A brief overview of EMVision ahead of our chat with the co-founder this Thursday, Scott Kirkland (a substantial shareholder with a 5% interest in the business).

The business is attempting to develop and commercialise a portable brain imaging device to diagnose and monitor strokes. This is traditionally done using CT and MRI scanning, which remains the gold standard, but are very large, expensive and limited in availability.

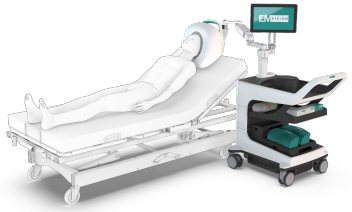

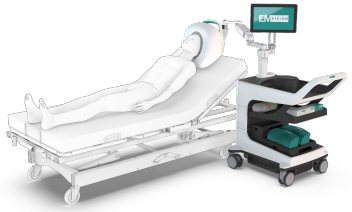

The EMVision device (below) has been in development for around ten years, with the work being pioneered at the the University of Queensland. It has the benefits of being very low radiation (less than an iPhone), portable (comparable to an ultrasound device, and the 2nd generation device can actually be installed in an ambulance) and fast (can render images in 30 seconds). If you know anyone who has had a stroke, you'll know that early detection and treatment is critical -- the so-called "golden hour".

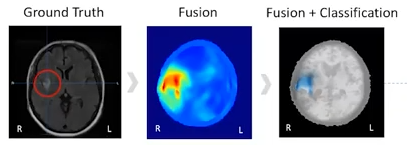

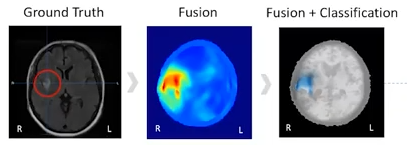

A recent trial was conducted, comparing scan results with MRI images. As can be seen below, the EMVision scans (middle and right) aligned exceptionally well with the MRI standard, and are also able to distinguish between the two types of stroke (clot or bleed)

There's a broader trial due to start this year, and the company has already engaged with the FDA's breakthrough technology program, as well as having early discussions with potential manufacturers and distributors.

One interesting tidbit i learned was that the company has so far met all of the milestones it has presented to the market. Followers of this industry would know that this is pretty rare.

The market is, of course, massive, and as far as I can tell there's no comparable device in development (although this is something to check in our meeting).

The CEO, Dr Ron Weinberger, is a former Executive Director and CEO of Nanosonics (ASX:NAN) where he helped develop and successfully launch their Trophon disinfection device. He holds around 1.9m shares. He gives a good overview of the business at an ASX presentation last year (see here)

As with Nanosonics, the company is looking to deliver the device on both a capital sales and subscription basis. The former of which also has a (very high margin) consumables component (a cap for the patients head I believe). There will also be servicing and training revenues. The device is expected to be priced at around $150k on the capital sales model. For comparison, an MRI machine can cost upwards of US$1.2m (based on a quick google search -- any medicos let me know if that's not correct)

The company listed in late 2018 and has yet to generate any sales revenue (although has other income of around $1.8m from grants and R&D incentives etc). Last year it had about $10m in costs and currently has around $10m in cash at hand.

All told, this is a very early stage company that is likely at least a couple years away from a successful commercialisation. Given costs and the cash balance, i'd expect at least a few capital raisings ahead. It will almost certainly be extremely volatile.

That being said, the technology is progressing well with some very encouraging results to date. The market opportunity is massive and the business is led by a team of experienced players with a lot of past success in this space. At a current market valuation of $192m, and given it's stage of development, it's probably comparable to Nanosonics in (roughly) 2010.

As was seen there, a successful commercialisation led to a 10x return for shareholders from that point over the following decade. BUT, as we've also seen plenty of times before, the path to commercialisation is fraught with difficulty and companies can bleed huge amounts of cash along the way...

If you have any questions you'd like me to put to Scott, you can do so here

Personally, i'll be looking to get a sense of the expected cash burn, timelines for regulatory approval, milestones for product build and distribution partnerships.