Happy New Year to all StrawPeople.

I am taking a short break this afternoon from my Extended Summer Retreat on the Sunshine Coast (hence my radio silence on this forum over recent weeks, as I've taken time away from the markets - save for 'adverse event monitoring' - and had my head down in a pile of summer reading.)

However, as January marks the winter conference season in the US, on this rainy Noosa afternoon, I caught up with the RMD and TLX presentations.

I thoroughly recommend anyone who is an $RMD holder or watcher to listen to Mick's presentation. I caught the recording shortly after it went out on my mobile app for Quartr.com (free). (Still can't access via the website, as I think you need a JP Morgan invitation. Even so, the presentation is available on the Resmed Investor relations site. Presentation )

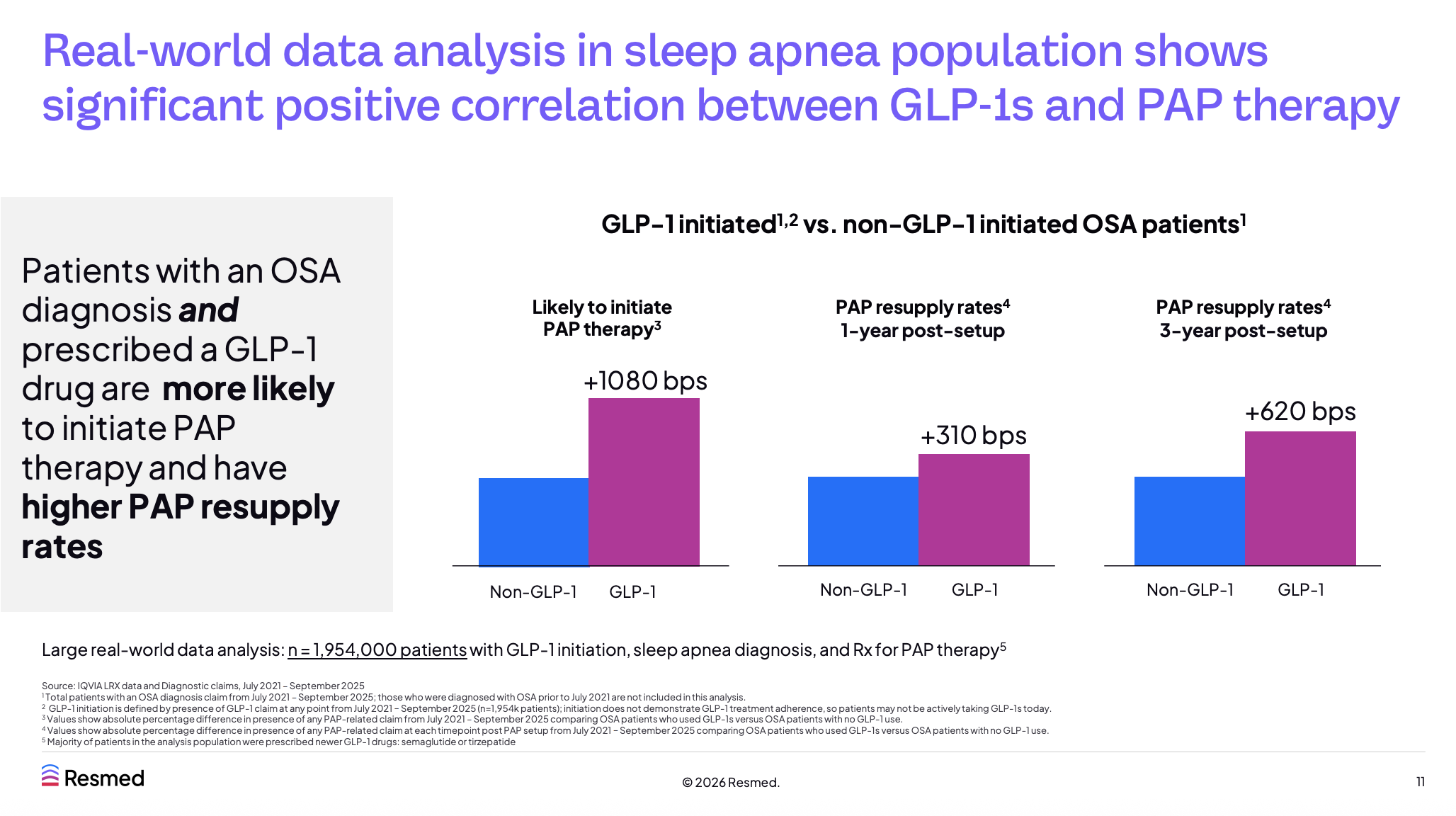

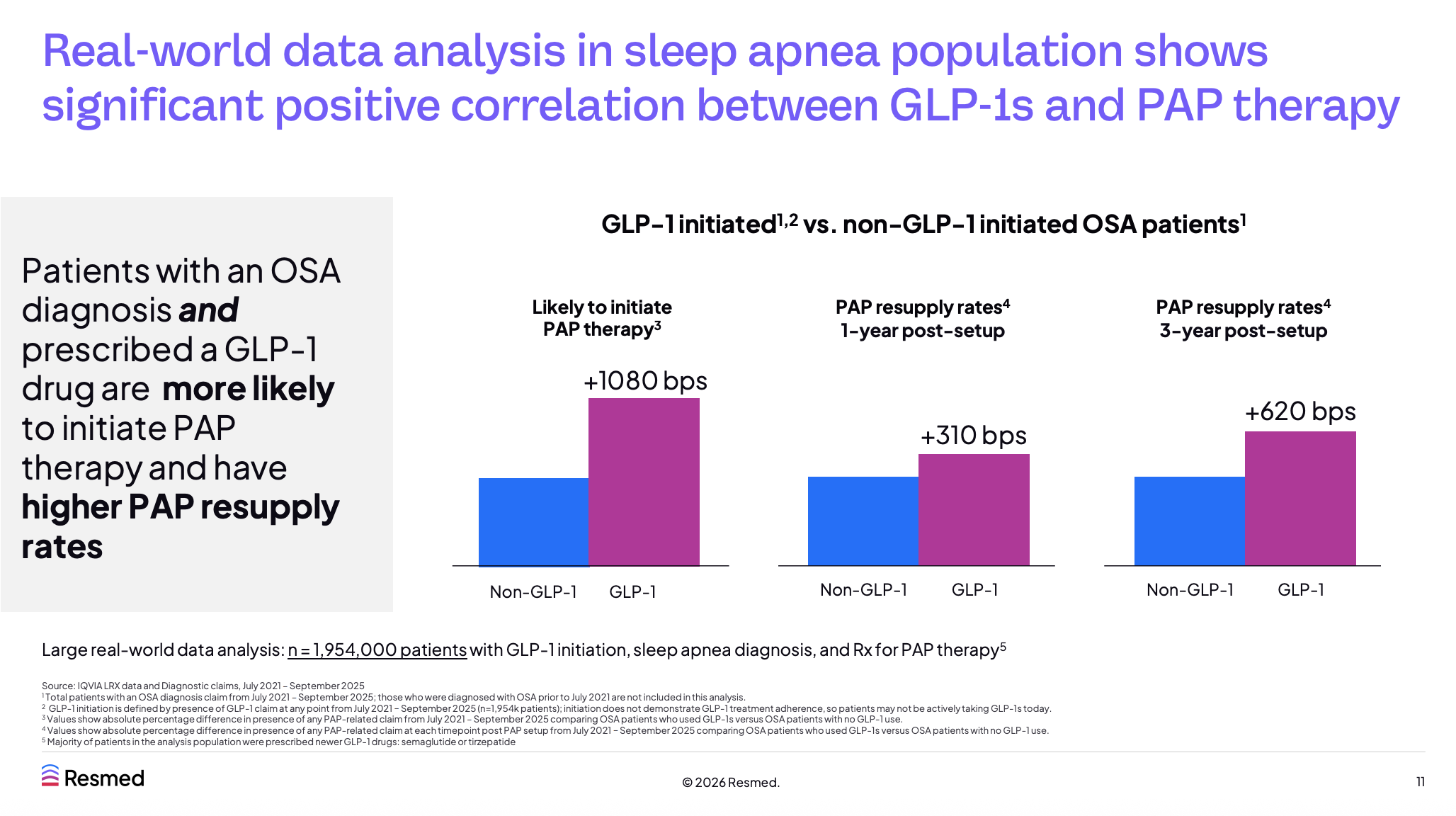

To the point of this post ... just take a look at this chart.

It is showing for the first time, the 3-year data for the differential in PAP resupply rates post set-up for patients with and without a GLP-1 script. RMD's thesis is that GLP-1 patients represent a more highly motivated cohort who use PAP therapy more and for longer is holding up. Importantly, the differential value of this cohort appears to be expanding, extending the initial picture first shown a couple of years ago.

In my mind, this should be marked as a price sensitive announcement in tomorrow's market open, and it will be interesting to see how the US market reacts overnight, as the presentation was made after the US market closed, and it is unclear to me whether the Australian market took much notice of it today.

Now that said, there was no change to long term guidance of high single digits revenue growth with operating levarge to drive teens EPS growth. So, arguably you could say this is all in the share price, albeit the market is at a 13% discount to consensus.

Beyond this, the overall presentation is well worth listening to. It is less about the detailed financial and operational performance, and more about strategy, markets, products, trends, competition and the opportunity ahead. Included there were some interesting insights shared from last week's CES conference, where $RMD is clearly investing in positioning itself for the trend with consumer tech / home tech. (Mick has been banging on about brand value and marketing ROI for about a year now.)

As I am still on "retreat" you'll have to excuse me not giving my usual summary. But as I was partly back in "work mode" to listen to the conferences, I thought I'd at least share the insight above.

Overall, its a pretty exicting presentation inncluding other good news on gross margin potential, and PAP therapy exclusion from competitive tendering requirements in US public health (which was still an open question at the last quartertly).

Mick was at his "Energiser Bunny" best!

I'll be back properly in a couple of week's time, in the run up to quarterlies and half year results.

Here's to a propserous 2026 for all.

Disc: Held