The new Buddy brand has done my head in of late, but I am slowly coming around to it. I agree with some of the concerns relating to Aussie potentially squeezing their own margins, but management’s comments on the call put me at ease for the most part. When you consider some of the restrictions they are placing on Buddy customers also, I can see why it makes sense from a business/margin perspective (which was my primary concern). Any signs this business wants to get into a cost-war with other budget providers would be a significant red flag/thesis bust, but I don’t think that is happening here.

A few considerations

- For the most part, Australians are increasingly shifting to higher speeds (100mbps and over). This is partly consolidation of the tiers but I would also suggest that its evidence a good portion of Australians consider high speeds and reliable internet connection vital for their household, even with current cost-of-living pressures.

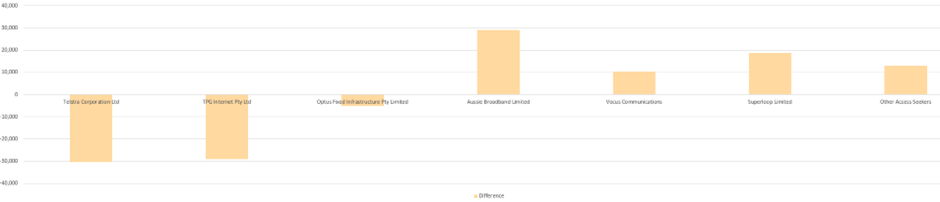

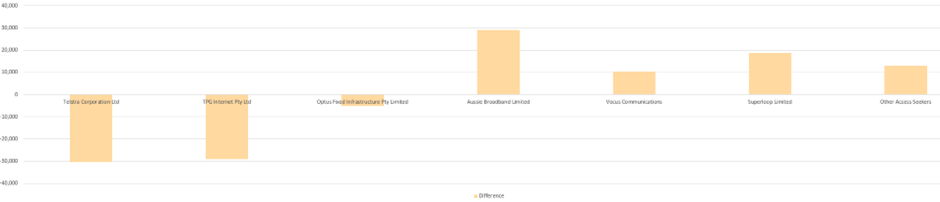

- Incumbents are continuing to lose market share. Make no bones about it, this industry is continuing to be disrupted.

- In the recent report (Jan to March 2024) Aussie continued to take more market share than any other NBN provider. Going further, last quarter, Aussie essentially won what Superloop and Vocus did combined (the other dominant players winning market share off the incumbents). This was almost true of the quarter before that, when Aussie won 30.5k services, and Superloop and Vocus together won 32k. Organically, the trend continues that Aussie is winning the most market share and the incumbents are slowly losing their customers. That isn’t to say Vocus and Superloop aren’t also benefiting.

- But what does this mean? What are they winning? Well, not the small end of the market. At 12 and 25mbps, Aussie isn’t growing. There are almost 3m services for these tiers, and Aussie has just 157k – 5% of the market. Even when you add in 50mbps, another 4.3m services and easily the most popular speed tier in Australia, Aussie services just 250k of these, not even 6%. Aussie’s growth here has almost plateaued.

- Consider the very quickest speeds (ultrafast, 1000mpbs and 500mpbs), 140k services in total, and Aussie services 53k of these – a mammoth 38% of the market. But these services are growing (i.e. users are continuing to shift to higher speeds, despite cost-of-living pressures), while Aussie’s take rate is also growing. Aussie is overwhelmingly the provider of choice for these speed tiers, a nice place to be when users continue to migrate to higher speeds.

Importantly, I don’t think there are any orange flags with respect to Aussie’s current market position, this is only continuing to strengthen where the margins are most attractive. I also think, perhaps controversially, that the argument that cost-of-living pressures is impacting Aussie’s core customer base is unfounded. Ongoing organic growth and take rate at the higher end of the market support this. They aren’t losing customers; they are continuing to add them! It is clear that Buddy is going after the customers of Belong, Amaysim, Dodo and other budget offerings. And with that, we are starting to see Aussie flex its own fibre infrastructure – the budget service is only available to customers with fixed-line NBN (which makes sense to Aussie for a margin perspective). Additionally, users won’t be sold/provided a router and won’t get priority call-centre support.

What I do like is that Aussie is clearly separating its premium segment (Aussie) from the budget one (Buddy). The big factor will be, how many customers at the premium end will churn to the budget end? They expect 5%, but those that make this change could quite well have churned elsewhere if savings are the most important factor for them. I don't think this is a big concern but we will see with time.

I think this move does add a bit of weight to the view that the Superloop acquisition attempt was partly based on capturing more of the mid-tier and budget market, but I am still of the view that move was primarily an infrastructure one to capture Superloop’s existing fibre. Ultimately, it is that fibre that allows Aussie to go to war with the budget market and strip out some of the premium overheads.

TLDR – I am cautiously supportive of this move. Time will tell. My thesis is primarily based on Phil Britt – he knows how to win and understands the market very well. There have been very few slip-ups from Aussie over the last few years and I have no reason not to back him in.