Austco released a trading update today to coincide with their AGM later this morning. Overall impression is it was what you would want to see, which is to say, solid. They didn't break down the organic/inorganic split, which would have been nice, but did reconfirm targeted 10-14% organic growth for FY26. Highlights included:

• Revenue of $23.2 million, up 51% on the pcp, which includes both organic and inorganic growth.

• EBITDA of $4.2 million, representing 18.1% EBITDA margin, up from 16.0% at FY25 year-end.

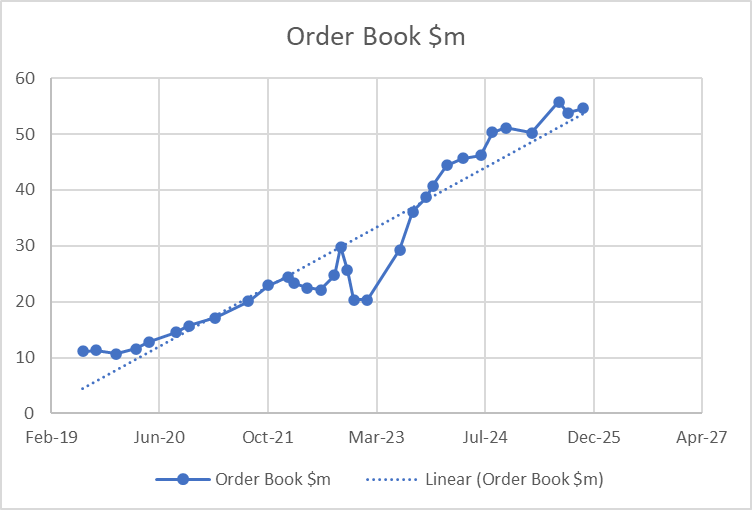

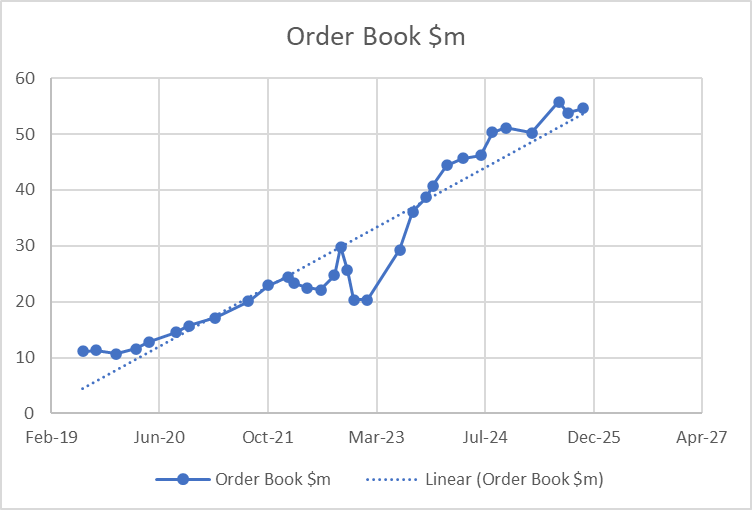

• Order book of $54.6 million at 23 October 2025.

Here's how the order book has tracked over the past six years:

Overall it continues to deliver at or above what I need it to in order to justify continuing to hold. I've been lightening some positions that have gotten a bit frothy in recent months but Austco is not one of them.

[Held]