15-May-2024: Actually this straw is specifically about the Chairman, rather than about the rest of PNV Management.

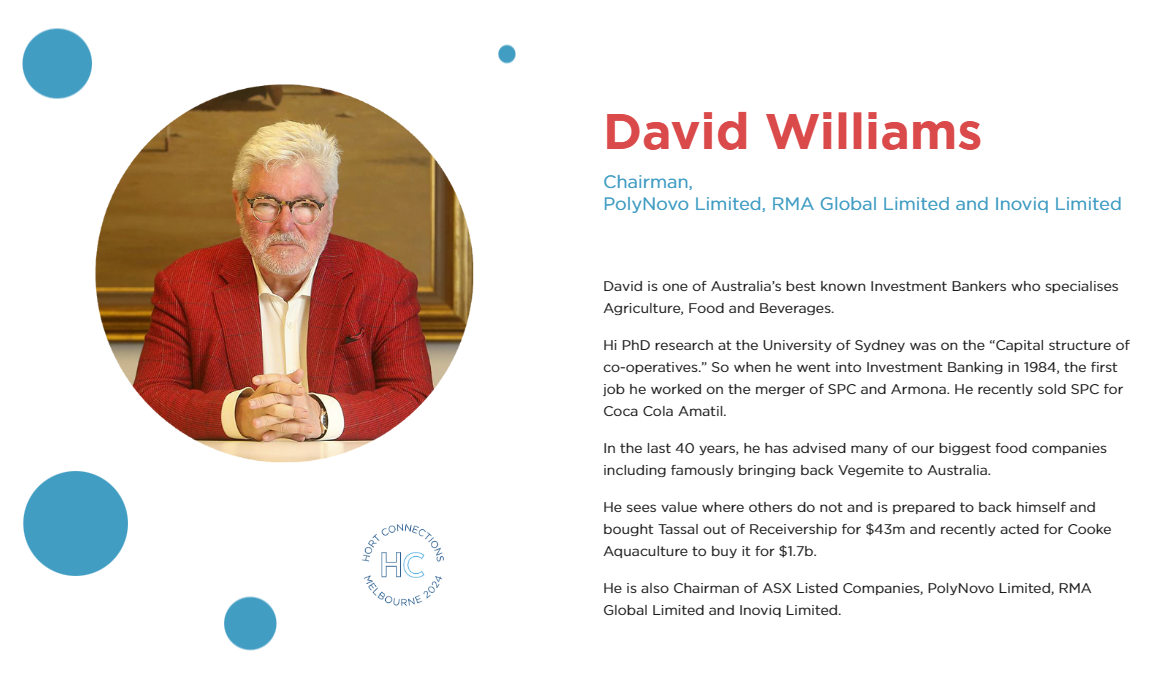

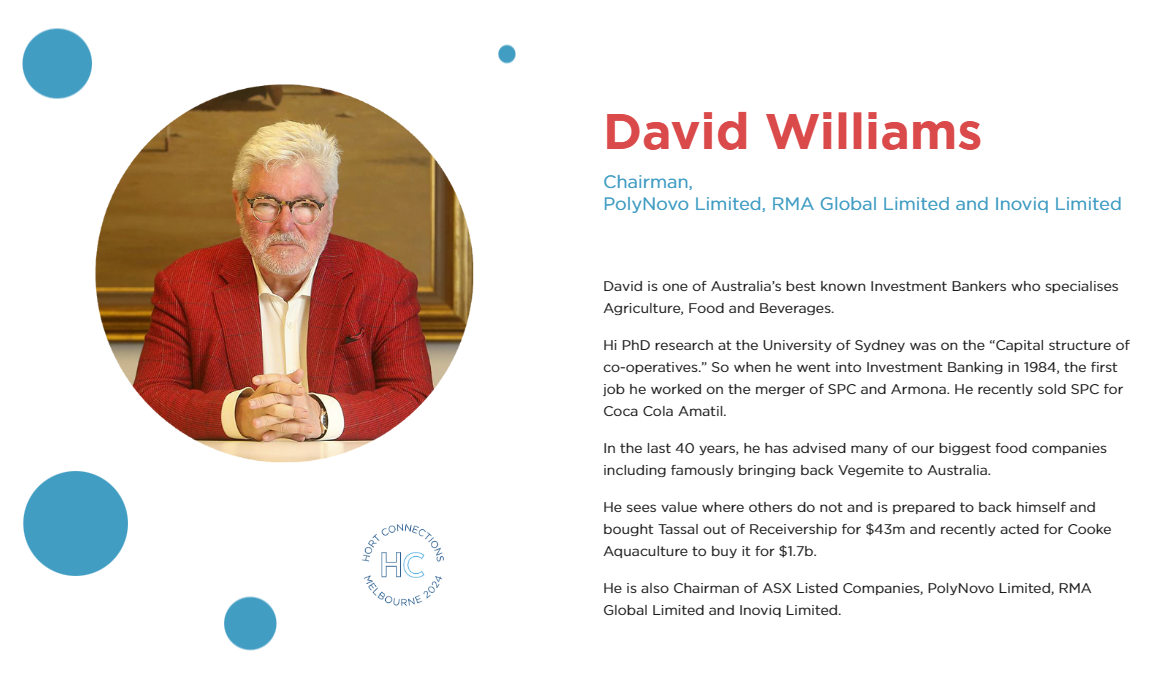

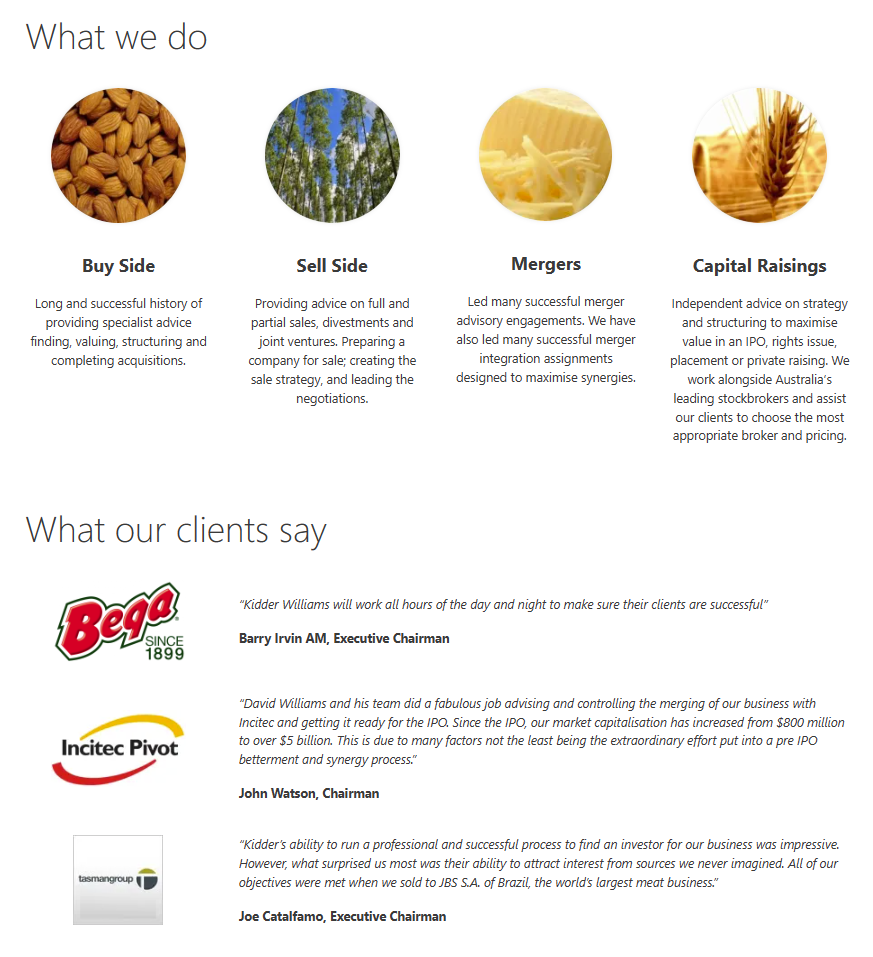

Quite a character, our Mr. David John Williams. Chairman of three ASX-listed companies (PNV, IIQ, RMY) and past Chairman of at least three more companies - Medical Developments International (MVP.asx, for 13 years to 28-April-2023), Tassal Group (acquired by Canadian aquaculture company Cooke Inc. in August 2022), and Austin Group (family owned private company); David has also been a director of Select Harvests (SHV, 5 years to 18-Feb-2004) and Amcal which was acquired by Sigma Pharmaceuticals, now Sigma Healthcare, SIG.asx, who entered the ASX200 Index last week (on May 10th) when Boral (BLD) was removed. SIG's m/cap was recently significantly increased by their merger with Chemist Warehouse Group (a.k.a. CW Group).

David is also a lover of either red wine or lots of sunlight, perhaps both, and proficient user of photoshop one suspects.

With a social media presence and a flair for promotion.

(4) David Williams | LinkedIn

David Williams (@DavidJ_Williams) / X

Chris Judd Invest | Following yesterday’s Talk Ya Book with David Williams, find out why he likes Polynovo (ASX: PNV) and Rate My Agent (ASX: RMY). To watch… | Instagram

David Williams | Hort Connections

David Williams (businessnews.com.au)

David Williams is also Managing Director of corporate advisory firm Kidder Williams:

David Williams

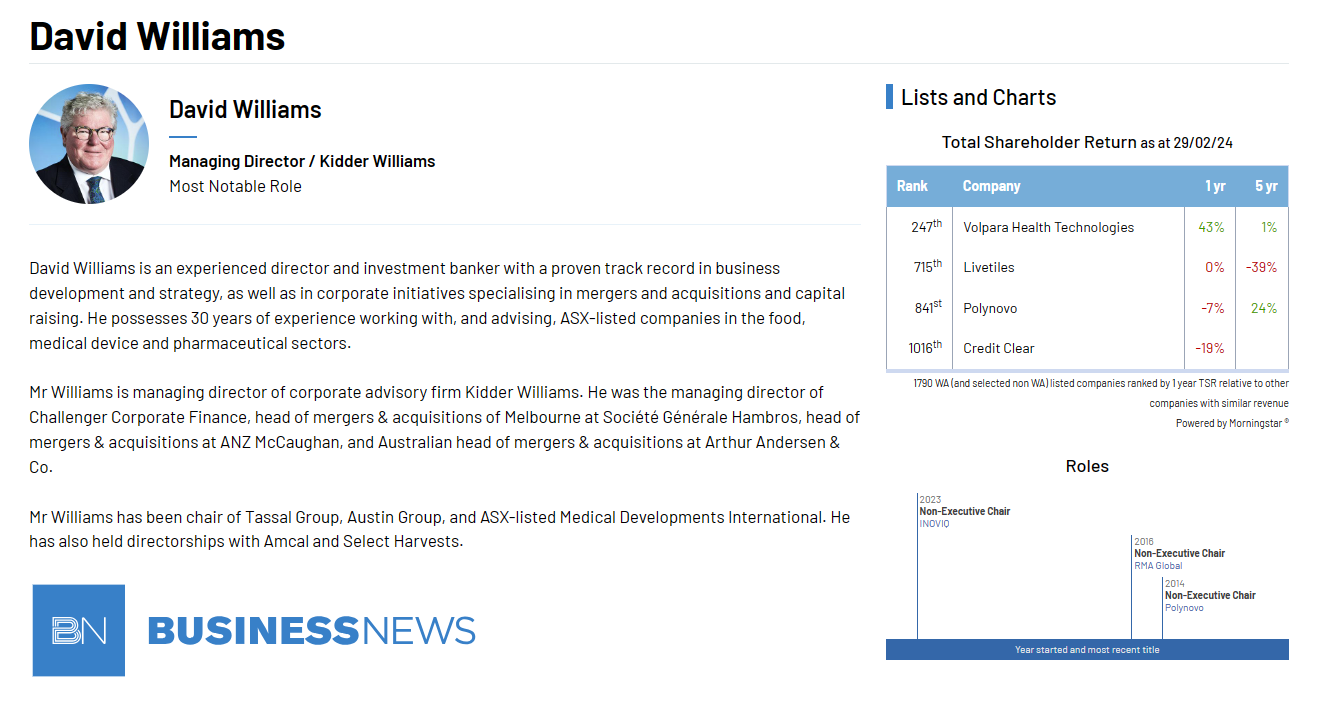

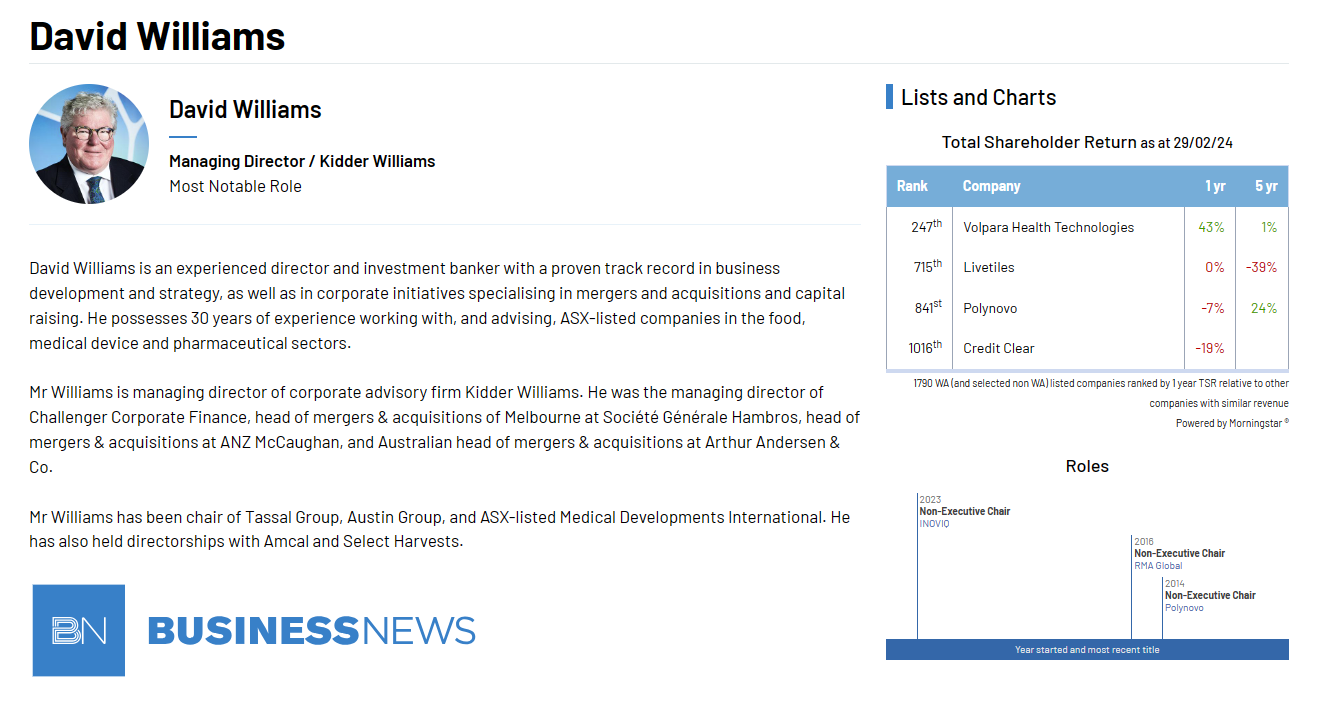

David has over 30 years’ experience providing mergers and acquisitions, capital raising and strategic advice. Prior to establishing Kidder Williams, David was the Managing Director of Challenger Corporate Finance, Head of the Melbourne corporate finance office of SG Hambros, Head of M&A at ANZ McCaughan, and Head of M&A at Arthur Andersen.

David holds an Honours and Master’s degree in Economics and conducted Ph.D. research on Cooperatives and their capital structures. He is a Fellow of the Australian Institute of Company Directors. David is Chairman of ASX-listed companies; PolyNovo Limited and RMA Group Limited. [Also Chairman of INOVIQ Limited (IIQ).]

Kidder Williams:

Kidder Williams - Kidder Williams

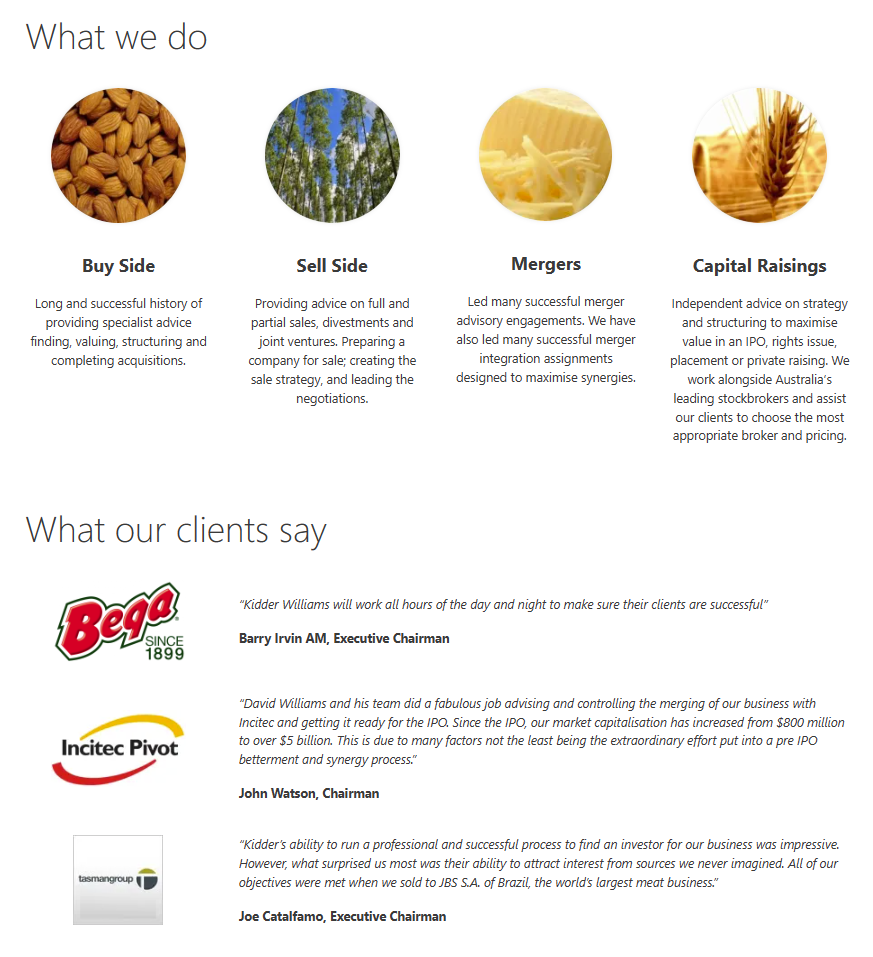

We are a leading adviser to the food, agriculture and beverages industries, and also have extensive experience in medical and digital technologies.

We are globally connected and source international capital for Australian companies.

Kidder Williams Limited provide Corporate Advisory and Investment Banking services to private and ASX-listed companies, including: Corporate Finance Strategy, Mergers & acquisitions, Divestments and demergers, Capital structure, Equity and debt raisings and IPO. We are a leading adviser to the food, agriculture and beverages industries, and have extensive experience in medical and digital technologies. We are globally connected and source international capital for Australian companies. Kidder Williams Limited was originally part of the Mariner Group and set up on its own in 2005.

--- ends ---

OK, so, to recap:

David Williams is:

- the Chairman of PolyNovo Ltd (PNV), and owns 21.4m PNV shares worth around 3% of the company with a current market value of about $46m (@ $2.16/share);

- the Managing Director of corporate advisory firm Kidder Williams;

- the Chairman of INOVIQ Ltd (IIQ), and owns 5.43% of that company, that holding currently being worth around $2.7m;

- the Chairman of RMA Global Ltd (RMY), and owns 184.4m RMY shares, or 33% of the company, that holding currently worth around $12.7m;

- a previous Chairman of Medical Developments International Ltd (MVP), and a current substantial shareholder of MVP with a 13.35% stake worth around $4m (MVP's entire m/cap is now down to only around $36m); and

- a previous Chairman and substantial shareholder of Tassal Group Ltd, buying it out of receivership and arranging the sale of Tassal in August 2022 to Canadian aquaculture company Cooke Aquaculture Inc.

"It isn’t Melbourne investment banker David Williams’ first foray into the salmon game." Photo: Jesse Marlow

Source: Former Tassal Group owner David Williams back for second helping (afr.com) (22-June-2022)

David Williams has also previously been the Chairman of private family-owned company Austin Group and a previous director of Select Harvests (SHV, 5 years to 18-Feb-2004) and also of Amcal (now part of Sigma Healthcare, SIG.asx). Through his work at Kidder Williams, David has worked on numerous mergers and IPOs (SPC & Ardmona, Incitec Pivot), acquisitions (Bega buying back Vegemite), divestments and asset sales (SPC for Coca-Cola Amatil, Tasman Group to JBS S.A. of Brazil, selling Tassal out of receivership to Cooke Aquaculture Inc. of Canada), and other corporate actions, strategic reviews, recapitalisations, etc.

The man has some solid form, and is a rather unique individual.

Further Reading:

Medical Developments International (ASX: MVP) Providing An Alternative To Opioid Addiction - A Rich Life (11-June-2021, by "Downunder Value")

About INOVIQ | INOVIQ

RMA Global Limited (rma-global.com)

Home - Medical Developments International

Kidder Williams - Team

PolyNovo:

Revolutionary Synthetic Skin Substitutes | PolyNovo

Investor Relations | PolyNovo

PolyNovo | Healing. Redefined.