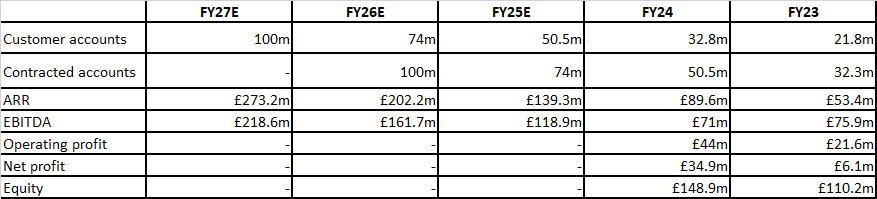

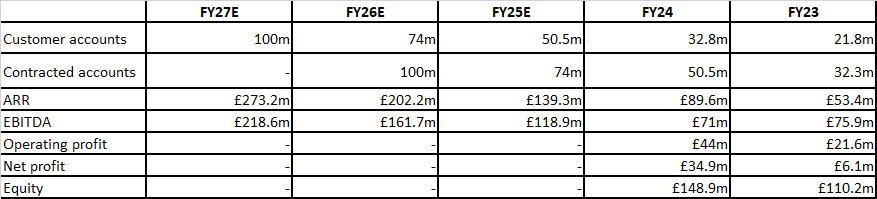

I have been watching Gentrack for a while (don’t hold), and so ahead of the annual results on Monday I have decided to put together some details on Kraken Technologies for comparison.

For some reason, I cannot find Kraken’s 2025 annual report. The 2022-2024 annual reports are easily accessible. Origin Energy’s FY25 annual report contains some details, so have made a lot of assumptions and guesses. Due to the accounting standards in the UK, they seem to be exempt from reporting on cash flow.

Notes:

- All figures in UK pounds.

- Contracted accounts include both paying accounts and signed accounts that will be billed in the future.

- ARR estimated on ARR/account from FY24.

- Origin Energy reported that 100m contracted accounts =500m ARR, which is well above my calculated 2.8/account from FY24. I have used my figure in FY25/26/27 to be conservative.

Overall thoughts: On the surface, Kraken looks like a much more appealing company than Gentrack. When it was announced in July 2025 that Kraken would be de-merged from Octopus the GTK share price began a steady sell-off signalling that other investors would rather wait and see and I feel the same.

Given that markets have sold off this week on tech stocks, GTK needs to post some seriously good numbers or guidance to avoid any further pressure.