Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Interesting they picked this Australian Small Cap fundie favorite as the key pick.

5 long and short stock calls from Sohn London - Chris Conway | Livewire

LIFE360 (ASX: 360 / NASDAQ: LIF) — Short Call by Priya Kodeeswaran (Katamaran Capital)

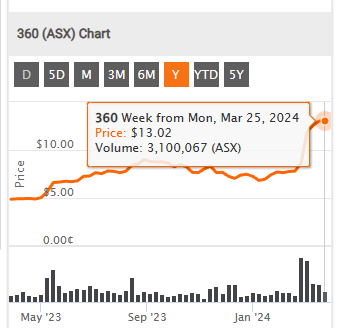

Life360 1-year price chart (Source: Google Finance)

Katamaran Capital’s Priya Kodeeswaran argued that Life360 “monetises parental anxiety” but faces rising competition from free location-tracking services embedded in Apple and Google ecosystems.

He highlighted the company’s heavy reliance on U.S. paid subscribers and low conversion rates abroad, forecasting up to 40% share-price downside.

Let the straw people know about the Pets,

Consumerism:

Getting Started with Jiobit for Pets Beta in the Life360 app

Jiobit for Pets Beta is a GPS Tile tracker designed to help you monitor your pet in the Life360 app, no matter where they wander. It offers peace of mind with real-time location tracking.

Note: Available to members in the US only. A Life360 Gold annual membership is required.

Jiobit is Out of stock:

https://www.amazon.com/Jiobit-Lightweight-Resistant-Real-Time-Long-Lasting/dp/B0BG38VSK8

Published 15/08/2025, 01:12 am

Market Position and Competition

Life360’s freemium business model has been identified as a key strength, creating significant competitive moats and lowering customer acquisition costs. The company’s unique position in the market, offering real-time location sharing and communication services specifically tailored for families, has allowed it to maintain strong growth with minimal direct competition.

International Expansion

Life360’s international growth has been particularly impressive, with international MAU growing by 35% year-over-year. The company has seen strong performance in international metrics, including MAU and ARPPC growth. This global expansion is expected to continue, with the upcoming launch of pet-related services in international markets set to drive further growth

Bear Case

How might macroeconomic uncertainties affect Life360’s growth?

While Life360 has shown resilience in the face of economic challenges, macroeconomic uncertainties could potentially impact consumer spending on subscription services. Economic downturns might lead to reduced discretionary spending, potentially affecting the company’s ability to convert free users to paying subscribers or retain existing premium users..

Bull Case

Life360’s strong international MAU growth of 35% year-over-year demonstrates significant potential for global expansion. As the company continues to localize its offerings and tailor its marketing strategies to different regions, it could tap into large, underserved markets.

The planned launch of pet-related services in international markets in Q4 2025 could accelerate this growth, providing a unique selling proposition in new territories. Additionally, the company’s experience in navigating different regulatory environments and cultural norms around location sharing and privacy could give it an advantage as it expands globally.

International expansion also provides an opportunity to diversify revenue sources geographically, potentially reducing reliance on any single market and providing a hedge against regional economic fluctuations

SWOT AnalysisThis analysis is based on information available up to August 14, 2025.

Strengths:

Strong user growth and engagement

Unique freemium business model with low customer acquisition costs

Valuable first-party location data

Diverse product offerings (location sharing, communication, pet tracking)

Weaknesses:

Dependence on app store policies for distribution and payments

Potential privacy concerns related to location tracking

Reliance on subscription model in a competitive app market

Opportunities:

Expansion into pet tracking and elder care services

International market growth

Increased monetization through advertising and partnerships

Integration of Tile technology for expanded tracking capabilities

Threats:

Macroeconomic uncertainties affecting consumer spending

Potential new entrants or increased competition in the family safety app market

Changes in app store policies or regulations regarding data privacy

Technological changes affecting location tracking or smartphone usage

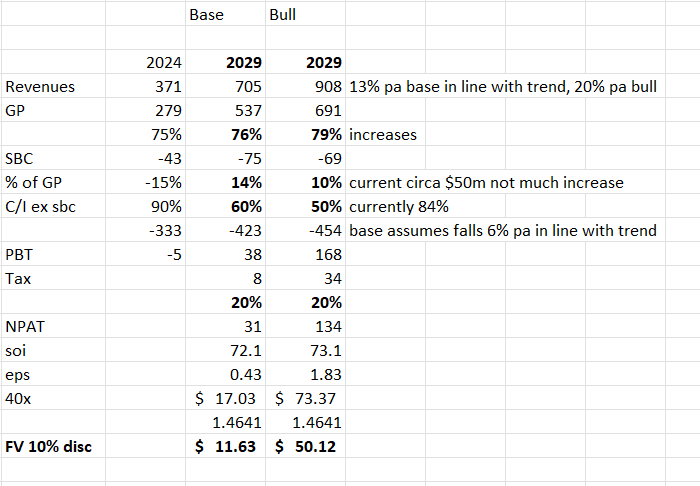

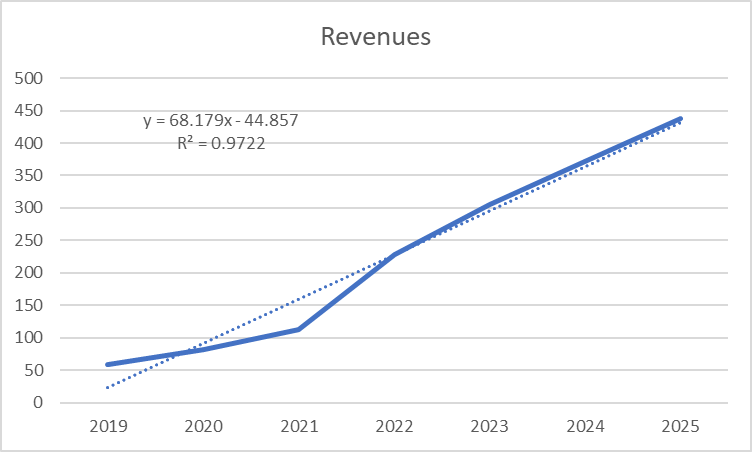

I haven't looked at this one for a few years. It was around $ 4 per share then, and my conclusion was that it had potential. However, knowing my luck, I felt that two weeks after I invested in it, AAPL or GOOG would decide to end 360's life. Maybe that's wrong; maybe the TAM here is just too small for the big boys to bother with, and it ends up as a small, growing, profitable niche or sells out. Whatever, so i decided to do a valuation based on a forward estimate of the 2029 P&L under a base case and bull case scenarios. main assumptions, and there are a few in bold. the most sensitive is the cost ratio on a mature basis or operating leverage, in other words. The conclusion is a very wide range of outcomes.

I'm interested in any Bulls' views on what they see differently.

if anything in the post-GFC investing world, we see winning biz models keep winning and valuations lag, so I'm following this one, its likely to be volatile given the sensitivities.

Monthly Active Users Reached Approximately 88.0 million; Up 25% Year-Over-Year Record Q2 Global Net Additions of 136 thousand Paying Circles, Reaching 2.5 million Total Total Quarterly Revenue Increased 36% Year-Over-Year to $115.4 million Annualized Monthly Revenue Increased 36% Year-Over-Year to $416.1 million

Full-Year Outlook for Revenue and Adjusted EBITDA Raised Based on Year-To-Date Performance SAN FRANCISCO, California. Life360, Inc. (“Life360” or the “Company”) (NASDAQ: LIF, ASX: 360), the provider of the market leading family safety and connection mobile application, today announced unaudited financial results for the second quarter (“Q2”) ended June 30, 2025.

Motley fool article below, before the Tuesday Results say:

Life360 results

Life360 Inc (ASX: 360) shares will be on watch today when the location technology company releases its second quarter update. According to a note out of Bell Potter, its analysts are forecasting a 29% increase in revenue to US$109.1 million and a 16% lift in adjusted EBITDA to US$12.8 million. This is expected to be driven by a 26% jump in global monthly active users to 88.6 million and a 24% increase in paying circles to 2.52 million.

I see Life 360 hit the targets in Q2: Users 88Mill, Reach 2.5mill, Revenue of $115.4mill exceeded expectations.

https://hotcopper.com.au/threads/ann-sec-form-8-k.8707720/

Below Life 360 actually has a positive eps of $0.09

Net income: $7,000.000

Weighted av' ord' shares: 76.797,385 ( eps = net profit / # ord' shares)

some slides from the presentation>

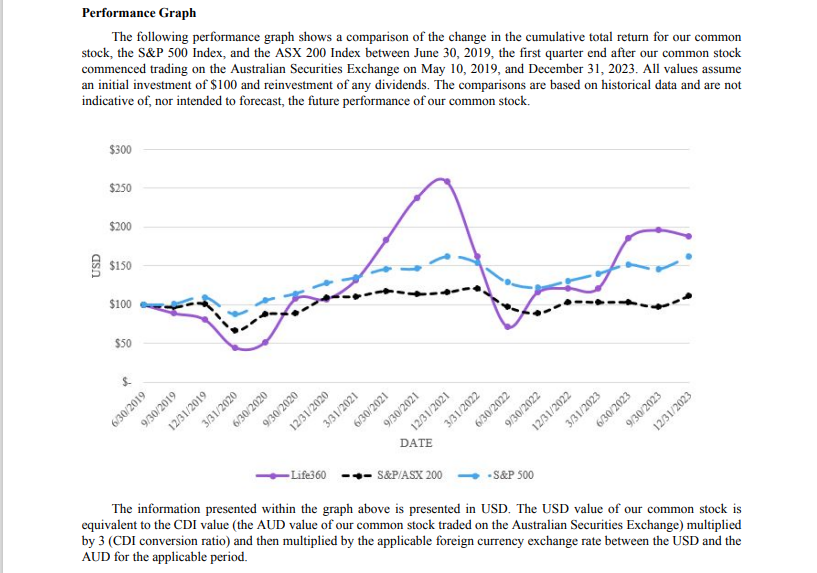

Return (inc div) 1yr: 128.42% 3yr: 95.35% pa 5yr: 59.68% pa

I attended the Ophir Meet the Managers event last night and they had a run down on their investment thesis in Life360.

The part I found interesting was they are selling it as it's making up too much of their portfolio. They also said it will run another 8 times... so a little conflicted with their comments.

I have 2 young kids and I don't like the idea of them knowing that I know where they are at all times. Trust with kids needs to be earnt and they need to be empowered to go down the road to the shops or whatever. I acknowledge there are cases where it is appropriate. It's a little different if you're lending your 17yr old your car when they're on their P plates and you want some piece of mind they're going to the right place and not being idiots on the road.

I won't be using the app on moral grounds, unless my kids turn out to be numbskulls...

Some of their summary from my notes:

- subs growing at 30%pa

- market expects MUA growth to slow, Ophir thinks the market is wrong. The adoption curve is still early in the global side.

- Subscription upside - Pets, Elderly, Driving behaviour. Life360 already know your data on where you go, what you do, if you have a pet, if you've been visiting your parents at the aged care home, etc. and then adding these upgrades to existing users is a slam dunk. Don't need to spend mega marketing money as they already know who you are!

- Advertising revenue - Highlighting Demand Side Platforms and the monetisation of the data. currently sits at $1.50 per MAU/year, Ophir thinks this will get to $5+. which equated to a $550 million EBITDA opportunity. Apparently this isn't priced in.

- They have raised $200m and expect strategic M&A.

Valuation wise, they are saying it could be an $800m USD revenue --> 30x EBITDA --> $24B AUD. currently $3-4B so 7-8x upside

Discl: Not Held

I have watched ASX:360 from afar but could never quite clearly understand its purpose, why people would sign up to it, what drives the growth, and why it would be sticky.

Fell off my chair when my 16 year old daughter sent me a link to sign up so that she can see where I am. Not sure she fully realised that it cuts both ways - I can see where she is as well, which is the whole point of the app. So, it was a wee bit of a shock to her when I said "Oi, what are you doing in the shop 200m from the library when I thought you were in the library studying ...". But such is the power of social media that despite this, she was pulled to signing up and dragged me into the mix as well.

Anyhow, I signed up and took the opportunity to give the app a spin to see the investment case. Comments are my immediate reactions/thoughts only – have not done any prior research into 360, so have no prior context, and comments below could be way off the mark!

Totally welcome any pushback/clarifications to these very raw, dumb initial user thoughts!

THE APP

The App appears to be positioned as a "Location-based security for families" app, so everything is built around the whereabouts of the people in the "circle" (people who you invite in).

Free Version

- Each member of the "circle", can see where the others in the circle are, real time.

- Shows me she is in a car, how fast the car is driving etc – similar to the progress of your Uber/Didi ride in their respective apps

- Can specify 2 set locations and I get alerts if my daughter goes to those locations eg. school

- I can tell how many minutes she has been at the current location

- I can see where she has walked as she walks from place to place

- 2 days of location history

- Crash alerts from driving

- Data Breach alerts – scans for data breaches, presumably based on mobile number and email as it picked up a 2019 breach of my email, pretty basic

Paid – Silver $79.99/yr

- Place Alerts – get notification as Circle members come and go from the specified place – 5 places with Silver, then Unlimited with Gold & Platinum

- Location history ie, where members of my circle have gone for 7 days

Paid-Gold $159.99/yr

- Place Alerts – unlimited, 30 days location history

- Driving Safety on the road - Crash Alerts with 24/7 Emergency Dispatch

- Individual Driver Reports – know how (and what) your family is doing behind the wheel when they drive – the app detects driving behaviour via motion and the GPS from the phone

- Roadside Assistance

- SOS with 24/7 Emergency Dispatch

- ID Theft Protection – USD25k reimbursement from stolen funds from a data breach

- Stolen Phone Protection - $500 for replacement cost

Paid -Platinum $249.99/yr

- ID Theft Protection – USD1m reimbursement from stolen funds from a data breach

- Stolen Phone Protection - $1000 for replacement cost

- Disaster Response – get help in life-threatening situations like natural disasters, active shootings or disease outbreaks

- Medical Assistance – looks like links to telehealth manned by nurses, medical referrals etc

- Travel Support – help with travel arrangements, lost luggage, translator services etc

THOUGHTS ON APP

It thus feels like a “family safety/family tracking/concierge” app. With all the drama’s in the US, impacting personal safety, I can see the attraction of the app – the cost is really small for all the benefits IF the family members get caught up in some strife. With less strife in Australia, in relative terms, I do feel the cost seems a wee bit high relative to the value.

The “value add services” differentiates 360 from basic WhatsApp/iPhone live tracking etc and that is what drives the value/decision for the paid subscriptions.

It also feels that country expansion is not quite automatic – the value add services need to be set up in each country before the subscriptions can fully kick in for that country.

The key issue is getting family members to actually agree to being tracked to the n-th level 24/7. Which is what surprises me the most – that my 16 year old would WANT to be trackable like this. I know my older girls would be dead against this level of tracking. It is really extremely creepy to be able to access so much location detail. As I am writing this, I am actually trying out the texting capabilities within the app to tell her I know exactly where she is to see if I would provoke an adverse reaction. And as I expected, this reality is creeping her out ...

So perhaps the key is to start the app going when the kids are just getting a phone (and make the app a condition to getting the phone) so that it becomes part of the family thing that carries through as the kids get older. The issue also extends to the adults and whether the parents will also consent to be tracked ad nauseum. I personally don’t have an issue with being tracked, but there will be a lot of parents/adults who will deeply resent being tracked like this.

RISKS

The risk then is that as kids get older, they will resent being tracked like this and once they reach high school or Uni, the 360 family unit starts to “break down” and subscriptions are downgraded or stopped. I wonder if there are demographics or churn-related stats to see how prevalent this is or is not.

It would also be interesting to research the duration of subscriptions and whether there is an implicit fixed lifespan. Assuming kids get phones when they are say 10 years old, Years 4-6 maybe (out of security fear), and assuming they get antsy being tracked when they hit 15 or 16, which means a contract duration of 6-10 years, after which churn could rise.

Family breakdowns could also be another reason for churn.

INVESTMENT CASE?

With, admittedly my perceived, teenager and human aversion to being tracked, 360 does not feel water-tight “sticky” as my other SAAS companies like CAT, XRO which are deeply integral to the team or operations of the customers.

It does feel like there is a natural cliff when location-tracking not only stops being useful in a family, but could cause internal strife such that it creates a jump-off point for subscriptions. Am also curious as to whether Life360 has been around long enough to confirm or debunk this unease.

I was quite surprised with the availability of the additional security services – that does make sense for a family. But from this list, I wonder what else “safety-related” that can be added to the app that would add further value to the family that justify future cost uplifts.

SUMMARY

With the growth in the price, and my perceived less than water-tight subscription stickiness, I think I will give this a pass for now.

Friday: 360 finished up 7% so that warms the heart..

https://hotcopper.com.au/threads/ann-q424-media-release.8470818/

https://hotcopper.com.au/threads/ann-q424-investor-presentation.8470836/

Financials:

With the notable exception of @raymon68 this stock seems to get no love on SM. I've held for a while IRL and watched it grow and an impressive rate to the point where it now has 13% penetration of the US smartphone carrying population. It's financials are rapidly tilting towards profitability and with the huge number of people now using the app, opportunities for monetization seem everywhere...

I've always held back a little on the oft raised concern 'is this business simply going to become Apple's feature' but I think that risk is decreasing with time. It now seems more likely it will continue to be a standalone function and anecdotally I hear more and more people using the app. Tailwinds exist in the shittiness of the world unfortunately and people's desire to keep an eye on loved ones...

How to value such a business... I think they could easily be sitting on a 100mil net profit in 2029 which on a PE of 25 would see them 2.5 Bil. Funnily enough that discounts back roughly to 1.5 bil now which is where they sit... ?fairly valued?

Uber joins the platform as a key partner, integrating with Life360's Landing Notifications to provide timely transportation options and launching targeted ads to parents of teens for Uber teen accounts. These accounts allow teens aged 13-17 to request their own rides and order food, all with parental supervision and essential safety features built into the experience.

To help bolster the growth of the Life360 Advertising Platform, the company has appointed Google veteran Brian McDevitt as its first-ever Vice President of Ad Sales and Strategy. McDevitt will focus on building, scaling, and running Life360's ad business globally.

I found some information below:

Life 360 Blog: 5 Uber Safety Tips for Women | Ride Sharing Safety | Life360

Life360: Live Location Sharing – Apps on Google Play

Life360: Find Friends & Family on the App Store (apple.com)

Compatibility

iPhone

Requires iOS 15.3 or later.

Disc: I don't currently use the 360 app

Disc: RL

Life 360 Opened at $17 , gapped up. Traded positively on the NASDAQ last night. Trading above $17.00 this arvo.

Snap shot of the opening trades here:

Dics: holding

Life360 Chief Financial Officer Russell Burke noted, “We continued to take meaningful steps on our path to profitability during the quarter, and our U.S. IPO enhanced our strategic flexibility.” Burke continued, “While costs from the U.S. IPO impacted our Net Loss versus the prior year, we achieved our seventh consecutive quarter of positive Adjusted EBITDA1 , and our fifth consecutive quarter of positive Operating Cash Flow.

Our commitment to balancing growth with expanding profitability was reflected in our Q2’24 results, as our total revenue reached $84.9 million and grew 20% YoY, while our total operating expenses increased 12% YoY.

We remain on track to reach our target of sustained positive EBITDA1 in 2025.”

San Francisco area-based Life360, Inc. (Life360 or the Company) (ASX: 360) today announced the launch of its initial public offering in the U.S. (the “Offering”) of 5,750,000 shares of its common stock.

Slide 3 Life360 met or exceeded all of the guidance metrics we provided to the market for 2023. Revenue growth of 33% to $304.5 million, benefited from continued strong momentum in our subscription business, with revenue increasing 44% year-on-year. At the same time, GAAP operating expenses increased just 4% YoY, and reduced 1% YoY when excluding variable sales commissions, reflecting a disciplined approach to cost.

The strong revenue growth combined with cost restraint ,underpinned a greater than $60 million yearon-year improvement in each of net loss, EBITDA and Adjusted EBITDA to $(28.2) million, $(20.8) million and $20.6 million respectively. A similar $60 million improvement in operating cash flow delivered the first full year of positive cash flow of $7.5 million.

Life360’s balance sheet is strong, finishing the 2023 year with cash, restricted cash and cash equivalents of $70.7 million.

I thinking .. We promise the profits.....

Return (inc div) 1yr: 122.56% 3yr: 36.57% pa 5yr: 30.15% pa

Presumably the intent to list in the US is around access to capital… whilst that’s good in theory it leads me to wonder if there’s no plan for near term profitability… thoughts?

Months Total operating expenses are up (Mill) 66,392 Vs 64,722

So Expenses vs Revenue 'game'

360: down 9% at open today

Life360 has commenced CY24 with strong operating metrics. Global Monthly Active Users (MAU) were 66.4 million at the end of CY24 Q1

Market Update reaction : up 16.9% this morning

Return (inc div) 1yr: 185.48% 3yr: 44.14% pa 5yr: N/A

John Philip Coghlan Chairman

2023 Performance Life360 met or exceeded all of the guidance metrics we provided to the market for CY23.

Revenue growth of 33% to $304.5 million benefited from continued strong momentum in the core Life360 subscription business, which increased 52% year-on-year.

At the same time, GAAP operating expenses increased just 4% YoY, and reduced 1% excluding variable commissions, reflecting a disciplined approach to cost.

The strong revenue growth combined with cost restraint underpinned a greater than $60 million year-on-year improvement in each of net loss, EBITDA and Adjusted EBITDA to $(28.2) million1 , $(20.8) million and $20.6 million respectively. A similar $60 million improvement in operating cash flow delivered the first full year of positive cash flow of $7.5 million.

Life360’s balance sheet is strong, finishing CY23 with cash, restricted cash and cash equivalents of $70.7 million.

Rerview Life360 is a leading technology platform used to locate the people, pets and things that matter most to families. Life360 is creating a new category at the intersection of family, technology, and safety to help keep families connected and safe. The Company’s core offering, the Life360 mobile application, includes features that range from communications to driving safety and location sharing. The Life360 mobile application operates under a “freemium” model where its core offering is available to users at no charge, with three membership subscription options that are available but not required. Our platform recently entered a new era of location tracking services with the successful acquisitions of Jiobit and Tile. By offering devices and integrated software to members, we have expanded our addressable market to provide members of all ages with a vertically integrated, cross-platform solution of scale. For the years ended December 31, 2023 and 2022, Life360 generated: • Total revenues of $304.5 million and $228.3 million, respectively, representing year-over-year growth of 33%; • Subscription revenues of $220.8 million and $153.3 million, respectively, representing year-over-year growth of 44%; • Hardware revenues of $58.2 million and $47.9 million, respectively, representing year-over-year growth of 21%; • Other revenues of $25.5 million and $27.1 million, respectively, representing year-over-year decline of 6%; • Gross profit of $222.6 million and $148.6 million, respectively, representing year-over-year growth of 50%; and • Net loss of $28.2 million and $91.6 million, respectively. Key Factors Affecting Our Performance As we focus on growing our customers and revenue, and achieving profitability while investing for the future and managing risk, expenses and capital, the following factors and others identified in the section of this Annual Report on Form 10-K titled “Item 1A. Risk Factors” have been important to our business and we expect them to impact our operations in future periods: Ability to Retain Trusted Brand. We strongly believe in our vision to become the indispensable safety membership for families, with a suite of safety services that span every life stage of the family. Our business model and future success are dependent on the value and reputation of the Life360, Jiobit and Tile brands. Our brand is trusted by approximately 61 million members as of December 31, 2023, and because we know the value of trust is immeasurable, we will continue to work tirelessly to ensure that we provide useful, reliable, trustworthy and innovative products and services. Attract, Retain and Convert Members. Our business model is based on attracting new members to our platform, converting free members to subscribers, and retaining and expanding subscriptions over time. Our continued success depends in part on our ability to offer compelling new products and features to our members, and to continue providing a quality user experience to convert and retain paying subscribers. We will also seek to increase brand awareness and customer adoption of our platform through various programs and digital and broad-scale advertising. Maintaining Efficient Member Acquisition. Our investment in developing effective services and devices creates an efficient member acquisition model which drives strong unit economics. Our member acquisition model is complemented by our word-of-mouth and freemium models. We accelerate our organic member acquisition with strategic and targeted paid marketing spend. We expect to continue to invest in product and marketing, while balancing growth with strong unit economics. As we continue to expand internationally, we may increase our targeted marketing investments.

Return (inc div) 1yr: 168.03% 3yr: 40.48% pa 5yr: N/A

01 Mar 2024 15:16:111 ViewBy Stuart Condie

SYDNEY--Life360 accelerated plans to sell customer access to third-party advertisers after trials showed no drop in the family safety app's user numbers or engagement, its chief executive said.

The trials indicated that customers viewed exposure to targeted advertising as part of a social contract in having Life360's product for free, Chief Executive Chris Hulls said Friday. Rolling out advertising involved less risk than expanding into new product areas, he told The Wall Street Journal.

Life360 expects revenue from advertising to users of the free version of its tracking and safety app to eventually match its income from subscriptions. The company, which reports in U.S. dollars, generated $200 million in core subscription revenue in 2023.

"Most of our focus to date has been monetizing by having people pay us directly, but 85% of our people don't pay us, and we want to demonstrate we can make money off of them," Hulls said.

Hulls said that Life360's audience is expanding as tech-savvy millennials, who typically have fewer objections to being tracked, have families. Life360 will still screen advertisers and not pitch ads at children on the app, he said.

"We'll just turn it off for very young kids, most likely under 13s in the U.S., that age range. We're going to be thoughtful. We're not going to have anyone advertising to our customers," Hulls said.

Life360, which allows users to see family members' locations and offers paid functions such as emergency service dispatch, has aspirations to widen its product suite further, Hulls said.

"We want to do fintech for kids like a debit card, we want eldercare products, we want special deals for our customers that aren't harvesting but are giving them extra value, we want to have a doc locker for your important documents; there's so many features we can build," he said.

Write to Stuart Condie at [email protected]

(END) Dow Jones Newswires

- Revenue up 33% to US$305 million

- Subscription revenue up 52% to US$200 million

- Adjusted EBITDA of US$20.6 million

- Net loss of US$28.2 million

- Cash and equivalents of US$70.7 million

For the 12 months ended 31 December, Life360 reported a 33% increase in revenue to US$305 million. This was in the middle of its guidance range of US$300 million to US$310 million.

A key driver of this growth was its core Life360 subscription revenue, which came in at US$200 million. This was up 52% year on year and ahead of guidance for a ~50% increase.

Some Slides Below:

Heading to the conference call but on a very quick glance the results and outlook are looking ok but I'll reserve any further opinion until I've had a chance to listen to the call and have a full read of their presentation.

equivalent to approximately US$4 million.

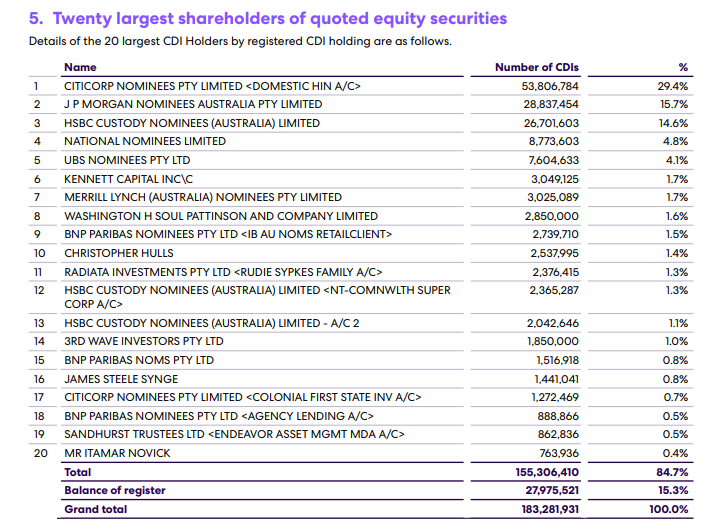

Chris Hull Holding: circa 1,647,061 units

J.P. Coghlan: 201,408 units

3Month Trend Bearish.

Noted: Refer to Annexure!!!!!!!!!! "Com On", I want percentage here.......

Normally the result is in Percent.

16/5/23: Growth Return (inc div) 1yr: 64.96% 3yr: 44.42% pa 5yr: N/A hang yah hat on that

8/9/2022 Bell Potter’s Technology Decoded Conference

This 360 'share price' seems to have run up out of the dip since June 2022

This Price chart is left to right up...ok

at $5.19 up 9% price reaction to the Quarterly Report 11/8/22

Cashflow is gaining momentum.

(Operating cash flow / Total tangible assets) getting more positive

TLTAI (Total liabilities / Total tangible assets) - getting the Liabilities under control.

Market cap: $794mill Liquidity is good 500k plus

52 week high $14.00 Low $2.40

Performance Return: 3M: + 59%, 1yr: - 34% , 3yr: 11.56%, 5yr: NA

all growth no earnings per share! , No dividends here yet. ( zero cashflow for the dividends )

Scalable via subscriptions.

Peers: XRO,WTC, BRN, ALU, TNE, IRE, SDR, BVS, IFM

Life360 vs Xero these businesses have the same profile: widely used / adopted but no profits!

Revenue YOY up 34% and Subscription revenue up 66% YOY

As of Monday 13 March 2023, U.S. time, the Company has regained access to its funds in SVB accounts, and is transacting normally.

SVB It seems – again, we don’t know for sure – that SVB had a similar problem, but rather than being caught out on the availability of funding, like in the GFC, it was rising rates that may have been responsible.

Rising rates (yields) pushes down the value of long term, low-rate bonds. (If you bought a 10-year US Treasury at 2% in the past, no-one is going to buy it off you at face value because they can buy a newer bond at, say, 3% or 3.5%. That means your bonds are worth less.

So a lesson: Don't buy bonds especially when the rates increase ...move from low to high rate environment. Leave it to the experts...lol..

by:Understanding the collapse of Silicon Valley Bank (fool.com.au)

As of March 10, 2023, the Company had cash and cash equivalents of approximately $95.1 million, including $6.1 million in deposits with SVB, and $75.4 million in shares of money market mutual funds managed by Morgan Stanley, Blackrock and Western Asset, which are invested in short-term, AAArated U.S. Government Treasury and Government Agency securities. Although SVB acted as custodian of these accounts, the Company understands that these accounts were not co-mingled with SVB’s assets. As a result, the Company expects that the FDIC should act to liquidate the funds and disburse these amounts, or otherwise make the funds available, to the Company (subject to FDIC confirmation of customer ownership) in the near term, but timing has not been confirmed by the FDIC.

CY23 total revenue growth currently expected in the range of 35% YoY. Positive Operating Cash Flow and positive Adjusted EBITDA1 is expected for the full year CY23

Number of securities: 9,845,930 Voting power: 5.28%

For Android - Google Play & Apple - App store

Chris Hulls, Co-Founder and CEO, and David Rice, COO, of San Francisco-based Life360, Inc. (Life360 or the Company) (ASX:360) will today participate in Bell Potter’s Technology Decoded Conference. The conference presentation is attached.

Return (inc div) 1yr: -48.50% 3yr: 13.13% pa 5yr: N/A

We will see how the investors react to this today. Nasdaq up overnight so could be / should be trading ok.

link: 2924-02565580-2A1397298 (markitdigital.com)

Tile Integration: on Life 360 web page. there are no hints on the Holiday Season offering? Membership offering no clarity on the offer claims ( roadside assistance, Nurse help line .. ect ) on page 19 here.

360 web page: INT'L: Plans & Pricing - Life360

So download & check the features - for the family safety.

Reviews:

1/ Tracking My Teen Driver with LIFE360 HONEST REVIEW at https://youtu.be/ZkQZQp9PoyU

2/ Life 360 GPS Family Tracker App Real Family Review. at https://youtu.be/Q9k4n3QfL4s

still growing Total MAU Quarterly : 35.5mill up to 38.3mill

Average Revenue per subscription growth - ok

- Release Date: 05/08/22

- Summary: Becoming a substantial holder from CGF at 6.36% voting power.

Note that FY's align with calendar years for 360.

During October the 360 SP/Rev multiple was 11.3.

With the combined revenue from Jiobit & Tile Inc and given the similar growth profiles I would expect the same revenue multiple to apply post-acquisition.

Combined revenue US$214M and share dilution to 180M the CY22 SP is A$18.60 (allowing for current A% conversion).

Discount 10% for safety = $16.70.

A report published today discusses the sale of location data by Life360 to various data brokers.

From the article:

Life360, a popular family safety app used by 33 million people worldwide, has been marketed as a great way for parents to track their children’s movements using their cellphones. The Markup has learned, however, that the app is selling data on kids’ and families’ whereabouts to approximately a dozen data brokers who have sold data to virtually anyone who wants to buy it.

and:

...CEO Chris Hulls said in an emailed response to questions from The Markup. “We see data as an important part of our business model that allows us to keep the core Life360 services free for the majority of our users, including features that have improved driver safety and saved numerous lives.”

I don't hold, nor have I followed the company closely, but this seems to be an under reported aspect of the business.

Parents using the app to track their kids location are likely to be concerned about what data is being sold (rightly, in my opinion) and how it is used. The article notes Life360 discloses data sale in the privacy policy.

It may also damage the Tile brand (a recently announced acquisition) if Tile customers share similar privacy concerns.

Trading halt yesterday to announce the purchase of Tile Inc for A$280M (including incentives).

For anybody unfamiliar with Life360 a little background is helpful:

Life360 provides a mobile app platform for family messaging, location safety, driving safety, crash detection & emergency assistance etc. CY21 Revenue US$111M. Life360 is approaching cash flow breakeven and scaling rapidly.

At the CY2020 results release Life360 announced an acceleration strategy to broaden their market reach.

Since this time two key acquisitions have been announced:

1. Jiobit - Provider of wearable location devices with annualised revenue of US$11.7M. Think small children, pets, elderly relatives etc. (Terms include US$54.5M in 360 shares - including performance targets). This acquisition was completed in August 2021.

2. Tile Inc - Operates a global leading platform for finding 'everyday things'. Things like keys, wallet, passport etc. CY21 Revenue of US$103M. (Terms include US$205M funded by cap raise of 23.3M 360 shares at A$12 based on current A$ exchange rate).

Life360 have a Freemium model and offer premium memberships with additional functionality. The acquisitions appear highly complementary and clearly the intent is to drive membership growth in premium subscriptions. I think the combined offering is compelling.

Comments on Tile Inc acquisition:

1. YonY subscription growth >50% (similar to Life360)

2. YonY subscriber growth 26% (same as Life360)

3. Acquisition cost at 2xCY21 revenue (looks cheap)

4. Deal close by 1st QTR CY22 (so no impact on current CY21 financial year.

Life360 SP had been flat at or about A$9.50 for September & October and suddenly increased 40% during November prior to the Tile Inc announcement. A little suspicious to me.

DISC: I own IRL

Life 360,

This stock has some momentum.

Need to check the outlook.

Life360 App:

The Life360 App experience starts with families creating private Circles to share each other's current location, places visited, driving data and other activities performed throughout the day. Life360 notifies Circle members on location activity and offers direct messaging features to facilitate co-ordination for the family. Beyond helping with daily activities, Life360 protects families through safety-related features such as Help Alerts, Crash Detection, Crime Reports and Roadside Assistance. Customers can download the Life360 App for free and upgrade to one of two premium subscription offerings, being Life360 Plus and Driver Protect. These premium offerings provide access to safety and driving monitoring features.

Some revenue from the premium side of the app. Subscriptions.

No profits at the bottom line though,