Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Raiz posted their latest results and I've highlighted my concerns about operating cashflow below

The cashflow decrease appears to be from increased expenses and there is not much detail on what professional fees are.

Granted last year was an exceptional year for Raiz

I'm hoping the increase in expense is just a one-off but you never know.

I only got interested in Raiz when they started pivoting away from Asia and back into the local market which seemed to have made a difference last year with the big increase in casflow.

[held]

Article in the AFR

https://www.afr.com/wealth/investing/6-asx-companies-that-have-microcap-stock-pickers-excited-20250803-p5mjxo

Could be responsible for the pop today

Other companies include EGL and CSX

Held

Something a bit more positive and different to all the AI / deepseek discussion for a change.

Went through the previous straws a few months back that are 3 years old and thought "did I make a mistake?"

However, over the last 6 months, Raiz started introducing a diverse product offering on their micro-investment platform from standard, super and even a option for kids to invest and build a portfolio. To me this looked like a interesting "fintech" biz and I thought I'd give this one a go few months back.

And with the latest update, looks like there is some momentum with a positive business update today

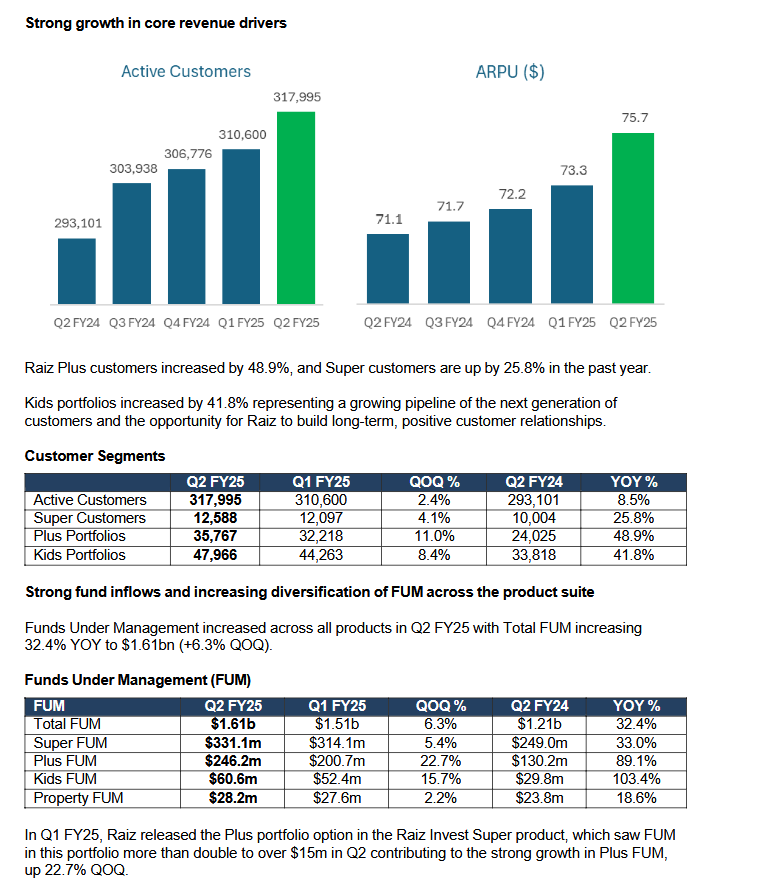

* Positive operating cash flow of $700k and $12m cash balance.

* Active Customers 2 up 8.5% YOY to 317,995: Active Customers grew further to 322,219 at 25January 2025.

* ARPU (Average Rev per user) up 6.4% YOY to $75.68: Driven by changing product mix to higher revenue products.

* Total FUM of $1.61bn up 32.4% YOY (QOQ: +6.3%), driven by strong growth in netflows of $183m in Calendar Year 2024 (CY24) (CY23: $57m) and positive investment markets. FUM increased to $1.67bn at 25 January 2025. But this is off a low base

[held]

Just Googled Raiz Ads made me Laugh

Raiz Ad: Waxed

https://www.youtube.com/watch?v=fDa7jMiEoWQ

Raiz Ad: The wrestler

Raiz your game

Raiz Invest Limited (RZI): April 2022 - Key Metrics

Raiz Invest Limited (Raiz or the Company) today announced its Australian, Indonesian, and Malaysian Active Customers and Australian Funds under Management (FUM) update for the month to 30 April 2022i.

Commentary

Raiz Invest Managing Director/Joint Group CEO George Lucas says: “Growth in Active Customers globally picked up in April and FUM remain above $1 billion despite weaker markets. Our Indonesian and Malaysian operations underpinned Active Customer growth with sound performances considering this month overlapped with Ramadan and the ongoing poor investor sentiment globally.

“Active Customers globally increased 2.1% in April. In Indonesia, Active Customers grew 4.2% in April, up to 240,550, and in Malaysia they were up 3.5% to 108,072. Also notable is the fact the number of customer sign-ups in Indonesia passed the one-million benchmark in April.

Great to hear CEO George Lucas will be coming on Strawman for a chat

It will be interesting how the deal with Seven West Media (6.6% stake) starts to play out with the assist (ing) in brand awareness and attracting new and old customers.

The $8 million SWM campaign, launched on 1 May, will significantly increase the Raiz marketing presence”.

Raiz kids was launched in late April as well

Some high level assumptions to derive at a $3 valuation to 2026

Rev growth 40% in 2022 then 30% per annum to 2026 to 53.6mill

Shares outstanding to grow by 4% pa

Gross margin to grow from 62% to 67%

Price to sales which currently sit at 12x sales in FY21 to reduce to 10x

Market cap current 157mil to grow to 531mil

Discounted back 10% per annum from 2023

$3 share price

Management have been good at delivering growth and from an EPS expect this come positive in FY 2023

This is what Raiz issued today...

Raiz Invest Limited (RZI): Notice under Section 249D of the Corporations Act

Raiz Invest Limited (Raiz or the Company) announces that following the close of trading yesterday, the Company received a request from BBH-GL Nominees Pty Ltd (a company associated with Managing Director/CEO George Lucas), being a shareholder holding greater than 5% of the shares in the Company, for the Company to call a meeting of shareholders pursuant to s249D of the Corporations Act (Cth) 2001.

The notice requests the convening of a general meeting of the Company to consider the following ordinary resolution:

“THAT pursuant to section 203D of the Corporations Act and clause 10.19(e) of the Company’s Constitution, Nina Finlayson, Kevin A Moore and Kelly Humphreys are removed as directors of the Company with effect from the close of this meeting.” Further details will be provided in due course. - ENDS -

DISC: I hold

Has anyone heard anything? This is trying to get rid of 3 out of 5 directors of RAIZ...

I can't believe RAIZ hasn't put any further info out! RAIZ shares currently down over 11% 1:44pm 1/9/21

Raiz Invest Limited (RZI): CONTINUED STRONG GROWTH IN 1H21

1H21 Highlights

- Continued strong growth in Active Customers, up 53.6% to 343,573.

- Strong growth in Australian Funds under management (FUM), up 33.5% to $605.6 million.

- Growth in Raiz Super, up 16.3% to $81.0 million, despite $5.8 million in Early Release.

- Group revenues increased by 17% to $5.2 million compared to the same period in 2019, reflecting an increasingly diverse base.

- $11.3 million in cash and term deposits.

Disc; I hold

Raiz Invest Limited (RZI): January 2021 - Key Metrics

Raiz Invest Limited (Raiz or the Company) Australian, Indonesian, and Malaysian Active Customers and Australian total Funds under Management (FUM) update for the month to 31 January 2021

Commentary

Raiz Invest MD/Global CEO George Lucas says: “Funds under management (FUM) and Active Customers both showed solid gains in January. Total FUM in Australia enjoyed a 5.5% growth spurt to $639.08 million.

“Active customer growth picked up the pace in January, increasing 9.5% to 376,198, driven by an increase in Active Customers in Australia.

“Custom Portfolio, which gives Australian customers greater choice to select their own asset weightings, was successfully launched in late January. The uptake has been very encouraging with more than 3,200 clients representing more than $14 million in FUM using this option. The average balance in a Custom Portfolio is $4,273, significantly higher than the average balance of $2,224 across the entire customer base.”

All figures are un-audited.

DISC: I Hold

27-Nov-2020: Taylor Collison: Raiz Invest (RZI): Early Replication of Australian Successes into SE Asia

No analyst listed. Release Authorised by Mark Pittman, http://www.taylorcollison.com.au

- Recommendation: Spec Buy

- Market Capitalisation: $70.5M

- Share price: $0.94

- No Target Price given

- 52 week low: $0.30

- 52 week high: $0.99

Raiz Invest Limited (RZI)

Early Replication of Australian Successes into SE Asia

Our View

RZI’s future success hinges on continuing growth in active customer numbers, increasing funds under management, further leveraging its installed Australian customer base, and delivering on its early stage SE Asia growth opportunities. At this early juncture, RZI remains a pre-profit venture capital style investment – with associated (and expected) risks – but its FY20 result and recent AGM update both encouragingly displayed continuing positive momentum.

To the end of October, active user growth (yoy) was +43.8% and total FUM +27.9%. Progress is clearly being made and achieving these growth rates in a COVID impacted, uncertain consumer environment, is commendable. But the challenge is to improve customer engagement and gain greater share of customer wallet. The size of the opportunity is large, and combined with an $11.8m net cash position (30 June 2020; $5m held in regulatory capital) and Australian operations verging on cash flow breakeven, we remain positive, rating RZI a Speculative Buy.

Key Points

Growing out of its infancy – We stress that investors need be cognisant of both the opportunities and growing pains of an early stage funds platform business. RZI must successfully navigate its high growth phase, and we note:

- SE Asian’s expansion into Indonesia and Malaysia has shown promising initial sign up numbers. RZI needs to monetise that initial interest. Encouragingly growth rates continued unhindered post June/July’s fee introduction.

- Australian active users were up 10.6% in the year to end Oct 2020, an average month on month uptick of just 0.8%. Acknowledging COVID and SE Asian distractions, Australia’s plateauing user numbers need bolstered through marketing, new user sources, and innovative products.

- Australian FUM up 27.9% for the 12 months to end Oct 2020 suggests greater success in convincing active users to increase contributions onto its platform. Positive user experiences and outperformance in its chosen ETFs are helping.

- The broader funds platform industry is competitive and alternate solutions may arrive from overseas. Positively, the technology on which RZI’s offering is licensed (from Acorns) continues to gain traction in the US, proving its worth.

Australian growth plans – To encourage greater Australian customer saving and investing, RZI intends to launch new products over FY21. More portfolio options and the introduction of new custom portfolios, together with the onboarding of SMSFs are intended to broaden RZI’s offering and appeal to users with larger account balances. With increased users comes increased maintenance fees ($2.50 set fee per user per month) and significantly, with increased FUM comes increased account fees (charged as a percentage of FUM). Traction here is crucial in RZI’s more established Australian business. RZI needs to innovate to grow.

Encouraging initial SE Asian uptake – The initial uptake in both Indonesian and Malaysian active users was a lofty +84.0% and 311.6% respectively on a threemonth basis to end-Oct. The month on month uptake was a still healthy 10.9% and 22.5%. Offices have been established in Jakarta and KL, licensing is in place, teams have been hired, and new partners targeted. These countries are to provide the blueprints for further pushes into Vietnam and Thailand and we watch with interest as these mobile phone prevalent, underbanked, and densely populated countries add to the RZI portfolio.

--- click on the link at the top to access the entire TC report on RZI ---