Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

I decided over the weekend to fully exit my EMV position IRL and in SM. Have exited EMV in SM in full and 40% of my IRL holdings today. I expect to sell down the rest of the 60% in the coming days.

Portfolio Context

Cash proceeds will likely be used to top up my 3 US medical companies - AVH, NAN and BOT, all of which have established FDA-approved products, large TAMS and good opportunity ahead. These appear to be more optimal use of the capital currently invested in EMV.

At ~1.72, EMV was a 1.74% position in my RL portfolio. Exiting at 1.74 netted a ~15% gain over 2 years - not flash but not too shabby either.

RATIONALE FOR EXIT

- The BOT and AVH experience has demonstrated the huge challenges in any medical company introducing a new FDA-approved product into the US market.

- EMV is doing very well heading towards FDA approval for both bedside Emu and the portable version of Emu and given current trajectory and progress, FDA approval for both is imminent in the next 12-18 months

- The EMV price will continue to move sideways until FDA approval is obtained as there really is no catalyst to boost the price - it has been drifting downwards steadily

- But post FDA-approval, EMV will go through the same challenges with launching the commercial sales of Emu, and will likely go through the same challenges as AVH and BOT is currently undergoing to get commercial traction

- EMV management is mostly NAN-experienced and will no doubt bring to bear the experience of commercialising Trophon to the commercialising of Emu, but both BOT and AVH have demonstrated that having prior experience in the commercialisation process does not guarantee a smooth ride either.

- Would rather not have to go through the wild price ride again

- The entry into EMV has been good as it was skin in the game to build knowledge on (1) how medical devices go through FDA approval process and (2) the challenges of pre-FDA approval commercials

Discl: Held IRL, but should fully exit in the coming days

Discl: Held IRL and in SM

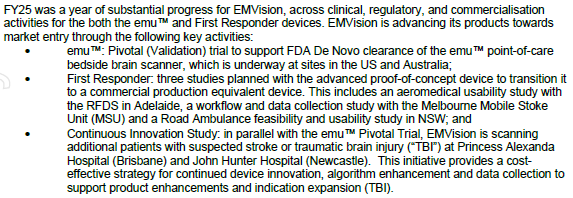

SUMMARY

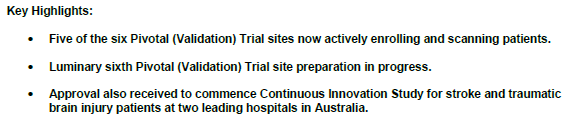

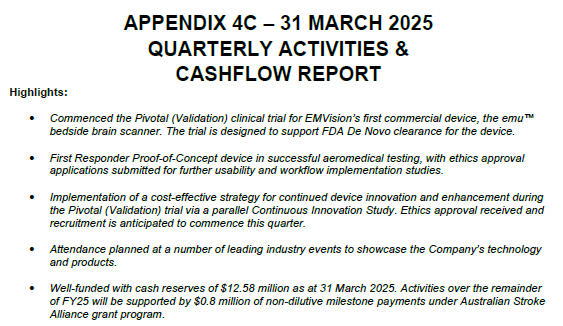

- Progressing nicely on all trial fronts - going as best and as fast as can be it would seem

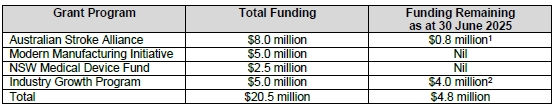

- The key thing I am watching is funding: 30 June 25 cash balance is $10.5m, with $4.8m of grant funding to come + FY25 R&D Tax Incentive of ~$2.0m, so total funding of ~$17.3m is available - at $3.0m operational burn, this is 5.8 quarters of funding, which should take EMV to sometime 2QFY2027 - that feels reasonable, particularly given how relentless EMV has and will continue to be with the grant opportunities

OPERATIONAL UPDATE

Nothing exciting or new about the EMV trading update as all the news has already been announced prior - this is a good summary of where things are at:

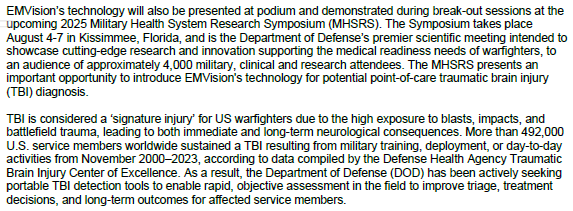

This was interesting as it provides context to understanding the US Defence market for Portable Field Scanners which was mentioned in an earlier announcement.

FINANCIALS

- Excluding the $0.98m 1st payment from the $5.0m Industry Growth Program Grant announced in June, EMV burned $3.05m this quarter

- Only change worth noting was that R&D expenses fell to $0.8m, a sharp drop from the previous 2 quarter’s spend of $1.2m each in 2Q and 3Q, respectively. This is consistent with Scott saying that R&D expenses will fall as they focus on trials.

Summary

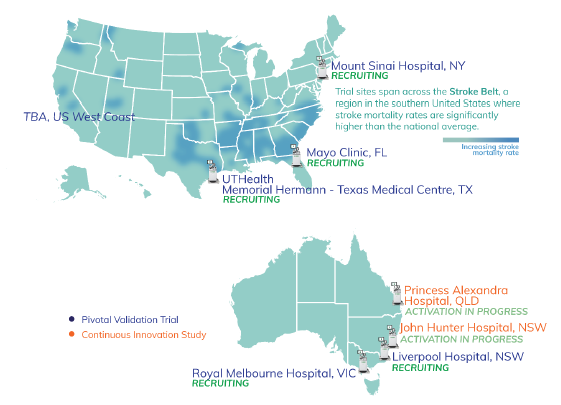

- Pivotal (Validation) Trial is moving steadily - all sites are luminary, high volume comprehensive stroke centres

- Continuous Innovation Trail is good front end loading for the indication expansion into traumatic brain injury

- All are occurring at major stroke centres - nice map to show where trials are occurring, which in the US, are also likely to be where commercial activities will be focused on per, as Scott indicated in the SM interview

Continuous Innovation Study

In parallel to the Pivotal Trial, EMV is implementing a cost-effective strategy for continued device innovation, algorithm enhancement and data to support indication expansion for traumatic brain injury

Ethics approval received to commence scanning patients with suspected stroke or traumatic brain injury at Princess Alexandra Hospital BNE and John Hunter Hospital NTL - both sites are high volume Comprehensive Stroke and Level 1 Trauma Centres.

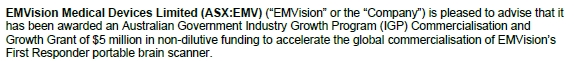

Nice award! To put this in perspective:

- At 31 Mar 2025, EMV had available funding of $12.6m, so this increases available funding to $17.6m, with the $5m to be progressively dispensed quarterly

- Actual cash outflow, excluding Grants and Incentives, in FY2025 to 31 Mar 2025 was $8.8m

- There thus appears to be funding for roughly 18M, which should get EMV past FDA approval, I suspect

I still expect a capital raise but the grant removes the immediate need for that, pushing the timing of any raise nearer to commercial launch. Am very OK with that prospect as EMV has been very careful in its funding approach.

Next week’s SM chat with Scott is timely to get a better sense of how it is thinking about funding.

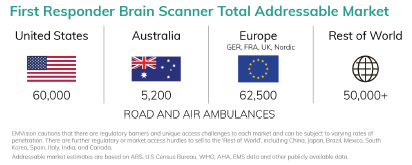

On a separate note, this was a good summary of the TAM for the First Responder Unit. I don’t think its new, but its the first time I have taken notice of it!

Discl: Held IRL and in SM

Nothing newsworthy as all of the business updates have been previously announced

- A good cash flow quarter as $2.1m FY24 R&D Tax Rebate was received this quarter which reduced the cash outflow to a low $1.07m

- Cash burn would have been $3.2m excluding the Tax Rebate, about the same as 2QFY25, so no concerns

- The $12.6m cash on hand + $0.8m Stroke Alliance Grant, $13.4m will last ~13M ie Mar-April 2026, at the current burn rate

Announcement says “remains well funded” but there has been no announcement of any funding plans for the latter part of CY2026 thus far. Management has a good track record of proactively paving the way forward, so I do expect news on this front should be forthcoming soon. Would be significantly more comfortable once this funding issue is decisively sorted.

Both a capital raise, particularly as FDA approval for emu becomes imminent would be a distinct possibility, or short term debt for 1-2 years to provide funding coverage for the commercialisation startup, would make sense.

Discl: Held IRL and in SM

In these turbulent times, happy to take whatever positive news is on offer by any of my companies! 2 positive things out of this:

- emu Pivotal Trials continue to chug along nicely

- It absolutely can't hurt, from the perspectives of (1) the product (2) company reputation and (2) trial integrity, when one of your US trial sites is THE Mayo Clinic ..

Discl: Held IRL and in SM

Another on-track tick obtained to keep the trials moving forward. Things are happening quickly, and very much on the right track!

Discl: Held IRL and in SM

SUMMARY

- No operational concerns - progress on both emu Bedside and emu First Responder is marching along nicely

- As external funding has mostly ended, EMV now only has about 4 quarters of funding available vs expectations of market entry for emu Bedside Scanner during CY2026

- Clearly feels insufficient, is a risk, and will need to be addressed soon - share price will remain subdued until this is clearly resolved.

Discl: Held IRL and in SM

Operational Highlights

- Neurodiagnostic algorithms deliver excellent results in EMView study - previously reported in Nov 2024, so not new news

- Validation (pivotal) trial preparations well progressed after positive FDA engagement, commencement of the validation (pivotal) trial fast approaching

- Trial of up to 300 suspected stroke patients is expected, with a primary endpoint of “Blood or not” sensitivity and specificity.

- 6 leading clinical sites - 4 in US, 2 in Australia, anticipated enrolment of 6-12 months

- Ethics approval being pursued in both the US and Australia

- Assuming successful trial, market entry is projected to be during CY2026

3. First Responder POC Brain Scanner

- 2 additional First Responder devices have been fabricated - additional devices are targeted for deployment in a pre-hospital feasibility study scheduled to commence this quarter

- Healthy human volunteer study is underway

- Up to 30 participants are expected to be enrolled across aeromedical (RFDS) and road ambulance study arms

Financials

- 2QFY25 Net Operating cash outflows were $3.27m - largest quarterly outflow in the past 2.5 years - driven by R&D expenses ($1.18m) and the lack of funding inflows

- R&D costs increased in the current quarter due to the purchase of components for devices to be used in the upcoming validation trial

- Proforma cash reserves of $15.78m, including $2.12m FY24 R&D tax rebate received after quarter end

- EMV’s activities over the remainder of FY25 will be supported by further non-dilutive funding from the ASA grant program - $0.8m expected

- EMV continues to actively pursue non-dilutive funding opportunities to advance and accelerate other activities, including the First Responder device.

Not unexpected - this was 1 of 2 sources of funding that EMV flagged for FY2025. But good to have it locked in regardless.

Probably adds a quarter of funding more to the 9.7 quarters of funding as of end-Sep 2024.

Discl: Held IRL and in SM

There were some interesting slides in the EMV FY2024 slide pack. No new news as EMV has communicated clearly and regularly to the market but there were a few background/context slides which was interesting to note.

Discl: Held IRL and in SM

The Stroke Indication was always front-and-centre

Seeing “Traumatic Brain Injury” as a second indication for the first time since I started deep-diving EMV

Also seeing the introduction of “Time Sensitive Medical Emergencies” for the first time - makes good sense and probably provides an indication of EMV’s direction and focus areas in the longer term

The step improvement in size and mobility illustrates how game changing EMV’s products will be in improving the diagnosis and treatment options

Don’t recall seeing a TAM slide like this before, so this was really useful

No target sale price for First Responder yet, so size of the TAM is unclear, but the significantly higher number of potential units surprised me somewhat

Nice summary of the pre-validation clinical results - that is seriously impressive accuracy

Nice summary of what’s ahead

End CY2025 Market Entry target is key from a funding standpoint - if that holds, and assuming no additional funding is obtained, EMV should have consumed ~55% of available cash at 30 Sep 2024 to get to that point (5 quarters vs ~9.4 quarters available funding)

First Responder timeline

Amen, but I would have liked to have seen a line or 2 to confirm “we have available cash to see us through to market entry”!

NEURODIAGNOSTIC ALGORITHMS DELIVER EXCELLENT RESULTS IN EMVIEW STUDY

My medical expertise goes as far as applying a band aid on a small cut wound, but this looked like good news in the stroke detection capabilities of Emu.

The absolute Sensitivity (correct diagnosis)/Specificity (negative diagnosis) looked really good in absolute terms in the highlights. What blew me away though was how good those results are relative to the current Gold standard CT scans, in absolute terms AND given the size and mobility of the device.

Entering the Validation Trial is another milestone which adds to the good EMV track record of defining and meeting milestones.

I do have an emerging concern about cash reserves though from the last Appendix 4C.

- Cash balance last Quarter was $16.8m, and secured funding from various agencies ends this current Quarter, with $0.8m due, with the reserves funding ~9.8 quarters.

- Excluding receipts from Govt Grants/Other Funding, EMV burns between $2.3m and $3.5m per quarter in the last 5 quarters.

- The $4m needed to fund the validation trial should be completely manageable, as it will already have been planned for and will likely be BAU, not incremental cost.

But without additional funding clearly lined up to replace the end of the existing formal funding, things do start to feel tighter ... not a huge cause of concern yet, but one which I am watching very closely.

Held IRL and in SM

Back to a “normal” Quarter after the spike in spend in R&D Expenses in 4QFY2024 - combination of R&D expenses and Staff Costs have reverted back to normal quarterly levels.

At the current cash burn rate, there is funding for 9.7 quarters or 2 years and a bit.

Keeping a close eye on the funding situation as the ASA funding is down to the last $0.8m, expected in 2QFY25, and the FY24 R&D Tax Incentive claim. Not an immediate cause of concern given that FDA approval is going to plan, but need to keep a closer watch on this from hereon.

Disc: Held IRL and in SM

------

OPERATIONAL HIGHLIGHTS SUMMARY

‘EMView’ multi-centre pre-validation trial recruitment complete, enrolling over 300 participants. Stage 3 trial results anticipated in November.

277 suspected stroke patients provided valuable data for EMV’s “blood or not” and “ischemia or not” AI algorithms

EMVision continues validation trial preparations after positive FDA engagement.

The study design was confirmed as a multi-centre, prospective, consecutive, paired diagnosis, diagnostic performance study that is anticipated to enrol up to 300 suspected stroke patients at a minimum 5 stroke centres including a minimum 3 based in the United States.

Transformative ultra-light weight First Responder Proof-of-Concept brain scanner device unveiled. Preparations for road and air study well advanced.

- Ultra-light weight (<12kgs), non-ionising, non-invasive device that can be easily operated by trained healthcare professionals and is designed for cost-effectiveness, to enable rapid stroke and stroke sub-type diagnosis at the point-of-care.

- Represents an opportunity to fundamentally transform stroke and thereafter traumatic brain injury (TBI) outcomes, for all patients, regardless of their location.

- Intended to enable much earlier diagnosis and therefore much earlier triage, transfer or treatment decisions, which in acute stroke and TBI is proven to lead to improved patient outcomes.

- Delivery of the First Responder PoC device satisfied the "Ambulance Device Fabrication" milestone under the Company's Project Agreement with the Australian Stroke Alliance (ASA), which is funded by the Commonwealth of Australia's Medical Research Future Fund (MRFF), resulting in a $600,000 non-dilutive milestone payment during the quarter.

- Comparative initial bench tests have been conducted with the First Responder PoC device and emu™ bedside scanners.

- Pleasingly, the First Responder PoC device is demonstrating at a minimum equivalent sensing performance in these initial tests

Well-funded with cash reserves of $16.85 million. Activities over the next few months will be supported by further non-dilutive funding from the Company’s FY24 R&D Tax Incentive claim, currently being finalised, and the Australian Stroke Alliance grant program.

$1.72m cash outflow within normal quarterly cash outflow ranges

9.78 quarters of funding available

EMVision’s activities over the next few months will be supported by further non-dilutive funding from its FY24 R&D Tax Incentive claim, currently being finalised, and the ASA grant program. The final ASA milestone payments are due on achievement of telemedicine and road/air integration activities ($400,000) and commencement of pilot studies of the first responder device targeted for first quarter CY 2025 ($400,000).

EMV announced the following milestones today:

- reached its recruitment target for Stage 3 of its multi-site clinical trial of 30 haemorrhagic stroke patients, rapid achievement of this target is attributed to the continued positive engagement and goodwill at the investigational sites as well as the introduction of several recruitment accelerating initiatives under Stage 3

- Company’s FDA pre-submission package has been delivered and is under FDA review prior to a consultation meeting in the coming months

- In parallel, activities to initiate the Validation clinical trial are well under way, including protocol finalisation, CRO appointment and engagement of luminary investigational sites.

Continues the steady progress achieved thus far!

Discl: Held IRL and in SM

Interim Stage 2 Analysis Confirms Hyperacute and Acute Ischaemic Stroke Detection Capabilities

Stage 2 data confirms positive AI algorithm performance to help answer the “clot or not” question. This comes off the back of earlier positive news of the AI detecting "blood or not".

Key clinical question of “ischaemia or not” (“clot or not”) - current non-contrast computed tomography NCCT scans shows a limited sensitivity to detecting acute ischaemia

Other tests are required for patients with suspected ischemic stroke to confirm diagnosis - advanced imaging modalities such as CT Angiogram, CT Perfusion or MRI are often used to confirm the presence of ischaemia (‘clot or not’) and determine a patient’s eligibility for thrombectomy (clot retrieval).

Depending on the neuro-diagnosis, and treatment capabilities of the hospital to perform urgent intervention, a time critical decision is whether to transfer the patient to a comprehensive stroke centre, or not.

Continues the good progress and news on Stage 2 Trials.

Discl: Held IRL and SM

SUMMARY

- EMV has been making good progress on all fronts - trials, pre-FDA submission, First Responder System proof-of-concept

- Remains well funded following Keysight Investment with $21.35m cash reserves, $2.6m remaining grant funding ontop of this

- No concerns - it feels like there is good project cadence on the several fronts that EMV is focused on

Summary of Highlights - Most Already Announced Previously

- Strategic $15.28m investment from Keysight Technologies

- Stage 2 clinical trial insights confirm stroke diagnostic and clinical viability

- Time from start of scan data acquisition to removal of the device was 5.5 minutes (range from 4.2 to 14.6 minutes), confirming the emu device seamlessly fits into acute stroke workflows, in time sensitive situations

- Preparations well advanced for a pre-submission meeting with the FDA

- To clarify and confirm the points remaining to finalise the Validation Trial package

- Pre-submission package is well-advanced for near-term submission

- Validation Trial designed will be finalise aligned to the FDA’s expectations to ensure the trial will deliver the clinical data critical to the emu’s De Novo market clearance application

- First Responder System on track

- Progressing well, leading to the near-term assembly of the proof-of-concept unit

- Ethics approval received for healthy human volunteer testing

- $21.35m cash reserves as at 31 Mar 2024 - nothing extraordinary

- $2.65m of funding is remaining from the 3 Grant Programs below

Another positive announcement which the market seems to have liked. While the quantum of the funding release is only $0.6m, it is EMV's continuation of a stellar track record of meeting milestone obligations that is the key positive here.

Discl: Held IRL and in SM

Not much to write home about, a good thing! Things look like they are progressing nicely to plan on all fronts of the trials, algorithm analysis, Gen 2 prototype build and cash reserves. Good to see the showcasing going international and generating interest and leads.

First production unit unveiled and branded as "Emu".

- Reached its recruitment objective of 150 suspected stroke patients for Stage 2 of its pre-validation trial being conducted at three leading stroke centres in Australia

- Stage 2 results anticipated to be reported in Q1 CY2024.

- In parallel, EMVision is preparing for its engagement with the FDA in early 2024 to achieve alignment for EMVision’s validation (sensitivity/specificity confirmation) clinical trial phase. Completion of this phase is anticipated to support the FDA submission for the emu™ product

- Concurrently, EMVision will activate Stage 3 of the trial (pre-validation) as planned, allowing recruitment to continue in the interim at the three sites. This will include up to 30 haemorrhagic patients over the coming months with samples expected to further de-risk and set the validation trial phase up for success.

Good Product Demo video of the point-of-care scanner to get a better sense of what it is and how it is actually used in hospitals. Very exciting to see the product come to life.

Chugging along nicely on the trials plan and FDA engagement is commencing. Quite a bit happening in CY2024!

Discl: Held IRL and on SM

My notes on the 30 min conversation with CEO Scott Kirkland this morning. As the communcation from EMV to the market on its journey have been clear and regular, nothing earth shatteringly new. It was a really good conversation to take a step backwards and look at how the various pieces tie together, the bigger picture of what is coming ahead and evolving management thinking on the revenue model - it does indeed look very positive and promising from all angles.

Discl: Held IRL and on SM

Progress of Trials

- Pre-Validation Trials going well - 150 suspected stroke patients presenting in 3 major stroke treatment hospitals - Liverpool Sydney, Royal Melbourne and Princess Alexandria, generating data for FDA Pre-Validation approval

- EMV scans are obtained immediately after the usual CT scans are done, before treatment commences, then get follow-up scans if patient is admitted - get data on suspect strokes, then data to monitor progress thereafter

- Targeting 150 stroke patients by Q2FY2023 - enrolment of patients into trial study has been relatively straightforward and has been accelerating - not invasive, dedicated nurses to do enrolling and scanning

- Validation trials commence in CY2024

- Engaging FDA in parallel with collected data

- Looking forward to presenting real data in Nov 2023 to the largest Imaging Conference RSNA - in 2019 only had brochures of the device, will now have production models of scanners and scanned data on-site

Path to Commercialisation

- Gen 1 Hospital Mobile Device market entry planned for FY25 - Gen 1 device is a mobile device and has no predicate, so need to prove its efficacy from the ground

- Once approved, Gen 1 will be the predicate device for Gen 2 Mobile Scanners as a lot of the patients that are scanning today are the same patients that will be seen in an ambulance or pre-hospital environment - data from Gen 1 will be applicable, the Gen 2 device will have a different form factor

Funding

- Pre-revenue, non-dilutive funding has been a key part of the EMV strategy - $20m in grants, about $4.4m left

- R&D funding requirement for ongoing trials is modest unlike a Phase 3 pharmaceutical trial - getting a quick scan, payment to access radiological files, not a huge cost

- National Reconstruction Fund, $1.5b earmarked for manufacturing of Australian medical products is positive in terms of funding opportunities, exploring other domestic funding for med tech, manufacturing, follow-on funding for next phases of funding from alliances eg. Australian Stroke Alliance - pursuing these funding opportunities aggressively

Radiation Dose of the Scanners

- The scanners operate on the Electro Magnetic Imaging on the microwave frequency - sending signals similar to what mobile phones transmit for voice and data - “non ionising”

- Passed all independent EMC testing required to get device into study, into hospital sites knowing that it is not going to cause any interference

- Can also have multiple scans as the signals are not in any way harmful to the patient and the operator - any healthcare professional can operate the device

Secret Sauce of the Data

- The EMV devices are a new modality - no data available to acquire to enhance or train the data - the only training sets that are available are the ones that EMV themselves generate

- Real patient scan data models are expensive and time consuming to acquire

- EMV creates a “simulation pipeline” - take an MRI file, segmented into the tissue types, use the model of EMV’s system in the simulation software which very closely matches the real world against a healthy MRI to see how the signals would response to to the healthy head. Then generate different synthetic strokes and see response in the system. Able to generate a lot of simulations in the time to get real data from 150 patients, speeding up verification, development etc.

Competitive Landscape

- Same or similar output of images with classification, localisation from a similar form factor and the ability to produce a quality image, is it a stroke, what type of stroke, where is it in the brain - no competitors for this

- Competitors in mobile brain imaging, sensing, smaller CT’s, new method of ultrasound for the brain - plenty of competitors, mostly to inform that a stroke has occurred and how big, but not much more than that

- R&D of big companies are mostly focused on incremental improvements to existing products - anything bigger and they usually have to go outside to partner/collaborate

Revenue Model

- Direct and Distributor models, likely to be different models for different regions - Aust likely to sell direct, US likely to be a Distributor model to leverage off brand name, established network and credentials of the Distributor, at least in the first 5 years

- US surveys indicate preference for a capital purchase model

- Consumable mix has changed: Gen 1 - $25 per patient per scan for the cap, gel, Gen 2 - $50 per patient per scan

- Service - 8-15% of asset cost per annum, labour and spare parts

- Survey suggests 5 scans per day per device for larger hospitals

- Growth opportunities are to add use cases in the area of traumatic brain injury - 15m strokes per year worldwide but 27m cases of traumatic brain injury requiring treatment - these will add to consumable pool

Positioning of Use of EMV Scanners

- Longer term objective is to get use of the product in different workflows from early to post treatment monitoring, into guidelines, over time

- In Emergence Dept of a large tertiary hospital - have strict stroke protocols to get a CT scan quickly - not trying to replace or introduce an extra scan before a CT but rather for ICU/Stroke Wards, post treatment monitoring

- It is the rural settings where they might not have CT facilities and/or a radiographer to run the CT - definitely see a role for EMV Gen 1 in that ED scenario - speed up transfer decision making, triage, opening door to treatment

- Focus on environments where urgent brain imaging is required, not competing with a CT or MRI - not practical in that environment

Closing Thoughts

- Now in the studies face, recruiting trial patients at a great rate

- Encouraging insights and capability from the technology - will share further insights from the study as it progresses

- Progress on partnership and strategic relationship fronts

- Gen 2 mobile helmet scanner - being fabricated at the moment, advanced prototype available, bench testing and healthy patient testing next quarter, ambulance and road trials next year

- 2 product pipelines running adjacent to each other

Hi all, first ever straw since joining as Premium member last week. Overwhelmed as a newbie with the expertise here!

Was totally engaged in the EMV session this morning. It was my first intro to the company but I have a bit of affinity for new technology companies across industries, so was able to follow and see the opportunity. Post the meeting, and following a quick review of the straws here, I opened a small starting position in EMV, in my SMSF portfolio, as well as my Strawman portfolio to "get into it".

Here are my notes from the meeting and throughts thereof. Likely to be mistakes as I went off memory, but this was what drove my investment decision.

KEY TAKEAWAYS FROM 21 FEB 2023 ZOOM SESSION

- Development and commercialisation of non-invasive, portable brain scanner device to provide rapid assessment of (1) stroke presence (2) type of stroke

- Provides opportunity for significantly earlier insights on the presence of stroke, enabling early intervention to improve patient outcomes, especially for situations away from medical facilities - stroke victims need to be treated within the “golden hour” to increase survivability

- Portability and speed to scan are key benefits - current technology of MRI/CT Scans involve radiation, needs dedicated facilities, requires patient to be moved, scans take hours to return vs EMV’s portable device that can be wheeled to patient, does not require patient movement, involves no radiation hence no need for dedicated facilities, will provide result in 5 mins or less - game changer for early diagnosis and hence early intervention

- Technology has a lot of IP protection around it

- Development and clinical trials are going to company’s plan - long way to go, but is marching at the expected pace - key milestone of 1st Gen multi-site clinical site has commenced

- $335b TAM - hospitals and mobile ambulances/planes

- Similar to NAN, has an ongoing consumable component for potential recurring revenue

- Has superior technology to competitors who have taken 2 general approaches (1) slimmed down MRI capability - still involves radiation (2) scans are taken of brain, but cannot tell type of stroke

- Less superior technologies have FDA approval, auguring well for EMV’s portable brain scanner, which has far better scan outcomes

- Management team is mostly ex-NAN - have solid experience in developing and commercialisation leading edge medical technology

- Strong management alignment - own ~20% of stock

- Backed by various non-dilutive grants and funding, taking pressure off shareholder funding - $15.5m at 31 Dec 22, $9.9m funding remaining

- Strong collaboration with Australian Stroke Alliance, RFDS etc - likely to end up being customers, so future customers are helping mature the technology

- Manufacturing facilities have been identified in SYD, capable of scale up - plan is to keep manufacturing team with the R&D team to enable rapid introduction of continuous improvements into the manufacturing cycle

- Cash reserves $9.6m in Dec 2022.

INVESTMENT THESIS

- Significant patient outcome benefit which far justifies the capital cost

- Significant, untapped TAM - first to market with portable scanning technology

- Technology IP moat

- Management Team alignment to company

- Significant management experience in developing and commercialisation of medical technology

- Solid non-dilutive funding model

- Reasonable entry level at $1.495 as (1) well off highs of ~$4.00 in late 2020 (2) well off 52 week high of $2.70 (3) striking distance of 52 week low of $1.23

RISKS

- Issues arise during clinical trials - delays approval or causes complete change in direction

- Mindset of the regulatory authorities is still unclear - need data points to be able to fine-tune plan for regulatory approval

- Cash flow issues if regulatory approval is delayed - delayed funding, shareholder capital raising risk

- Rival technology improves and poses a significantly more direct threat than today

- Loss of key R&D personnel, impacting journey to commercialisation

- Still 1-2 years out to earning revenue, at least

Post a valuation or endorse another member's valuation.