Pinned straw:

@RhinoInvestor there is a lot in your question, and I will consider it more deeply when I do my model update.

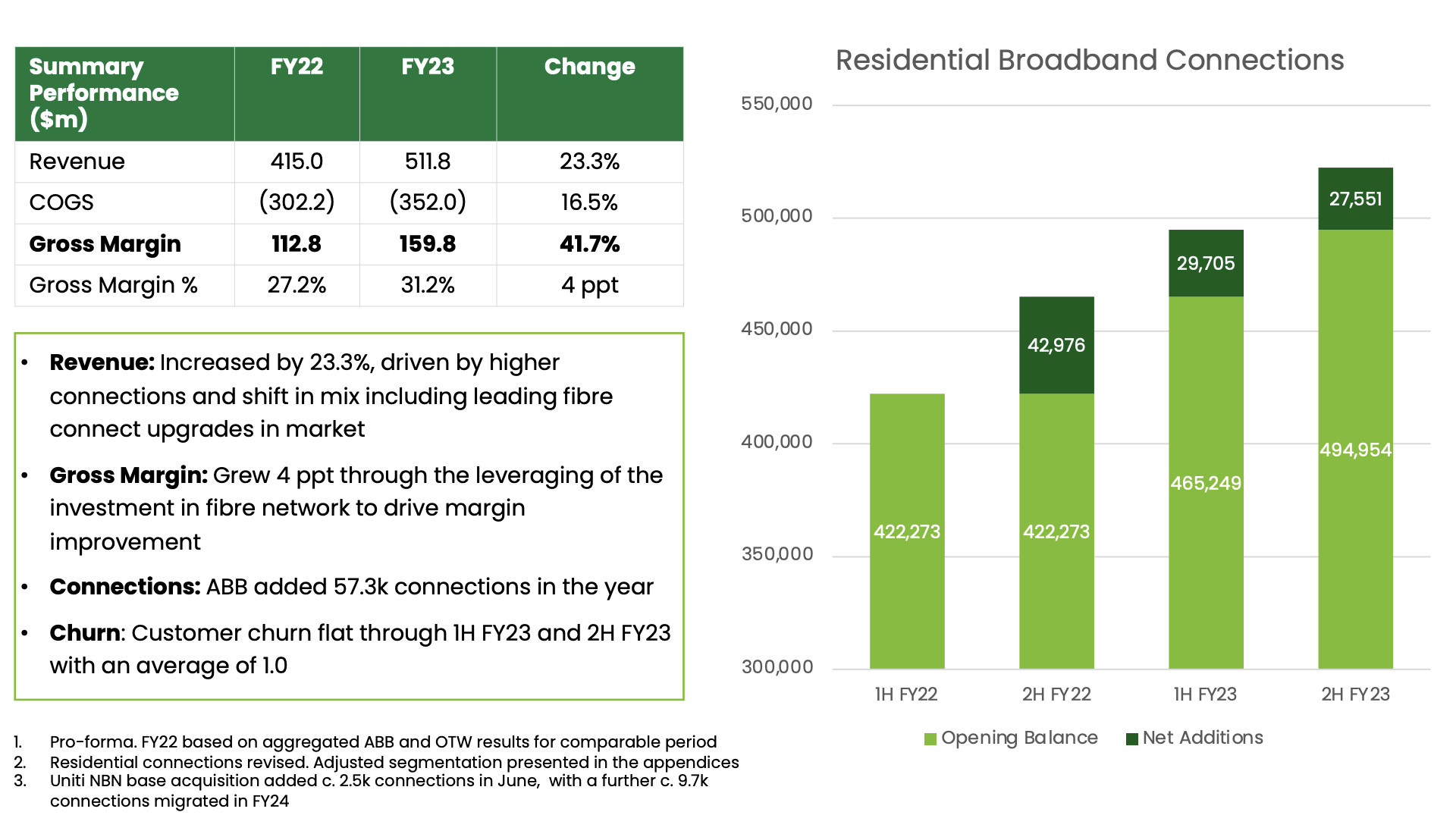

But the quick answer is that my investment thesis is that $ABB will continue to grow strongly in resi to and beyond their targets (albeit at a slowing rate), driven by the brand value and a continued focus on offering a differentiated customer service, focused on the higher value plans. I actually get them achieving between 12-14% share of overall connections market by 2032 - my final explicit year. In terms of number of connections that's driven by resi. That's kind of the base.

What really differentiates my scenarios is their success in Business and E&G, supported by the targeted fibre backbone they've laid in the capital cities which allows then to capture more of the customer value.

In business, it is instructive to go back to their Market Day presentation last year. This lays out the services on offer: high-speed broadband connection (incl. hardware), Voice/VOIP (including hardware to support), private cloud and security, and mobile.

In my higher value cases (which gets to valuation of over $5.00/share, subject to updating) by 2027 I have 40% of revenue coming from B+E+G+W and this increases over time to 2032 to 44% in my high scenario. But share of Gross Margin from BEG&W grows to 53% by 2032. Note that's the upside case.

I think their strategy is clear both from the fibre they've laid and Phil's focus at the last call. I haven't reconciled their trajectory in business over the last year against my different scenarios. That's on the to do list.

So in summary, they're starting in my model as a majority resi business but by the end of it most of the value lies in BEG&W.

As I said, there is a lot in your question to consider. In truth it gets into more detail than I've evaluated, so I will think further about this when I do my update.

The funny thing about my investment in ABB is that I first bought it almost a year ago when the SP was languishing around $2.30, and I was interested in the value of the brand. So when I built my first model I couldn't get any reasonable valuation below $3.00 (worst case), so I had to buy it. I didn't intend for it to be a long term investment, as I don't like the sector, but I could see a 2-3 year very lucrative play because it had become so undervalued. After the Market Day, I did more work and got a better feeling for this business and realised the strength of the fibre they are laying, as well as the brand. So actually, now I can see it as a long term winner. Its bothered me because I still don't like the sector and have resisted increasing my RL position beyond its current 3.8%. However, it is now one of my higher conviction holdings and if it keeps performing then, on SP weakness I would probably increase my holding. In fact the only reason I haven't after these results is that there were some higher priorities on my shpping list.

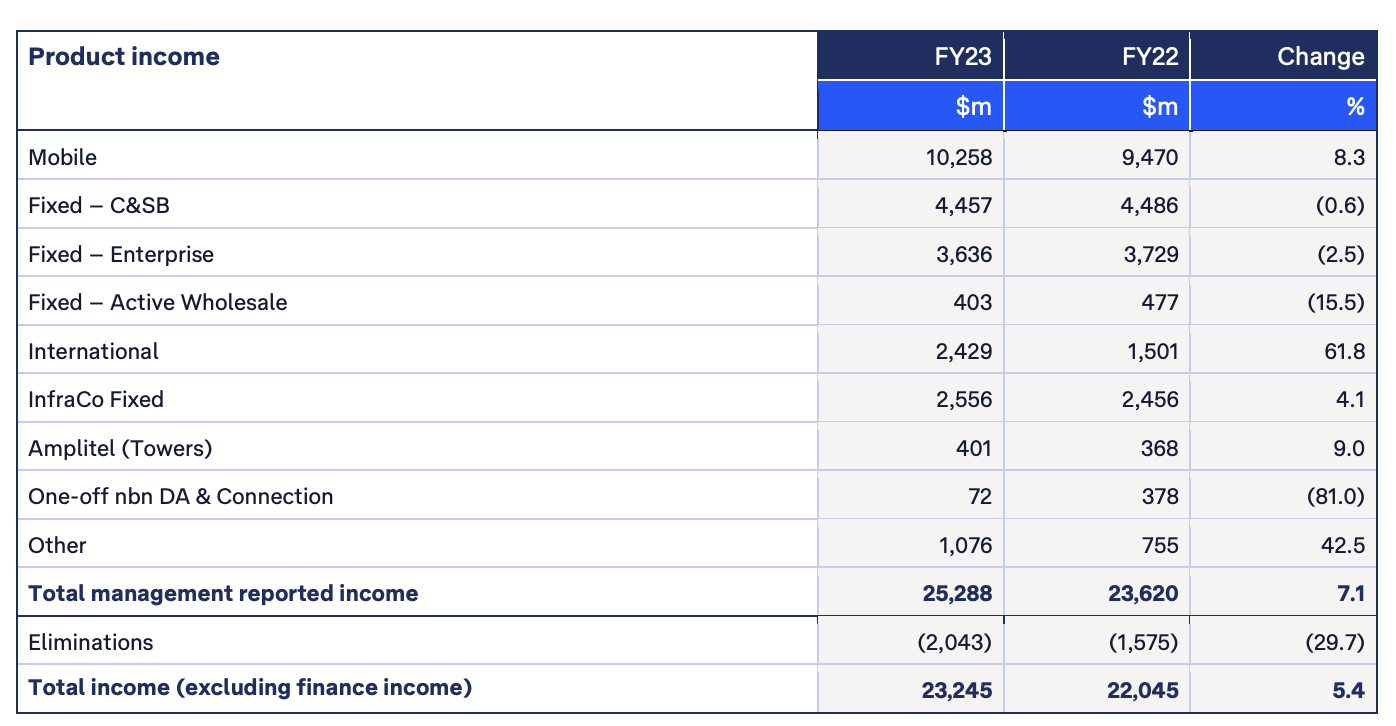

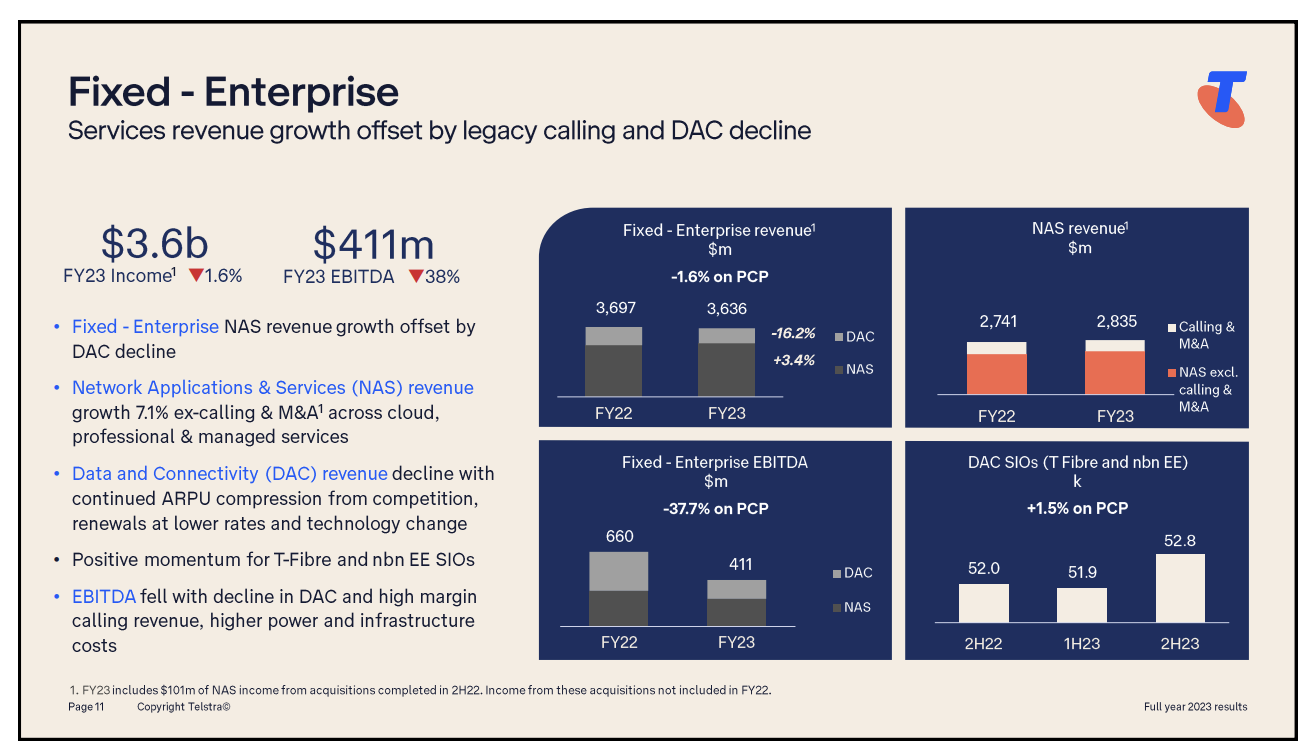

Still, in a market when you have a dominant incumbent like $TLS that is slowly seeing its business being eroded - particularly from the high value ends - you have to consider what a competitive response might look like especially as $ABB gets bigger, so I don't want to get to wedded to the story. All that said, I enjoyed watching the $TLS results call and seeing the evidence of where they are losing!