Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I decided over the weekend to fully exit my EMV position IRL and in SM. Have exited EMV in SM in full and 40% of my IRL holdings today. I expect to sell down the rest of the 60% in the coming days.

Portfolio Context

Cash proceeds will likely be used to top up my 3 US medical companies - AVH, NAN and BOT, all of which have established FDA-approved products, large TAMS and good opportunity ahead. These appear to be more optimal use of the capital currently invested in EMV.

At ~1.72, EMV was a 1.74% position in my RL portfolio. Exiting at 1.74 netted a ~15% gain over 2 years - not flash but not too shabby either.

RATIONALE FOR EXIT

- The BOT and AVH experience has demonstrated the huge challenges in any medical company introducing a new FDA-approved product into the US market.

- EMV is doing very well heading towards FDA approval for both bedside Emu and the portable version of Emu and given current trajectory and progress, FDA approval for both is imminent in the next 12-18 months

- The EMV price will continue to move sideways until FDA approval is obtained as there really is no catalyst to boost the price - it has been drifting downwards steadily

- But post FDA-approval, EMV will go through the same challenges with launching the commercial sales of Emu, and will likely go through the same challenges as AVH and BOT is currently undergoing to get commercial traction

- EMV management is mostly NAN-experienced and will no doubt bring to bear the experience of commercialising Trophon to the commercialising of Emu, but both BOT and AVH have demonstrated that having prior experience in the commercialisation process does not guarantee a smooth ride either.

- Would rather not have to go through the wild price ride again

- The entry into EMV has been good as it was skin in the game to build knowledge on (1) how medical devices go through FDA approval process and (2) the challenges of pre-FDA approval commercials

Discl: Held IRL, but should fully exit in the coming days

Discl: Held IRL and in SM

SUMMARY

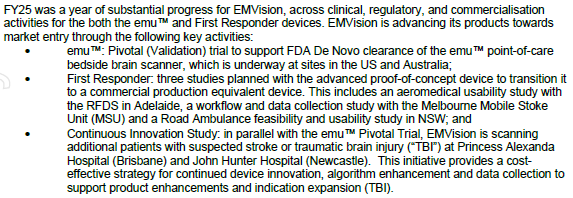

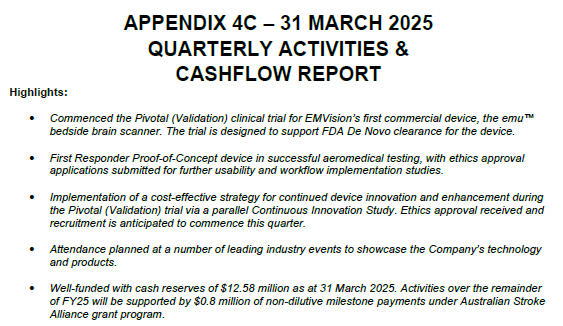

- Progressing nicely on all trial fronts - going as best and as fast as can be it would seem

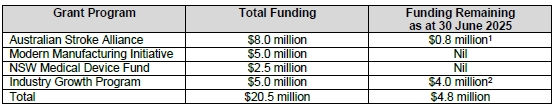

- The key thing I am watching is funding: 30 June 25 cash balance is $10.5m, with $4.8m of grant funding to come + FY25 R&D Tax Incentive of ~$2.0m, so total funding of ~$17.3m is available - at $3.0m operational burn, this is 5.8 quarters of funding, which should take EMV to sometime 2QFY2027 - that feels reasonable, particularly given how relentless EMV has and will continue to be with the grant opportunities

OPERATIONAL UPDATE

Nothing exciting or new about the EMV trading update as all the news has already been announced prior - this is a good summary of where things are at:

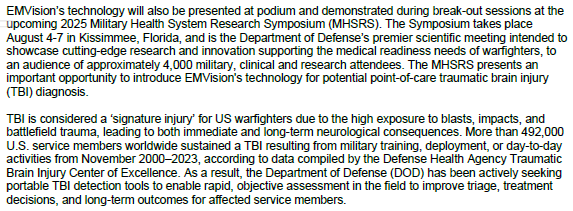

This was interesting as it provides context to understanding the US Defence market for Portable Field Scanners which was mentioned in an earlier announcement.

FINANCIALS

- Excluding the $0.98m 1st payment from the $5.0m Industry Growth Program Grant announced in June, EMV burned $3.05m this quarter

- Only change worth noting was that R&D expenses fell to $0.8m, a sharp drop from the previous 2 quarter’s spend of $1.2m each in 2Q and 3Q, respectively. This is consistent with Scott saying that R&D expenses will fall as they focus on trials.

EMVision Medical Devices Limited (ASX:EMV) has provided a progress update on its First Responder portable brain scanner program.

The First Responder device aims to address significant unmet needs in stroke and traumatic brain injury (TBI) care by enabling earlier triage, transfer or treatment decisions at the scene and is being advanced in parallel to the emu bedside scanner.

With a First Responder advanced protype developed, ethics approval has been granted for two studies that will progress the device towards commercial production equivalence.

Key Highlights:

• Ethics approval granted for two important studies that will advance the prototype First Responder Device towards a commercial device:

Royal Flying Doctor Service (RFDS) aeromedical study

Mobile Stroke Unit (MSU) study

• Studies are designed to demonstrate that the First Responder brain scanner device can fit seamlessly into emergency workflows and collect valuable data in the pre-hospital setting.

• $400,000 non-dilutive milestone payment received under Australian Stroke Alliance Project Agreement on achievement of First Responder development milestone

EMV_1st RESPOND_PRGRM ADV_&_MILESTONE_PAYMT.pdf

Summary

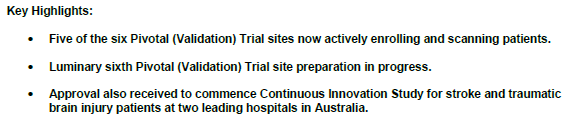

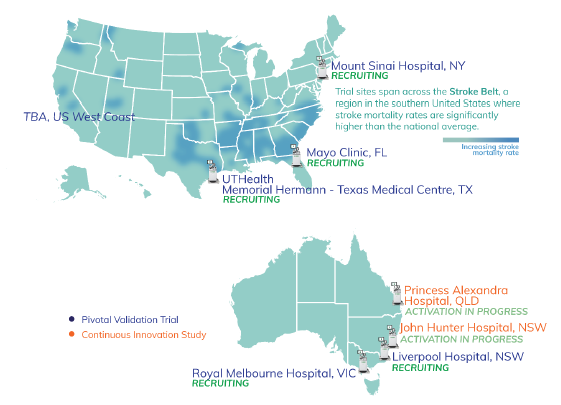

- Pivotal (Validation) Trial is moving steadily - all sites are luminary, high volume comprehensive stroke centres

- Continuous Innovation Trail is good front end loading for the indication expansion into traumatic brain injury

- All are occurring at major stroke centres - nice map to show where trials are occurring, which in the US, are also likely to be where commercial activities will be focused on per, as Scott indicated in the SM interview

Continuous Innovation Study

In parallel to the Pivotal Trial, EMV is implementing a cost-effective strategy for continued device innovation, algorithm enhancement and data to support indication expansion for traumatic brain injury

Ethics approval received to commence scanning patients with suspected stroke or traumatic brain injury at Princess Alexandra Hospital BNE and John Hunter Hospital NTL - both sites are high volume Comprehensive Stroke and Level 1 Trauma Centres.

Pre-revenue med-tech isn’t for the faint-hearted.. It carries real risks. But it does feel like EMVision is edging closer to the all-important commercialisation phase.

As Scott noted, this has been a 7-year journey for the company, and around $60 million invested into R&D. And that follows a decade of foundational work in a university setting. Long timelines like this are typical in med-tech. What’s not typical is when all that effort, time, and capital actually pays off for shareholders.

But EMVision does seem well placed to be one of the rare exceptions.

What I like:

- They’ve been very prudent with capital. Dilution has been remarkably low compared to most peers in this space.

- The market opportunity is clearly massive. Stroke is a huge global burden, and there’s nothing else like this currently on the market.

- There’s real optionality beyond stroke, and the US, but that initial focus makes perfect sense.

- The company has a decent runway, with over $12 million in the bank and non-dilutive grants still flowing.

Of course, more capital will be needed -- even if the FDA process is favourable. Sales teams, manufacturing, support... those costs aren’t yet material, but they will be. That’s not necessarily a negative; if there's meaningful traction, the ROI on that spend could be compelling. But it’s something to factor in.

On the flip side, a negative FDA outcome would likely decimate the share price. That's probably unlikely, but again something to be mindful of.

I exited a (very) small watching position earlier this year, mainly as part of a broader portfolio tidy-up, not due to any specific concerns about the business. It's a company I've kept on the radar, and I wouldn’t rule out getting back in if a few more things go their way. No doubt at a higher price, but also with (hopefully) less risk.

The recording of the meeting is now up on the Meetings page, and here’s the if you're interested.

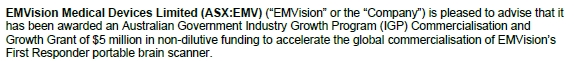

Nice award! To put this in perspective:

- At 31 Mar 2025, EMV had available funding of $12.6m, so this increases available funding to $17.6m, with the $5m to be progressively dispensed quarterly

- Actual cash outflow, excluding Grants and Incentives, in FY2025 to 31 Mar 2025 was $8.8m

- There thus appears to be funding for roughly 18M, which should get EMV past FDA approval, I suspect

I still expect a capital raise but the grant removes the immediate need for that, pushing the timing of any raise nearer to commercial launch. Am very OK with that prospect as EMV has been very careful in its funding approach.

Next week’s SM chat with Scott is timely to get a better sense of how it is thinking about funding.

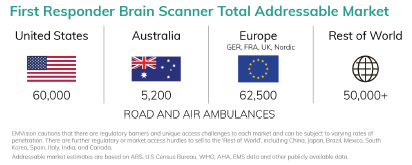

On a separate note, this was a good summary of the TAM for the First Responder Unit. I don’t think its new, but its the first time I have taken notice of it!

Discl: Held IRL and in SM

Nothing newsworthy as all of the business updates have been previously announced

- A good cash flow quarter as $2.1m FY24 R&D Tax Rebate was received this quarter which reduced the cash outflow to a low $1.07m

- Cash burn would have been $3.2m excluding the Tax Rebate, about the same as 2QFY25, so no concerns

- The $12.6m cash on hand + $0.8m Stroke Alliance Grant, $13.4m will last ~13M ie Mar-April 2026, at the current burn rate

Announcement says “remains well funded” but there has been no announcement of any funding plans for the latter part of CY2026 thus far. Management has a good track record of proactively paving the way forward, so I do expect news on this front should be forthcoming soon. Would be significantly more comfortable once this funding issue is decisively sorted.

Both a capital raise, particularly as FDA approval for emu becomes imminent would be a distinct possibility, or short term debt for 1-2 years to provide funding coverage for the commercialisation startup, would make sense.

Discl: Held IRL and in SM

In these turbulent times, happy to take whatever positive news is on offer by any of my companies! 2 positive things out of this:

- emu Pivotal Trials continue to chug along nicely

- It absolutely can't hurt, from the perspectives of (1) the product (2) company reputation and (2) trial integrity, when one of your US trial sites is THE Mayo Clinic ..

Discl: Held IRL and in SM

Another on-track tick obtained to keep the trials moving forward. Things are happening quickly, and very much on the right track!

Discl: Held IRL and in SM

SUMMARY

- No operational concerns - progress on both emu Bedside and emu First Responder is marching along nicely

- As external funding has mostly ended, EMV now only has about 4 quarters of funding available vs expectations of market entry for emu Bedside Scanner during CY2026

- Clearly feels insufficient, is a risk, and will need to be addressed soon - share price will remain subdued until this is clearly resolved.

Discl: Held IRL and in SM

Operational Highlights

- Neurodiagnostic algorithms deliver excellent results in EMView study - previously reported in Nov 2024, so not new news

- Validation (pivotal) trial preparations well progressed after positive FDA engagement, commencement of the validation (pivotal) trial fast approaching

- Trial of up to 300 suspected stroke patients is expected, with a primary endpoint of “Blood or not” sensitivity and specificity.

- 6 leading clinical sites - 4 in US, 2 in Australia, anticipated enrolment of 6-12 months

- Ethics approval being pursued in both the US and Australia

- Assuming successful trial, market entry is projected to be during CY2026

3. First Responder POC Brain Scanner

- 2 additional First Responder devices have been fabricated - additional devices are targeted for deployment in a pre-hospital feasibility study scheduled to commence this quarter

- Healthy human volunteer study is underway

- Up to 30 participants are expected to be enrolled across aeromedical (RFDS) and road ambulance study arms

Financials

- 2QFY25 Net Operating cash outflows were $3.27m - largest quarterly outflow in the past 2.5 years - driven by R&D expenses ($1.18m) and the lack of funding inflows

- R&D costs increased in the current quarter due to the purchase of components for devices to be used in the upcoming validation trial

- Proforma cash reserves of $15.78m, including $2.12m FY24 R&D tax rebate received after quarter end

- EMV’s activities over the remainder of FY25 will be supported by further non-dilutive funding from the ASA grant program - $0.8m expected

- EMV continues to actively pursue non-dilutive funding opportunities to advance and accelerate other activities, including the First Responder device.

Not unexpected - this was 1 of 2 sources of funding that EMV flagged for FY2025. But good to have it locked in regardless.

Probably adds a quarter of funding more to the 9.7 quarters of funding as of end-Sep 2024.

Discl: Held IRL and in SM

There were some interesting slides in the EMV FY2024 slide pack. No new news as EMV has communicated clearly and regularly to the market but there were a few background/context slides which was interesting to note.

Discl: Held IRL and in SM

The Stroke Indication was always front-and-centre

Seeing “Traumatic Brain Injury” as a second indication for the first time since I started deep-diving EMV

Also seeing the introduction of “Time Sensitive Medical Emergencies” for the first time - makes good sense and probably provides an indication of EMV’s direction and focus areas in the longer term

The step improvement in size and mobility illustrates how game changing EMV’s products will be in improving the diagnosis and treatment options

Don’t recall seeing a TAM slide like this before, so this was really useful

No target sale price for First Responder yet, so size of the TAM is unclear, but the significantly higher number of potential units surprised me somewhat

Nice summary of the pre-validation clinical results - that is seriously impressive accuracy

Nice summary of what’s ahead

End CY2025 Market Entry target is key from a funding standpoint - if that holds, and assuming no additional funding is obtained, EMV should have consumed ~55% of available cash at 30 Sep 2024 to get to that point (5 quarters vs ~9.4 quarters available funding)

First Responder timeline

Amen, but I would have liked to have seen a line or 2 to confirm “we have available cash to see us through to market entry”!

NEURODIAGNOSTIC ALGORITHMS DELIVER EXCELLENT RESULTS IN EMVIEW STUDY

My medical expertise goes as far as applying a band aid on a small cut wound, but this looked like good news in the stroke detection capabilities of Emu.

The absolute Sensitivity (correct diagnosis)/Specificity (negative diagnosis) looked really good in absolute terms in the highlights. What blew me away though was how good those results are relative to the current Gold standard CT scans, in absolute terms AND given the size and mobility of the device.

Entering the Validation Trial is another milestone which adds to the good EMV track record of defining and meeting milestones.

I do have an emerging concern about cash reserves though from the last Appendix 4C.

- Cash balance last Quarter was $16.8m, and secured funding from various agencies ends this current Quarter, with $0.8m due, with the reserves funding ~9.8 quarters.

- Excluding receipts from Govt Grants/Other Funding, EMV burns between $2.3m and $3.5m per quarter in the last 5 quarters.

- The $4m needed to fund the validation trial should be completely manageable, as it will already have been planned for and will likely be BAU, not incremental cost.

But without additional funding clearly lined up to replace the end of the existing formal funding, things do start to feel tighter ... not a huge cause of concern yet, but one which I am watching very closely.

Held IRL and in SM

Back to a “normal” Quarter after the spike in spend in R&D Expenses in 4QFY2024 - combination of R&D expenses and Staff Costs have reverted back to normal quarterly levels.

At the current cash burn rate, there is funding for 9.7 quarters or 2 years and a bit.

Keeping a close eye on the funding situation as the ASA funding is down to the last $0.8m, expected in 2QFY25, and the FY24 R&D Tax Incentive claim. Not an immediate cause of concern given that FDA approval is going to plan, but need to keep a closer watch on this from hereon.

Disc: Held IRL and in SM

------

OPERATIONAL HIGHLIGHTS SUMMARY

‘EMView’ multi-centre pre-validation trial recruitment complete, enrolling over 300 participants. Stage 3 trial results anticipated in November.

277 suspected stroke patients provided valuable data for EMV’s “blood or not” and “ischemia or not” AI algorithms

EMVision continues validation trial preparations after positive FDA engagement.

The study design was confirmed as a multi-centre, prospective, consecutive, paired diagnosis, diagnostic performance study that is anticipated to enrol up to 300 suspected stroke patients at a minimum 5 stroke centres including a minimum 3 based in the United States.

Transformative ultra-light weight First Responder Proof-of-Concept brain scanner device unveiled. Preparations for road and air study well advanced.

- Ultra-light weight (<12kgs), non-ionising, non-invasive device that can be easily operated by trained healthcare professionals and is designed for cost-effectiveness, to enable rapid stroke and stroke sub-type diagnosis at the point-of-care.

- Represents an opportunity to fundamentally transform stroke and thereafter traumatic brain injury (TBI) outcomes, for all patients, regardless of their location.

- Intended to enable much earlier diagnosis and therefore much earlier triage, transfer or treatment decisions, which in acute stroke and TBI is proven to lead to improved patient outcomes.

- Delivery of the First Responder PoC device satisfied the "Ambulance Device Fabrication" milestone under the Company's Project Agreement with the Australian Stroke Alliance (ASA), which is funded by the Commonwealth of Australia's Medical Research Future Fund (MRFF), resulting in a $600,000 non-dilutive milestone payment during the quarter.

- Comparative initial bench tests have been conducted with the First Responder PoC device and emu™ bedside scanners.

- Pleasingly, the First Responder PoC device is demonstrating at a minimum equivalent sensing performance in these initial tests

Well-funded with cash reserves of $16.85 million. Activities over the next few months will be supported by further non-dilutive funding from the Company’s FY24 R&D Tax Incentive claim, currently being finalised, and the Australian Stroke Alliance grant program.

$1.72m cash outflow within normal quarterly cash outflow ranges

9.78 quarters of funding available

EMVision’s activities over the next few months will be supported by further non-dilutive funding from its FY24 R&D Tax Incentive claim, currently being finalised, and the ASA grant program. The final ASA milestone payments are due on achievement of telemedicine and road/air integration activities ($400,000) and commencement of pilot studies of the first responder device targeted for first quarter CY 2025 ($400,000).

Interim Stage 2 Analysis Confirms Hyperacute and Acute Ischaemic Stroke Detection Capabilities

Stage 2 data confirms positive AI algorithm performance to help answer the “clot or not” question. This comes off the back of earlier positive news of the AI detecting "blood or not".

Key clinical question of “ischaemia or not” (“clot or not”) - current non-contrast computed tomography NCCT scans shows a limited sensitivity to detecting acute ischaemia

Other tests are required for patients with suspected ischemic stroke to confirm diagnosis - advanced imaging modalities such as CT Angiogram, CT Perfusion or MRI are often used to confirm the presence of ischaemia (‘clot or not’) and determine a patient’s eligibility for thrombectomy (clot retrieval).

Depending on the neuro-diagnosis, and treatment capabilities of the hospital to perform urgent intervention, a time critical decision is whether to transfer the patient to a comprehensive stroke centre, or not.

Continues the good progress and news on Stage 2 Trials.

Discl: Held IRL and SM

SUMMARY

- EMV has been making good progress on all fronts - trials, pre-FDA submission, First Responder System proof-of-concept

- Remains well funded following Keysight Investment with $21.35m cash reserves, $2.6m remaining grant funding ontop of this

- No concerns - it feels like there is good project cadence on the several fronts that EMV is focused on

Summary of Highlights - Most Already Announced Previously

- Strategic $15.28m investment from Keysight Technologies

- Stage 2 clinical trial insights confirm stroke diagnostic and clinical viability

- Time from start of scan data acquisition to removal of the device was 5.5 minutes (range from 4.2 to 14.6 minutes), confirming the emu device seamlessly fits into acute stroke workflows, in time sensitive situations

- Preparations well advanced for a pre-submission meeting with the FDA

- To clarify and confirm the points remaining to finalise the Validation Trial package

- Pre-submission package is well-advanced for near-term submission

- Validation Trial designed will be finalise aligned to the FDA’s expectations to ensure the trial will deliver the clinical data critical to the emu’s De Novo market clearance application

- First Responder System on track

- Progressing well, leading to the near-term assembly of the proof-of-concept unit

- Ethics approval received for healthy human volunteer testing

- $21.35m cash reserves as at 31 Mar 2024 - nothing extraordinary

- $2.65m of funding is remaining from the 3 Grant Programs below

Another positive announcement which the market seems to have liked. While the quantum of the funding release is only $0.6m, it is EMV's continuation of a stellar track record of meeting milestone obligations that is the key positive here.

Discl: Held IRL and in SM

This looks like a good deal for EMVision -- a lot of funding at an attractive price, and with a partner that can offer some real advantages including access, production and components.

Companies that are pre-commercial are always spicy, especially those in the medical space, but EMVision really does seem to be making good headway and I'll be watching with great interest to see how the industry responds to its products. There's clearly a big and attractive market, and the potential of accurate, low cost & portable brain scans could be a bit of a game changer.

I hold a very small watching position.

The award for best start to the trading year goes to...

EMVision up 23% at present on no news. And not insignificant volume.

Expect a "please explain" from the ASX.

My notes on the 30 min conversation with CEO Scott Kirkland this morning. As the communcation from EMV to the market on its journey have been clear and regular, nothing earth shatteringly new. It was a really good conversation to take a step backwards and look at how the various pieces tie together, the bigger picture of what is coming ahead and evolving management thinking on the revenue model - it does indeed look very positive and promising from all angles.

Discl: Held IRL and on SM

Progress of Trials

- Pre-Validation Trials going well - 150 suspected stroke patients presenting in 3 major stroke treatment hospitals - Liverpool Sydney, Royal Melbourne and Princess Alexandria, generating data for FDA Pre-Validation approval

- EMV scans are obtained immediately after the usual CT scans are done, before treatment commences, then get follow-up scans if patient is admitted - get data on suspect strokes, then data to monitor progress thereafter

- Targeting 150 stroke patients by Q2FY2023 - enrolment of patients into trial study has been relatively straightforward and has been accelerating - not invasive, dedicated nurses to do enrolling and scanning

- Validation trials commence in CY2024

- Engaging FDA in parallel with collected data

- Looking forward to presenting real data in Nov 2023 to the largest Imaging Conference RSNA - in 2019 only had brochures of the device, will now have production models of scanners and scanned data on-site

Path to Commercialisation

- Gen 1 Hospital Mobile Device market entry planned for FY25 - Gen 1 device is a mobile device and has no predicate, so need to prove its efficacy from the ground

- Once approved, Gen 1 will be the predicate device for Gen 2 Mobile Scanners as a lot of the patients that are scanning today are the same patients that will be seen in an ambulance or pre-hospital environment - data from Gen 1 will be applicable, the Gen 2 device will have a different form factor

Funding

- Pre-revenue, non-dilutive funding has been a key part of the EMV strategy - $20m in grants, about $4.4m left

- R&D funding requirement for ongoing trials is modest unlike a Phase 3 pharmaceutical trial - getting a quick scan, payment to access radiological files, not a huge cost

- National Reconstruction Fund, $1.5b earmarked for manufacturing of Australian medical products is positive in terms of funding opportunities, exploring other domestic funding for med tech, manufacturing, follow-on funding for next phases of funding from alliances eg. Australian Stroke Alliance - pursuing these funding opportunities aggressively

Radiation Dose of the Scanners

- The scanners operate on the Electro Magnetic Imaging on the microwave frequency - sending signals similar to what mobile phones transmit for voice and data - “non ionising”

- Passed all independent EMC testing required to get device into study, into hospital sites knowing that it is not going to cause any interference

- Can also have multiple scans as the signals are not in any way harmful to the patient and the operator - any healthcare professional can operate the device

Secret Sauce of the Data

- The EMV devices are a new modality - no data available to acquire to enhance or train the data - the only training sets that are available are the ones that EMV themselves generate

- Real patient scan data models are expensive and time consuming to acquire

- EMV creates a “simulation pipeline” - take an MRI file, segmented into the tissue types, use the model of EMV’s system in the simulation software which very closely matches the real world against a healthy MRI to see how the signals would response to to the healthy head. Then generate different synthetic strokes and see response in the system. Able to generate a lot of simulations in the time to get real data from 150 patients, speeding up verification, development etc.

Competitive Landscape

- Same or similar output of images with classification, localisation from a similar form factor and the ability to produce a quality image, is it a stroke, what type of stroke, where is it in the brain - no competitors for this

- Competitors in mobile brain imaging, sensing, smaller CT’s, new method of ultrasound for the brain - plenty of competitors, mostly to inform that a stroke has occurred and how big, but not much more than that

- R&D of big companies are mostly focused on incremental improvements to existing products - anything bigger and they usually have to go outside to partner/collaborate

Revenue Model

- Direct and Distributor models, likely to be different models for different regions - Aust likely to sell direct, US likely to be a Distributor model to leverage off brand name, established network and credentials of the Distributor, at least in the first 5 years

- US surveys indicate preference for a capital purchase model

- Consumable mix has changed: Gen 1 - $25 per patient per scan for the cap, gel, Gen 2 - $50 per patient per scan

- Service - 8-15% of asset cost per annum, labour and spare parts

- Survey suggests 5 scans per day per device for larger hospitals

- Growth opportunities are to add use cases in the area of traumatic brain injury - 15m strokes per year worldwide but 27m cases of traumatic brain injury requiring treatment - these will add to consumable pool

Positioning of Use of EMV Scanners

- Longer term objective is to get use of the product in different workflows from early to post treatment monitoring, into guidelines, over time

- In Emergence Dept of a large tertiary hospital - have strict stroke protocols to get a CT scan quickly - not trying to replace or introduce an extra scan before a CT but rather for ICU/Stroke Wards, post treatment monitoring

- It is the rural settings where they might not have CT facilities and/or a radiographer to run the CT - definitely see a role for EMV Gen 1 in that ED scenario - speed up transfer decision making, triage, opening door to treatment

- Focus on environments where urgent brain imaging is required, not competing with a CT or MRI - not practical in that environment

Closing Thoughts

- Now in the studies face, recruiting trial patients at a great rate

- Encouraging insights and capability from the technology - will share further insights from the study as it progresses

- Progress on partnership and strategic relationship fronts

- Gen 2 mobile helmet scanner - being fabricated at the moment, advanced prototype available, bench testing and healthy patient testing next quarter, ambulance and road trials next year

- 2 product pipelines running adjacent to each other

I dont exactly agree with what @Silky84 has said, but might further clarify that the functional outcomes that are achieved via any method of stroke treatment (thrombolysis or clot busters Vs thrombectomy) are more dependant on 'time to treatment'. Regardless of opinions on treatments, we can all agree on time equalling functional tissue.

It is correct to say that this technology could have some say in that department. HOWEVER. I dont see this reinventing the treatment cascade anytime soon. Consider that this trial is occurring in the hospital, i.e the patients are already in hospital with their symptoms. It is a phase 1 trial really just aiming to prove the method of scanning is not INFERIOR to a conventional CT or MRI. In essence, the sole goal of these initial scans are to determine 1: are these symptoms actually caused by a stroke and 2: is the stroke embolic (clot) or haemorrhagic (bleed).

I dont have the data to back this up, but I was a Paramedic in a past life and feel that it is fair to say most, if not all patients who have an acute, i.e treatable stroke arrive at hospital via ambulance. In the past I have written that I would avoid investing in this company with the longest pole I could find, based on information at the time that the clinical trials would be run with NSW Ambulance service. I said this because I know the logistic hurdles and government red tape that would be involved.

Now sure, further down the road, if this tech was proven to be non-inferior to conventional imaging in regards to quality AND time to acquisition of image. Then there could be a compelling arguement to put one of these scanners in the back of an ambulance, and recognise TREATABLE strokes earlier, and expedite that patient to a hospital that has the facilities to provide that treatment.

Consider an example where perhaps a patient is taken to a hospital that does not provide these treatments who could instead be identified sooner and just taken directly to the best place. In Sydney, as a general rule any patient who presents with 'stroke like' symptoms within 4-6 hours will be taken (by ambulance) to one of the big 5 or 6 hospital that do currently do this. So another consideration would be 'does the time taken to acquire the image in an ambulance actuallly change the destination', or furthermore, does it change the 'time to treatment'? Personally, I would argue that in a metropolitan area this would not be the case. The next step to that line of thought would be 'what about regional and rural?'. For example an area like Lithgow or semi urban. This WOULD make a difference (if the tech and time to acquisition was proven non inferior).

I am still steering well wide of this from an investment point of view, but to answer all the above questions + the nuance and all the other things I havn't considered I would say would take a minimum of 5-8 years. Trials, phase 1, 2 + 3 including data saturation and proving benefits against conventional CT..... Any doctor in this chat can attest to how freaking fast a CT is these days, at least in the ones I have been involved in from my Paramedic days where we would call ahead and would transfer from the ambulance bed to the CT scanner, hit the button and the radiologist would give a verbal report on 'clot vs bleed' on the spot. Pretty cool, also pretty hard to disrupt.

something to consider- having acces to rapid portable scans to aid stroke diagnosis seems like an amazing tool to have at our disposal. However it is worth knowing that the treatment which rapid scans enables to occur, stroke thrombolysis, is yet to be proven to work! (A controversial statement which currently induces rapturous debate between neurologists and emergency physicians) It is a potentially life threatening treatment for a non life threatening, but function threatening illness.

emergency clot retrieval- an alternative treatment to thrombolysis- requires a huge level of expertise and is currently only offered in a few large tertiary centres in australia and around the world

the above arguement has nothing to do directly with EM visions technology development. But an important consideration in the area in which they intend to operate. I dont really have any thoughts on current valuation and i may be completely overthinking things

Hi all, first ever straw since joining as Premium member last week. Overwhelmed as a newbie with the expertise here!

Was totally engaged in the EMV session this morning. It was my first intro to the company but I have a bit of affinity for new technology companies across industries, so was able to follow and see the opportunity. Post the meeting, and following a quick review of the straws here, I opened a small starting position in EMV, in my SMSF portfolio, as well as my Strawman portfolio to "get into it".

Here are my notes from the meeting and throughts thereof. Likely to be mistakes as I went off memory, but this was what drove my investment decision.

KEY TAKEAWAYS FROM 21 FEB 2023 ZOOM SESSION

- Development and commercialisation of non-invasive, portable brain scanner device to provide rapid assessment of (1) stroke presence (2) type of stroke

- Provides opportunity for significantly earlier insights on the presence of stroke, enabling early intervention to improve patient outcomes, especially for situations away from medical facilities - stroke victims need to be treated within the “golden hour” to increase survivability

- Portability and speed to scan are key benefits - current technology of MRI/CT Scans involve radiation, needs dedicated facilities, requires patient to be moved, scans take hours to return vs EMV’s portable device that can be wheeled to patient, does not require patient movement, involves no radiation hence no need for dedicated facilities, will provide result in 5 mins or less - game changer for early diagnosis and hence early intervention

- Technology has a lot of IP protection around it

- Development and clinical trials are going to company’s plan - long way to go, but is marching at the expected pace - key milestone of 1st Gen multi-site clinical site has commenced

- $335b TAM - hospitals and mobile ambulances/planes

- Similar to NAN, has an ongoing consumable component for potential recurring revenue

- Has superior technology to competitors who have taken 2 general approaches (1) slimmed down MRI capability - still involves radiation (2) scans are taken of brain, but cannot tell type of stroke

- Less superior technologies have FDA approval, auguring well for EMV’s portable brain scanner, which has far better scan outcomes

- Management team is mostly ex-NAN - have solid experience in developing and commercialisation leading edge medical technology

- Strong management alignment - own ~20% of stock

- Backed by various non-dilutive grants and funding, taking pressure off shareholder funding - $15.5m at 31 Dec 22, $9.9m funding remaining

- Strong collaboration with Australian Stroke Alliance, RFDS etc - likely to end up being customers, so future customers are helping mature the technology

- Manufacturing facilities have been identified in SYD, capable of scale up - plan is to keep manufacturing team with the R&D team to enable rapid introduction of continuous improvements into the manufacturing cycle

- Cash reserves $9.6m in Dec 2022.

INVESTMENT THESIS

- Significant patient outcome benefit which far justifies the capital cost

- Significant, untapped TAM - first to market with portable scanning technology

- Technology IP moat

- Management Team alignment to company

- Significant management experience in developing and commercialisation of medical technology

- Solid non-dilutive funding model

- Reasonable entry level at $1.495 as (1) well off highs of ~$4.00 in late 2020 (2) well off 52 week high of $2.70 (3) striking distance of 52 week low of $1.23

RISKS

- Issues arise during clinical trials - delays approval or causes complete change in direction

- Mindset of the regulatory authorities is still unclear - need data points to be able to fine-tune plan for regulatory approval

- Cash flow issues if regulatory approval is delayed - delayed funding, shareholder capital raising risk

- Rival technology improves and poses a significantly more direct threat than today

- Loss of key R&D personnel, impacting journey to commercialisation

- Still 1-2 years out to earning revenue, at least

An encouraging start to EMVision's year long clinical trial of their brain scanning device.

EMV-21Feb2023-Clinicaltrialprogress.pdf

Of course, it's very common for things to fail in the final stages when it comes to clinical trials (or at least not be as good as expected). So it's not something to get too excited over, in and of itself.

Still, nice to hear things are off to a positive start.

Will no doubt get a bit more detail from Scott when we meet with him later today.

Came across Openwater in a business insider article

Mary Lou Jepsen, the CEO of Openwater.

Picked by: Jeff Huber, a cofounder and general partner at Triatomic Capital (Huber sits on Openwater's board but is not an active investor in the company)

What it does: The San Francisco startup is working to improve imaging in medicine.

Funding raised: $40 million, PitchBook said

Why it's poised to take off in the next year: Openwater was founded by CEO Mary Lou Jepsen, a former Facebook and Google executive who helped design the Oculus. While Openwater has been around for six years, Huber said it's poised to take off as it expects to publish its first use case in a medical journal within the next 12 months. The startup has developed imaging technology that can detect strokes faster, which could help improve patient outcomes.

The device — a wearable electronic headset — could potentially be used in ambulances to help first responders figure out if someone is having a stroke caused by a blocked artery or uncontrolled bleeding. The two types of stroke have similar symptoms but are treated differently. Openwater's approach could bring MRI-like imaging directly into ambulances at a fraction of the traditional cost. "The implications for global health and affordability and accessibility are huge," Huber said.

EMVision is in a trading halt pending an announcement in response to a Government media release:

I believe this is the media release they are referring to:

Obviously, the Government didn't give them a heads up before the announcement, but I suppose they are more focused on getting out the message ahead of the election :)

Anyway, seems like it's good -- albeit not Earth shattering -- news

Emvision just sent me a research report from MST Access. You can read it here:

MST Access - EMV Update - 13Apr22.pdf

Note, this research report was commissioned, so it's no surprise it gives an extremely bullish valuation. While the current market price of EMV is $2.06, MST believe shares are worth $5.52.

Although they provide some forecasts, there's no information on how the valuation was derived. EG. They see the business as loss making out to FY24 and indeed, assume a market cap that is only slightly above the current level at that point.

Personally, i'm extremely sceptical of paid for research -- the result is ALWAYS going to be favourable. (I bet if i paid MST to value the local corner shop they would say it's worth $10m!!)

Anyway, thought i'd share it here anyway. You'll also see a link in the report to a video EMVision has done (here).

I have a very small position, mainly as a watching brief. I like the tech and think it has good potential. But it's still quite risky and will take several years before it starts to play out.

EMVision looks optimstically valued to me. Here's my valuation after the site visit @Strawman arranged last week. But I acknowledge that with a pre-revenue business, it all comes down to assumptions and perceived likelihood of them achieving commercial success. So I put together a valuation for a base case if they succeed, but then adjust that down given the majority of companies at a similar life stage won't succeed.

1. Guide for sale per unit US$150k (they have stated this several times)

2. Consumables per unit per year: US$50k (based on some insights they gave us at site visit)

3. Length of life per unit: 5 years (they have stated this several times)

4. Avg rev per unit per year (capital and consumables): (US$150k + 5 x US$50k)/5 =US$80k (and this is close to what they suggested at the site visit they might be looking to charge for a subscription/service model as an alternative to a capital purchase model)

5. Addressable global market: 20,000 units (they have said in a couple of different forums there are about 10,000 potential sites in the US, so doubling that for the rest of the world)

6. Penetration: they would be doing very well to get 10% = 2,000 units in 10 years times

7. Rev per year in 10 years time = 2000 units x US$80k per year = US$160m/yr

8. Net income: 10% margin (roughly what Nanosonics has achieved in recent years) = US$16m/yr

9. PE: 25 (at penetration of 10% they would be doing well to be growing at 15%, so a PE of 25 seems reasonable) = market cap of US$400m in 10 years

10. Additional capital raising over next 10 years: 20% (they will almost certainly need more money before they become self-sustaining and acknowledged as much at the site visit, plus likely options vesting if they succeed) = US$400m/1.2 = US$333m market cap based on current outstanding shares

11. Discounting 10% per year across 10 years gives current market cap of US$128m today

12. Convert to A$ = $170m valuation IF they succeed

13. Adjusting down given majority of similar businesses won't succeed: $170m x 0.8 (assumes about 30% chance of achieving or exceeding the above level of success) = A$136m risk-adjusted valuation

14. Divided by 77.3m shares on issue = $1.76 per share

Big picture, I think there's a lot of optimism already baked into the current price. Not a bargain and not enough room for error in my view. But of course, if you have a different view on some the above assumptions, I can see how someone can come up with a vastly different valuation.

A brief overview of EMVision ahead of our chat with the co-founder this Thursday, Scott Kirkland (a substantial shareholder with a 5% interest in the business).

The business is attempting to develop and commercialise a portable brain imaging device to diagnose and monitor strokes. This is traditionally done using CT and MRI scanning, which remains the gold standard, but are very large, expensive and limited in availability.

The EMVision device (below) has been in development for around ten years, with the work being pioneered at the the University of Queensland. It has the benefits of being very low radiation (less than an iPhone), portable (comparable to an ultrasound device, and the 2nd generation device can actually be installed in an ambulance) and fast (can render images in 30 seconds). If you know anyone who has had a stroke, you'll know that early detection and treatment is critical -- the so-called "golden hour".

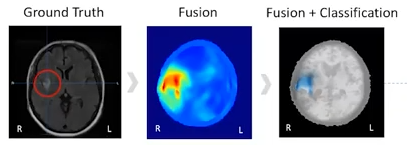

A recent trial was conducted, comparing scan results with MRI images. As can be seen below, the EMVision scans (middle and right) aligned exceptionally well with the MRI standard, and are also able to distinguish between the two types of stroke (clot or bleed)

There's a broader trial due to start this year, and the company has already engaged with the FDA's breakthrough technology program, as well as having early discussions with potential manufacturers and distributors.

One interesting tidbit i learned was that the company has so far met all of the milestones it has presented to the market. Followers of this industry would know that this is pretty rare.

The market is, of course, massive, and as far as I can tell there's no comparable device in development (although this is something to check in our meeting).

The CEO, Dr Ron Weinberger, is a former Executive Director and CEO of Nanosonics (ASX:NAN) where he helped develop and successfully launch their Trophon disinfection device. He holds around 1.9m shares. He gives a good overview of the business at an ASX presentation last year (see here)

As with Nanosonics, the company is looking to deliver the device on both a capital sales and subscription basis. The former of which also has a (very high margin) consumables component (a cap for the patients head I believe). There will also be servicing and training revenues. The device is expected to be priced at around $150k on the capital sales model. For comparison, an MRI machine can cost upwards of US$1.2m (based on a quick google search -- any medicos let me know if that's not correct)

The company listed in late 2018 and has yet to generate any sales revenue (although has other income of around $1.8m from grants and R&D incentives etc). Last year it had about $10m in costs and currently has around $10m in cash at hand.

All told, this is a very early stage company that is likely at least a couple years away from a successful commercialisation. Given costs and the cash balance, i'd expect at least a few capital raisings ahead. It will almost certainly be extremely volatile.

That being said, the technology is progressing well with some very encouraging results to date. The market opportunity is massive and the business is led by a team of experienced players with a lot of past success in this space. At a current market valuation of $192m, and given it's stage of development, it's probably comparable to Nanosonics in (roughly) 2010.

As was seen there, a successful commercialisation led to a 10x return for shareholders from that point over the following decade. BUT, as we've also seen plenty of times before, the path to commercialisation is fraught with difficulty and companies can bleed huge amounts of cash along the way...

If you have any questions you'd like me to put to Scott, you can do so here

Personally, i'll be looking to get a sense of the expected cash burn, timelines for regulatory approval, milestones for product build and distribution partnerships.

Ice cold water bear case:

The headlines on this do look good I will give it that, its a headline grabbing breakthrough if it was to work and I am certainly not saying that it wont, its just at least 5-10 years minimum away.

I work for NSW Ambulance and study medicine, currently NSWA is in discussion with another company called medfield who have developed a similar device, they might even be collaborating I am not sure but just wanted to add context. https://www.medfielddiagnostics.com/products/.. Look at the strokefinder product.

Discussions are between NSWA and a European Ambulance service to run pilot study for efficacy. If NSWA is chosen it would be run in Newcastle NSW and this is where my context begins. As Chagsy has said, most Paramedics would not feel comfortable making these sorts of decisions, (specifically because there is a long term 'risk off' attitide by both clinical and management staff'). Extending from Chagsy comments about number needed to treat. Consider how many strokes are required to be identified and run through the trial when it is only operating in Newcastle with Paramedics involved feeling skeptical and out of depth.

From a simple investment thesis approach the problem is definitly there, however I dont see this as the solution. If there was telehealth involvement of medical radiology experts looking at the same scans (this might be in the plans im not sure) then it has more of a chance but I would be steering clear.

Hi again General,

Thanks for the update regarding 2nd generation scanner and revised strategy.

I hope you dont mind me adding some more cold water. Sorry!

Some years ago there was much excitement regarding thrombolysis (clot busting drugs) for ischaemic strokes. There was clear evidence of benefit for using thrombolytics in heart attacks: the thrombolytics were given in through a drip, dissolved the clot that was blocking the blood and oxygen flow getting to a part of the heart. The oxygen starved section of heart (and patient) got better. A small percentage of patients had life-threatening bleeds into their guts or brain for example. A number of them died, but mostly the risk of giving the drug and stopping the patient dying from a heart attack significantly outweighed the risk of dying from a heart attack. Studies were done proving this, with 10s of thousands of patients.

here is a link showing the numbers of pooled results from multiple studeis showing that the "number needed to treat" (NNT) to cause a good outcome, vastly outweighs the NNT to cause harm.

For years, in medicine we have argued about the risk:benefit ratio for thrombolysis in acute ischaemic CVA. The studies done were never of the same size (couple of hundred) which reduces the power and statistical validity. A bunch got stopped halfway through as they caused more harm than good - never a good look. Most of the push to use thrombolytics came from the AHA (American Heart Association) and people questioned what they were doing poking their oar into a neurolgocial condition. The spotlight beam sharpened when it was pointed out that their (the AHA) major financial sponsor was the manufacturer of tPA (which just happened to be the drug used for thrombolysis). And so it went on. A new study would come out and the talking heads would be dissecting the numbers to validate their underlying biases.

It is likely that, on balance, thrombolysis is helpful in a carefully selected group of patients who are younger, present earlier, have just the right size of stroke and no contra-indications:

That is the premise for this product: identify these patients in the driveway, prove they have an ischaemic stroke and give them the brain saving thrombolysis.

Only problem is that we dont give thrombolysis anymore. We do clot retrieval. The patient is taken to a stroke hospital to have the catheter thingy I talked about earlier, fed up into the artery supplying the brain to suck out the clot. NO thrombolysis.

There is a case for something called "bridging thrombolysis": if a patient accidentally goes to a hospital without clot retrieval, gets a scan proving the "goldilocks size" and time of Stroke, have it discussed with a stroke team, get accepted for transfer for clot retrieval and have no contra-indications for thrombolysis; then thrombolysis is useful - probably. (I have done it once in the last 15 years of working as an Emergency Physician).

So, to apply these thoughts to pre-hospital thrombolysis:

patient gets loaded into back of ambulance with a possible stroke

establish that the stroke is within the time window for treatment (longer time = greater chance of bleeding and death or bad outcome if given thrombolysis)

establish the stroke is of goldilocks size (usually performed by a stroke physician or at a push an Emergency physician with an interest). But in this secenario, by an ambulance officer - I can't see them being overly keen to take that responsibility!

put the scanner on the patient and run the scan

get the result and have a scan with sufficient accuracy that it has a zero chance of misinterpreting the ischaemic stroke as a bleed (or you kill the patient)

Adminster the thrombolytic the drug, and drive off to the stroke unit.

All that has to happen faultlessly in one cohort of patients.

Then you have to compare that cohort of patients to the current standard of care and prove that patients will do better with our new fancy scanner + driveway thrombolysis option. You would need to run a trial with 100s and likely 1000s of patients to demonstrate an improvement in outcome. This will take many years to recruit into and run, and cost millions of dollars. There is a very real chance of it causing more harm than good (my guess is that this would indeed be the case).

And finally, as per previous, you would then need to demonstrate a cost:benefit case to convince health providers that this is worth the dollar spend, as opposed to every other good idea and interest group out there clamouring for funding.

Jeez that went for a bit longer than i intended, but I hope I have demonstrated just how difficult it is to make any money with a new "medical breakthrough". I lost money hand over fist when I started out investing, mostly on just such companies. I am not going back there again. High ROE, high margin, low cost of capital, no/low debt, structural tailwinds, predominantly FCF positive and asymmetric risk companies for me from now on.

All the best

C

Totally agree with @Chagsy, largely why I have avoided this one. Its also a fairly competitve space albeit with different approaches. IMO many investors are likely backing the man (ex NAN) rather than focusing too much on the detail.

It's great to see an evolving medtech company on the ASX. This is an amazing bit of technology, however.....

They are a long, long way away from demonstrating a use case, and even further away from demonstrating an adequate accuracy to guide management, and yet a few steps further away from demonstrating an improvement in clinical outcome and then a step or two to demonstrate a cost:benefit advantage over current managment.

They are targeting acute stroke as their clinical indication for use. There are two types of stroke, a bleed (haemorrhagic) and a blockage in an artery (ischaemic).

The treatments for each are quite different. Specifically, to treat ischaemic strokes drugs that thin the blood are given which will make a haemorrhagic stroke worse, potentially with a fatal outcome. In some instances a clot busting drug can be given (like for heart attacks). This is not a low risk proposition even if given for ischaemic strokes. If given for the wrong type of stroke ie a haemorrhage stroke, one can safely assume the patient will die. However, clot using drugs are nowadays used less and less as acute ischaemic strokes are currently managed with something clot retrieval. Here a catheter is inserted into the blood vessels in the brain and the offending blood sucked out, thus restoring blood and oxygen flow and limiting the damage to the brain.

Their most recent study on data sets at the PA hospital in Brizzy, shows the ability to differentiate between a haemorrhagic and ischaemic stroke of 93.3%. Which doesnt sound bad, but means that if we were to use this product in its current set up we could kill up to 6.5% of patients for, as yet, no demonstrated advantage (were clot busting drugs used, or huge resource overuse if clot retrieval used). There is a long way to go for this use case, just to prove equivalence in accuracy. You would then need to demonstrate that the time saved by using a bedside scan as opposed to putting the patient through a conventional scanning technique which is all of 20m away in most hospitals, translates into a meaningful improvement in mortality and morbidity (death and deficit) - I have no confidence that this could be achieved.

That is the use case for this scanner within the emergency department.

It may have a better use case in the pre-hospital setting. The theory being that potential stroke patient can be identified at the scene and then transported to an acute stroke unit facility that can offer clot retrieval. Currently, patients that have symptoms of a an acute stroke are transferred to stroke units. It doesnt matter if they could be an ischaemic or haemorrhagic stroke. Given that 87% are ischaemic strokes, the number of haemorrhagic strokes transported unnecessarily to a clot retrieval facility is low. Applying the converse situation, what happens to the ischaemic stroke patient that is not transported to the correct facility ? They have a potentially far worse outcome that was entirely preventable under the old system. Medico-legal pay-outs related to this scenario would be punitive.

Like any other investment thesis, I would start with "what problem does this solve" and "how well does it do it".

Currently my feeling is "I dont know" and "not very well".

Now, it may be that with further training of the data sets this scanner becomes very accurate. Even then, the cost of trials to demonstrate its safety and efficacy will be prohibitive. The medical approval process is incredibly slow and expensive and has a very poor success rate.