In seeking to replace the large hole in my portfolio ALU had filled as a large cap quality growth company I have picked up some RMD and SHL with a view that I disagreed with bears who drove the price down recently. I am looking at IEL to plug the rest of that hole, but I am still trying to understand and respect the bear position. With over 14% short, I have to accept there is at least a decent amount of smart money saying it is overvalued, a point I fully agreed with 6 months ago, but today it seems more reasonably valued, unless those bears are right and they can smell their winter feed still to come.

So here are the factors that I think are supporting a bear position (no particular order):

· Fem Fatal: Tennealle O’Shannessy, the new CEO has quite an unenviable share market performance record as CEO, having IPO’ed Adore Beauty with it’s 80% share price drop and now 50% plus for IEL. Her move from 10+ years at SEEK to lead a listed fashion retailer was probably an awkward fit, the role at IEL which has a strong SEEK heritage is more aligned with her previous training focus at SEEK, seems a better fit. However, bears may see her as a dark omen, rational or not, it plays into sentiment and can be self-reinforcing enough for bears to make a nice profit on in the short to medium term. Bear’s may also believe she is no good at the job, but the Adore Beauty debacle seems more about the IPO price than operating performance, which was reasonably solid but over hyped at IPO. If her leadership is questionable, then having the former CEO Andrew Barkla (who lead IEL from $670m at IPO to $6.8b valuation at his exit in 7 years) as an NED should provide strong downside protection from something stupid happening.

· Geo-Political: Lets face it, Russia, China, Iran and lets not forget North Korea are good for any bear thesis for just about any company… but an international student business is very exposed to global conflict. IEL did well during Covid considering, with online options, so is well positioned, but a disease is a war everyone in the world has an interest in helping to win, the other kinds provide longer lasting and sometimes permanent division along geographical lines. A real risk, but hard to price and assess.

· Sovereign Risks: Probably the most tangible and quantifiable risk bears can call upon are changes in government policies and unofficial sanctioning hitting sales in certain markets. New and proposed tightening of student work rights and targeting non-genuine students in Australian and the UK as well as Canadian reduced immigration resourcing in India are all headwinds to what have been growing channels that may stagnate or shrink.

· Competition and Fees: IEL has been part of, if not the lead in the commercialisation of education by Universities, leading the growth of a new and untapped industry. Additional competition like the Canadian government allowing 4 new competitors added to a maturing of the industry suggests that previous growth will be hard to replicate. Even the reduced PE of around 30 still anticipates a long and solid growth runway, bears may be betting that runway is shortening and less attractive off what is now a higher base to justify high PE’s. The PE’s of the previous couple of year were “priced to perfection”, so it only takes a small reduction in expectations for a large re-rating, but at what price and PE does the bear case become the one based on unrealistic expectations.

· Other: The bears may know something others don’t or I have simply missed a major risk or issue in play. There are other issues such as a $60m contingent tax liability issue for GST on Indian state taxes which could blow up for instance, costing a lot more or leading to regulatory backlash.

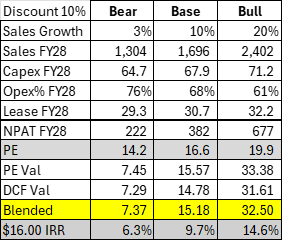

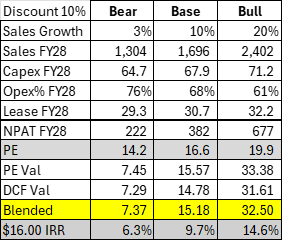

I would like to better understand what is driving the bears, but it may just be a pure valuation assessment that says the previous price around $30 required 20%+ growth rates whereas now we are looking at a more reasonable 10% top line growth (FY25-FY28) which by my calculations has a value closer to $15.

Draft Valuation:

It’s a great business at a much better price, but I am still unsure if it’s a good price… if the bears keep going I am sure we will get there as the asymmetry switches to the upside.

Please let me know any bear points I have missed or more insights on the ones highlighted.

Cheers.

Disc: Don’t own, but its on the top of the watch list