Overview

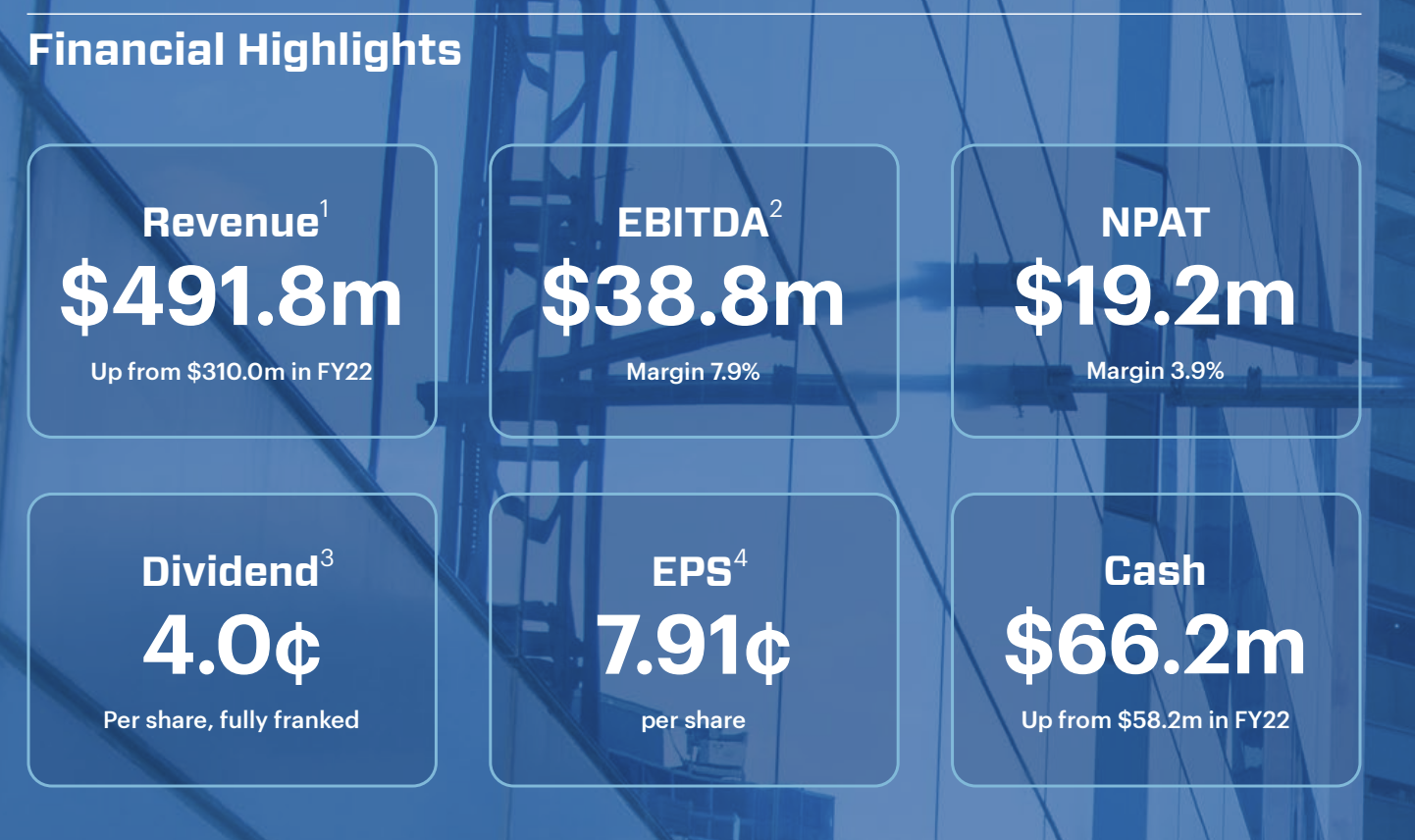

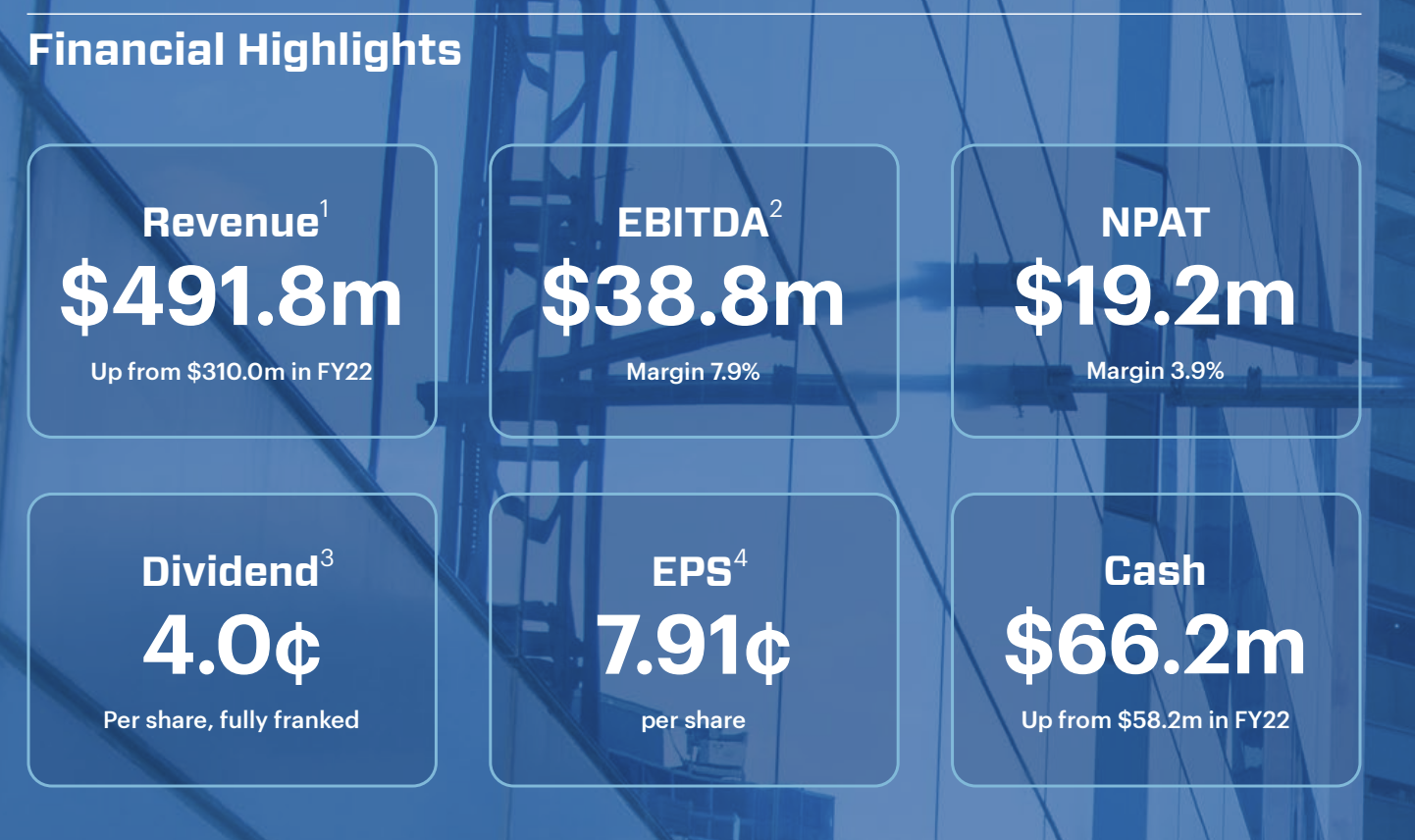

-Duratec came in at the top end of their twice upgraded revenue and EBITDA guidance:

-They had a total of 1944 projects (compaired with 1664 in FY22)

-Their workforce increased by 20%

-Wilson Pipe Fabrication (WPF), the first substantial acquisition for the company, has been a sucess and has the highest margins within the business (gross margins about 30%)

-The Mining & Industrial, Energy and WPF segments have the highest margins and are growing quickly on a forward looking basis

-NPAT margin increased from 2.5% in FY22 to 3.9%

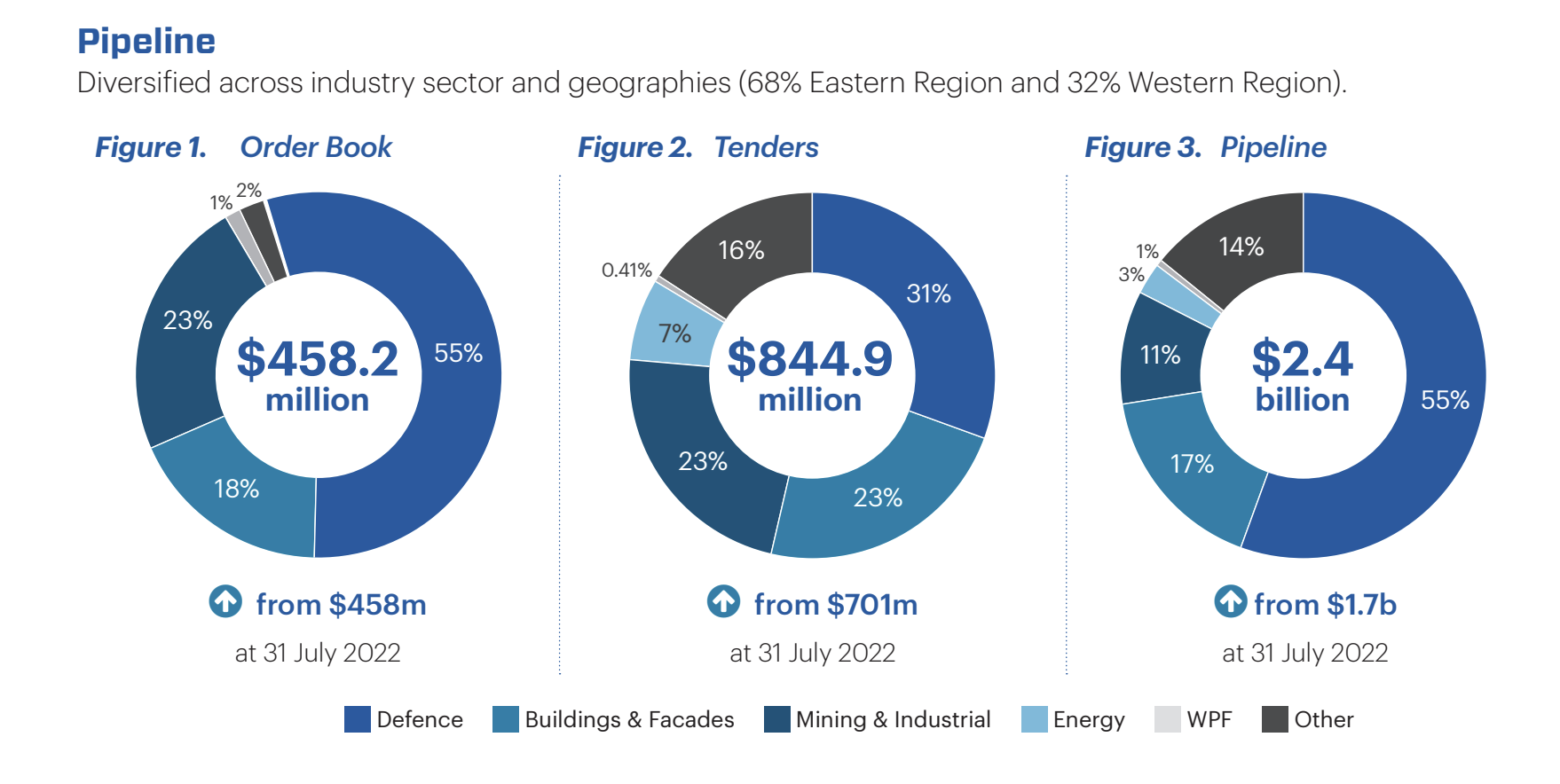

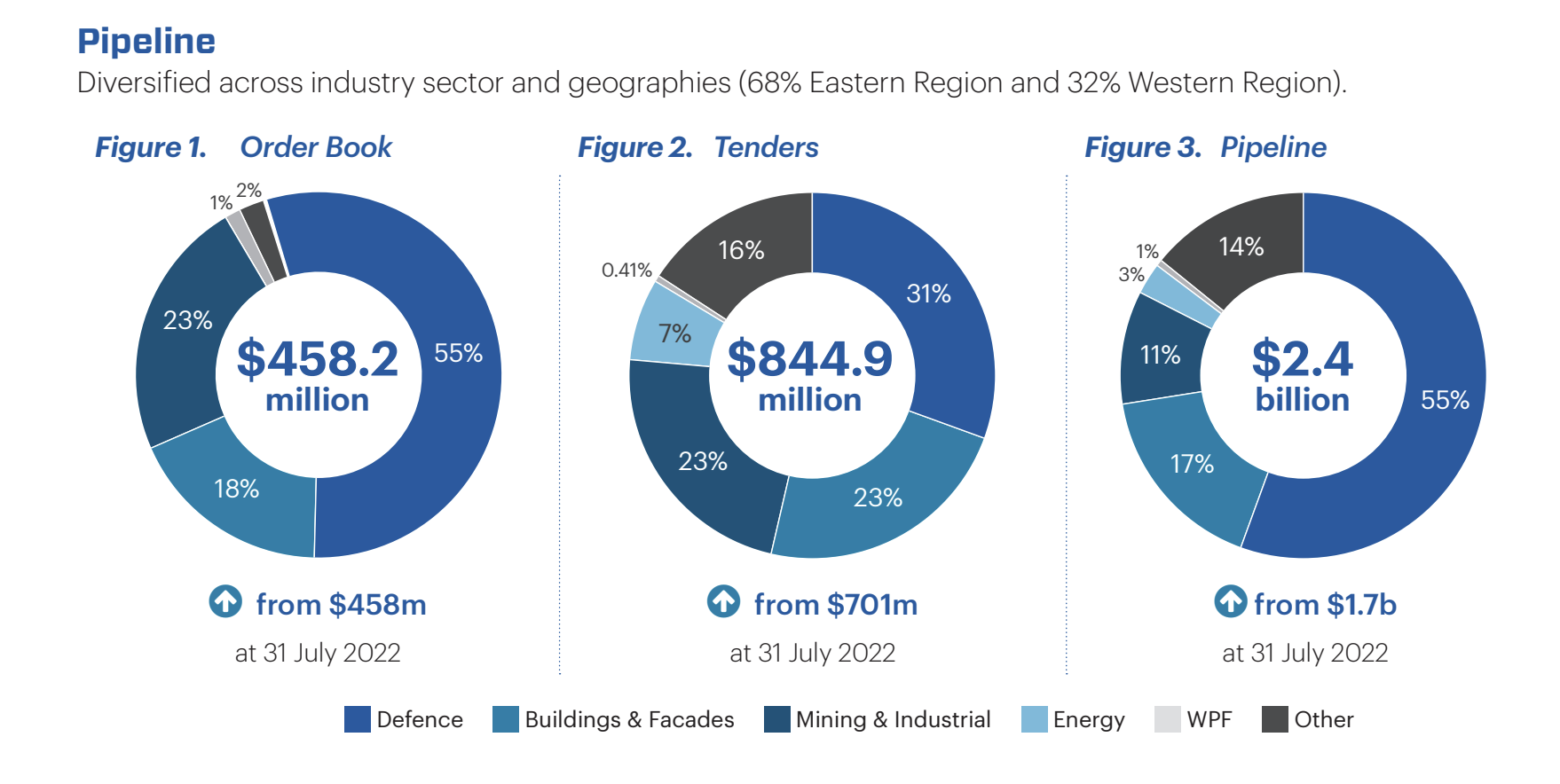

-The orderbook has $458.2m ($458m FY22) however this excludes $60-70m of master services agreement

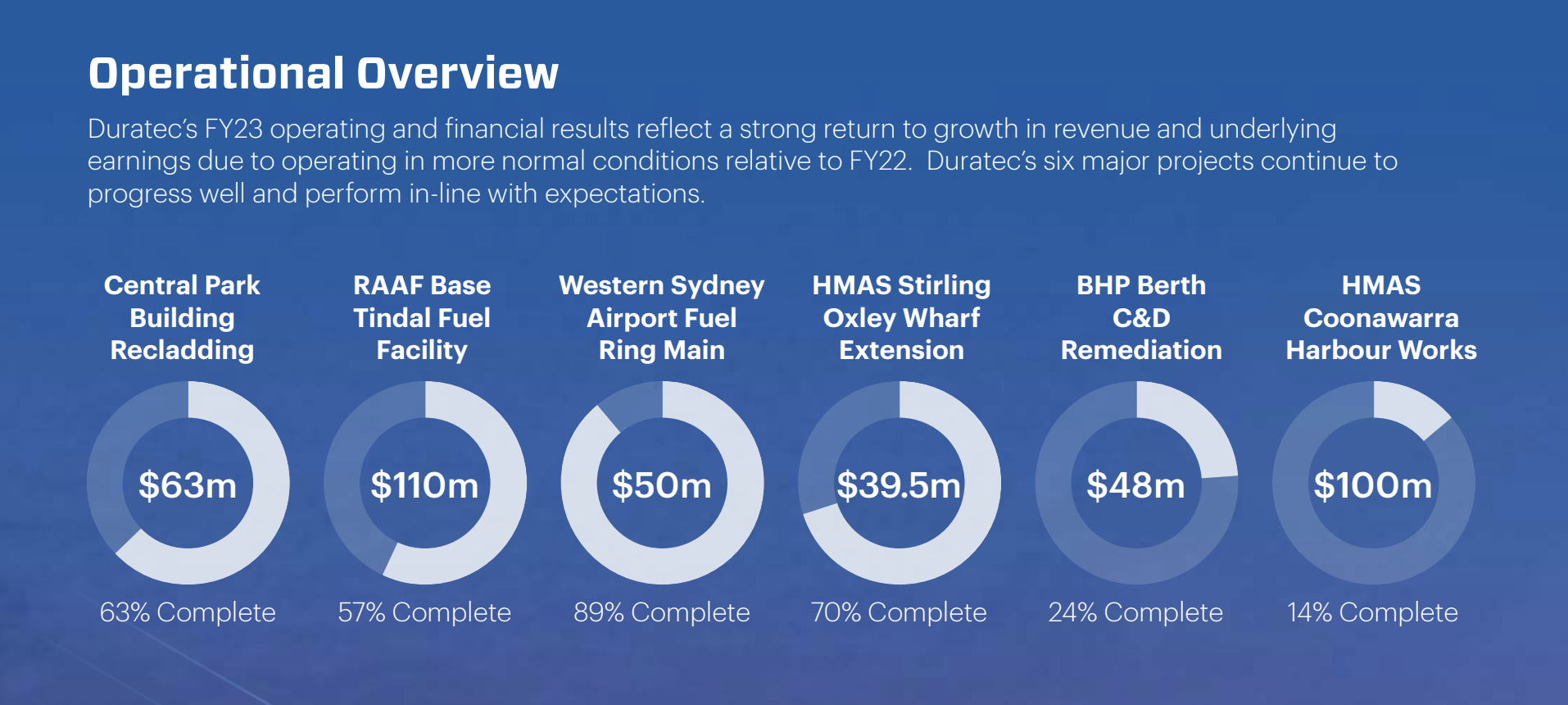

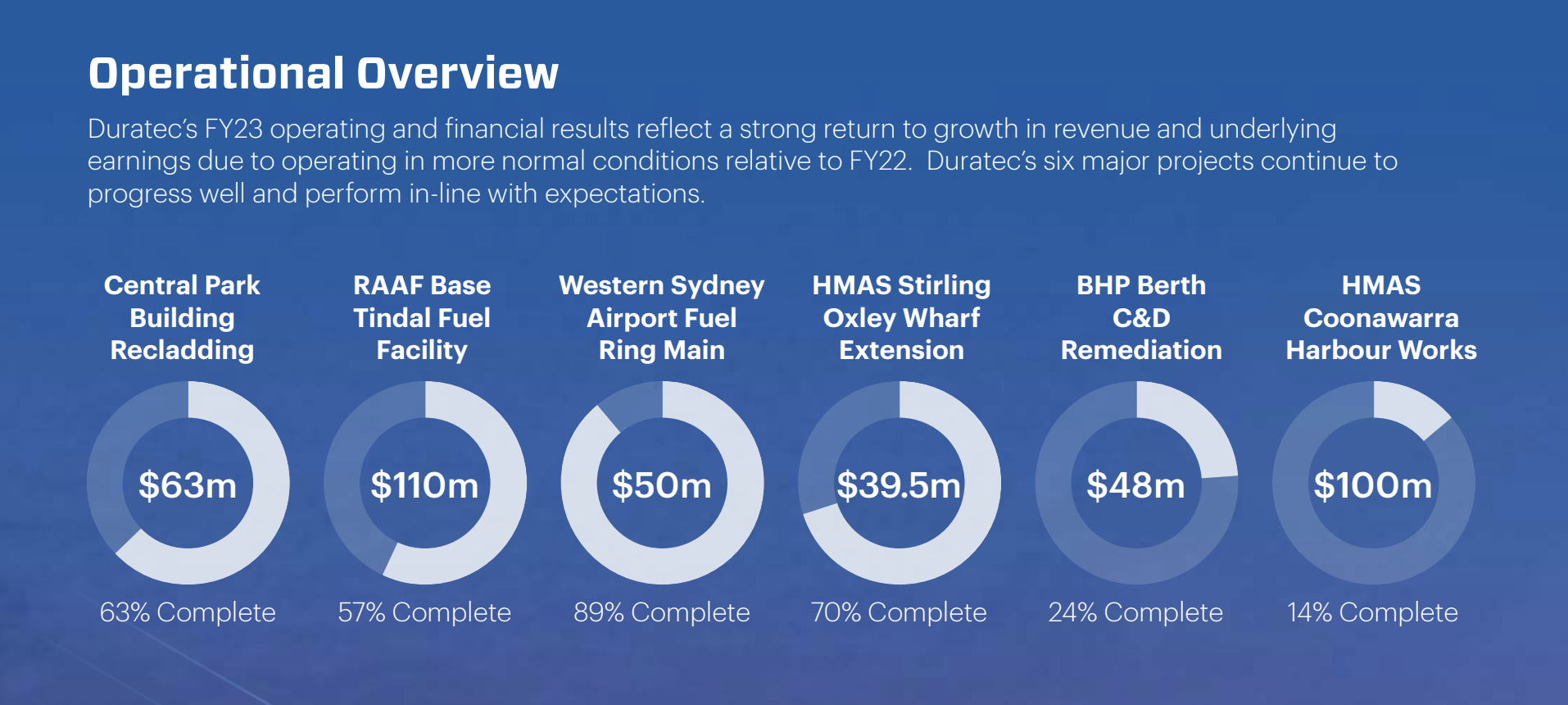

-One legacy heritage structure remediation project impacted the FY23 results due to scope/access/location. This was still completed to a high quality

Business Segments

Defence

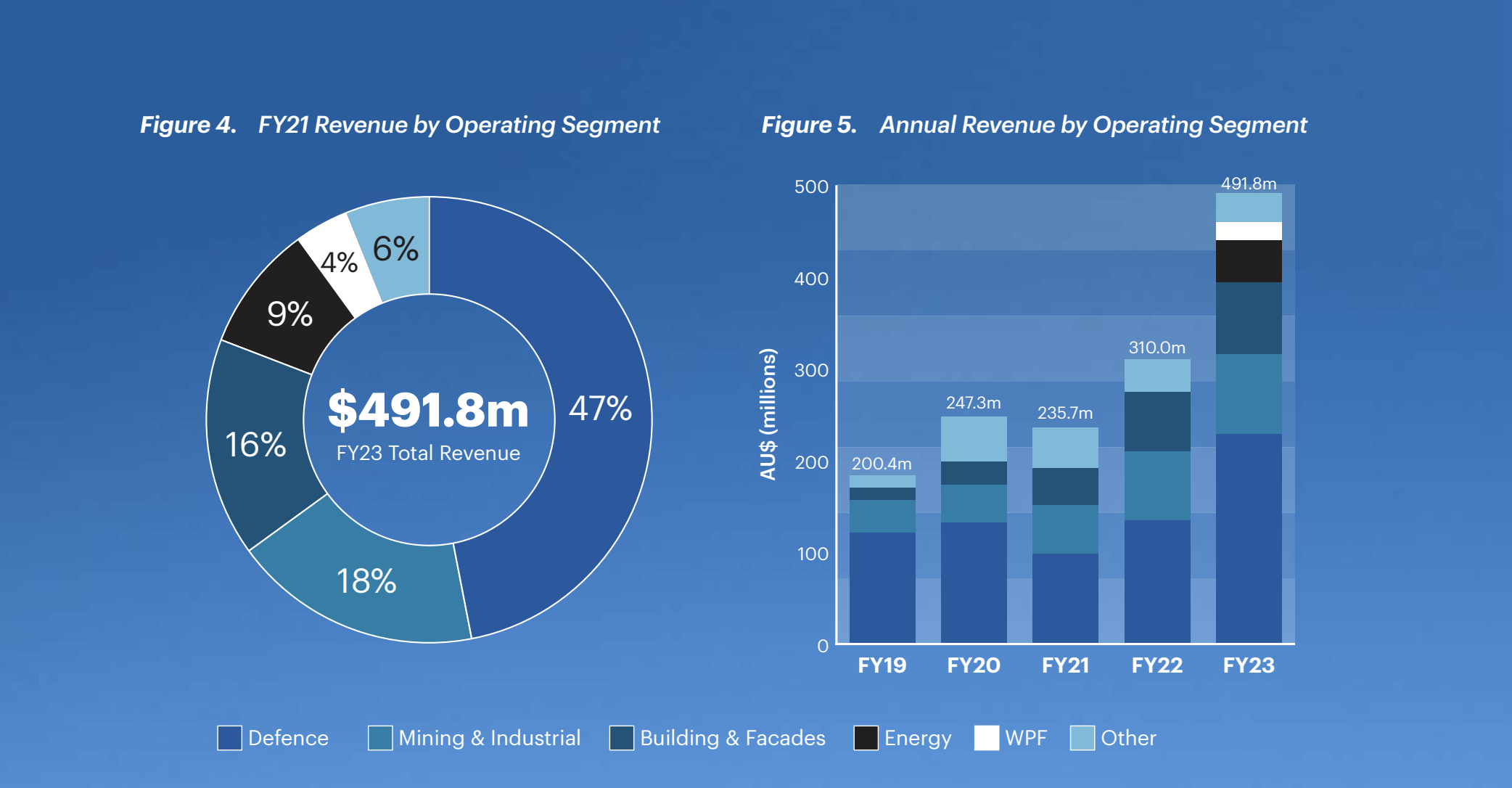

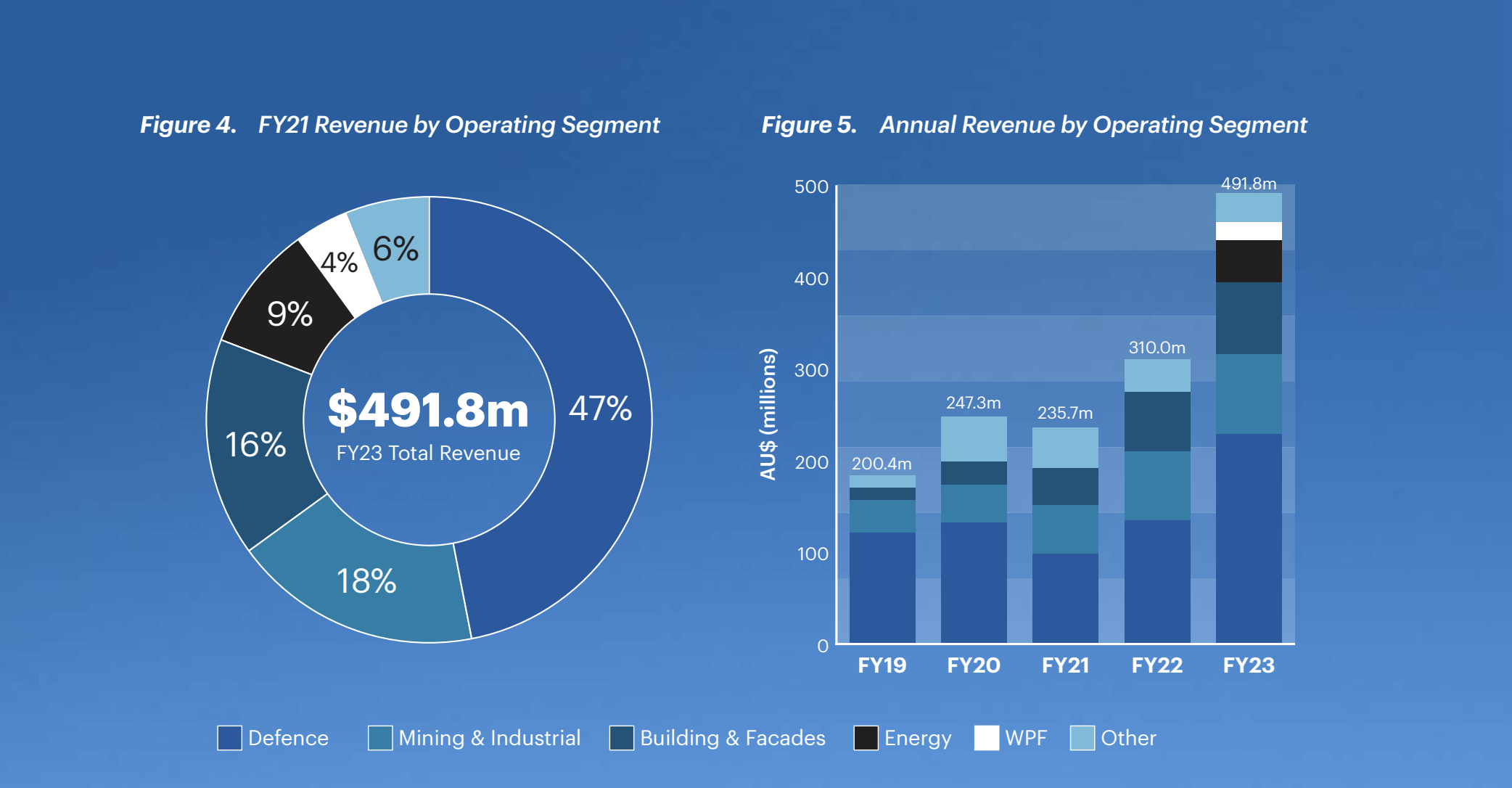

-Significant increased revenue of $229m ($135 FY22) with $252m in the orderbook

-This is the lowest margin segment about 13% gross margins

-Recent slowing of estate works due to cancellation/reprioritisation of projects that no longer suit the national defence strategic review (released May 2023)

- New priorites are: fuel reserves, maritime infrastructure, bases, ports and accommodation building

Mining and Industrial

-Revenue of $86m (up from $65m in FY22) with $105m in the orderbook

-This is a higher margin segment about 21% gross margins

-Second half of the year significant increase in award of iron ore industry upgrades comencing with BHP Berth wharf at Port Headland

- This followed an Early Contractor Involvement of 3D capture of the entire Wharf

- This had led to further additional awards in the Pilbra region of WA

Buildings and Facades

-Revenue of $78m (up from $65m in FY22) with $82m in the orderbook

-This segment has a gross margin of about 15%

-TAM $12b

Energy

-Revenue of $47m (up from $12m in FY22) with about $60m in tenders

-Higher margin segement about 21% gross margins

-Significant fuel security and upgrade works upside

Wilson Pipe Fabrication

-Highly motivated management team

-A key vertical acquisition for the energy segment

-About 30% gross margins

-Voted contractor of the year (Santos 2023 Directors awards)

-TAM $60b from decommissioning of offshore oil and gas infrastructure as the economy decarbonises

Mend Consulting (ECI - early contractor involvement)

-Full in-house solution

- Survey data/ laser scanning/ thermal

- Annoview labeling

- In-house sampling/ testing

- commercial options

-Asset management council innovation award 2023

-Since BHP win (discussed above) new enquires from an international gold miner with a variety of assets

DDR Australia

-Duratec has 49% ownership

-Revenue of $33m (down from $72m in FY22)

-A delay in tender award decisions has reduced the work over FY23

The 6 key projects

The pipeline of work

Remuneration

-Executive directors

- Phil Harcourt $1m (including a $450,000 cash bonus)

- Chris Oates $908,000 (including a $400,000 cash bonus)

-Employee expenses increased to $35.8m (from $27.8m in FY22)

Conclusions

-FY23 had a big increase in revenue driven by the Defence segment

-This flowed through to the bottom line and the NPAT margin and cash position improved

-The new WPF acquisition is earnings accretive and provides an important vertical for the Energy segment

-Management demonstrated excellent capital allocation with the acquisition of WPF

-The decommissioning of offshore oil and gas projects as we decarbonise has a TAM of $60b with WPF/Energy segment well placed to win this work

-Managements ability to risk manage project selection is a moat

-Mend consulting (Unique 3D modeling) is gaining traction and leading to commercial work

-It is unlikely that the Defence segment will continue at the same rate as it did in FY23

Disclosure held irl