I have a few points to add to Reece’s report and a different perspective on a few things.

Manufacturing

Step one could be viewed as marketing machine who do not control their manufacturing and I appreciate the comparison to A2M but I’m not sure it is relevant in the textile business. Basically all fashion labels outsource their production, from the big names Nike right down to the mass retailers. The good operators have steady long term relationships with factories and rely on them for sampling through to production, it is a system that has worked well in the past. Perhaps more recently the risks to a solely china manufacturing base have increased with the policy changes from Xi. I’m sure there are factories in Vietnam etc that could manufacture the product, what I don’t know is how readily available the ethical bamboo fibre is. If the yarn needs to be sourced from China there may be little advantage in manufacturing elsewhere. This is probably my key risk to the manufacturing process and it would be interesting to know if there is a contingency plan for a supplier base outside China.

Marketing

All fashion is marketing so in this regard Step one is no different in cultivating a brand and customer love for the product.

Customer acquisition will be hard in the space, especially overseas as a new brand. I think the only way to grow is through clever organic marketing on social platforms etc, and to build brand awareness. If the website traffic is generated from direct brand searching, I’m unsure if the google algo will have such a big impact?? I’ve noted Reece thinks this may be an issue with SEO.

Distribution

This needs to be fixed and is completely in the control of Step one. If customers love a product, they will cut some slack for poor delivery, especially as they actively advised customers on delays and upgraded product to express deliveries, but I suggest you can only get away with this once. Greg confirmed on the last investor call, delayed delivery of product to customers from the black Friday sales impacted Christmas sales as no repeat orders were made before initial product orders were received, this had a big impact on UK sales.

Womenswear:

Initial reviews on line hit the following points

· Endorsing fit/comfort,

· Comments around lack of bright colours and prints.

· Several request for larger sizes, current ranging XS-3xl (22), this surprised me

· Positive response to using advertising models in all sizes, small to big.

· Appears to be a bit of a fan club already, aka the men’s range.

Larger sizes womenswear

I have been wondering if they are tapping into a under serviced niche in larger women’s sizes. If you are plus sized, a fuller brief for support, (ie it sucks everything in) is a better option. Such underwear does exist but it looks like your grandmothers bloomers, not what you want if you in 30’s, well any age really. There may also be a comfort benefit in the longer trunk as they are less likely go up your arse and chafe, as sizes increase this is a bigger problem. Fashion companies often use the perfect size 10-12 when developing ranges, once these designs are scaled up beyond a certain size the styling/cut no longer functions well.

Plus sized womenswear, especially for young people is very under serviced, it often looks dowdy. (Big size menswear is similar) The common women’s size range is 8-16/18, but a lot of women are bigger than that. (City chic has had success tapping into this market, I think there is definitely room for improvement in plus size underwear as well)

I really like the sizing and colour display on the website, if you click on your size the accompanying product picture shows a model in your size. This is great, nothing worse if you’re a size 18 looking at a garment on a size 8 model.

Styling womenswear

I have a hunch women will appreciate the underwear for certain activities and clothing choices. I’m thinking they will perform well under jeans and ski pants. However I’m not sure women, even those who love them will wear them all the time. Unlike blokes who wear the same jocks everyday, I suspect women will be more likely to chop and change depending on the day/occasion.

The exception to this may be the plus sizing for the reasons mentioned above.

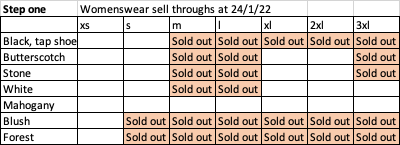

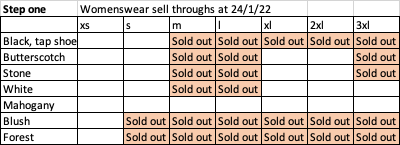

Womenswear: sell through

As of today this is the current sell through on colours and sizes as per the website availability. I’m not reading too much into this as we don’t know the initial starting ratios in each colour and size. Black is virtually sold out, I’m hoping they anticipated this and had 4-5 times the product in black, as this was obviously going to be the best seller. If you are a M or L the only colour now available is mahogany.

ESG component

I find this amusing, by nature bamboo is far less water intensive and uses no chemicals to grow, its basically a weed in the right conditions. So yes it is more environmentally friendly than cotton. However it is worth considering that there are 2 ways to process the bamboo into yarn, naturally or mechanically, which basically means lots of chemicals. According to Step one their bamboo is broken down with a mould process, so it is a natural process and is more expensive.

I’d suggest a lot of the bamboo fabric on sale is not processed in an environmentally safe method and is riding on the coattails of a being a perceived green product. Further detail here https://fairware.com/bamboozled-getting-the-facts-on-bamboo-textiles/

The compostable packaging is a plus re-enforcing the green credential.

Colour ranging

Step ones approach to the colour range seems pretty on track to me. Basically stock your core colours, black, grey, plus a few best sellers and rotate the highlight colours through to create a constant freshness to the product line and new images for marketing. I don’t see the range keeping all the colours once they are released they will be retired for something new and bought back if they get big sell through numbers. I used to develop product and sell menswear into the big discount retailers Big W etc. Black, grey and navy outsold all other colours significantly. However we always had a small amount of a highlight colour orange, red, whatever was in at the time to create interest at the store level. The highlight colours were usually dogs and marked down at the end of the season. However their role was to make the floor stock, merchandising look attractive. Without it the floor looked unappealing and ironically you sold more of the core colours by having the bright lure there. I don’t see that being any different online, the customer gets bored you need to keep the ranging fresh, so it looks different next time they log on, ie. “Look at that pink camo”. The main difference is jocks, being an undergarment, has a much greater colour range that appeals.

The other interesting point from a colour perspective is the men’s range uses the same colour accessories, grey elastic waistband and black inside leg panel, so the only change is the fabric colour which is a small change. This was probably done initially to keep costs down, one less variable. Furthermore the printed designs are done on a white base cloth so fabric can be ready to go and printed as required.

In contrast the women’s range as mentioned on previous straw is a bit dowdy on colour choice. I still think they missed an opportunity here. Lets hope they are nimble enough to respond to the first sales and adjust the ranging appropriately, they have mentioned on socials that prints are coming.

Interestingly they have gone with matching elastic waistbands, which makes sense in the women’s range, but does increase the production cost of the garment marginally depending on volume.

Catalysts

- I’m watching the response to the womenswears

- Reviews and feedback online pointing to sales in the US & UK

- Expecting management feedback on the womenswear range release at Feb reporting

Questions

What % of sales are returned on comfort guarantee?

What is the % of first time customers put in a 2nd order?