07-Aug-2022: Last week, Aeris Resources (AIS) presented at D&D (the annual Kalgoorlie Diggers and Dealers Mining Forum) and I included some stuff about them in my commentary in the "Gold as an investment" forum here, including their substantial shareholders, with Soul Patts (SOL) being particularly notable, since Aeris bought the Round Oak Minerals business from SOL which included the Jaguar mine and the Stockman Project. Those were bought by SOL a few years ago off IGO when IGO were concentrating on maximising the potential of their Nova nickel and copper mine in WA (which was quite close geographically to the Tropicana gold mine that they held 30% of but have since sold - that 30% - to Regis - RRL).

I used to hold IGO, so I was somewhat familiar with the Jaguar zinc mine. At the time IGO indicated that it was virtually mined out and they wanted to exit zinc anyway and they felt there was more upside with the Nova-Bollinger mineralised system in WA than what the Stockman project represented at that time. So they offloaded their "non-core" assets, including Jaguar and Stockman, which was also about debt reduction at the time, because Nova wasn't cheap to build. IGO are now of course into Lithium as well as nickel and copper, so a solid battery metals play if you're into that sort of thing. I don't hold IGO currently, but I would look at them again if their share price came down enough.

So SOL obviously took part in the capital raising that funded that Round Oak Minerals (ROM) purchase - when Aeris bought ROM from SOL, because SOL now own just over 30% of AIS. Aeris currently mine Copper from Tritton, and Gold from the Cracow mine in Qld. Australia's 3rd largest gold miner, Evolution mining (EVN) sold Cracow to AIS back in 2020 - see here: Aeris emerges as buyer of Evolution's Cracow gold mine - Australian Mining

As that article explains, Cracow had a short mine life at that time - it was due to run out of gold next year (2023). That has likely been extended if further gold of sufficiently high grades has been discovered there by Aeris, and it looks like that is the case with "Golden Plateau" but I haven't looked into that too much.

EVN's policy at that time was to strengthen the quality of their portfolio of gold mines. They had a "goal to hold six to eight assets with an average mine life of 10 years at minimum." So Cracow was one of their highest cost mines with the shortest mine life, which is why they sold it.

In Aeris' latest JUNE-QUARTERLY-REPORT-PRESENTATION.PDF, they show their AISC (all-on sustaining cost) for Cracow (on slide 3) as being high: FY22 production of 53,920oz at AISC of A$1,911/ounce (oz) of gold produced and for the June quarter, 11,717oz at AISC of A$2,361/oz. That's barely profitable. EVN's group AISC guidance for FY23 is $1,240/oz +/- 5%. That's almost half of what it cost Aeris to produce gold at Cracow (Cracow being their only producing gold mine) during the June quarter.

Aeris claim the main reason for the cost increase in the June Qtr was "Production impacted by reconciliation with geological models, which have now been revised." which in basic terms means they didn't find the gold in the grades they expected in the ore, and they have now revised their expectations downward to closer to what they now know is actually there.

This is the main reason why gold producers like Dacian (DCN) and Gascoyne Resources (GCY) tend to fail, because their models give them more gold that is cheaper to extract than the actual reality. In both of those cases (DCN & GCY), the processing plants were built by GR Engineering (GNG) who I hold shares in, and they were both good plants, but over the first 12 months of production it became evident that the ore that they were putting through those plants contained less gold than what they had anticipated and therefore each ounce of gold produced cost more than they had expected. Additionally, they encountered ore types that were more difficult to process and in some cases required plant modifications. This is a common mistake made by new project developers. They do not spend the required money up-front to build a plant that can handle a variety of ore types, and then they quickly run out of ore that the plant is designed to process. Sometimes it's a chemistry thing - i.e. the extraction process is actually different - to liberate the gold from the ore economically. Sometimes it's to do with too much clay in the ore or other contaminants that basically just clog up the process and cause equipment to either fail or not operate efficiently.

This is one of the reasons it can take years to do the necessary studies to determine what they need to build to get ahead of those issues before they occur. And that is always based on available data, so the more data available, the better the process outcome. Which in basic terms means they need to spend millions drilling and analysing test holes to determine exactly what they've got and the ore types that the gold is in, before they can even design the processing plant. That is why those companies that go from discovery to production in a year or two tend to fail.

Additionally, Gascoyne was run by management who were geologists, not engineers, so they were focused mostly on the grades of gold, not on the ore types and what it would take to efficiently extract that gold, AND they didn't do enough drilling. They did NOT get GNG to do their PFS and DFS (pre-feasibility and definitive feasibility studies). They basically did those studies themselves with some input from other companies who were not involved with the project after those reports were produced, and then they presented the plans to GNG and said, "Build this for us", which GNG did. In Dacian's case, GNG built them a REALLY good plant with massive annual production capacity, which is why Genesis Minerals is now buying Dacian - just to get their hands on that processing plant - which is currently idle (because the mine is shut down). Dacian just ran out of gold at grades high enough to be economically viable to process.

To give you some idea, in the Leonora area of the WA goldfields, the Dacian plant is capable of processing more than twice the ore per year that SBM's Gwalia plant is capable of. SBM are going to roughly double the capacity of their Gwalia plant/mill (which they call their Leonora mill - as it sits right next to the Leonora township) over the next couple of years because they have additional projects due to come online now that they have bought Bardoc Gold.

So the Dacian gold processing plant is a genuinely good asset, but that didn't stop Dacian from almost going to zero before the Genesis (GMD) takeover offer came through last month. Dacian traded at levels above $1.50/share for most of 2018 and the start of 2019, then below 8c/share in June this year, and are now at 12c/share, WITH a takeover offer in place, which has been unanimously recommended by their own Board (in the absence of a superior offer).

Gascoyne traded at over $8/share in 2018, when they were building the plant and then ramping it up towards nameplate capacity, and are now at 25c/share.

So not all gold companies are created equal. And not all gold companies have quality management teams who make sensible capital allocation decisions.

There is no doubt at all that you can certainly lose a LOT of money by investing in the bad gold producers.

Aeris (AIS) might look OK for a copper play, perhaps. They are certainly a high-risk gold play, because of their high costs and short mine life at Cracow. They have a nearby prospect that they are talking up - "High grade drill results from Golden Plateau". Their Constellation prospect, located 45km from their Tritton copper processing plant has copper, gold, and silver (see slide 10 of the June Qtr report - link above in this straw), but the gold grades are mostly low, and it's unclear whether the gold could be extracted efficiently and cost effectively at Tritton. Kurrajong, located 20km from Tritton, has the same three metals, but the gold grades are even lower, with the highest grades seen so far being 0.54g/tonne Au, so around half a gram of gold per tonne of ore based on one sample, with even less gold in the other samples. By contrast, the highest gold grades recovered at Constellation so far were 3.38g/t Au from a single 1m section of one drill core. If they had a LOT of gold with those grades there, then it could be exciting, but they'd need to find a LOT and it would still all have to be cost-effective to process (extract the gold at scale).

However, Aeris might be OK if you look at them as an emerging copper producer with some gold and silver assets as well. SOL aren't dumb, apart from Robert Millner believing climate change is NOT influenced by human behaviour (he's a prominent climate change denier), and SOL probably believed they had a good suite of assets in ROM (Round Oak Minerals) but that they needed more focused and experienced management to develop them successfully, which would be why they were happy to sell them to Aeris and take a large stake in Aeris, so SOL still retain exposure to those assets but no longer have to manage them.

In terms of future production, Aeris (AIS) could restart the Jaguar mine in WA which is mostly zinc with some copper, and they believe it has a 4 year mine life. The zinc grades are high enough that it would be considered a decent assets in a high zinc price environment. They also have the Mt Colin prospect near Cloncurry in Qld which has decent grades of copper, gold and silver, but only a 2 year mine life, so might not be worth the cost of getting it into production. Stockman is still at the DFS level, and first production is not expected before FY25.

In summary, some interesting assets, but all lower quality to middle-of-the-road. Nothing outstanding. I won't be following them. Too much execution risk, and they don't have high enough grades to make them an opportunity that stands out clearly above others in the gold sector. Could be a takeover target in the future, but then again, perhaps not, because none of their assets are compelling enough for other companies to want to pay a premium to gain control of. IMO. They could find something decent with their exploration efforts, but then so could everybody. Not enough there for me. Despite the company's own promotional material painting them in a decent light and a few brokers being quite bullish on them.

Happy to hear from anyone who has a different opinion and can give some reasoning behind that.

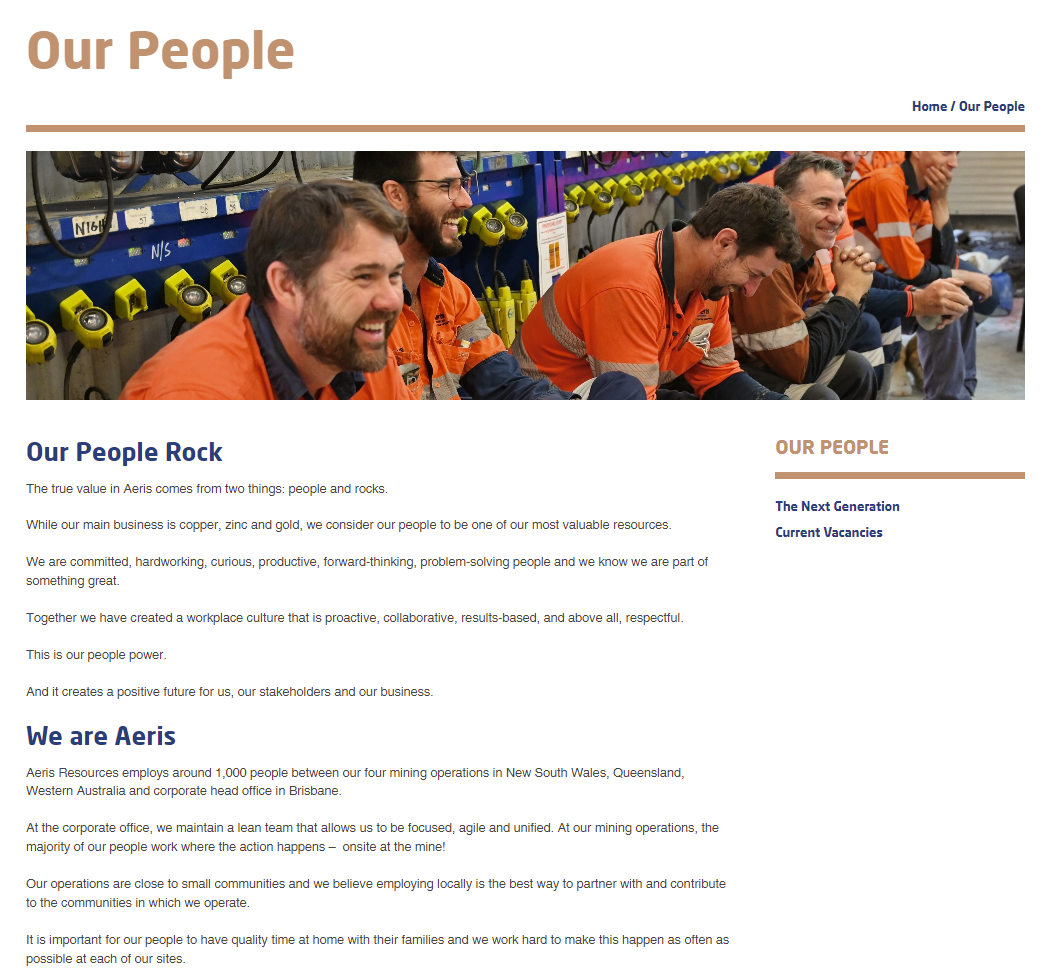

By the way, the following is my favourite thing on their website, always good when companies claim to value their workers like this. Even better when they're genuine about it, which I assume Aeris is (I don't have any evidence to the contrary).

Source: https://www.aerisresources.com.au/people/