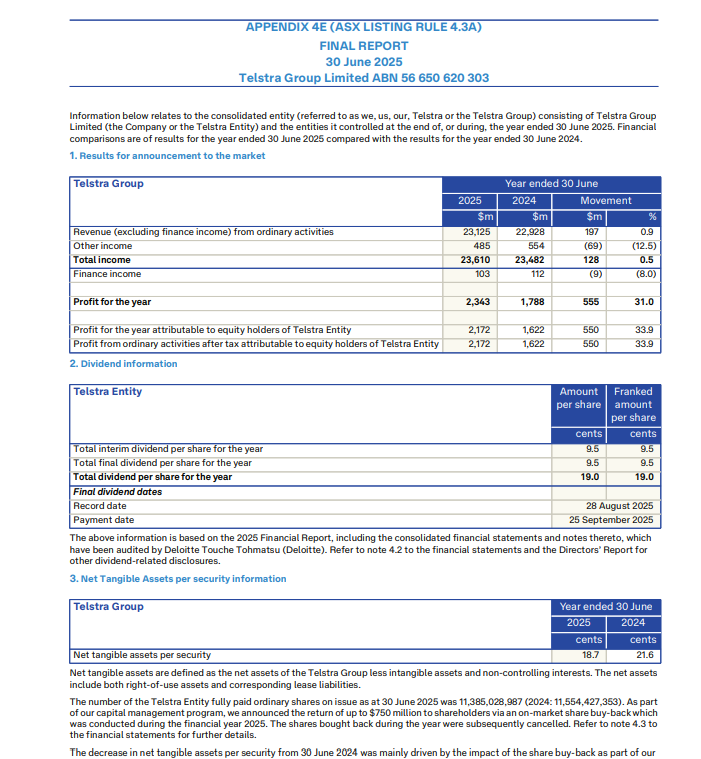

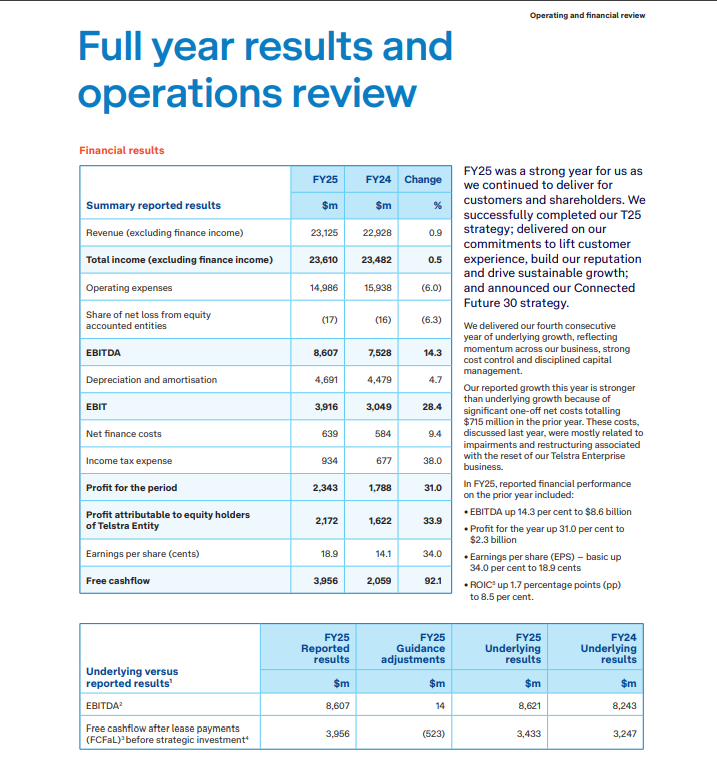

In June this year we completed our $750 million on market buy-back, and today they have announced an additional on-market share buy-back of up to $1 billion. This has been enabled by growth in earnings, and the strength of our balance sheet. The capital position and liquidity remained strong, and net debt remained well within their comfort zone..

https://hotcopper.com.au/threads/ann-tls-financial-results-for-full-year-ended-30-june-2025.8710777/

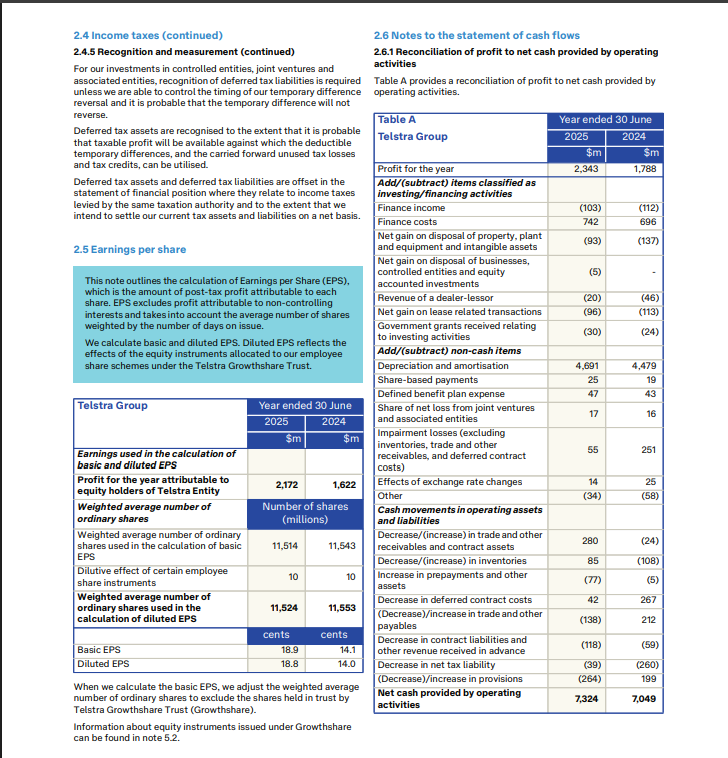

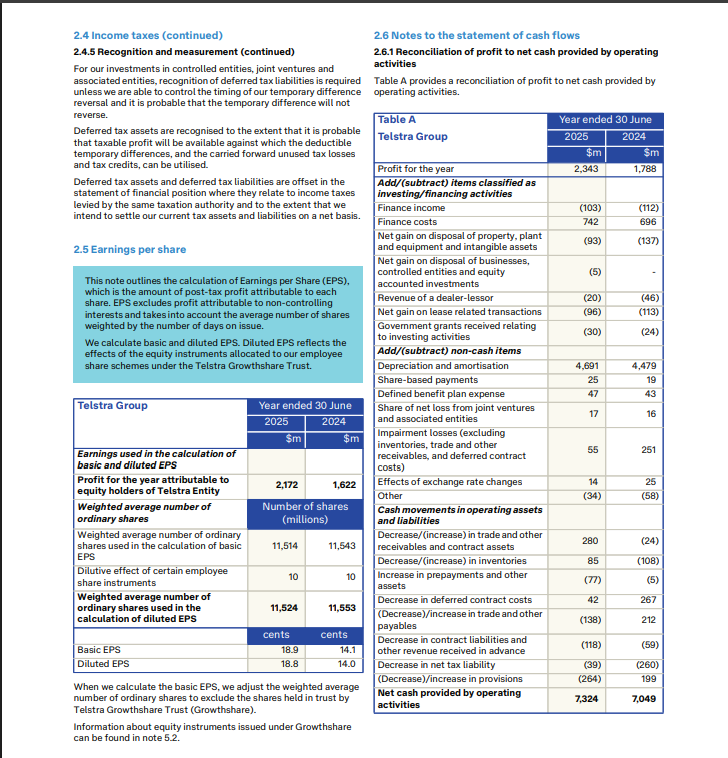

A look at EPS: Net Profit / # of Ord Shares

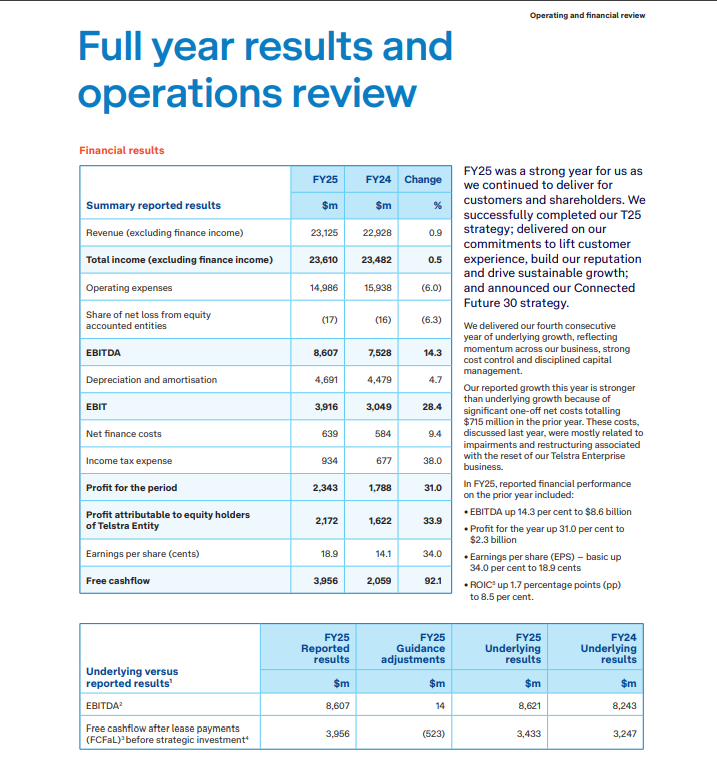

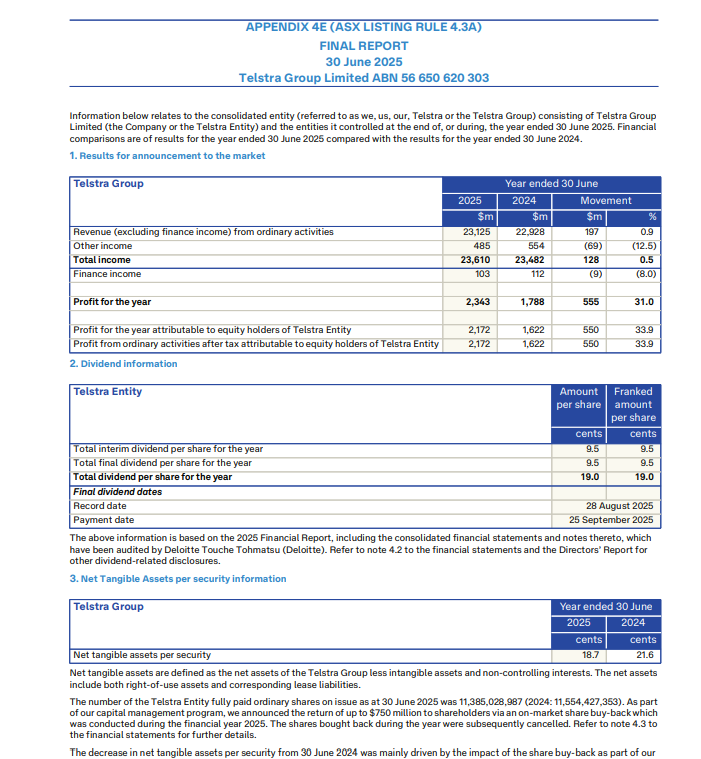

Motley fool says-Telstra Group Ltd (ASX: TLS) shares will be on watch this morning when the telco giant releases its full year results. According to a note out Macquarie, its analysts are expecting Telstra to report a 1% increase in revenue to $23,687 million and a 5% lift in underlying EBITDA to $8,655 million. The latter is broadly in line with the consensus estimate of $8,640 million. The market is expecting a fully franked dividend of 19 cents per share for the financial year.

So reports in inline to estimates as expected...

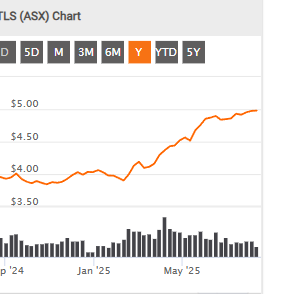

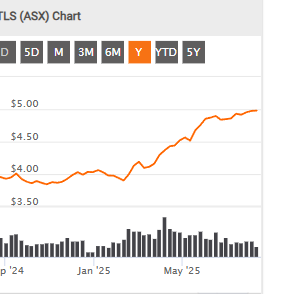

Return (inc div) 1yr: 34.72% 3yr: 12.42% pa 5yr: 14.94% pa