This one slipped past me yesterday -- Meta (Facebook parent) has engaged Playside to develop a VR title for its Quest device, based on the Dumb Ways To Die (DWTD) IP.

Playside will get a license fee as well as periodic development payments. They also get a share of net revenues in perpetuity.

They expect launch will take 18 months.

As a reminder, they bought the rights for DWTD for just $2.25m in 2021. They already made $9m just from NFT sales!! (yeah, a terrible "investment" for those that bought them, but it was great for PLY). Anyway, what a great purchase that's turned out to be.

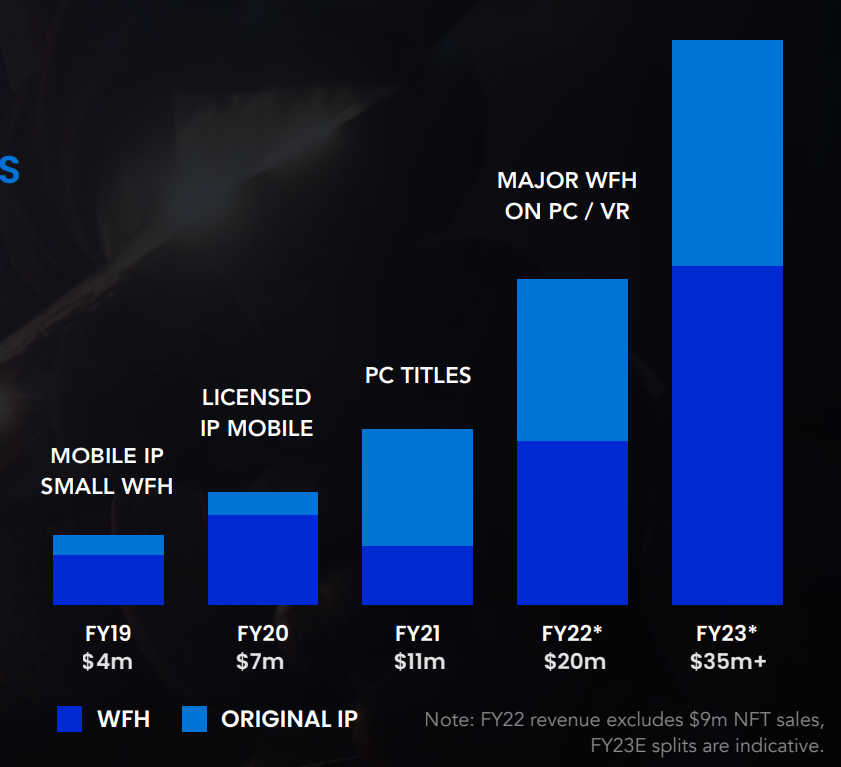

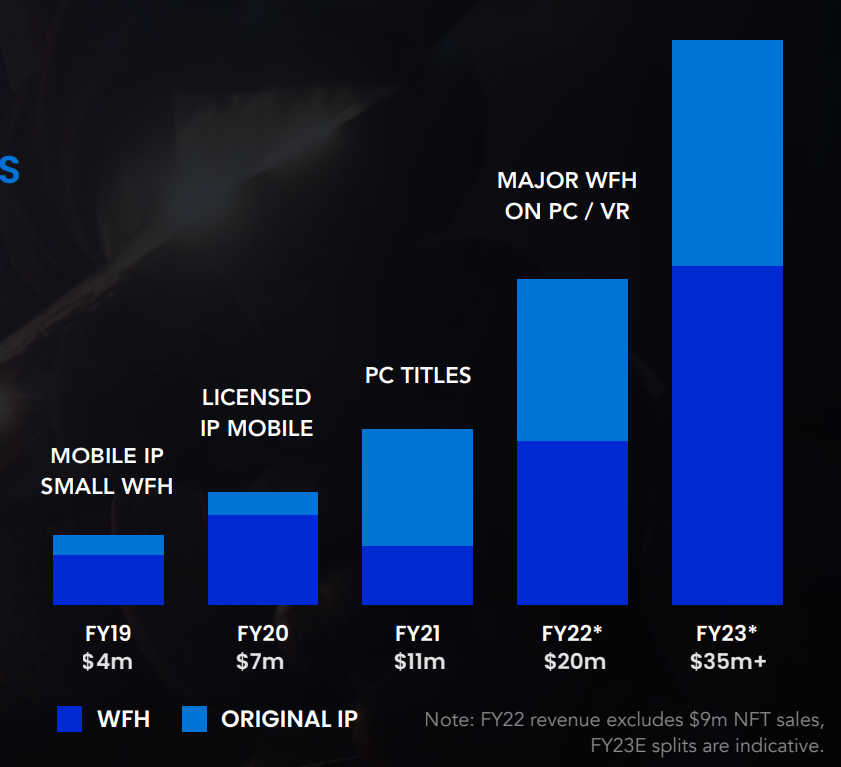

This news has led Playside to guide for FY24 revenue of $50-55m. They recently told investors to expect $35m in revenue for FY23.

The top line growth has really been remarkable:

Also worth noting they have $30m in cash and were cash flow positive in the March quarter.

Yes, shares are on something like 4x sales. But maybe that's not so high given the growth and scalability of the business.

See full announcement here