Half yearly is out, and the headline numbers look decent.

Breaking it down: Australia showed strong growth, the UK was okay but impacted by the cost of living (or at least that’s the given reason), and the US declined as ad economics didn’t stack up, leading them to pull marketing spend.

I had a few gripes with the presentation pack presented. There was a $1m foreign exchange gain made ($1.5m swing vs pcp) - adjusting for this, EBITDA and NPAT would actually be slightly down vs pcp. This fact wasn’t particularly highlight as they boasted about revenue and profit growth.

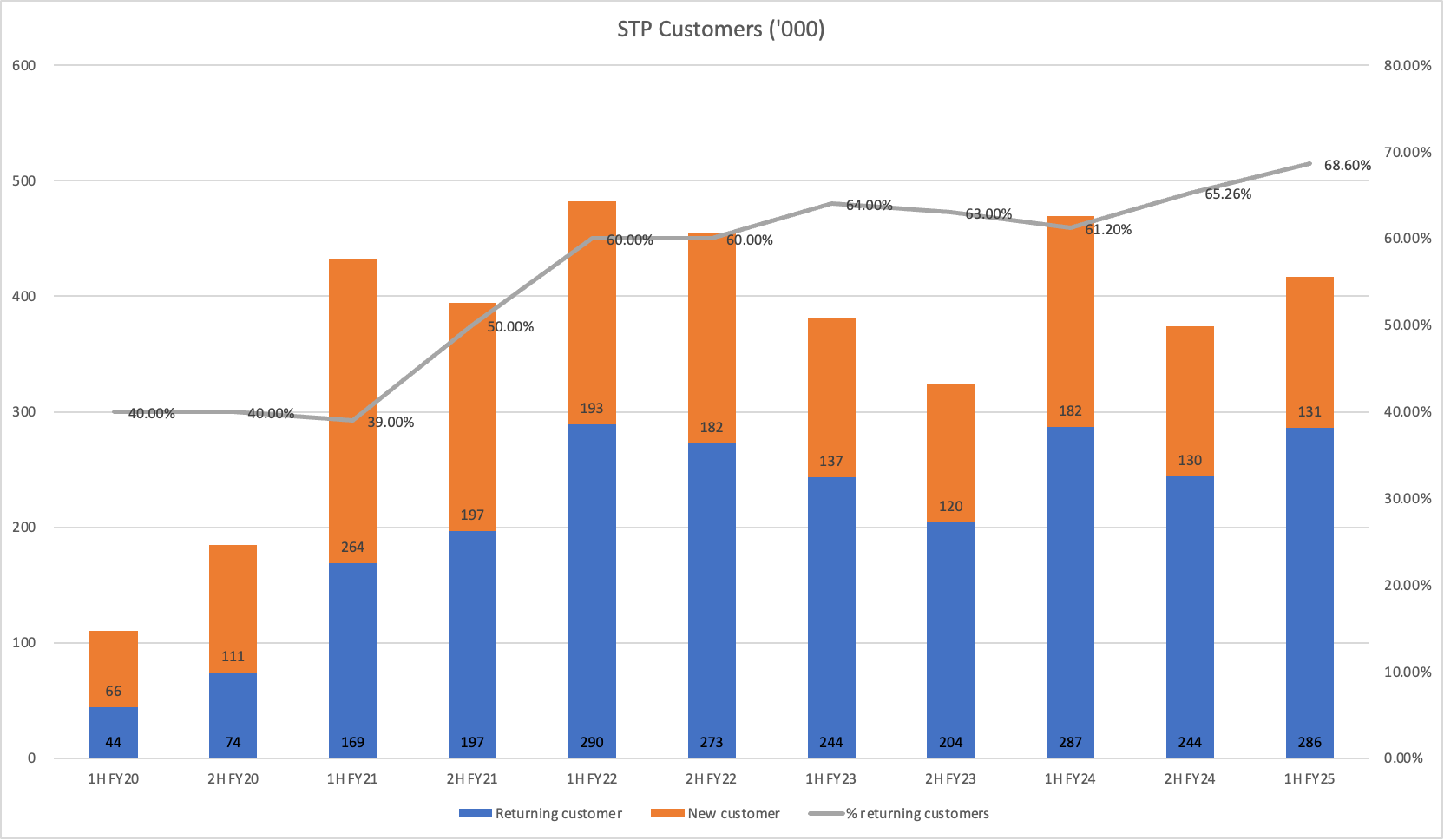

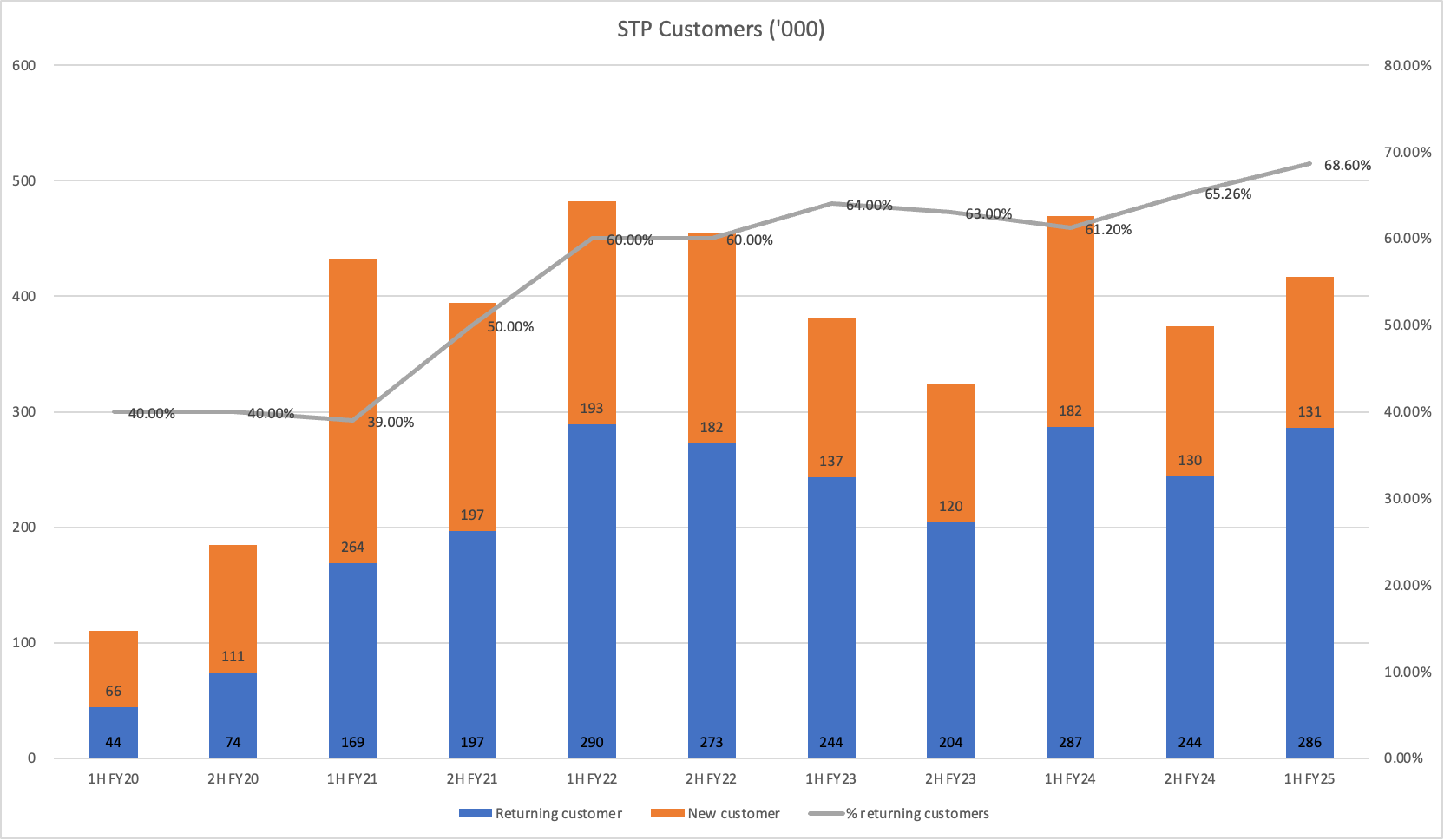

The presentation also omitted some stats from previous years, such as new/returning customer split (can be back-solved), order numbers by region, and %revenue done via sales events. I assume none of these numbers paint the company in the favourable light, so they were dropped.

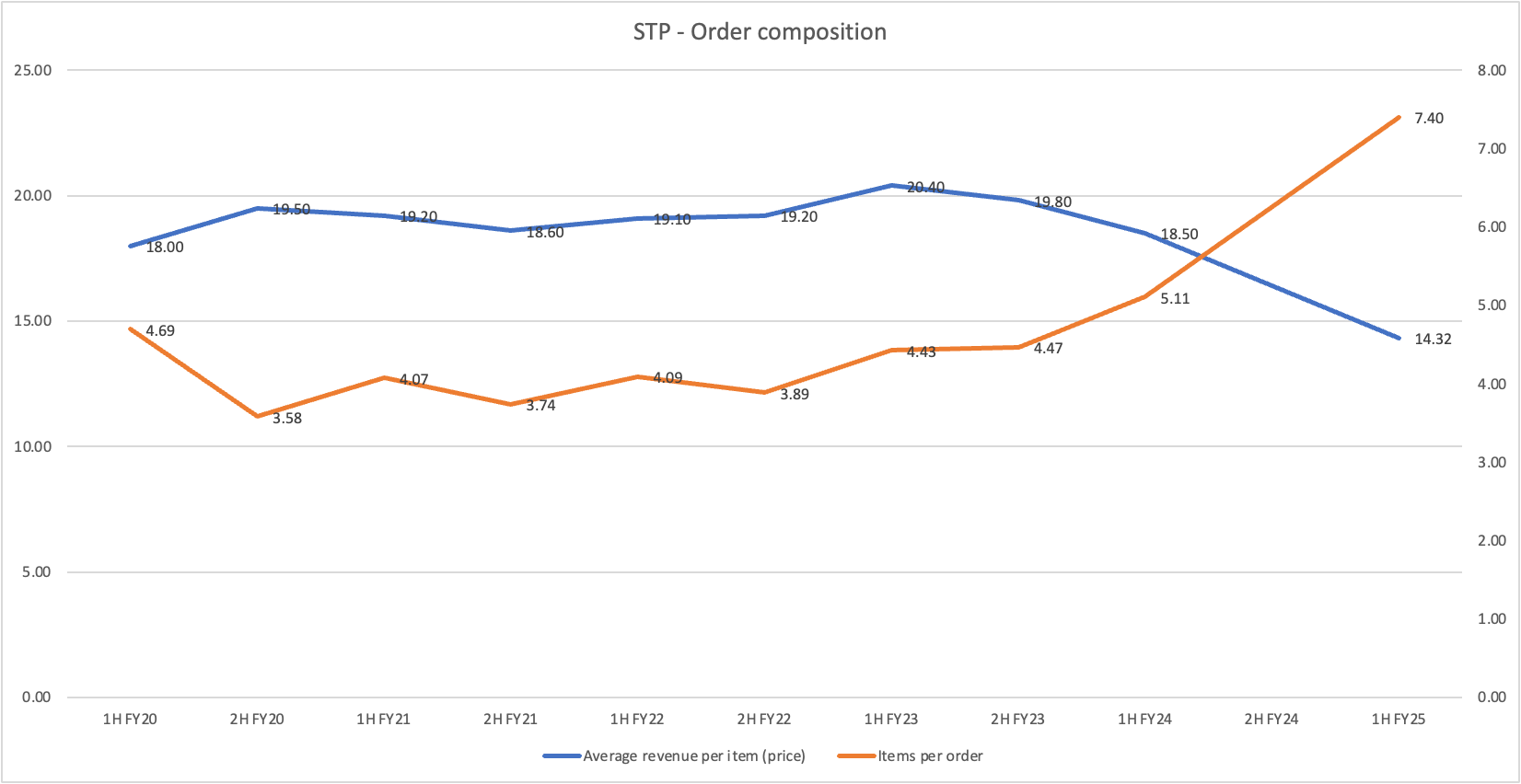

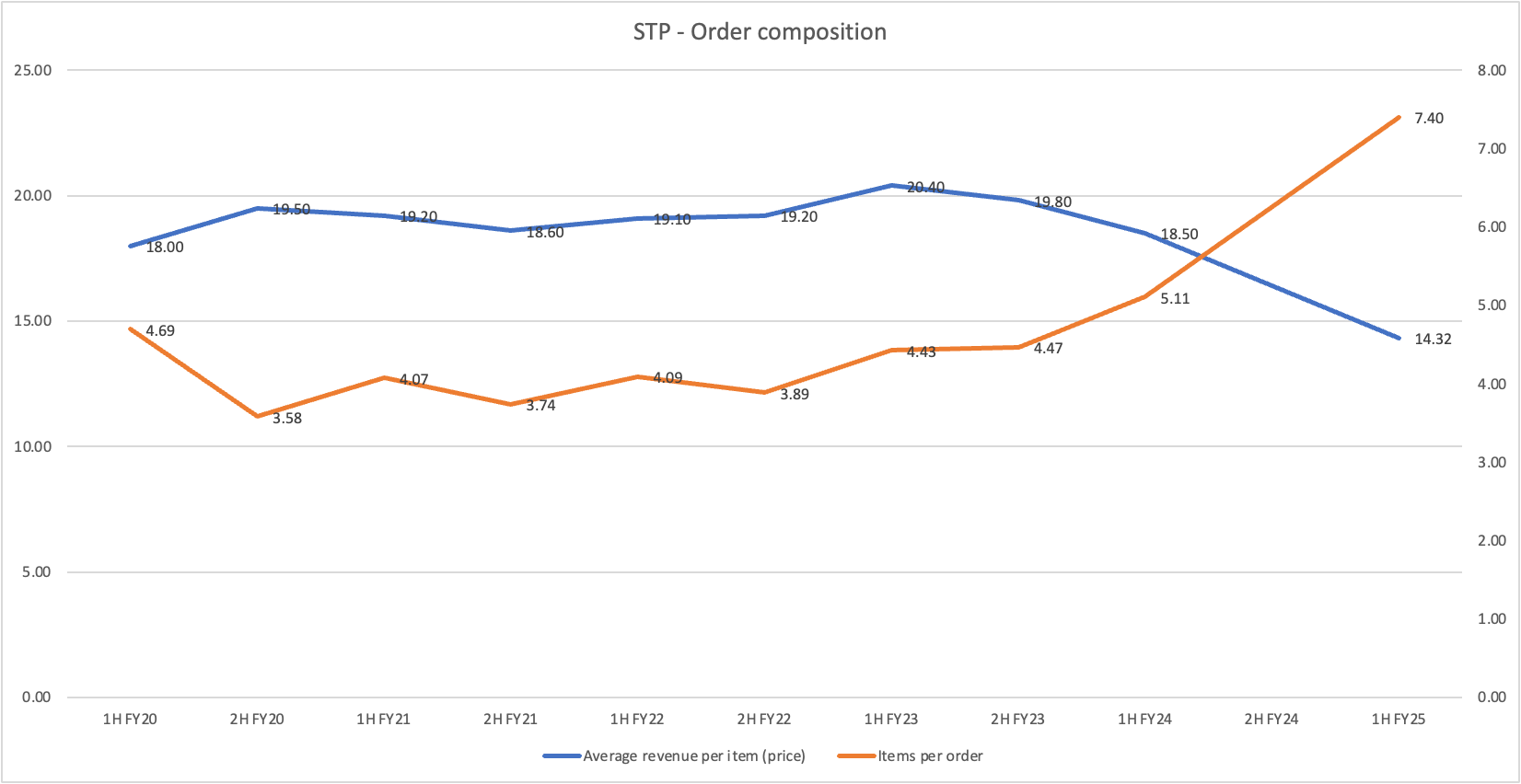

Overall, it’s a thesis break for me. While Australia growth is okay, international is stalling. Growth looks increasingly low-quality - driven by discounting especially with larger bulk sized orders. While the customer base has largely stagnated. Here are some graphs to highlight my point.

I had already cut my position substantially leading up to the report and fully exited this morning. I’ll do the same with the SM portfolio position.

This is an interesting one. Reported half yearly results today. Hit record revenues and profits (+25%, +38% respectively vs pcp) surpassing the numbers reached during the height of the pandemic. One of the very few ecommerce retailers to do so!

This is an interesting one. Reported half yearly results today. Hit record revenues and profits (+25%, +38% respectively vs pcp) surpassing the numbers reached during the height of the pandemic. One of the very few ecommerce retailers to do so!