I wanted to try get in a review of Alloggio for a better understanding of the company before the CEO meeting this week. Thanks @Vandelay for the Checklist. I didn't get to the end of it so will post it in sections to with the remainder to be completed after the meeting.

Business

• What does the company do and is it easily understandable?

Alloggio is a provider of short term rental accommodation (STRA) management for holiday properties and hotels across Australia

• What is the problem the company is solving and how are they solving it? - Where? Why does it need solving?

With around 500,000 holiday properties in Australia, typically short term accommodation management is provided by multiple small operators running individual complexes. Alloggio looks to acquire management rights of multiple complexes in popular destinations and streamline operations with their inhouse systems.

• What is the company business model? What is the pathway from product/service/offering to payment?

Alloggio splits its business into two segments. Holiday property management and Hotels. A bit of a brief overview on how management rights work can be found here:

https://www.resortbrokers.com.au/learn/blog/educational-booklets/management-rights-made-easy-guide.html

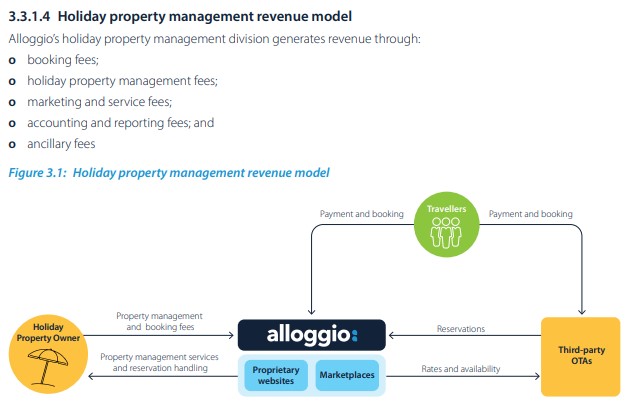

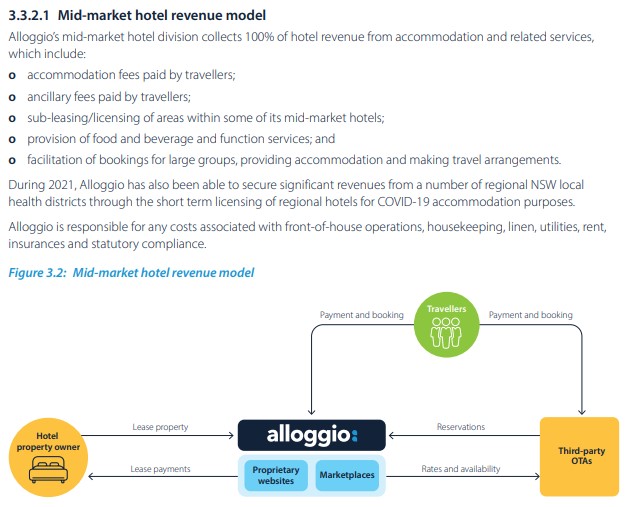

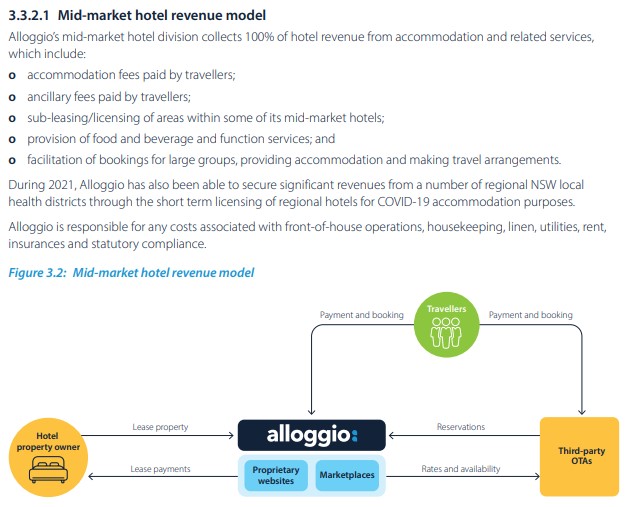

The pathways to revenue are shown in the below images from the company prospectus.

• Is the product offering diverse and therefore income generation diverse?

Alloggio only operates within the tourism and travel industry; this single industry focus is countered with a geographical spread as the company currently manages 1883 holiday properties and 428 hotel rooms across 3 states.

• Is the company a price maker or price taker?

Alloggio is a price taker. Alloggios margins on property management are driven by competition in the market and letting rates on holiday properties are

• Does the business generate recurring revenues? How reliable is this recurring revenue?

No. Revenue is based upon a fee for service

• Who are the core customers of the business?

Alloggios direct (hotels) and indirect (holiday properties) customers are traveller’s requiring short term accommodation

• Is the customer base diverse?

The customer base can be considered all travellers who may be looking for short term accommodation, whether it is business, domestic or international travellers.

Alloggio’s hotel leases are targeted at the budget end of the market, whereas the holiday properties are across a wider budget range.

• Is it easy to convince customers to buy the products/service?

If a holiday property in a popular destination has high ratings at a reasonable price, there is high demand for travellers for the product. Where this is the case, Alloggio will see low vacancy rates and good returns.

Where Alloggio are managing a hotel / property where they are not the owner of the lease or the management rights, the customer is the owner of the property who are also expecting the same outcome, high demand and high ratings for their property. If Alloggio can provide these outcomes with no headaches for the owners, then the ongoing management is an easy sell.

However..

• What is the customer retention rate?

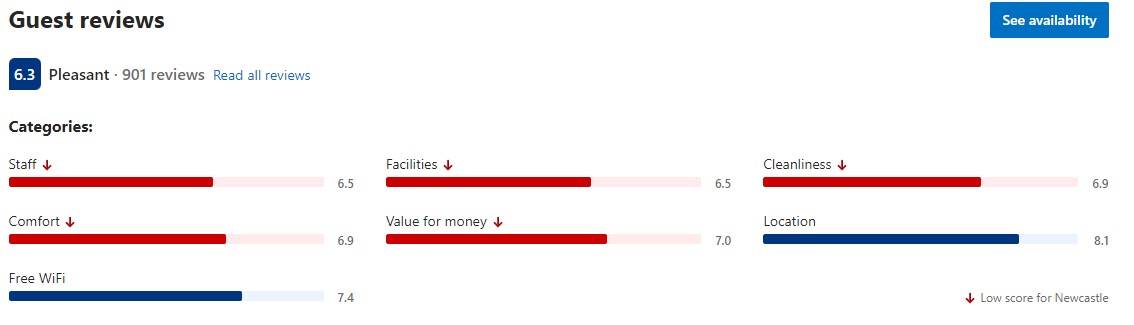

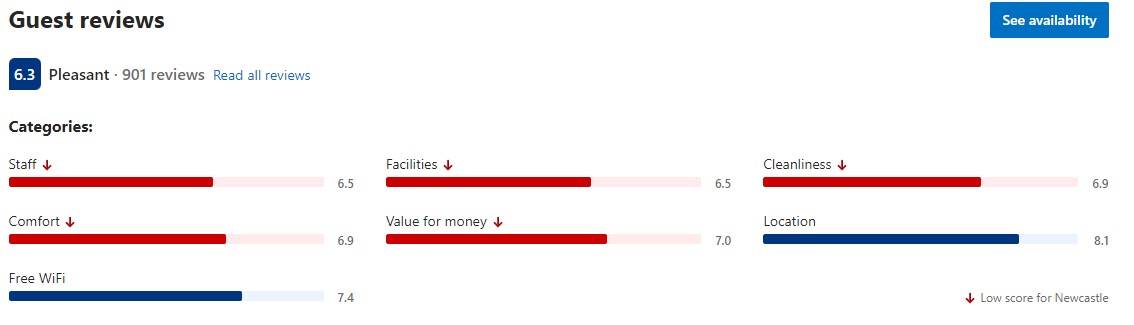

I have been unable to determine customer retention rates as it is a bit of a tricky one to unpack, so as a proxy I have had a look at ratings from travellers on booking.com (third party booking portal)

First up the “mid-market” hotels, which did not come back positive. The general feeling I get is that the Alloggio “platform” minimises the onsite staff which means issues at the hotel in terms of maintenance and cleaning build up and are not dealt with immediately, generally impacting the guest experience. I’ve stayed in my fair share of roadside motels and generally haven’t seen reviews this bad. This is definitely a red flag that needs to be investigated further.

Alloggio Hamilton Brisbane Airport

Alloggio Bathurst

Alloggio Tudor Hamilto

Alloggio Hanbury Mayfield

• Does the company operate in multiple markets/countries?

Alloggio currently only operates in the Eastern states of Australia. According to a report by Frost & Sullivan, 82% of STRA properties in Australia are located in the NSW, QLD & VIC.

• Is there a history of launching new lines of business successfully?

In the FY22 results presentation Will Creedon provided an example of executing on adjacent business options for Alloggio. This was a hire car business to support their accommodations on Magnetic Island. Contributions from this weren’t seperated in the Revenue breakdown, so success of this example is hard to determine.

More broadly Alloggio has demonstrated that they are adhering to their strategy of acquiring attractive property leases and management rights and integrating them into the companies operations.

• Is the company disruptive and innovative in its field?

As Alloggio isn’t the only company offering software platforms to streamline holiday accommodation operations or providing accommodation in a different manner, I wouldn’t classify their business model as disruptive.

• Are the profit margins attractive (better than industry)?

Question for meeting. @Strawman

• What are the CAPEX requirements and are they ongoing?

Ongoing capex is required for the addition of new property leases, purchasing of management rights and development of properties. These will be a continuous requirement to drive growth as due to the nature of the business, i.e a room can only ever be let to one person at one time placing a cap on potential revenue.

• Has the business evolved for the better over time?

As the business has only been listed for a short time, it’s hard to get a clear picture on this at this time.

• Does the business have strong and supportive relationship over its suppliers?

Question for meeting. @Strawman

• To what degree is the business cyclical?

The business is cyclical to the degree that it is exposed to the high and low seasons for tourism in the areas it operates i.e school holidays and summer periods. Some of this is offset by the hotel operations.

• What extent does the business experience operating leverage?

The business will only ever be able to achieve small amounts of operating leverage as each new acquisition required to grow revenue also increases the amount of operating costs required.

• How does interest rate increase and inflation affect the business?

Increased interest rates work against Alloggio. Firstly, increased interest rates provide pressures on household budgets which may have impacts on the volumes of travel. Secondly as Alloggio continues to grow through utilisation of their debt facility, as interest rates increase, it will decrease the feasibility of future acquisitions.

There is some protection from inflation as CPI is normally built into the agreements.

• Is the company unknown or misunderstood by the market?

As the company is small and a recent IPO it is still reasonably unknown in the market shown by the fact there are only a few institutional names on the shareholder register.

There is still a bit of work to do there but a start. Next step would be to go back through all the available annual reports provided with the prospectus