30-April-2023: Catching up on a few quarterly reports and other announcements during the past two weeks, and the report from Genex is a good one I reckon.

GNX-Quarterly-ActivitiesAppendix-4C-Cash-Flow-Report.PDF

They released that back on the 20th April, and on the 27th (Thursday), they released this:

GNX-Q3-FY23-Investor-Presentation.PDF

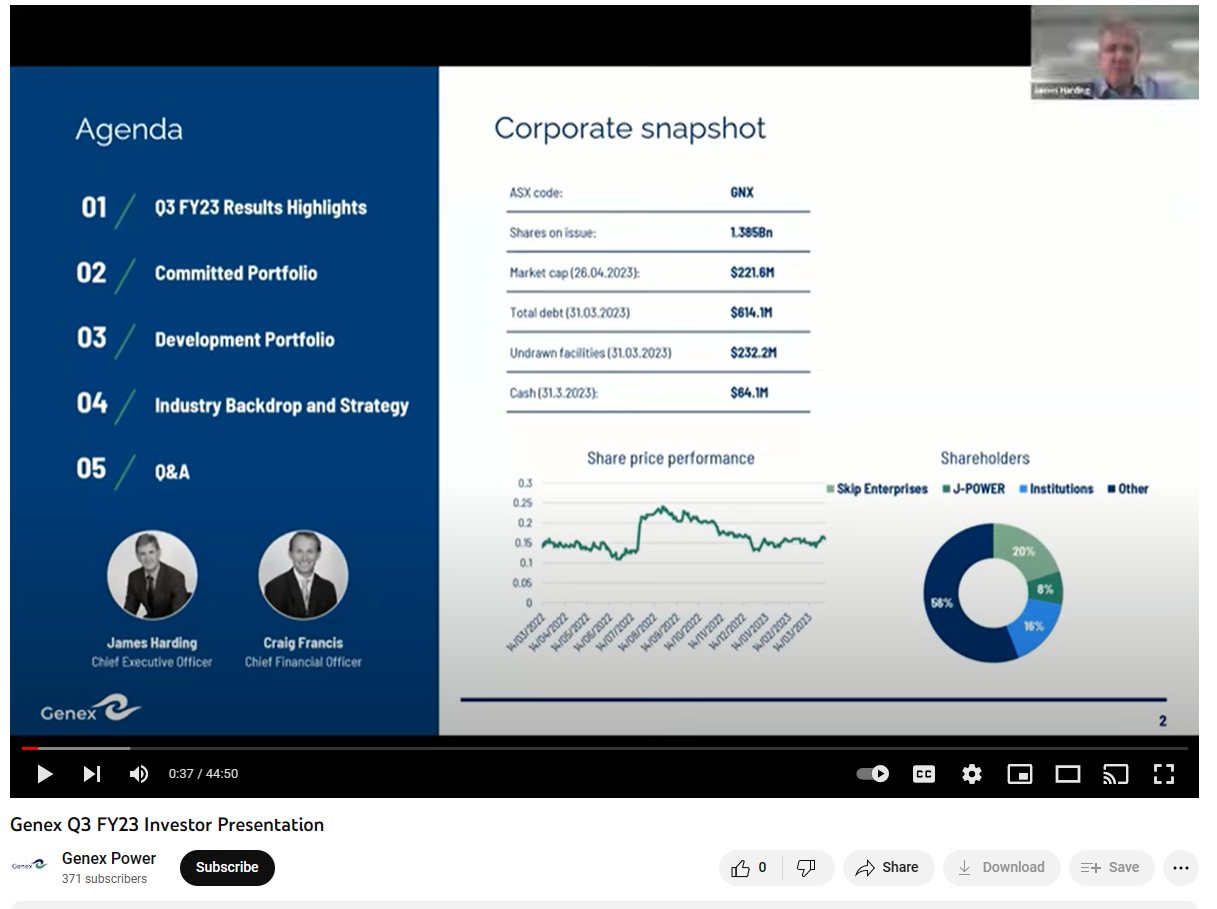

And here's the video of the Results Webinar:

Genex Q3 FY23 Investor Presentation - YouTube

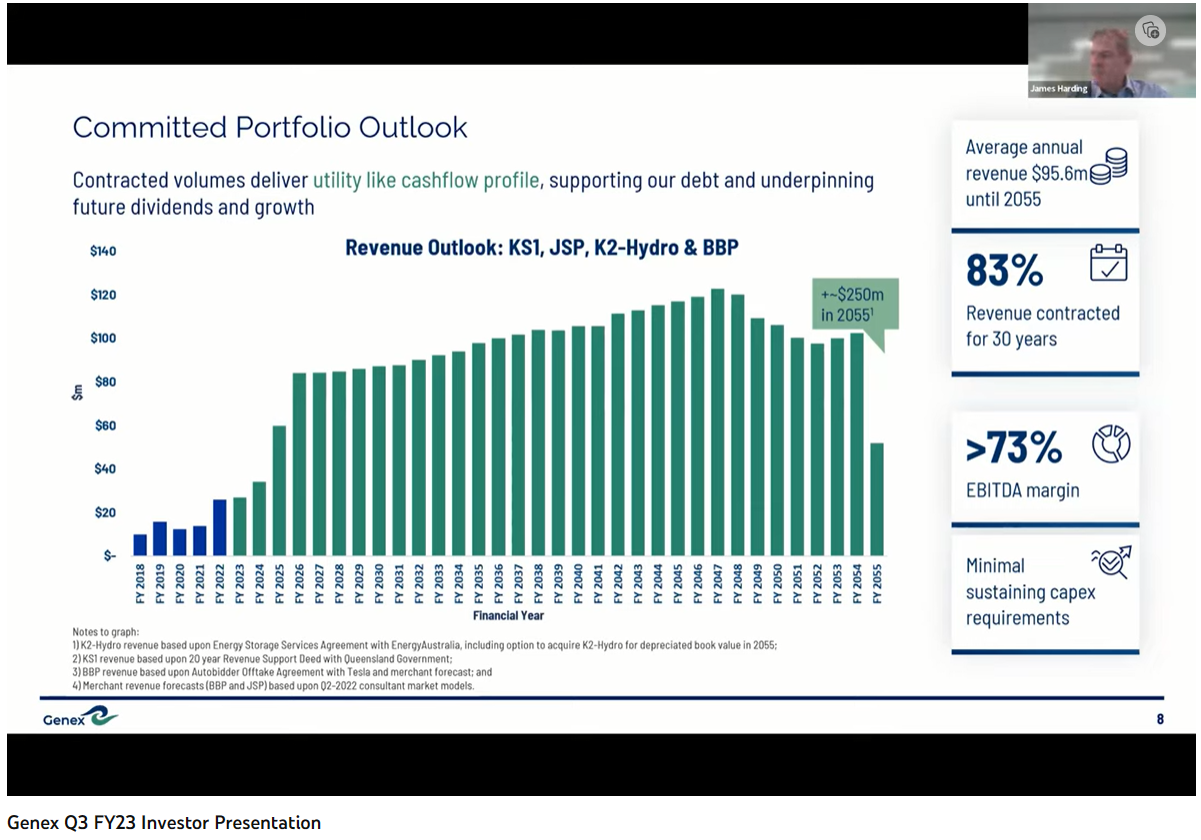

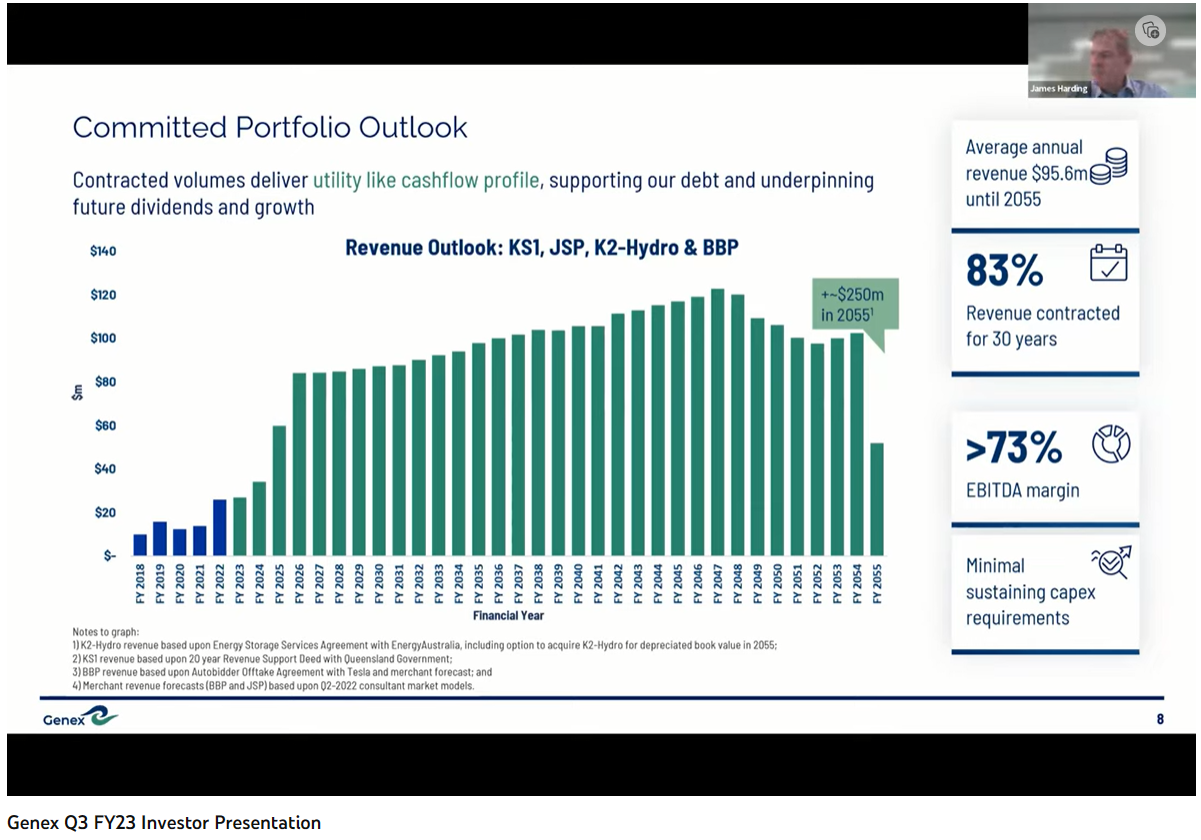

Slide 8 was the most interesting from my point of view, as they are giving details of expected cashflows over the next 32 years (through to 2055) based on their current portfolio of assets:

That's an average annual revenue of $95.6m, 83% of which is already contracted for the next 30 years, and an EBITDA margin of over 73%.

And it's all green/renewable energy production and storage assets that are producing this revenue.

There is plenty more in there, including the Q&A at the end, but this slide is a stand-out for me, in terms of quantifying the future value of the company vs. the current low share price.

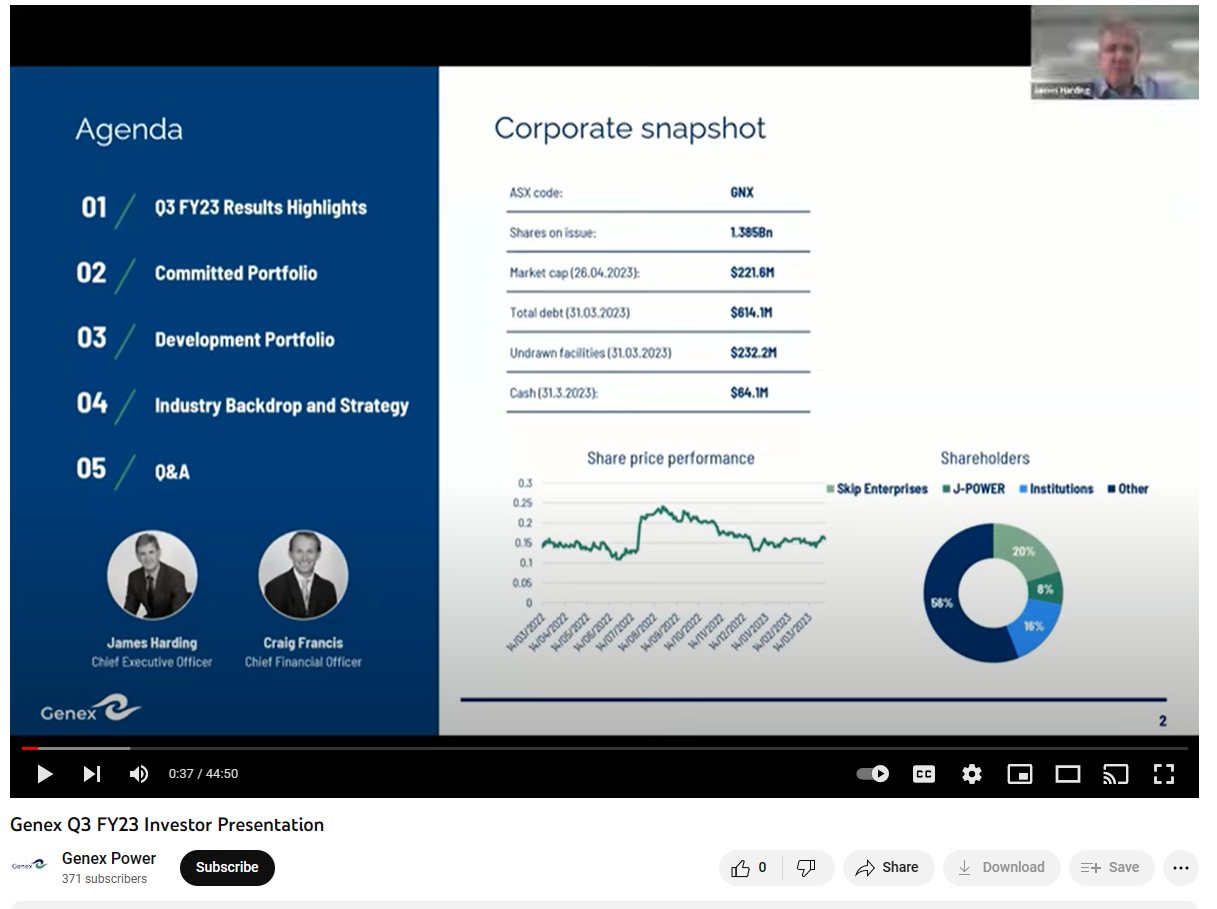

Another thing that did peak my interest me was slide 1 which lists Skip Enterprises (which I assume is part of Skip Capital) as owning 20% of the company.

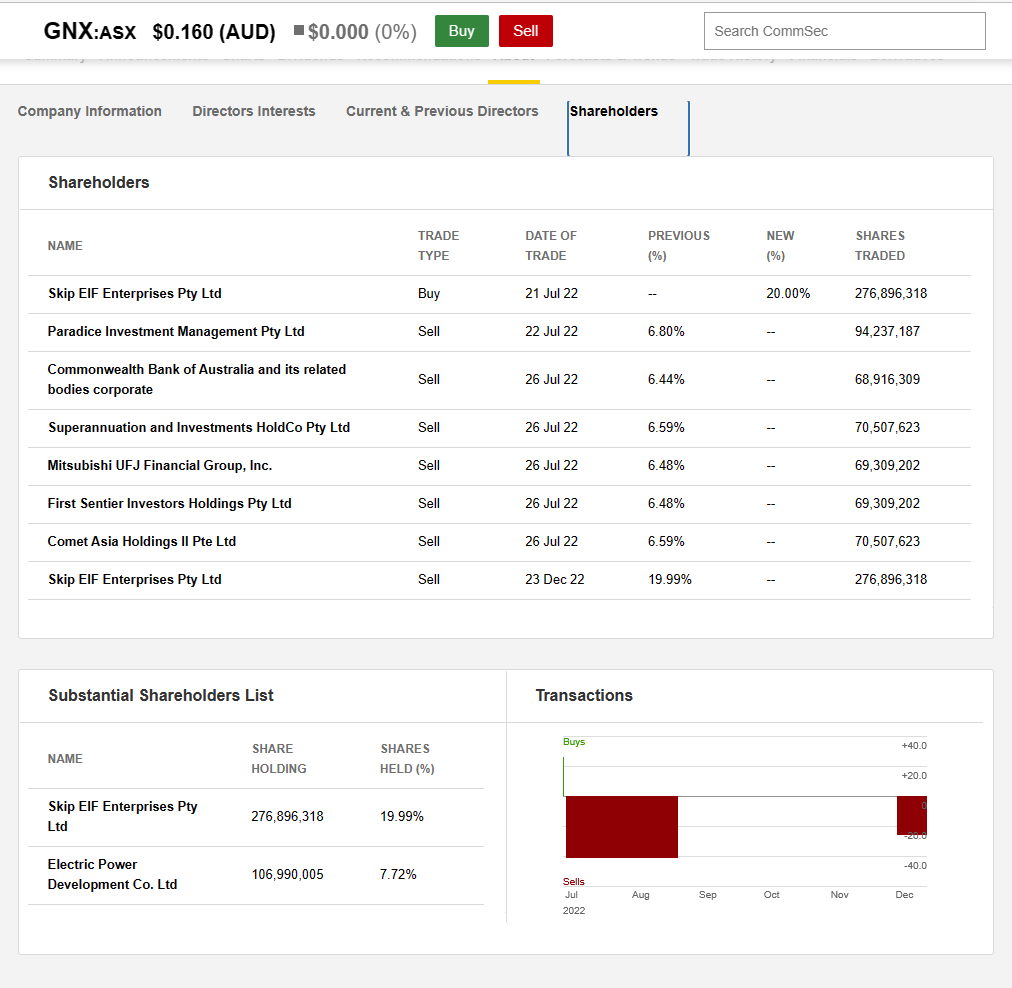

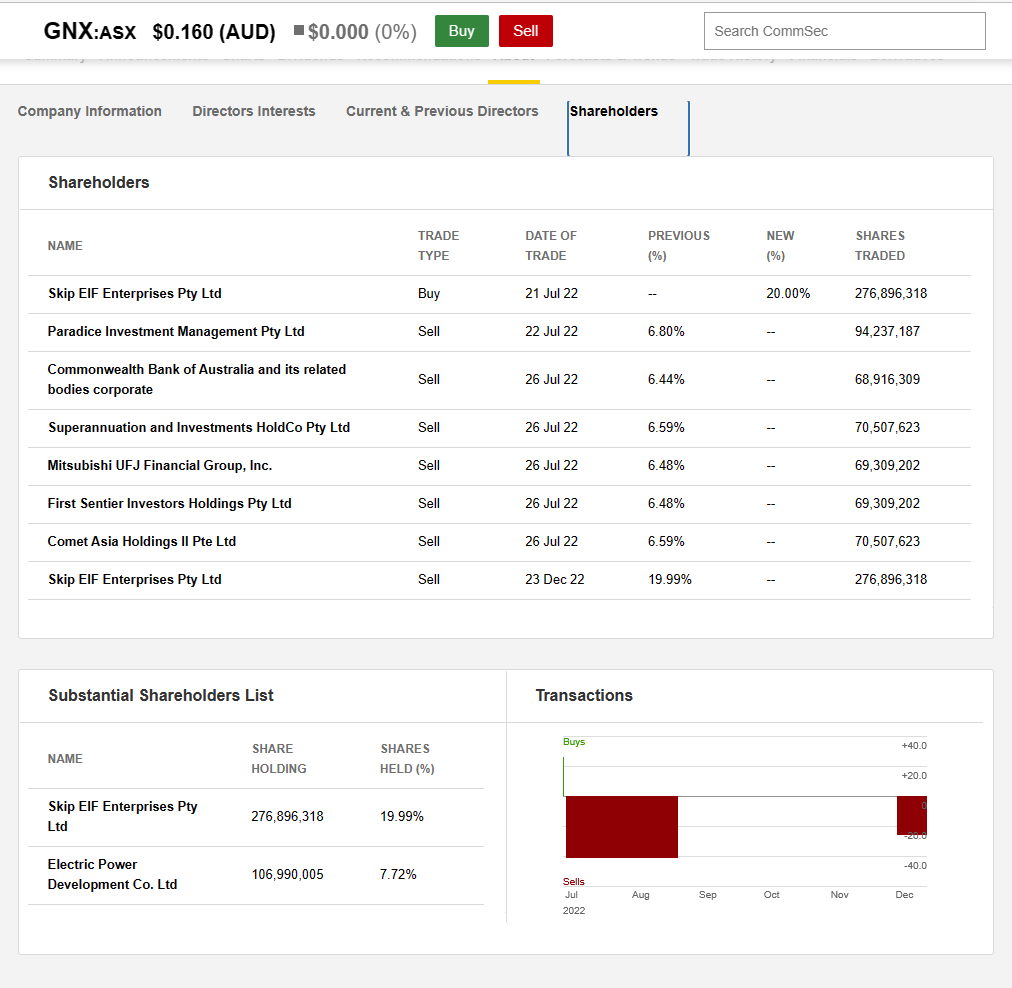

You might remember that Skip Capital (owned by Atlassian co-founder and tech billionaire Scott Farquhar and his wife Kim Jackson, and run by Kim Jackson) partnered with Stonepeak to bid 23c/share for Genex last year, a bid they then raised to 25c before walking away, and Commsec listed Skip as ceasing to be substantial holders of Genex on December 23rd, as shown below.

The "Substantial Shareholders List" in the bottom left corner there is taken from their FY22 Annual Report, however the subsequent trades are listed above that, and the last of those shows Skip selling 276,896,318 Genex shares and going from 19.99% to "--" and "--" can mean anything from 0% to 4.99%. 5% is the minimum threshold for substantial shareholders and anything below 5% is not required to be reported, unless you're a company director of that company (on their Board).

I'll flick them an email tomorrow and ask for some clarification on that.

Anyway, other than the shareholders piechart on slide 1, which may or may not be out-of-date, it's a good presentation I reckon.

They have just strung 4 quarters together of being cashflow positive too, so they're certainly moving in the right direction now that the tunnel boring issues at K2H (Kidston Pumped Hydro) have been fully resolved and the construction is fully back on track and the minor issues at their two operating solar farms have also been fully resolved.

Disclosure: I hold Genex shares both here and IRL.