscriber added, alongside higher churn”

PROFITABILITY - GROSS MARGIN

- Gross Profit grew on trend to $1.057m, first half crossing $1,000m

- Gross Margins fell 0.4% YoY, fell 0.7% HoH, but is still on a good growth trajectory

PROFITABILITY

- Revenue is up, slightly above trend, Expenses alse increased - above trend increase, more than the revenue gap - impacted by the acquisition costs of Melio

- Both EBITDA and NPAT are growing on trend

FREE CASH FLOW

- As revenue increased, FCF increased to $322k, growing on trend

- FCF margin flattened at 26.9%, but the long term trend is clearly up

RULE OF 40

- 1% increase HoH and YoY to 45%

- Clear continuation of 2 trends - declining revenue growth % and increasing FCF margin

@mikebrisy thanks for the comprehensive rundown on this result, although I'm confused why a smart guy like you pays any attention to analysts TP's i think they have no information value, maybe you used them as a trend, blah blah, anyway onto XRO. First up, I'm a sceptic, i admit it, but i do watch this company reasonably closely. it has a dominant position in ANZ, and if i could get UK/US as a free option, giddy up. but that's never the case with this one. There's something i don't like about the CEO, and no surprise she pays herself a fortune. my view is she cut costs, which were the old CEO's attempt to build a platform, and aggressively raised prices; all that is a great ST sugar hit, and it worked, the SP more than doubled (which she astutely used to raise capital). but that left the growth avenue: how to build a more comprehensive platform? and with Melio, we see the real game starting, imo. i thought the result was a mixed bag, revs a bit short but profits stronger, helped as you say by the interest on the float, now gone. XRO is a strong biz, no doubt about that and why I continue to watch it.

i note no price increases for the lower tiers. Are we seeing the first signs of issues with what has been aggressive price increases? lets see.

i am reticent to be overly confident in the valuation until we see how Melio works into the accounts and into the operations. payroll/accounting/payments working in the US would be a huge delta, and for those strong believers in success, XRO is a buy now. they can also probably go a bit before getting into INTU too much.

anyway, for those a bit more cautious, my buy price is just above $100, and could increase, perhaps meaningfully, with more demonstrated success in the US.

If @mikebrisy feels assured enough to top up I feel much better knowing this.

It has really hurt watching such an overweight position for me IRL trickle down to 18month lows since the acquisition, but I am reminding myself of the long term prospects of this business (should they turn words and promises into reality).

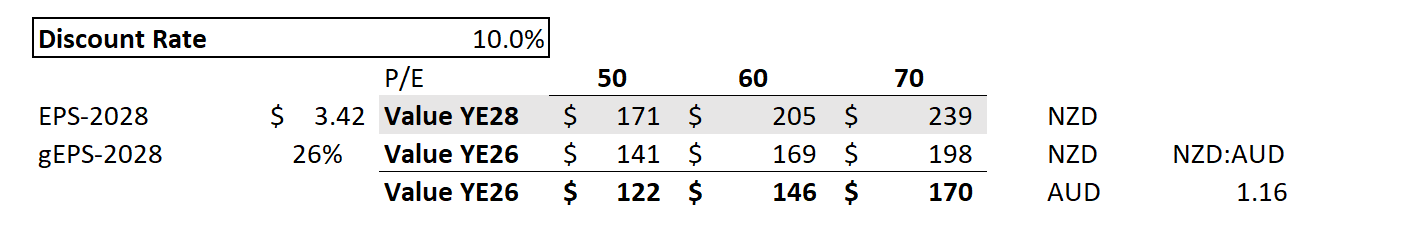

I've chosen P/E's of 50, 60 and 70 because in FY28, the growth in EPS is still 26% so, the business will still likely be highly rated at that point, albeit it will have fallen significantly from recent highs!

I've chosen P/E's of 50, 60 and 70 because in FY28, the growth in EPS is still 26% so, the business will still likely be highly rated at that point, albeit it will have fallen significantly from recent highs!