Thanks @Valueinvestor0909 for the link to the RHConsulting report - I hadn't read the latest one. It sent me down a rabbit hole of what Network Device Interface (NDI) is all about. Thought I’d share some thoughts here. Also shout out to @Noddy74 for his BirdDog (ASX:BDT) straw, which was also helpful.

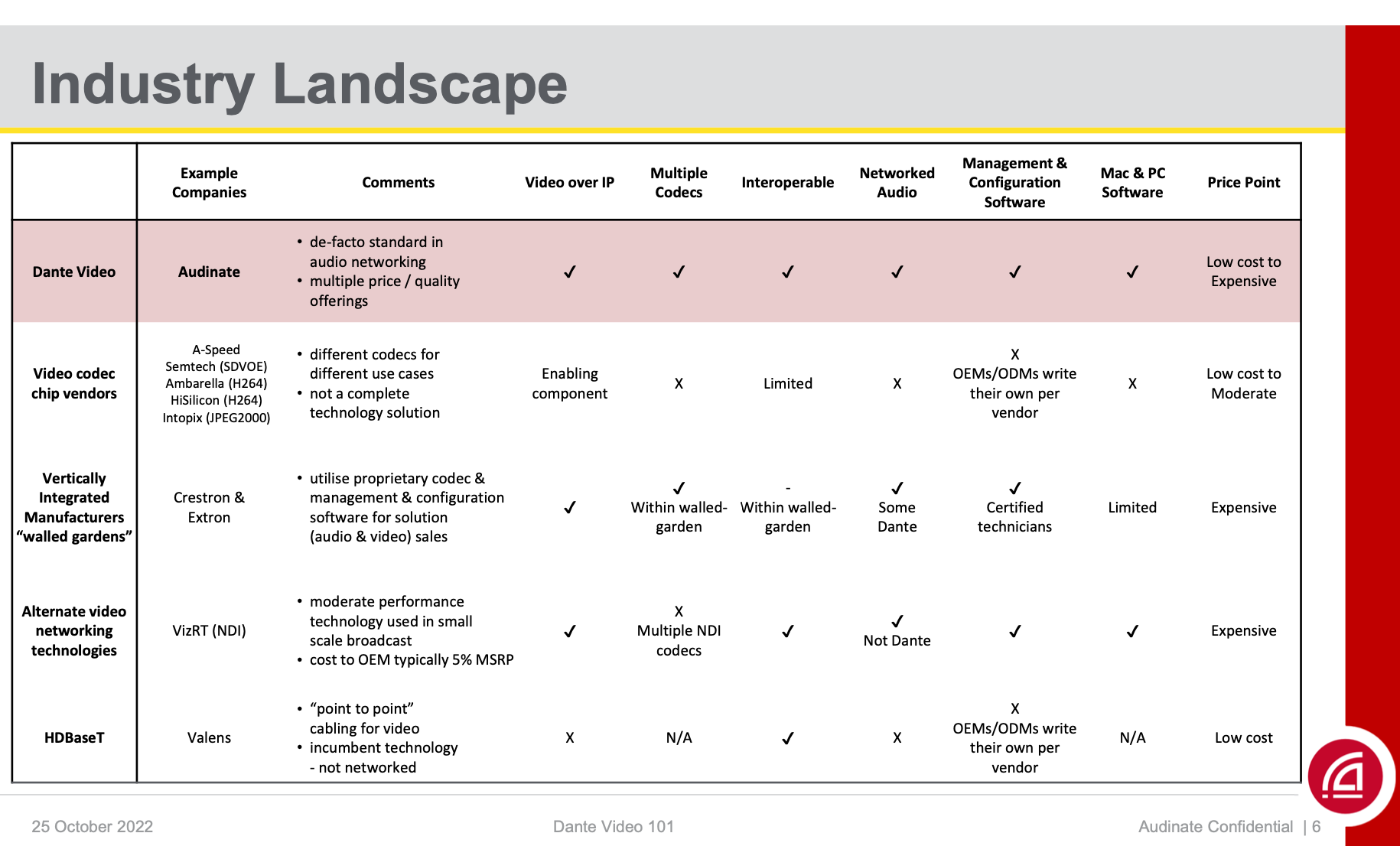

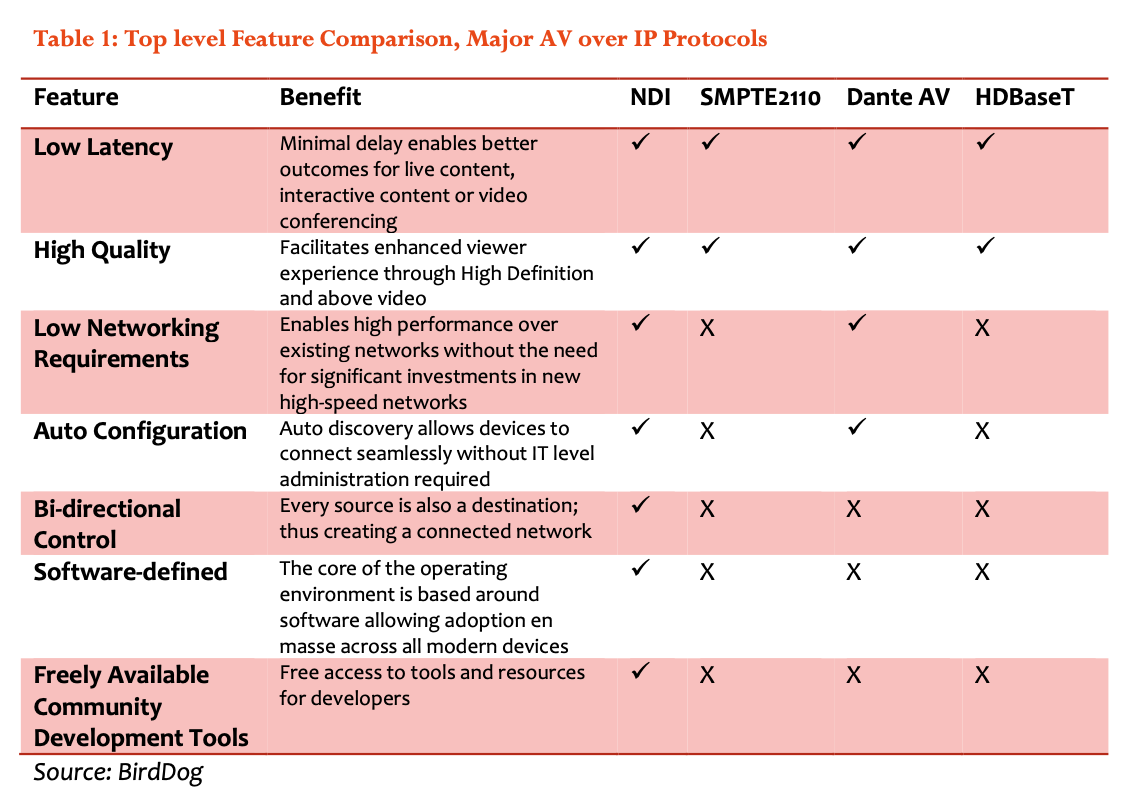

NDI is legitimate competition, and a key player in the digital AV protocol space. It’s touted by some as the “Dante for Video” - it’s plug and play, it works, and customers love it.

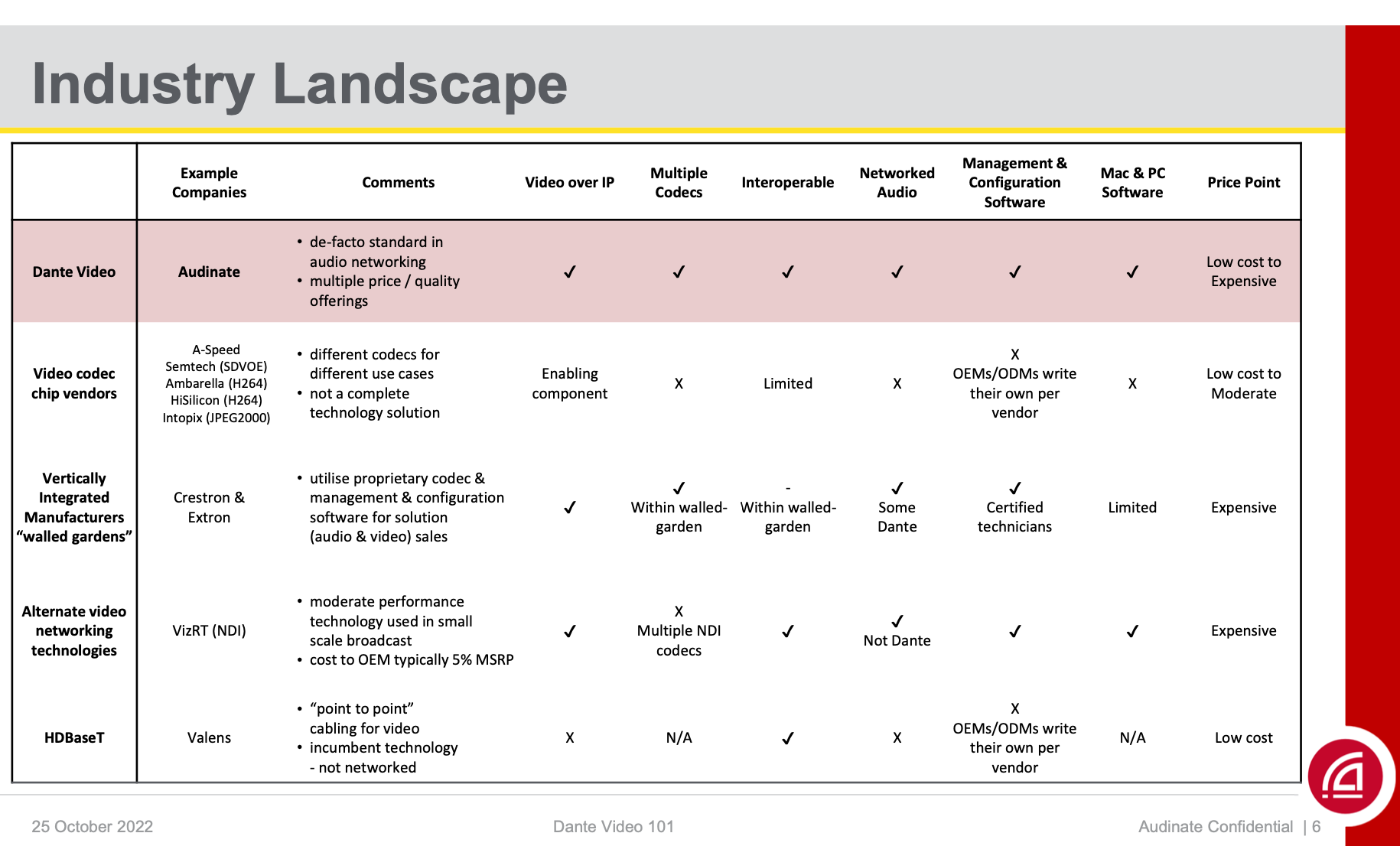

Even Audinate see them as a very strong competitor having noted the only weaknesses is being expensive (disputable), not codec agnostic, and doesn’t support Dante Audio natively.

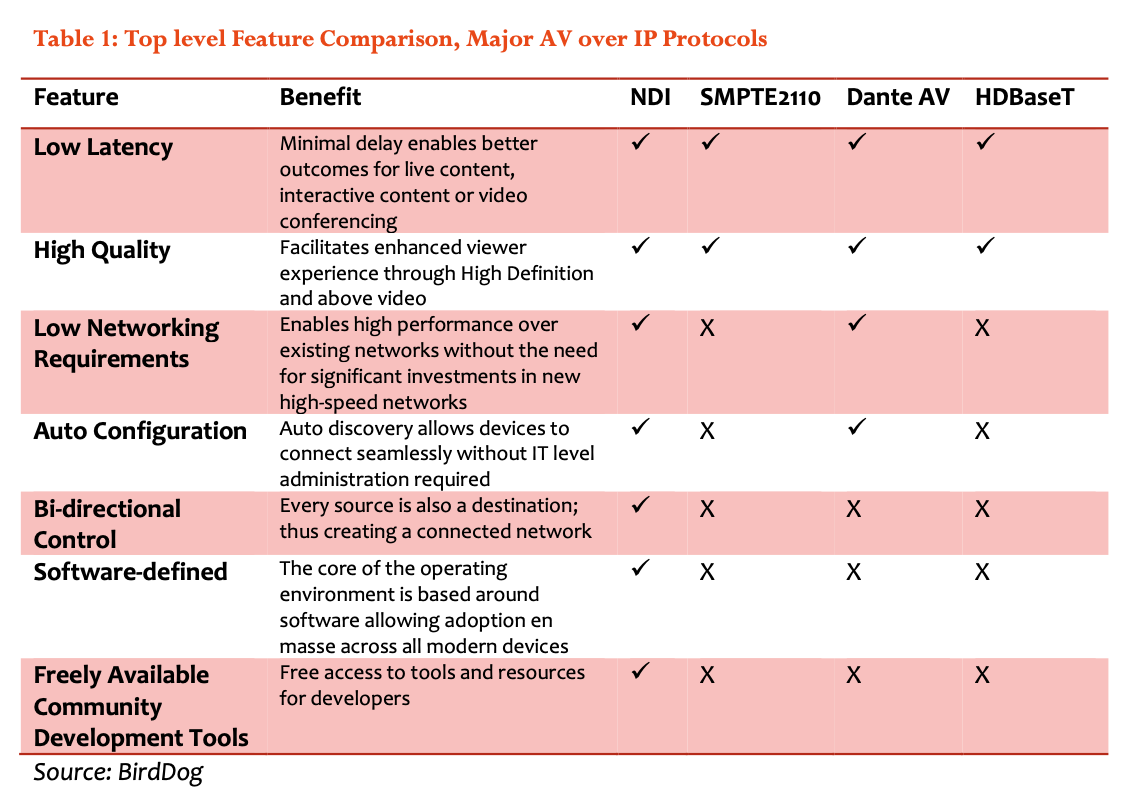

BirdDog (ASX:BDT), a heavy NDI focused equipment manufacturer, published the following grid stating Dante AV does not have bi-directional control, is not software defined (now false with the release of Dante AV-H) and has no free access to tools and resources for developers.

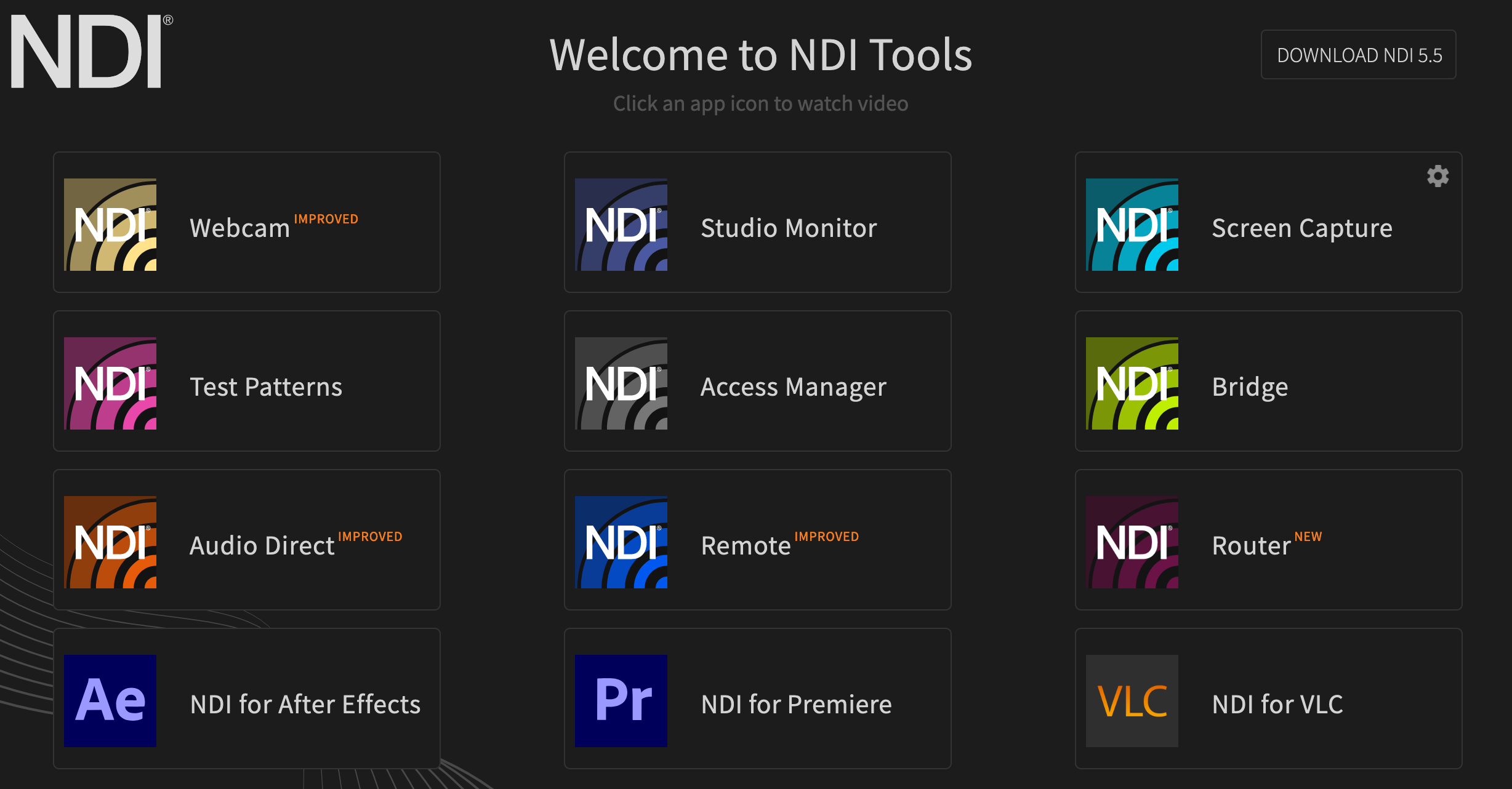

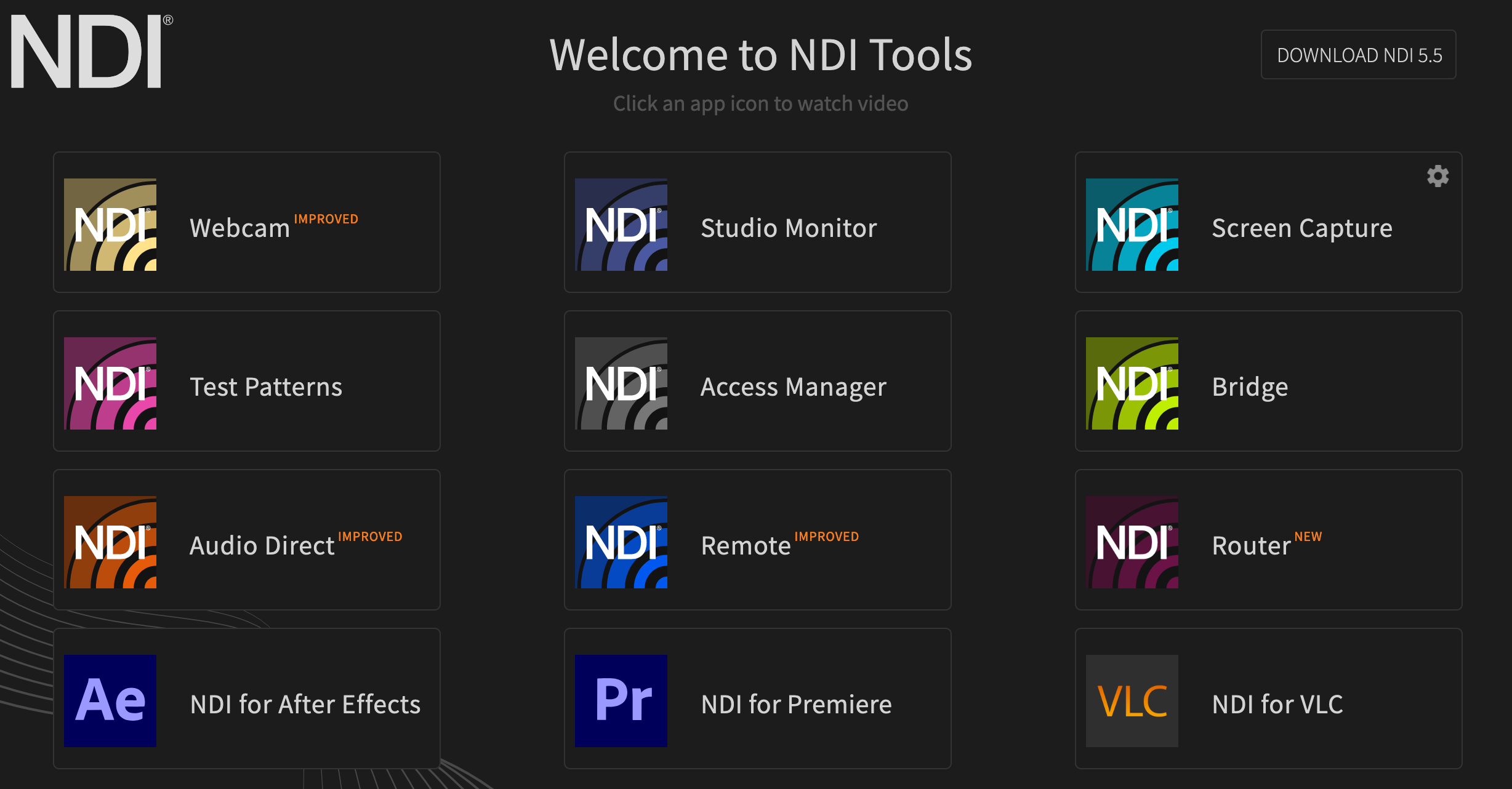

NDI has a whole heap of free tools and integration for the end consumer.

NDI was a protocol launched by NewTek in 2015. NewTek was eventually purchased by the Vizrt Group in May 2019 for US$95.25m

Vizrt Group the owner of NDI, NewTek and Vizrt, is a global company headquartered in Norway with around 600 employees. It is privately-owned by Nordic Capital Fund VIII. The group had revenues of €175m in 2021.

Looking back, I think US$100m may have been a steal for Audinate to sure up the digital video market. NDI’s several year head start has given them a sizeable advantage in the range of physical products, and software integration.

There’s probably some nuance on the markets each company is focusing on. NDI is particularly strong in small scale live video broadcast. While Dante has historically been more about live audio in physical spaces rather than content creation.

My understanding is Audinate is attacking the video market using its dominance in digital audio, and also using software rather than physical chips/cards/modules to penetrate the video OEMs faster.

On the software point I’ll use the pan, tilt and zoom (PTZ) camera market to highlight my point. From the Strawman interview with the CFO, it was mentioned that they’ve signed 7 of the top 14 PTZ manufacturers. The top 14 include NewTek (who will never sign with Audinate for obvious reasons) and BirdDog (who’s very NDI focused). I can see they’ve signed Lumens, Aver, PTZ Optics, Minrray, Yamaha, ValueHD - not sure who the 7th is.

Each of these OEMs already have NDI compatible cameras. And it appears they’re all implementing Dante AV-H for the Dante AV. In many cases it might just be a flash of the firmware, a new lick of paint, and different packaging. We might even see the advent of cameras that are both NDI and Dante AV compatible - though Vizrt and Audinate may have clauses in the contracts to prevent this.

Using the ubiquity of Dante Audio to drive video is the bigger play.

There’s a good use case interview that Audinate published on the investor page: https://youtu.be/ZN4FerH-dzc. The use case is Rutgers University, where the Head of AV was previously a touring engineer that worked with Dante extensively. He then introduced it to the university and is now using Dante AV for the video requirements. NDI doesn’t appear to have got a look in, because the university already had extensive Dante Audio build out and Dante AV was the logical addition.

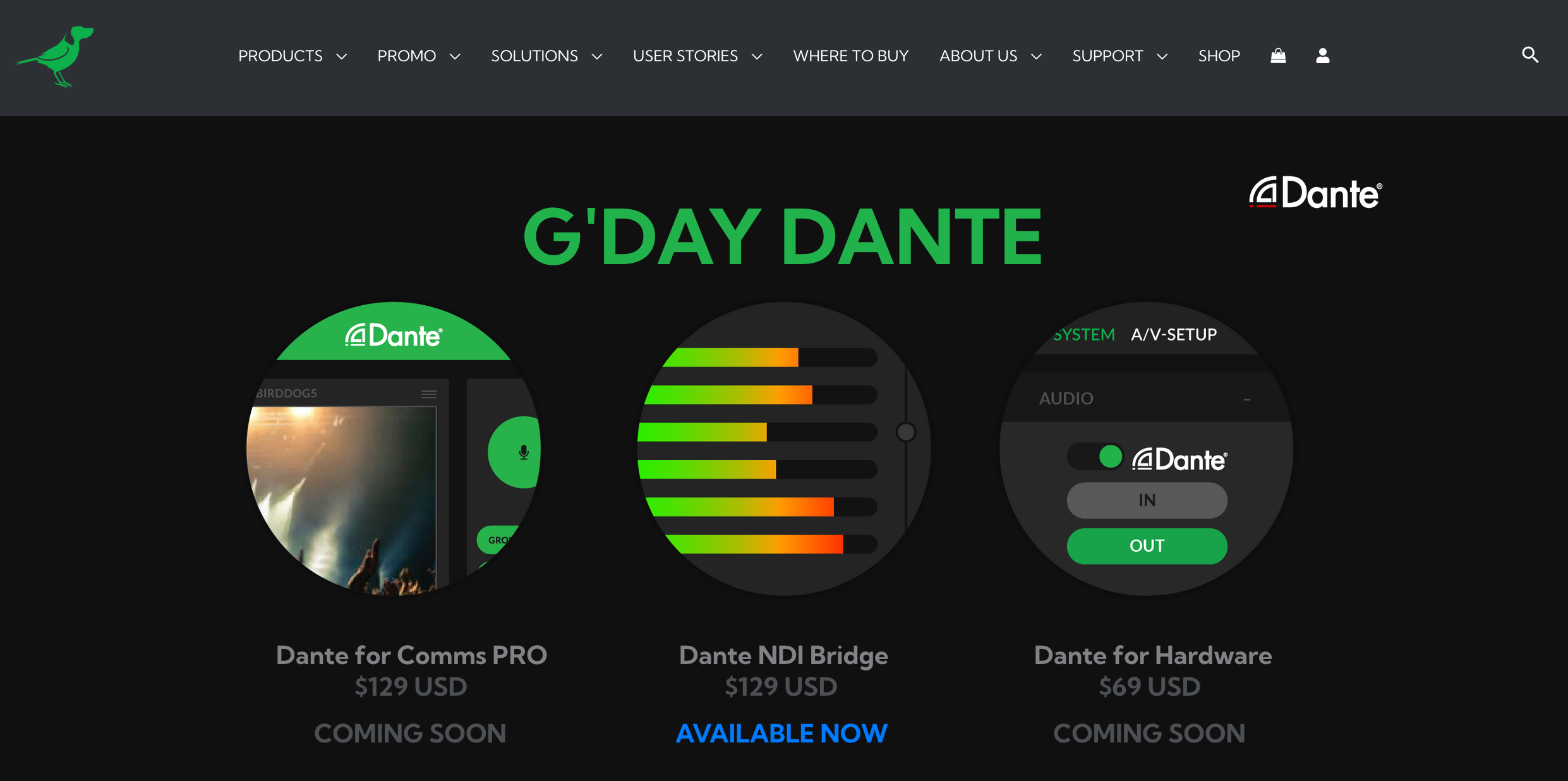

Also highlighting how dominant Dante is in audio, is some of the products BirdDog have or will soon be releasing. One bit of software is called Dante NDI Bridge which helps encode and decode audio between NDI and Dante. A use case would be needing to play a video in a large physical space with multiple speakers - the software can split the audio off the video stream and play it on Dante loudspeakers.

They’re also in the process of making a whole bunch of Dante Audio compatible products. It goes to show that even an NDI diehard OEM needs to play in the Dante Audio space.

No doubt Audinate is hoping system integrators will give up bridging NDI and Dante, save a lot of headache and just go all in on Dante AV.