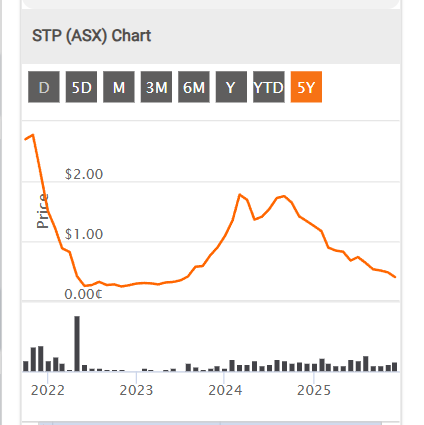

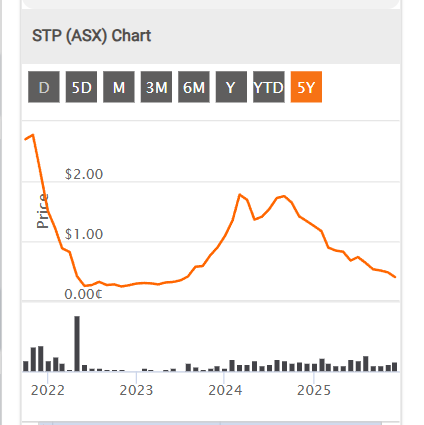

Today 26.5cps ..Ouch

https://hotcopper.com.au/threads/ann-1h26-trading-update.8922100/

ASX Announcement 4 December 2025 :

Step One Clothing Limited 1H26 Trading Update Step One Clothing Limited (ASX:STP) (“Step One” or “the Company”), a leading online, direct-to-consumer innerwear brand, today provides the following trading update for the first half of FY26 (1H26). Based on year-to-date trading, including estimates for December, Step One expects its 1H26 financial results to fall within the following ranges:

• 1H26 revenue is expected to be between $30 million and $33 million, which represents a decline of between 31% to 37% on the prior corresponding period (1H25: $48.1 million)

• 1H26 EBITDA is expected to be a loss of between $9 million and $11 million (1H25: $11.3 million profit), including a $10 million provision for inventory obsolescence

The recent sales results were materially below expectations, and our efforts to clear older and slower moving inventory were not successful. As a result, the Company has raised a $10 million obsolescence provision against this legacy stock. This inventory is now fully provisioned, and no further material provisions are anticipated at this stage.

The combined impact of softer sales and this one-off inventory provision has led the Company to reassess its full-year outlook. As the implications of these factors are still being evaluated, the FY26 EBITDA guidance previously provided is withdrawn, and no updated guidance will be issued at this stage.

The Company will update the market once greater visibility over trading and inventory outcomes is available. These estimates are preliminary and subject to trading conditions over the remainder of the reporting period, including pre- and post-Christmas sales, foreign exchange movements, and logistics timings.

The financial results remain subject to auditor review. Step One plans to report its 1H26 financial result on 18 February 2026.

-ENDS

This announcement was authorised for release by the Board of Step One Clothing Limited.

Return (inc div) 1yr: -81.16% 3yr: 8.08% pa 5yr: N/A

STP - The 5 year life of STP = from pre -profit , profit, now less Profit