Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Step One (STP) is the ASX listed on-line marketer of tight fitting, environmentally friendly bamboo undies. STP’s likeable CEO Greg Taylor was on Strawman in August of last year.

Yesterday STP released the following trading update:

“Based on year-to-date trading, including estimates for December, Step One expects its 1H26 financial results to fall within the following ranges: • 1H26 revenue is expected to be between $30 million and $33 million, which represents a decline of between 31% to 37% on the prior corresponding period (1H25: $48.1 million) • 1H26 EBITDA is expected to be a loss of between $9 million and $11 million (1H25: $11.3 million profit), including a $10 million provision for inventory obsolescence”.

Since the announcement you could almost see and smell the skid marks as the STP share price crashed from 48 cents to 27 cents. Earlier in the calendar year STP was selling for around $1.40.

In August Greg caused an earlier smaller share price skid with the announcement:

“We anticipate moderate revenue growth, led by the UK market and supported by new product launches. Earnings performance is expected to soften in the near term; however, we remain confident that these measures will enable Step One to navigate current market conditions effectively and establish a stronger foundation for sustainable, profitable growth as conditions improve. FY26 EBITDA is expected to be in the range of $10 to $12 million”

Maybe Greg was pooing his bamboo pants as he uttered the above words, since it was likely by that time he had a pretty fair idea how badly sales were deteriorating. Or maybe the sales decline just happened very suddenly when on Thursday he disclosed the horror 30% revenue decline. Either way Greg with 57% of the business has seen his net worth drop by over $100m since the start of the year. Which nearly made Scoonie shit his pants and he doesn’t even have any bamboo undies or STP shares.

Years ago the STP Chair David Gallop was for a decade CEO of the National Rugby League. Older followers of the sport will remember the period when almost every month David Gallop was fronting up on the TV news trying to defuse another episode of player misbehavior. Usually, the trouble was related to alcohol or sexual misconduct or both. Matty Johns being one of the more high-profile players gaining a lot of unwanted attention. Like Matty, many NRL players seemed to have difficulty keeping their pecker insider their undies. So maybe Step One with their super tight fitting and tough-to-get-out-of bamboo underpants, David spotted a market opportunity no one else did.

Anyway, full marks to CEO Greg for getting the Step One business off the ground and to sales of nearly $90m a year. Anyone who had the genius to achieve this with a garment that looked like it had floated off the set of Downton Abbey deserves applause. If you had got caught wearing what looks like your granny’s undies at the PE change rooms at any NSW public school in the 1970s you would have had the bamboo beaten out of you. Now the kids not only wear this stuff but boast about it on social media.

Today 26.5cps ..Ouch

https://hotcopper.com.au/threads/ann-1h26-trading-update.8922100/

ASX Announcement 4 December 2025 :

Step One Clothing Limited 1H26 Trading Update Step One Clothing Limited (ASX:STP) (“Step One” or “the Company”), a leading online, direct-to-consumer innerwear brand, today provides the following trading update for the first half of FY26 (1H26). Based on year-to-date trading, including estimates for December, Step One expects its 1H26 financial results to fall within the following ranges:

• 1H26 revenue is expected to be between $30 million and $33 million, which represents a decline of between 31% to 37% on the prior corresponding period (1H25: $48.1 million)

• 1H26 EBITDA is expected to be a loss of between $9 million and $11 million (1H25: $11.3 million profit), including a $10 million provision for inventory obsolescence

The recent sales results were materially below expectations, and our efforts to clear older and slower moving inventory were not successful. As a result, the Company has raised a $10 million obsolescence provision against this legacy stock. This inventory is now fully provisioned, and no further material provisions are anticipated at this stage.

The combined impact of softer sales and this one-off inventory provision has led the Company to reassess its full-year outlook. As the implications of these factors are still being evaluated, the FY26 EBITDA guidance previously provided is withdrawn, and no updated guidance will be issued at this stage.

The Company will update the market once greater visibility over trading and inventory outcomes is available. These estimates are preliminary and subject to trading conditions over the remainder of the reporting period, including pre- and post-Christmas sales, foreign exchange movements, and logistics timings.

The financial results remain subject to auditor review. Step One plans to report its 1H26 financial result on 18 February 2026.

-ENDS

This announcement was authorised for release by the Board of Step One Clothing Limited.

Return (inc div) 1yr: -81.16% 3yr: 8.08% pa 5yr: N/A

STP - The 5 year life of STP = from pre -profit , profit, now less Profit

FY25 Overview Step One continues to deliver strong financial results. The highlights include: ■ Revenue: $86.9 million, up 2.8% on pcp (FY24: $84.5 million) ■ EBITDA: $17.4 million, down 3.9% on pcp (FY24: $18.1 million) ■ Net profit: $12.7 million, up 2.0% on pcp (FY24: $12.4 million) ■ Cash and financial assets: $33.1 million and no debt Throughout the year, we adapted quickly to challenging market conditions, using promotional periods strategically to align with consumer behaviour and managing our advertising spend efficiently. While average order value grew, gross margins were impacted by the increased promotional activity required to maintain market share in a tough environment

Cash and cash equivalents at the end of the financial year 9 18,140 28,952

STP a wealth destroyer - So see how the STP strategy goes now... and the investor Buy, Hold , Sell..!

Return (inc div) 1yr: -58.37% 3yr: 31.27% pa 5yr: N/A

The unaudited results for FY25 indicate some concerns happening in 2HFY25.

Overall revenue came in at $86.9m up slightly on FY24 but this was due to the 1H results.

2H sales fell from $39.5m to $38.78m but the MAJOR problem centres around their EBITDA/Revenue margin. At just 16% this is well below the comparable figures of 23% for 1HFY25 & 22.6% for 2HFY24.

The cash assets reflect this worrying trend. At 1HFY25 we had cash and financial assets of $43.7m and just $33m for 2HFY25. Sure, the interim dividend of some $8.2m explains part of the fall – but given this is really a cash biz, where did the other $2.5m go. Inventory build-up in expectation of greater 2H sales??

I think FY25 signifies STP to be purely a one-product, income earning company attractive to those wanting the fully franked dividends.

Certainly, the days of growth are behind it unless it can find a new line of product to introduce to that valuable direct to customer database.

Hopefully the company can repeat the Final divvy of 2.8c which will make a grossed-up revenue stream of 10.28c – not bad the current SP of 76c, but will this be hammered today?

The company really needs to consider other products and perhaps other geographies.

I fully accept this share will be considered a ‘flash in the pan’ – but is it really?

Sure, undergarments aren’t the sexiest item in the shop but, like toilet paper, who isn’t using these products?

True, one can consider it a generic and they are available at Big W et al for under $10 for a pack of 5 or singularly at STP for $25.

Without giving away too many secrets, I opt for the $25 STP variety and feel very comfortable at the price v comfort ratio. I’ve been a tight ass in the past, but no more. The ‘boys’ enjoy the comfort and style…and many, many athletes can attest to what I mean here.

So, with STP we are talking about a product which has a massive price disincentive when compared to competitors and yet it is selling, selling, selling.

Also, the method of marketing is very different and direct – but that gives rise to two massive intangible assets, which I think are not appreciated by the market – the growing database of customers AND the huge repeat order customers. Remember, underpants do have a short life (or should) and need constant replacement. That said, they do last much longer than the ‘Big W pack of 5’.

Think about the value of that database where one can go direct to the customer – at the right time with the right incentive to replace said underpants.

What’s more, think about the different products which can be peddled to the expanding global database with existing product varieties to different customer segments (male, female, juveniles, kids). I won’t go into the gender extension of LBGTIQX because, for mine, you either fill out this product offering with your ‘junk’ or you don’t!

Right now, STP is experiencing success moving into the female and kid sectors.

Then, think about serializing the same product – surely there’s a specialty product for shy kilt wearers, specialty advertising – BHP’s ‘Think Big’ comes to mind. Maybe funny slogans for the soon to be married ‘Warning slow swimmers ahead’. If the women can have slinky sexy undies and g bangers a la Honey Burdett, why not the guys. White Y fronts are passe.

Then there are the ‘add on’ products to that valuable database – colognes, lotions, indeed all manner of beautification for both male and female. Hint: look at how The Shaver Shop (SSG) has branched out into ‘beauty’, as opposed to just trimmers.

No, I do think there is more substance to STP than meets the ‘eye’…are you with me here?

Certainly, the financials are pretty encouraging & the dividend paid is brilliant – but then again, I love the franking credits.

I bought a few today at 77c for which I expect the ff dividend over the next year to be around 8c – that’s a grossed-up return of 14.8%. Not bad.

Of course, the negative nellies will bring out their counter arguments – dividend sustainability (yep, I expect it might fall off a tad as they allocate more money to developing new regions like Germany). Some question the differential between cash ops and NPAT + non-cash items (bull, that may have applied in FY23 but look at the half yearly figures subsequent - they are generating over 100%, as they should.

Some will refer to the big sale by the founder at $1.70 in September last year. Fortuitous, yes, but he hasn’t sold a share since. And hey, everyone is entitled to a big draw to buy the big boy toys.

Others will raise the possibility of margin compression and yes, a definite possibility. But you cannot look at this in isolation without considering the global expansion of sales – Aus/NZ and UK are travelling nicely, and Germany is now a target. The company has wisely left the USA alone and so Donald’s tariff ‘fiasco’ has no impact on STP.

Yes there is risk, as there is for most things, but I think the risk is worth it. If not, I will eat my shorts!

Half yearly is out, and the headline numbers look decent.

Breaking it down: Australia showed strong growth, the UK was okay but impacted by the cost of living (or at least that’s the given reason), and the US declined as ad economics didn’t stack up, leading them to pull marketing spend.

I had a few gripes with the presentation pack presented. There was a $1m foreign exchange gain made ($1.5m swing vs pcp) - adjusting for this, EBITDA and NPAT would actually be slightly down vs pcp. This fact wasn’t particularly highlight as they boasted about revenue and profit growth.

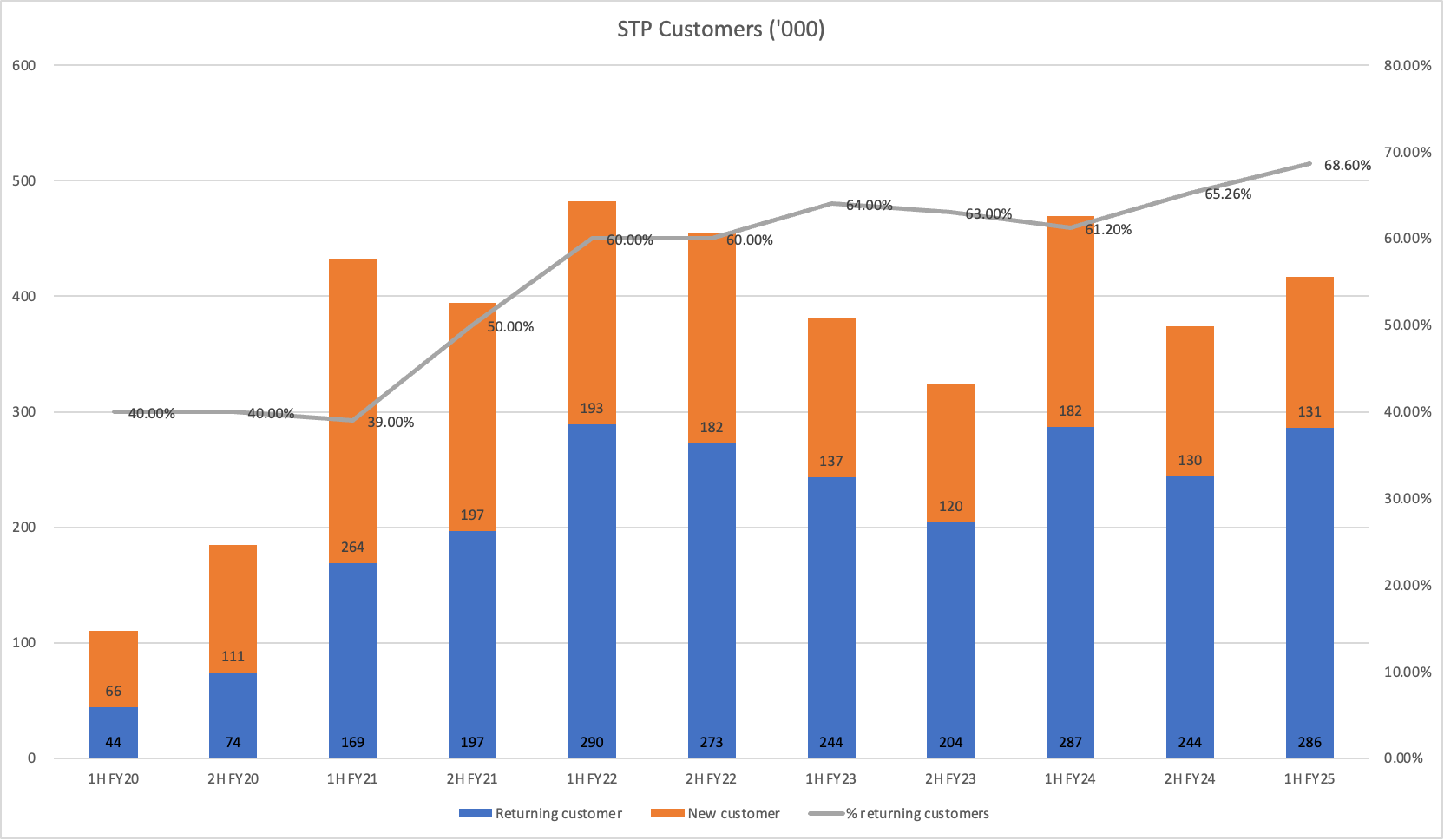

The presentation also omitted some stats from previous years, such as new/returning customer split (can be back-solved), order numbers by region, and %revenue done via sales events. I assume none of these numbers paint the company in the favourable light, so they were dropped.

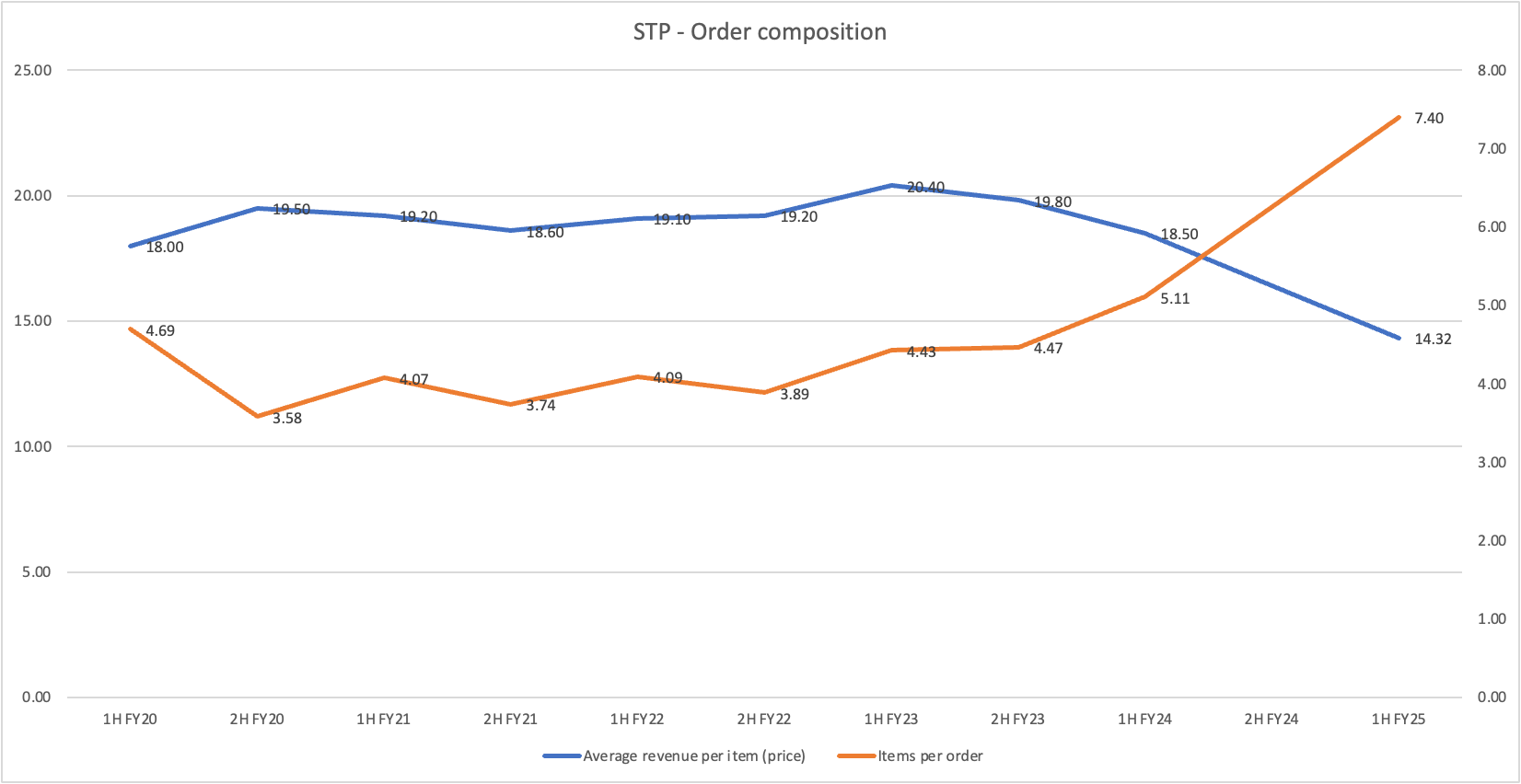

Overall, it’s a thesis break for me. While Australia growth is okay, international is stalling. Growth looks increasingly low-quality - driven by discounting especially with larger bulk sized orders. While the customer base has largely stagnated. Here are some graphs to highlight my point.

I had already cut my position substantially leading up to the report and fully exited this morning. I’ll do the same with the SM portfolio position.

Market reaction down 9%

Step One Clothing Limited Greg Taylor Partial Share Sale Step One Clothing Limited (ASX:STP) (“Step One” or “the Company”), a leading online direct-to-consumer innerwear brand, confirms that an entity associated with Mr. Greg Taylor, Founder and CEO, has agreed to sell down 16,632,352 fully paid ordinary shares in the Company, representing approximately 8.97% of its issued capital.

Mr. Michael Reddie, Director and Chief Legal Officer, has agreed to sell down 2,014,206 fully paid ordinary shares in the Company, representing approximately 1.09% of its issued capital.

The sales were undertaken at a price of $1.70 per ordinary share through a fully underwritten block trade. Following this sale, Mr. Taylor will retain approximately a 57.91% shareholding in the Company, remaining Step One’s largest shareholder.

Mr Taylor has reiterated his commitment to Step One as its Founder and CEO, and his intent to remain a substantial, long-term shareholder. Mr Taylor and Mr Reddie have agreed to escrow their remaining shares until the release of the Company’s full year results for the financial year ending 30 June 2025

Confession time: when Greg asked me if I was wearing StepOne's in the interview, i suggested I was.. He took me off guard and I was trying to be nice.

Truth is, i'd never worn a pair.

So, following the interview, I bought some online.

The experience in terms of ordering, messaging and delivery was all fantastic.

And the undies? yeah, I get it now. I dont think i'll be going back to the kmart 8-pack anytime soon.

I don't hold shares (although that might change), and certainly not trying to suggest others should, but just offering some customer feedback.

I do wonder how easily others copy what they've done -- it's hard to spot a moat here. But as @mushroompanda said "sometimes it only takes being 1% better here, and another 1% better there, and it adds up to become and multi-year growth story. How did Under Armour, Hoka shoes, or Lululemon become success stories in highly saturated markets? Did they have a clearer moat when they were fledgling companies?"

Well, this was one of the easier interviews I've ever done -- Greg is certainly a talker! But also, he came across as very genuine and his enthusiasm is contagious!

This has got to be one of the more impressive start-up stories I've ever heard. Amazing to think he went from his first orders being fulfilled in his bedroom in 2017, to $60m in sales by the time it listed! Even wilder, he was the 100% shareholder at that time because he couldn't secure any funding!! Amazing.

Oh, and it was already profitable then too, and he very much seems to be a conservative manager of cash (hard lessons learned from previous endeavours)

Another mind blow -- the Sydney head office has 10-12 people, according to Greg. It's an extremely lean affair -- they outsource everything -- manufacturing, logistics etc. The big exception being advertising; they don't use agencies.

So the model is very capital light. As Greg says they can afford to try a lot of things without risking too much (eg new geographies, ranges etc)

The fact they can deliver such strong sales and earnings growth AND payout 100% of earnings as dividends is testament to that. And the balance sheet is rock solid (although I have emailed him to clarify that - he said they had #38m in cash, as does the investor preso, but the Balance Sheet reports $28m.. I think someone has referenced the wrong year when putting the slide deck together)

The move into womens undies seems like a no-brainer, and the numbers reported today show really strong growth. I suggested this would double the TAM, but as Greg said it actually triples it because women (in general) spend twice as much as men in this area.

Another interesting thing Greg mentioned was a desire to build a legacy for his grand children. Maybe he's just saying things that sound good, but it may reveal a longer term focus.

The other thing that stood out with these results were how they contrast to other retailers. Yes, it's tough out there, but there's clearly something about their brand that people are still more than happy to pay up for relatively expensive undies.

At present, you have a business on 15x EV/EBITDA, which doesnt seem excessive at all.

I'm not a shareholder, but that may change! Hoping others can throw some cold water on it for me.

STP trades up 17% this arvo

An update was out this morning. I was expecting Revenue/PBT for 2H to be $36.3m/$5.8m (assuming PBT margins matched pcp of 16%) and it's coming in at around $39m/$7.2m. So revenue and PBT a bit better than my expectations in a seasonally weaker half.

The full year results will be interesting. In particular on the commentary around its expansion in the UK and the US. Shipping into the US increased dramatically in the past 6 months, and this should be a leading indicator that they're doing quite well there.

(sourced from import genius)

PS: The undies are on special on Amazon right now during its Prime Day sale. I've taken the opportunity to upgrade my threadbare ones.

This is an interesting one. Reported half yearly results today. Hit record revenues and profits (+25%, +38% respectively vs pcp) surpassing the numbers reached during the height of the pandemic. One of the very few ecommerce retailers to do so!

This is an interesting one. Reported half yearly results today. Hit record revenues and profits (+25%, +38% respectively vs pcp) surpassing the numbers reached during the height of the pandemic. One of the very few ecommerce retailers to do so!

Seems to have got the results by doing upsell promotions; by getting customers to buy more in a single order. As a result, average order size and the items per order have both increased, while the revenue per order decreased. So pushing more volume, for slightly lower prices. But margins have remained high, so the strategy is working.

A pleasing aspect of the result has been the performance of the UK and US divisions up 38% and 256% (tiny base) respectively. UK’s average order size has been moving towards that of Australia’s. While the US’s return customer metric has been improving and is now well above 40%. This will be the true upside for the company should they get those geographies rolling.

I like the candour of the management team. During the conference call, they mentioned that customer acquisition costs (CAC) is not solely about acquiring new customers. There is no way of attributing cost to new or returning customers. Which is the absolute truth - returning customers will still click on Google Ads! I haven’t heard of any ecommerce companies describe it like this.

One area to watch I touched on last time is the inventory levels. They’ve been able to run this down substantially in this half, and is consolidating the range of products. So a tick there.

At $1.40, it’s on a EV/E of 19 and pay around a 4.2% fully franked dividend.

Step One plans to report its 1H24 financial result on 20 February 2024.

ESG and what about the carbon credits..

Share price stepping up Nice.. As long as this price avoids the 'elevator' on the way down well it should be ok here.

Price reaction up 11% this morning

Step One details behind-the-scenes scramble ahead of profit warning

by Simon Evans, Senior Reporter, AFR, 19-May-2022 - 4:13pm

Underwear group Step One has been forced to detail the behind-the-scenes scramble that led to its dramatic profit downgrade on May 16.

The ASX issued a “please explain” compliance notice asking when Step One became aware of the large profit declines, with the company on Thursday replying with a blow-by-blow description of the events that included hasty phone calls to some board members last week.

Step One chief executive and founder Greg Taylor.

Step One, founded in 2017 by former rower Greg Taylor, promises a “no-chafing” experience to wearers of the bamboo fibre underwear. The stock reached $3 on November 19 in the weeks after a float when the issue price was $1.53, but its shares halved to 22¢ on Monday after the downgrade was announced to the ASX. The shares recovered slightly on Thursday to 35¢.

Step One told the ASX on Thursday in its reply to the compliance query that the extent of the deterioration in the group’s trading and full-year outlook didn’t become clear until the evening of May 11.

The company then re-worked some of its forecasts that night.

“Given the significance of the possible deterioration, management consulted with available board members between 9.49am and 9.55am on Thursday May 12 and agreed that additional time was required to validate both the new data and the reforecasting”.

The company secretary rang the ASX requesting a trading halt in a phone call which lasted two minutes from 10am on the same Thursday, and that was granted. The board and senior management worked over the weekend to further validate the situation and approve an announcement, which went to the ASX on May 16.

Step One said it complied with the ASX’s listing rules in the lead-up to the profit slide announcement.

The company on May 16 said profits for financial year 2022 were expected to be less than half of what was forecast seven months ago.

The group found the going much tougher than expected in both the US and the UK. It projected losses in the US would blow out to $3 million this financial year. The chairman of Step One is David Gallop, a former CEO of both the National Rugby League competition and Australia’s governing body for soccer, Football Federation Australia.

Chief executive Taylor said on May 16 he was disappointed to have to bring bad news to investors but the “challenges are by no means insurmountable”. The company has begun selling a small range of its products on Amazon.com to try to help build more awareness.

--- --- ---

Simon Evans writes on business specialising in retail, manufacturing, beverages, mining and M&A. He is based in Adelaide. Connect with Simon on Twitter. Email Simon at [email protected]

Further Reading:

Step One underwear group suffering overseas growing pains (afr.com) Simon Evans, 16-May-2022, "Rapid shrinkage for Step One underwear group"

Step One founder Greg Taylor sells in float, skips wedgie (afr.com) Myriam Robin, Columnist, AFR, 16-May-2022.

Step One hopes UK rugby star will fix British stumble (afr.com), Simon Evans, 22-Feb-2022.

Step One back on the horse after early stumble (afr.com), Simon Evans, 17-Jan-2022.

Step One ASX: Bamboo underwear company quickens its pace with a strong IPO (afr.com), Simon Evans, 01-Nov-2021.

Greg Taylor, the founder and CEO of Step One underwear, trimmed his stake in the company from 100 per cent to 66.4 per cent in the IPO. [photo: James Brickwood]

Step One underwear tries US on for size (afr.com), Simon Evans, 12-Oct-2021

Step One wraps up IPO, on track to list late October (afr.com), Anthony Macdonald, Yolanda Redrup and Kanika Sood, 07-Oct-2021.

Step One underwear ready to crack ASX (afr.com), Simon Evans, 16-Mar-2021.

Disclosure: I wear Step One Boxers but I have never owned STP shares either here or IRL. They're like the Red Bull of men's underwear, in terms of their set-up, being basically a marketing company that farms out all of the manufacturing and distribution, and just does the ads and other marketing, but without the Red Bull following and success.

The best of the further reading set above is probably this one:

Step One founder sells in float, skips wedgie

by Myriam Robin, Columnist, AFR, 16-May-2022 - 4:41pm.

Elite rower turned Step One bamboo underwear entrepreneur Greg Taylor made $41.3 million selling 27 million shares at the $1.53 float price when his four-year-old company listed in November. It’s more than the whole shebang is worth these days.

On Monday, Step One’s share price fell 55.2 per cent to 22¢. Its market capitalisation is now $39 million, after it slashed in half the $15.1 EBITDA guidance made in its October prospectus. Taylor’s remaining 123 million shares are currently worth $26 million, or 85 per cent less than they were the day Step One debuted.

Former NRL and FFA chief David Gallop may rue being partially paid in scrip by Step One. [photo: James Brickwood]

Seemingly not blessed with Taylor’s luck is Step One chairman and ex-football administrator David Gallop, who’s being paid partly in rapidly depreciating scrip. In December, he kicked in another $29,806.53 to buy 18,900 shares on-market at $1.58 a pop.

Another loser is Corporate Travel Management’s Jamie Pherous, who bought 150,000 shares in Step One’s float. We suppose Corporate Travel’s ever-loyal house broker Morgans – also the lead manager on Step One’s IPO – brought it to his attention.

Jocks seller/marketing company Step One got pantsed today on news of a significant downgrade to guidance (and prospectus). The U.S. tends to be where businesses from Downunder go to die and they're busy claiming another victim here with the company saying "USA revenue growth has occurred at a lower rate than expected, as we are working to establish our brand...". The chicks range of jocks also is cited as being a drag. This would come as no surprise to anyone who has had a look at it - I'm no expert when it comes to women's underwear (ok maybe one time) but it looked pretty underwhelming. @Slew flagged this in an earlier post. News that the company expects to spend 46% of revenue on marketing would be enough to make investors fill their jocks.

After listing at $1.53 and reaching a peak of $3.13 just six months ago management were strutting around like Harry Hipants. Today's update caught them with their pants down and shares are trading around 21 cents.

The business was originally well covered by analysts but with a market cap of less than $40m they're likely to have less coverage than a mankini.

[Not held]

Product review womens small.

I received my womens step ones last week and hate them. The rise is way too long 10 to 15 centimetres in my opinion which means they protrude excessively over the top of all my clothes which sit on the hipline not the waist.

The fabric is different to the mens, it's thinner with an increased amount of spandex, 7% versus 4% in the mens, which means they are much clingier. I found I was constantly having to dig them out of my behind.

Given the feedback/reviews from women wearing the men’s product, I thought I’d better try the mens pair. Apart from the obvious bunching in the front, they fit much better, the heavier fabric doesn’t ride in and the rise is shorter. Are there going to be disappointed women’s buyers out there?

After a couple of hours I requested a refund on the money back comfort guarantee and it was a painless experience. (Finding the return button wasn't super clear, you have to email, visibility on the website could be improved.) I had an answer offering a refund or a different size within an hour, I declined the replacement pair and had a payment credit pending on my credit card within three hours.

This experience backs up my initial thoughts on the women’s range that it has missed the mark. It also reinforces my opinion that the womenwear market has a lot more variables and is a lot harder to crack. I showed the product to a couple of girlfriends who were going to test them for me and they couldn't even bring themselves to buy them, one comment was hideous and the other was they are too high in the waist.

So my question for management, (hopefully in the earnings call next month) is what percentage of returns are they getting on the women’s and what is the size breakdown of sales. I am still wondering if the product has appeal for larger sizes.

I am unconvinced the women’s range is on the right track, cut, colour and fabric composition, doesn’t really leave anything else except a positive return experience!

I have a few points to add to Reece’s report and a different perspective on a few things.

Manufacturing

Step one could be viewed as marketing machine who do not control their manufacturing and I appreciate the comparison to A2M but I’m not sure it is relevant in the textile business. Basically all fashion labels outsource their production, from the big names Nike right down to the mass retailers. The good operators have steady long term relationships with factories and rely on them for sampling through to production, it is a system that has worked well in the past. Perhaps more recently the risks to a solely china manufacturing base have increased with the policy changes from Xi. I’m sure there are factories in Vietnam etc that could manufacture the product, what I don’t know is how readily available the ethical bamboo fibre is. If the yarn needs to be sourced from China there may be little advantage in manufacturing elsewhere. This is probably my key risk to the manufacturing process and it would be interesting to know if there is a contingency plan for a supplier base outside China.

Marketing

All fashion is marketing so in this regard Step one is no different in cultivating a brand and customer love for the product.

Customer acquisition will be hard in the space, especially overseas as a new brand. I think the only way to grow is through clever organic marketing on social platforms etc, and to build brand awareness. If the website traffic is generated from direct brand searching, I’m unsure if the google algo will have such a big impact?? I’ve noted Reece thinks this may be an issue with SEO.

Distribution

This needs to be fixed and is completely in the control of Step one. If customers love a product, they will cut some slack for poor delivery, especially as they actively advised customers on delays and upgraded product to express deliveries, but I suggest you can only get away with this once. Greg confirmed on the last investor call, delayed delivery of product to customers from the black Friday sales impacted Christmas sales as no repeat orders were made before initial product orders were received, this had a big impact on UK sales.

Womenswear:

Initial reviews on line hit the following points

· Endorsing fit/comfort,

· Comments around lack of bright colours and prints.

· Several request for larger sizes, current ranging XS-3xl (22), this surprised me

· Positive response to using advertising models in all sizes, small to big.

· Appears to be a bit of a fan club already, aka the men’s range.

Larger sizes womenswear

I have been wondering if they are tapping into a under serviced niche in larger women’s sizes. If you are plus sized, a fuller brief for support, (ie it sucks everything in) is a better option. Such underwear does exist but it looks like your grandmothers bloomers, not what you want if you in 30’s, well any age really. There may also be a comfort benefit in the longer trunk as they are less likely go up your arse and chafe, as sizes increase this is a bigger problem. Fashion companies often use the perfect size 10-12 when developing ranges, once these designs are scaled up beyond a certain size the styling/cut no longer functions well.

Plus sized womenswear, especially for young people is very under serviced, it often looks dowdy. (Big size menswear is similar) The common women’s size range is 8-16/18, but a lot of women are bigger than that. (City chic has had success tapping into this market, I think there is definitely room for improvement in plus size underwear as well)

I really like the sizing and colour display on the website, if you click on your size the accompanying product picture shows a model in your size. This is great, nothing worse if you’re a size 18 looking at a garment on a size 8 model.

Styling womenswear

I have a hunch women will appreciate the underwear for certain activities and clothing choices. I’m thinking they will perform well under jeans and ski pants. However I’m not sure women, even those who love them will wear them all the time. Unlike blokes who wear the same jocks everyday, I suspect women will be more likely to chop and change depending on the day/occasion.

The exception to this may be the plus sizing for the reasons mentioned above.

Womenswear: sell through

As of today this is the current sell through on colours and sizes as per the website availability. I’m not reading too much into this as we don’t know the initial starting ratios in each colour and size. Black is virtually sold out, I’m hoping they anticipated this and had 4-5 times the product in black, as this was obviously going to be the best seller. If you are a M or L the only colour now available is mahogany.

ESG component

I find this amusing, by nature bamboo is far less water intensive and uses no chemicals to grow, its basically a weed in the right conditions. So yes it is more environmentally friendly than cotton. However it is worth considering that there are 2 ways to process the bamboo into yarn, naturally or mechanically, which basically means lots of chemicals. According to Step one their bamboo is broken down with a mould process, so it is a natural process and is more expensive.

I’d suggest a lot of the bamboo fabric on sale is not processed in an environmentally safe method and is riding on the coattails of a being a perceived green product. Further detail here https://fairware.com/bamboozled-getting-the-facts-on-bamboo-textiles/

The compostable packaging is a plus re-enforcing the green credential.

Colour ranging

Step ones approach to the colour range seems pretty on track to me. Basically stock your core colours, black, grey, plus a few best sellers and rotate the highlight colours through to create a constant freshness to the product line and new images for marketing. I don’t see the range keeping all the colours once they are released they will be retired for something new and bought back if they get big sell through numbers. I used to develop product and sell menswear into the big discount retailers Big W etc. Black, grey and navy outsold all other colours significantly. However we always had a small amount of a highlight colour orange, red, whatever was in at the time to create interest at the store level. The highlight colours were usually dogs and marked down at the end of the season. However their role was to make the floor stock, merchandising look attractive. Without it the floor looked unappealing and ironically you sold more of the core colours by having the bright lure there. I don’t see that being any different online, the customer gets bored you need to keep the ranging fresh, so it looks different next time they log on, ie. “Look at that pink camo”. The main difference is jocks, being an undergarment, has a much greater colour range that appeals.

The other interesting point from a colour perspective is the men’s range uses the same colour accessories, grey elastic waistband and black inside leg panel, so the only change is the fabric colour which is a small change. This was probably done initially to keep costs down, one less variable. Furthermore the printed designs are done on a white base cloth so fabric can be ready to go and printed as required.

In contrast the women’s range as mentioned on previous straw is a bit dowdy on colour choice. I still think they missed an opportunity here. Lets hope they are nimble enough to respond to the first sales and adjust the ranging appropriately, they have mentioned on socials that prints are coming.

Interestingly they have gone with matching elastic waistbands, which makes sense in the women’s range, but does increase the production cost of the garment marginally depending on volume.

Catalysts

- I’m watching the response to the womenswears

- Reviews and feedback online pointing to sales in the US & UK

- Expecting management feedback on the womenswear range release at Feb reporting

Questions

What % of sales are returned on comfort guarantee?

What is the % of first time customers put in a 2nd order?

Step one released their women’s range today and in one word disappointing!

The colour range is woeful.

I’m really unsure who this range was product tested on? In the last trading update webinar Greg mentioned the range is ready and had been consumer tested with a positive response, is this just the fit or the colours too?

In my opinion the women looking for this sort of product are not looking for a traditional range of colours, it is not a traditional brief.

Yes you need the basics, black, grey and beige but there are no fun colours or prints. I feel this has really missed the mark and opportunity to appeal to a broad range of first time buyers.

I have some women lined up to test the product but I know they were looking for something far brighter/fun, orange/cameo aka the men’s range.

Australian brand Boody do a terrific range of women’s bamboo underwear, reasonable priced, great styling and colour range. The step one colours seem to echo their range, mmmm.

https://www.boody.com.au/collections/womens-bikinis-briefs

Knobbys also have a womens range which is now far more appealing in this category

https://knobby.com.au/collections/womens-underwear?uff_fkp63j_tags=Boyshort

In conclusion I felt the release of the women's range could have been the catalyst for the next stage of growth for the company, having seen the range I have serious doubts about this.

Held in SM to monitor, I won’t be buying in RL, Female/ex ragtrader