Something a bit more positive and different to all the AI / deepseek discussion for a change.

Went through the previous straws a few months back that are 3 years old and thought "did I make a mistake?"

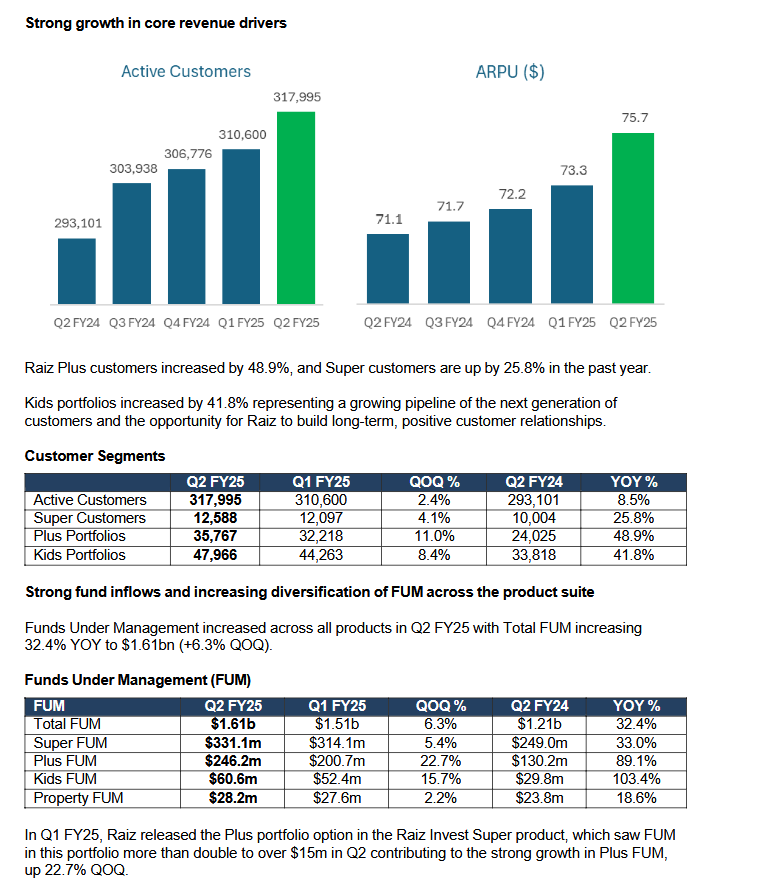

However, over the last 6 months, Raiz started introducing a diverse product offering on their micro-investment platform from standard, super and even a option for kids to invest and build a portfolio. To me this looked like a interesting "fintech" biz and I thought I'd give this one a go few months back.

And with the latest update, looks like there is some momentum with a positive business update today

* Positive operating cash flow of $700k and $12m cash balance.

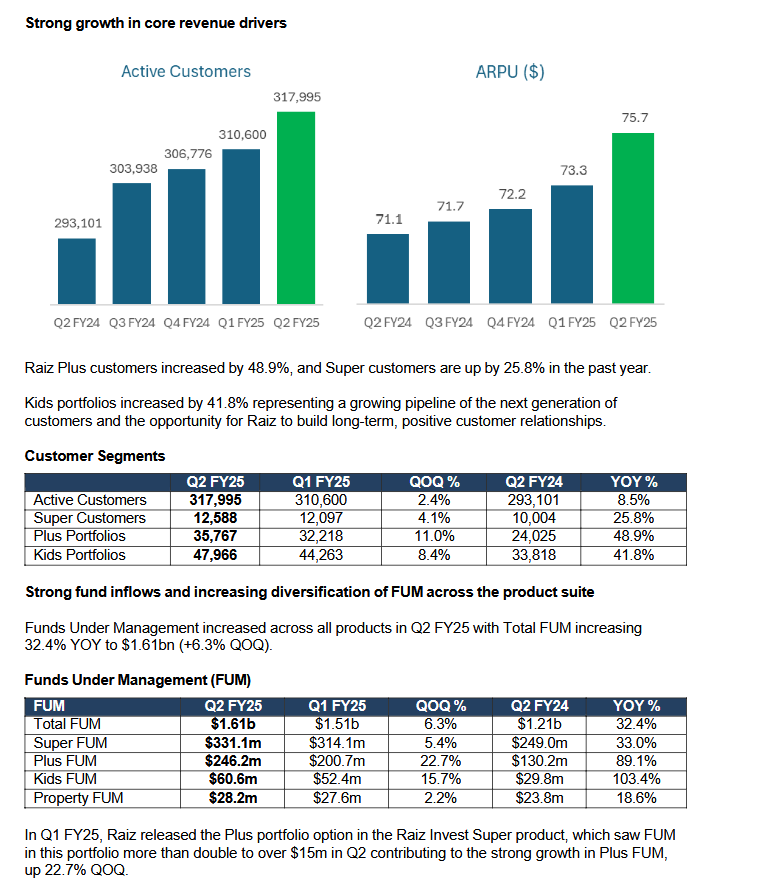

* Active Customers 2 up 8.5% YOY to 317,995: Active Customers grew further to 322,219 at 25January 2025.

* ARPU (Average Rev per user) up 6.4% YOY to $75.68: Driven by changing product mix to higher revenue products.

* Total FUM of $1.61bn up 32.4% YOY (QOQ: +6.3%), driven by strong growth in netflows of $183m in Calendar Year 2024 (CY24) (CY23: $57m) and positive investment markets. FUM increased to $1.67bn at 25 January 2025. But this is off a low base

[held]