Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

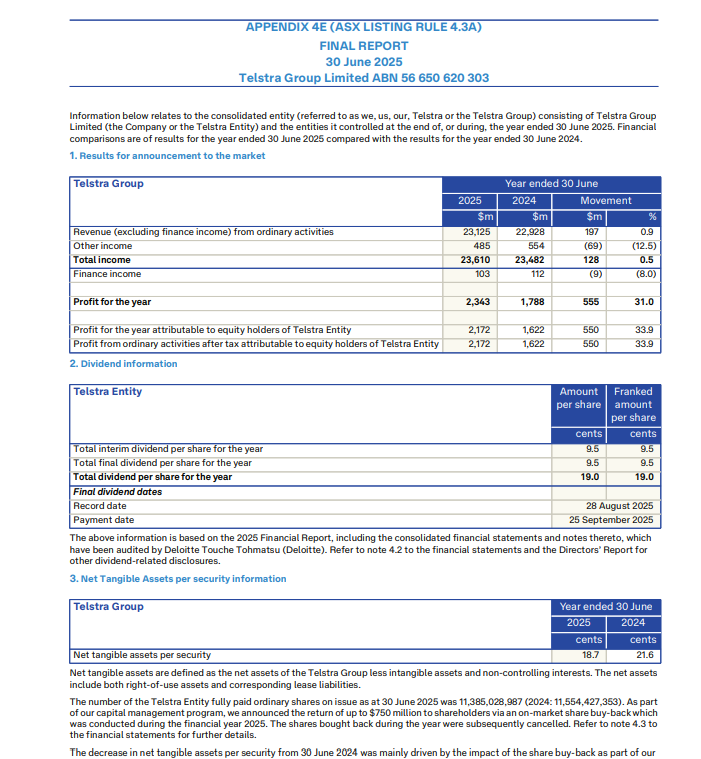

In June this year we completed our $750 million on market buy-back, and today they have announced an additional on-market share buy-back of up to $1 billion. This has been enabled by growth in earnings, and the strength of our balance sheet. The capital position and liquidity remained strong, and net debt remained well within their comfort zone..

https://hotcopper.com.au/threads/ann-tls-financial-results-for-full-year-ended-30-june-2025.8710777/

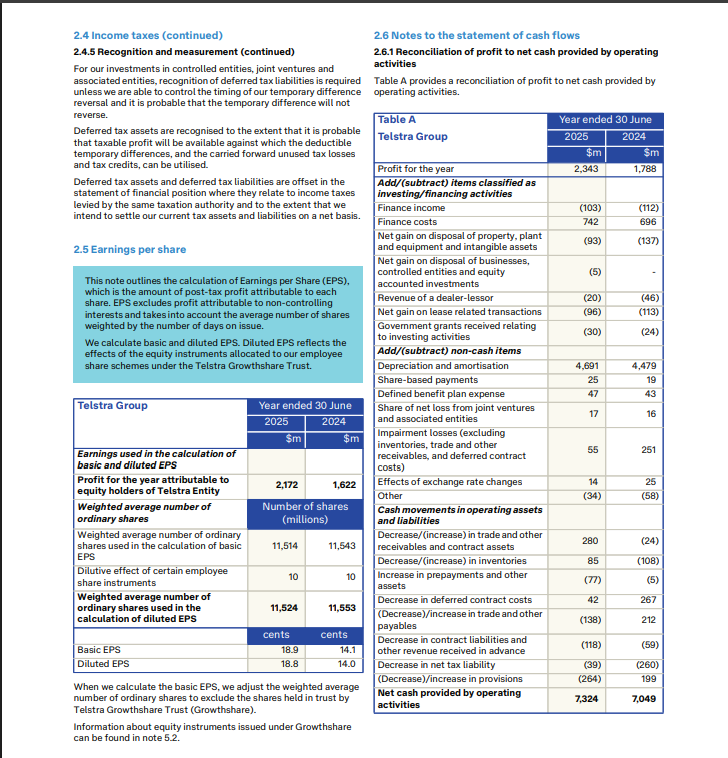

A look at EPS: Net Profit / # of Ord Shares

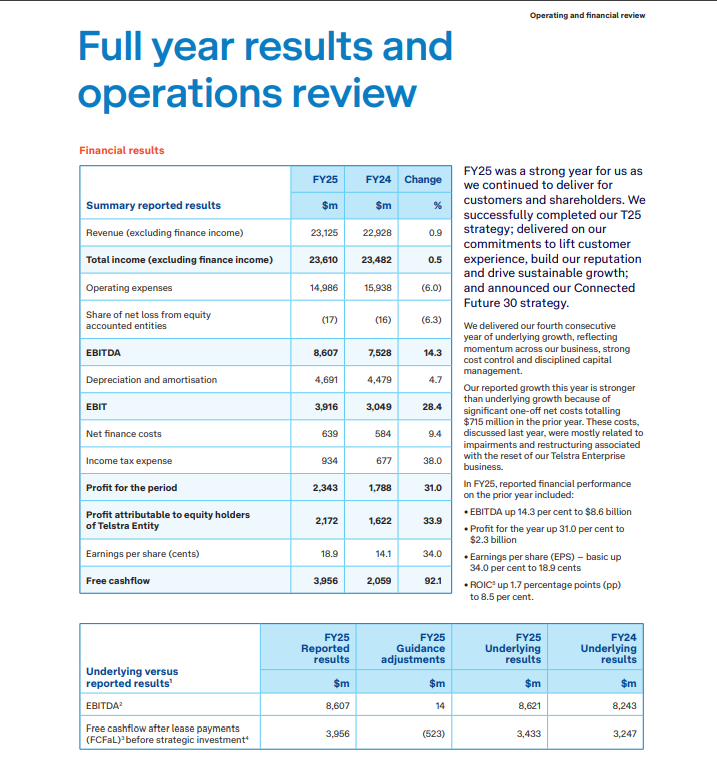

Motley fool says-Telstra Group Ltd (ASX: TLS) shares will be on watch this morning when the telco giant releases its full year results. According to a note out Macquarie, its analysts are expecting Telstra to report a 1% increase in revenue to $23,687 million and a 5% lift in underlying EBITDA to $8,655 million. The latter is broadly in line with the consensus estimate of $8,640 million. The market is expecting a fully franked dividend of 19 cents per share for the financial year.

So reports in inline to estimates as expected...

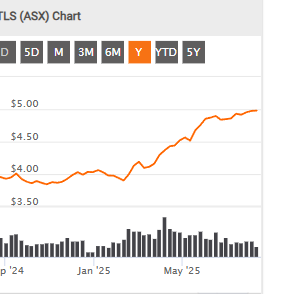

Return (inc div) 1yr: 34.72% 3yr: 12.42% pa 5yr: 14.94% pa

Got an email from Telstra a short time ago that my mobile plan will be increasing from $65 to $70/month representing close to a 10% increase. From memory, this is the second mobile increase in about 12-18 months, and potentially the 3rd in the space of 3-4 years.

First thought was "well that sucks", second thought was "can I do anything about it?" Unfortunately the answer to the latter is no - I work remotely in WA and we rely on Telstra's network at site, it's pretty standard for all mine sites to only have Telstra reception which does give them a bit of a monopoly on the WA 'FIFO' workforce.

Telstra seem to be exercising some pricing power for their mobile plans, this may (will) cause some people to switch to cheaper options that may not rely on their coverage network. I imagine TLS will also be doing the same for internet and other areas of the business.

Anyway, enough whining, taking a (very) superficial look at their numbers, I nearly fell off my chair when I saw that their SP was up ~16% YTD and a whopping ~37% over the last year. Yes, yes, yes we invest for longer than that, but still I was surprised. Their PE is 32! All this suggests that the market is either pricing in more growth on the back of their transformation which they went through in the last 12 months or so (if I recall correctly).

To justify a PE this high, they'd need to dramatically increase earnings - revenue would need to grow to $45-$57B at current margins of approx. 7%. OR they improve margins above approximate historical levels of 7% OR, convince the market that there is high growth potential to attract a higher price.

High price to pay for a blue-chip "boomer" stock.

Telstra's latest hail Mary is AI. Seriously, how much money has this behemoth torched in the pursuit of growth?

This is a company bereft of vision, incapable of any original innovation and burdened by bloat and bureaucracy.

The reality is, the business is very much ex-growth, and has been for a long time. But it's also a cash cow, (or could be) but instead of maximising that and delivering it to shareholders, they lurch from ill-informed acquisition, strategic pivot and cost-cutting exercise to the next.

Maybe this $700m investment will be the exception to the rule, but I doubt it.

Spent some time with Telstra last week.

Thought I might share some insight, I believe (hope) all of the below is public information, but thought I would summarize in the one place.

Disclosure: I am heavily involved in Telco but do not invest in the sector

Telstra, have finalized and organized the management teams of the three new divisions and the edges have been sharpened. They are also waking up form covid and finally returning to work, albeit slowly.

We have Andy stepping down and Vicky tacking over. It would seem she is highly motivated to continue the current trajectory.

Fiber

They have there new dark fiber offering, this is the first time this has been made available.

They are completing a complete new duel fiber run nation wide (due for release 2025). This new fiber is specifically designed, it is ultra fast with less repeaters. It may even prove quick enough for us to remove expensive datacenters in Perth for real time applications. More importantly. As is the case now, Telstra will be clipping the ticket of most Telco's to use it.

And price incentives for ethernet/fiber to premises has been extended to continue to compete with market share from NBN Co

Telstra Home

I think they have realized that perhaps they are loosing some of this market share of loyal "Telstra Home Users" we saw -

the acquisition of Fetch.

Teaming up with security vendors

And again heading for the new year software and security integration into many new products

There is also a lot of development into gadgets and IOT in the pipeline.

Towers

We have the new arrangement with TPG for spectrum space.

Wholesalers are about to get access to the 5G spectrum

Other Business

The are back in the DC space (after leaving many years ago).

Heaps of IOT and GPS tracking ideas/devices/wholesale.

Most of the copper has now been removed from the ducts. There is a lot of real-estate here and Telstra is keen to rent it.

That's about the crux of it, feel free to msg me for any in depth info, happy to share what I can.

Ultimately the wheels are still grinding away there at Telstra. Although they are harder to turn than the titanic and have the reputation of @$$% they are still a formidable company in this space. And remember if investing in this sector, Telstra is clipping the ticket of every telco.

Media reporting

Australia's consumer watchdog, the Australian Competition and Consumer Commission, is taking Telstra, Optus and TPG to court, alleging they misled consumers over NBN speeds.

The ACCC alleges the companies made false or misleading representations with respect to promotions. It is also alleged they all wrongly accepted payments from customers when they were not provided with promised speeds.

Link to article.

As a holder of ABB, I would be lying if I said I wasn't a little relieved that they also haven't been implicated (touch wood). I will be surprised if this doesn't have an impact on TPG and Telstra share prices when the market opens tomorrow.

Telstra Corporation Limited – Delisting from the Main Board of NZX Limited and letter to Shareholders

The Telstra Board has resolved to delist from the Main Board of NZX Limited (“NZX”), and move to a sole listing on the Australian Securities Exchange (“ASX”). NZ RegCo has approved the delisting, subject to Telstra meeting certain conditions. The trading of Telstra shares on NZX will cease at the close of business on Wednesday 16 June 2021.

NZX shares will be transferred to the ASX, and there will be no NZX trading, on Thursday 17 June and Friday 18 June 2021. Telstra will be delisted from NZX from the close of business on Friday 18 June 2021. The sole listing on the ASX will commence at the opening of the next trading day on Monday 21 June 2021.