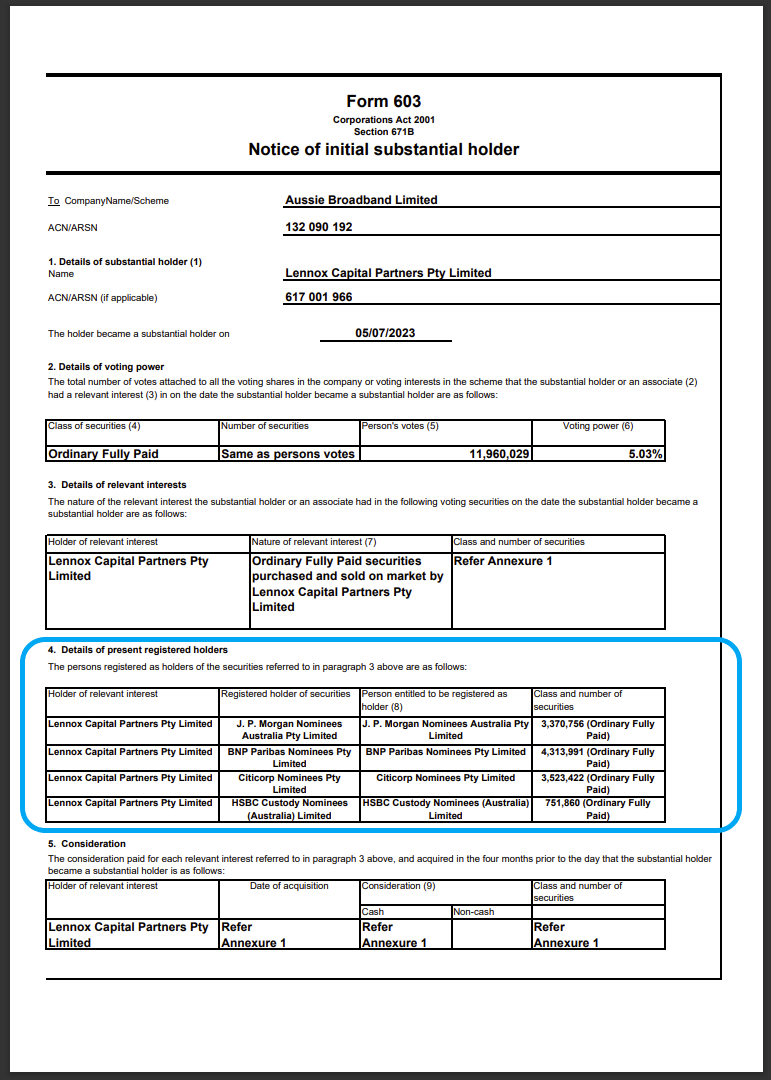

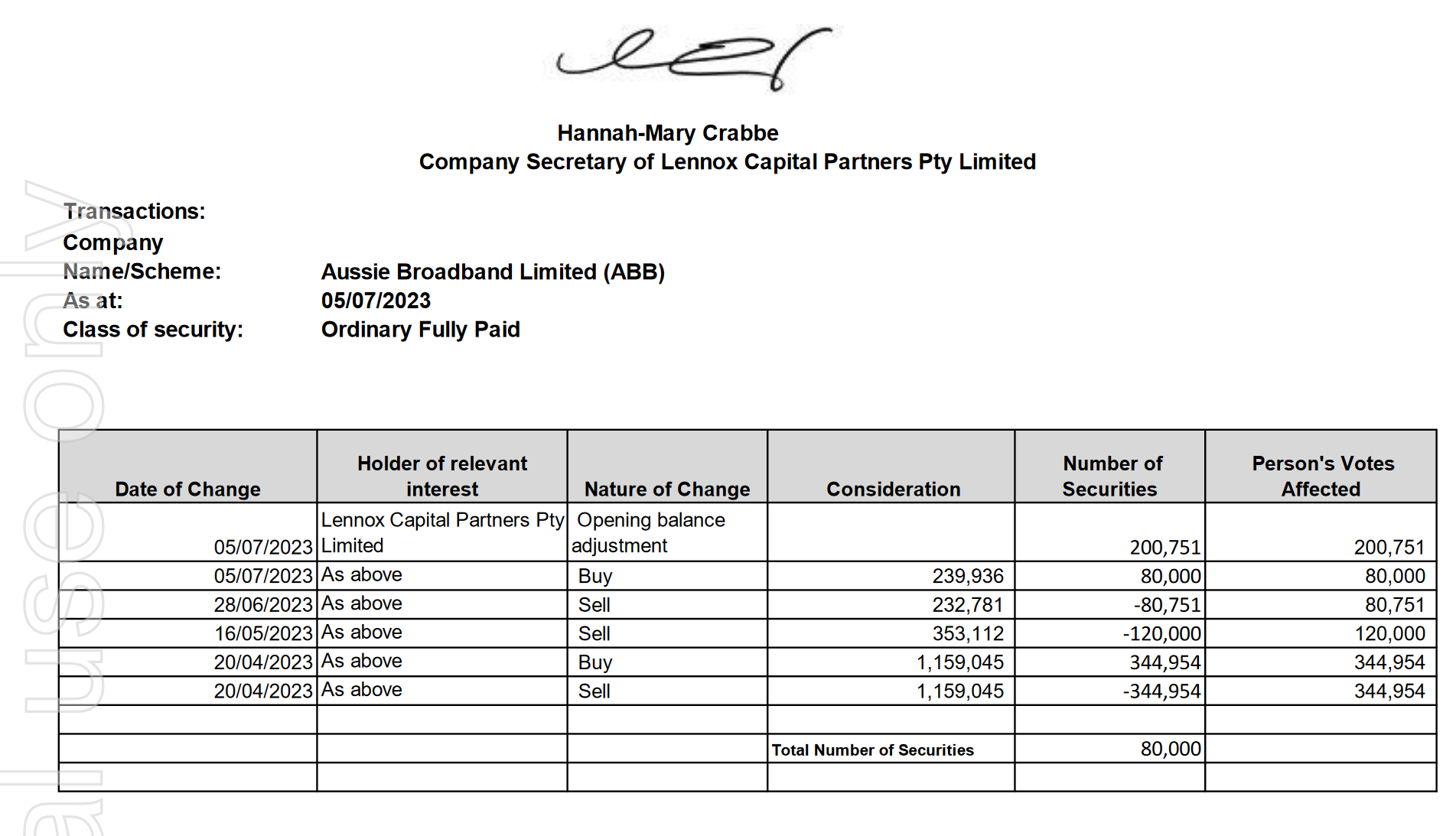

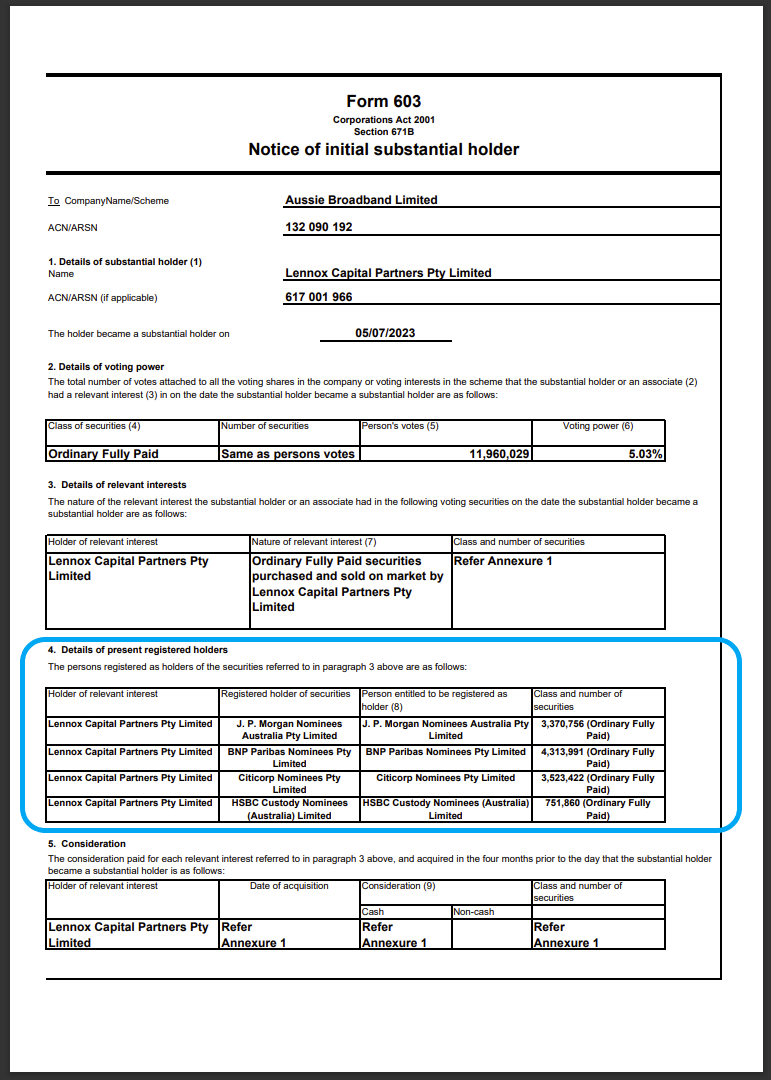

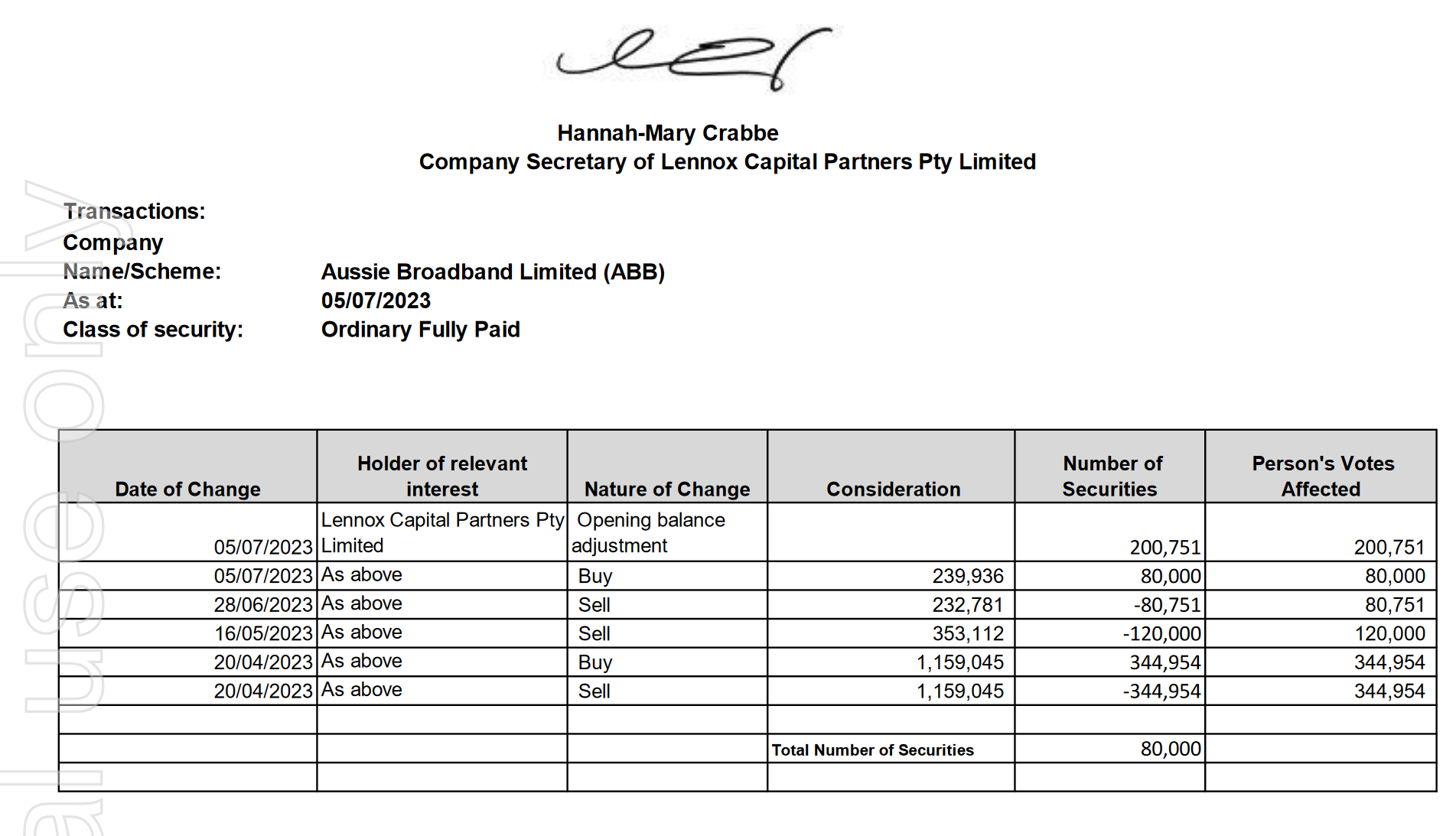

It might also be worth looking at who holds the shares for Lennox Capital - which is on page 1 of the form 603:

Source: Becoming-a-substantial-holder-for-ABB-(Lennox Capital).PDF

Not saying they are definitely shorting, but there's a couple of parties there that do like to lend their shares out to shorters, or to short themselves.

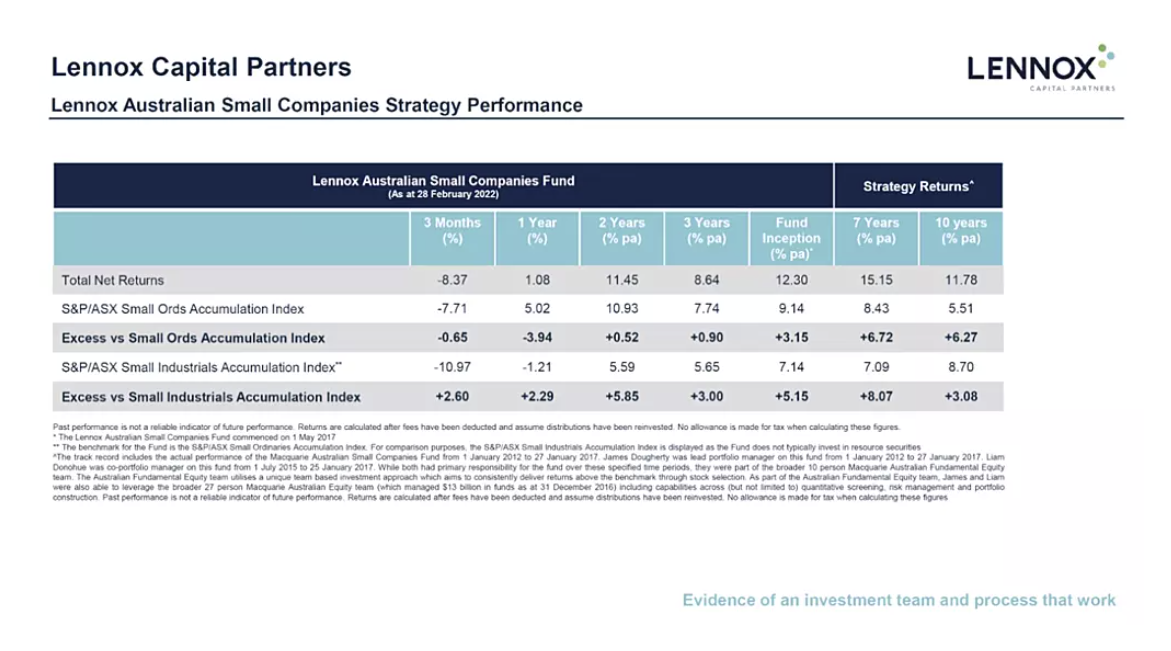

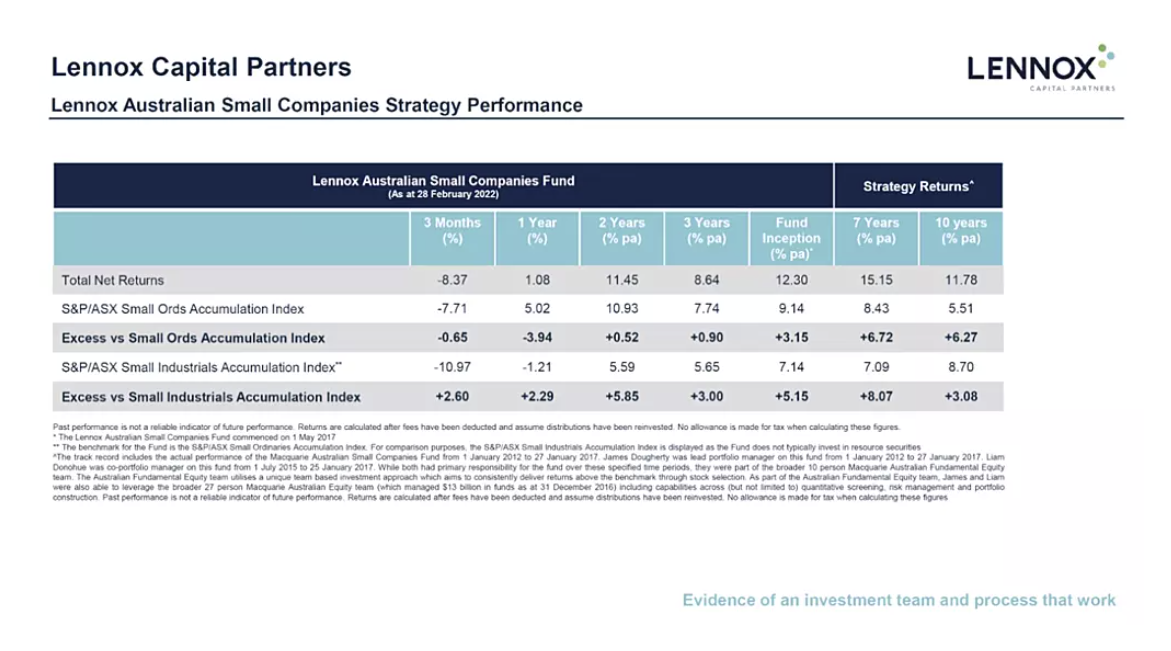

That said, Lennox seem to be dedicated (long-only, I assume) small-cap specialists - or they were when this Livewire Markets article was penned back in late April 2022 (just over 14 months ago):

https://www.livewiremarkets.com/wires/one-thing-that-unites-capital-destructive-businesses-and-how-to-avoid-it [late April 2022]

This next one is far more recent - just over one week ago:

https://www.livewiremarkets.com/wires/9-small-caps-to-buy-and-hold-for-the-next-5-years [29-June-2023]

[Lennox stock picks were CTD, KLS & HUB]

This article from early April last year (2022) explains their process fairly comprehensively:

https://www.livewiremarkets.com/wires/the-power-of-saying-no-and-having-skin-in-the-game [5th April 2022]

In that article, they included this slide (below) which includes ABB (top, middle).

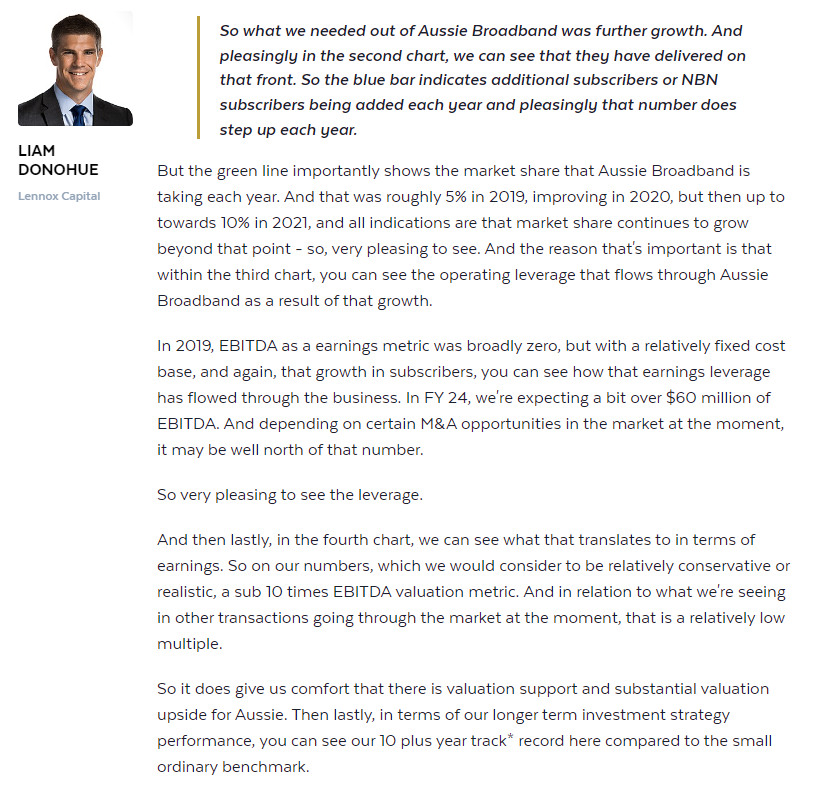

...which was followed by the following - about ABB:

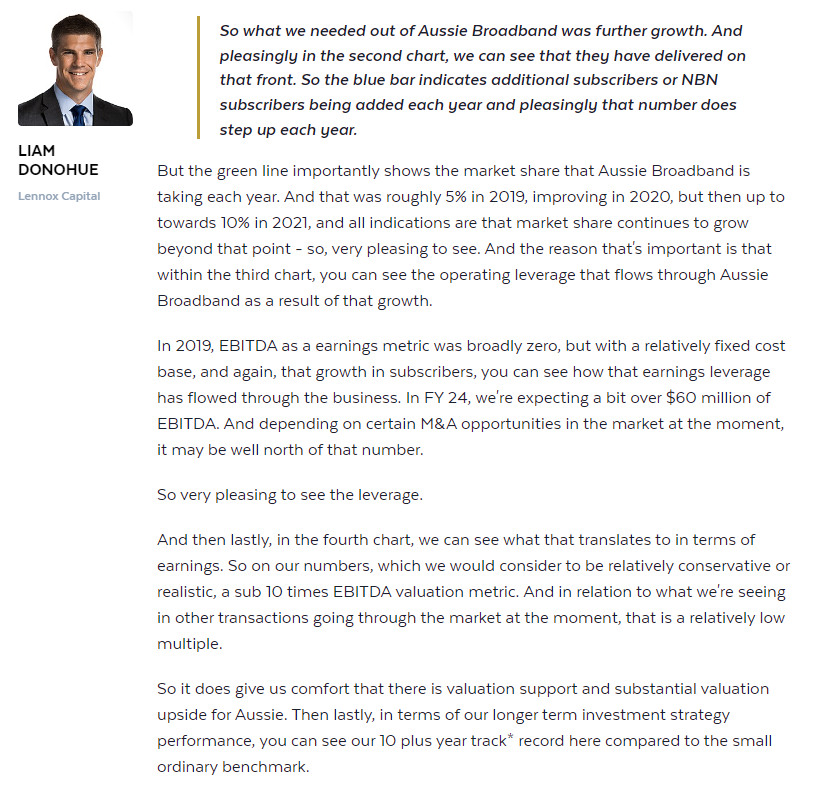

Source: The power of saying no (and having skin in the game) - Liam Donohue | Livewire (livewiremarkets.com) [5-Apr-2022]

So it certainly sounds like they're LONG ABB, not short. Can't imagine they've changed their tune too much in 15 months.

It's a bit of a head scratcher however...

Why would you sell 80,751 ABB shares in late June for $232,781, then buy slightly less (80,000) back for just over $7K more ($239,936) one week (5 trading days) later?

Must have been window dressing, in terms of end of FY weightings in their portfolio(s), but financially it's a head scratcher for sure. They wanted to look like they held less ABB at the end of FY23, and were prepared to pay over $7K to do that? Maybe, or maybe it was something else.

My best guess would be that they were trimming the position in Late June to lock in some profits and inflate their profit reserve (profit reserves only count realised profits, not paper profits, so you have to sell at a profit to increase the profit reserve), then upping the exposure again in July, by buying a similar number of shares back, albeit at a higher price which actually resets the cost base HIGHER, at least for those 80,000 ABB shares it does, if the ones they sold in May and June were bought prior to mid-July 2021. If they were bought in the period between (and including) August 2021 through to mid-August 2022, when the share price was higher, then they would indeed be resetting the cost base lower.

However in that early April 2022 Livewire Markets article that I have reproduced an excerpt from above, Liam Donohue from Lennox Capital said that they invested in ABB pre-IPO, so they have been in ABB since before their 2020 IPO (i.e. before ABB became a publicly listed company via their ASX float in or around October 2020), so Lennox definitely sold ABB at a profit in June, so did lock in profits, and they did reset the cost base higher for the 80,000 new ABB shares they bought in July.

In terms of whether these could be considered "wash trades", most professional fund managers know how to get around that ATO rule. They just needed a legitimate reason to sell, and another reason to buy back in, and to say the two are not connected, in other words there was no intention when they sold to buy them back the following week, but that's actually what happened because of further analysis or portfolio balancing or whatever. Coincidence rather than a plan. The ATO would then have to prove otherwise (that Lennox Capital intended to buy those ABB shares back the following week when they sold them) which would be close to impossible unless they had their phones and/or offices bugged or something. Like I said, professional fund managers can get around that rule.

Inflating their profit reserve prior to June 30 would mean they would have more cash to distribute to their investors, and it could also have positive implications for their performance fees (they would likely earn higher PFs on higher profits). Just saying...

Lennox Capital Partners - Small and Microcap equities specialists

Disclosure: I have no link to Lennox Capital, but I do hold ABB shares both here and IRL.