Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Bittersweet exit

@Bradbury I think it's an interesting business. My first impression was "how on Earth can they compete against AirBNB et al?" but as Will and Harley both explained those players are better thought of as clients/partners.

The short-term stay market is not one I'm really familiar with, but taking them at their word it seems like a vast opportunity with lots of growth potential. And they seem focused on profitable growth -- which was a big tick.

Roll-ups have a poor reputation, and for good reason, but they can be attractive when done right -- especially when they are at the start of their journey. Kelly Partners is a good example. Of course, it's a much better scenario when you have a larger multiple to prosecute the private-public arbitrage.

I'm curious as to how well they hold up in a more difficult economic environment. I get what Will was saying in that higher flight costs and a weaker AUD make domestic travel more attractive, and even that some pain can help them secure purchases at more favourable rates. But I guess you could argue that the current market price already provides somewhat of a margin of safety here.

The meeting with Will & Michael confirmed my initial impressions that the main goal of Alloggio is as @Strawman put it "an arbitrage play on private to public valuations"

Alloggio looks to roll up smaller individual leases / management rights at "attractive" valuations. The range given in the interview was around ~1.75 to ~2.25 x annual management commission (revenues) which were then valued at 2.75 to 3 x by banks. (Likely when carrying out assessment on lending.)

The other figures Will provided were EBITDA comparisons where they look to acquire at around 4 to 4.5 x EBITDA which after around a year and half of integration into Alloggio's operations after around efficiencies reduces the multiple to 3 to 3.5 x

One thing to note for FY22, Alloggio reported Revenue of $27.8m and an EBITDA of $11.2m and currently have a market cap of $34.2m, so the arbitrage isn't really in play at the moment.

Will has said that the company will continue to grow revenues through several avenues:

- Existing debt facility of ~$11.5m. Current macro environment offers opportunities for acquisitions with a strong pipeline for the future. Will still continue to acquire in a disciplined manner.

- Growth of ancillary services revenues i.e linen services

- Increase in utilisation. Increased cost of international travel is a tailwind for domestic travel

- Also suggested international expansion could be explored in the long term.

I haven't had the opportunity to look into the accounting / reporting that Michael mentioned in the meeting but didn't go into, (this is also what Harley made a comment on) so would like to hear if anyone has looked at the numbers.

Along with its debt facility, ALO had an operating free cash flow of $8m in FY22. Also having the cash generated from the business will assist with the growth strategy which will likely see revenue continuing to grow reasonably rapidly across FY23.

What were your takeaways @Strawman?

Only got about halfway through this list...

4. Risks

• What are the main reasons this might not be a good investment?

The business is a roll-up of smaller accommodation services. After time as less acquisitions become available, the return on investment on new additions are likely going to be less attractive as time goes on.

As the business grows, each new addition will contribute less to overall growth. There may be some cost efficiencies that are gained as operations are streamlined, however due to the nature of providing accommodation, a lot of the costs are fairly fixed.

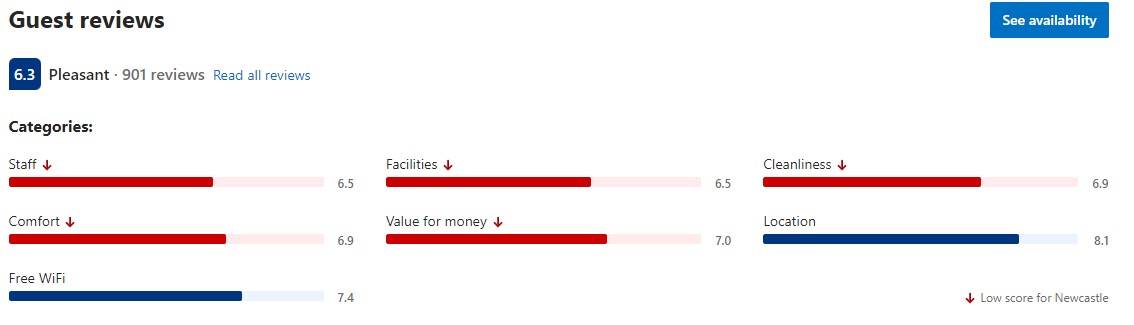

If costs are cut too far it will have adverse impacts on the brand reputation. Potential signs of this can be seen on the booking.com reviews.

• What are the key risks the business faces?

The prospectus lists out many risks such as data breaches, regulatory, debt and funding but the biggest risk I see for the business is its reputation. In a world of online reviews and aggregators it doesn’t take much for a series of negative customer experiences to have significant impact on how a hotel room and the brand by association by travellers carrying out a quick search online. Which rolls into the next point.

• How competitive is the industry landscape?

The STRA and hotel market is highly competitive, with a multitude of options in most locations. During peak seasons this may not matter, however its during the troughs between where brand perception and reputation will stand out. As per Alloggios own slides, there are ~ 500,000 holidays available in Australia.

• Who are the main competitors?

Alloggio is playing in a very crowded sandpit and has competitors in several areas:

- Providers of holiday accommodation and hotels competing for traveller bookings

- Providers of rental management competing for management rights / fees

- Providers of holiday property management software providing a better product than the Alloggio platform

Excerpt from prospectus.

Part 2 of @Vandelays list. I'm lucky my dive wasn't that deep as the moat looks pretty shallow.

2. MOAT

• What are the barriers to entry for competitors?

The main barriers to entry for competitors to Alloggio to operate on the same scale are capital and available property leases / management rights for sale. Either of which are not a substantial moat.

• What is the competitive advantage the company has on its competitors? Is it strong and sustainable?

Question for the meeting @Strawman

• Is the company the leader in its field?

Alloggio is still building their brand awareness. As they continue to grow through additional hotel leases across the country, travellers will become more familiar with the name.

• Are there any barriers to leave for customers, or switching costs (benefits for the customer improve over time, making it hard to leave)?

The only barriers to switching are the number and availability of properties in a region. There is very little to stop guests staying with other accommodation providers.

• Could the business raise prices without losing customers?

The market may accept minimal price rises. Raising prices will push travellers to other accommodation providers as a first choice.

• What is the degree of dependence the customers have on this business? If the business disappeared tomorrow, what impact would this have on its customer base?

Minimal. There are a wide range of alternative holiday homes and hotels available.

• Does the company have Network effects (if the positive impact of market share gain compounds)?

Alloggio describes their network effect as growing the number of businesses under management, which grows revenue, which in turn grows the number of business’s under management.

• Does the company have intangible assets (e.g. a strong brand with consumer appeal)?

Currently based on online reviews the brand appeal needs some work.

• Does the company have cost advantages (a lower cost structure or price point than competitors)?

Question for meeting @Strawman

I wanted to try get in a review of Alloggio for a better understanding of the company before the CEO meeting this week. Thanks @Vandelay for the Checklist. I didn't get to the end of it so will post it in sections to with the remainder to be completed after the meeting.

Business

• What does the company do and is it easily understandable?

Alloggio is a provider of short term rental accommodation (STRA) management for holiday properties and hotels across Australia

• What is the problem the company is solving and how are they solving it? - Where? Why does it need solving?

With around 500,000 holiday properties in Australia, typically short term accommodation management is provided by multiple small operators running individual complexes. Alloggio looks to acquire management rights of multiple complexes in popular destinations and streamline operations with their inhouse systems.

• What is the company business model? What is the pathway from product/service/offering to payment?

Alloggio splits its business into two segments. Holiday property management and Hotels. A bit of a brief overview on how management rights work can be found here:

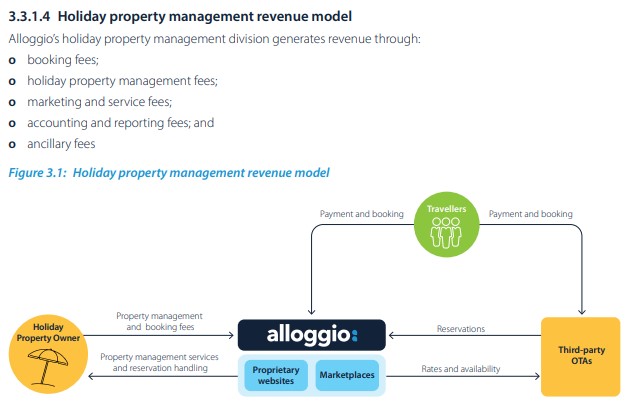

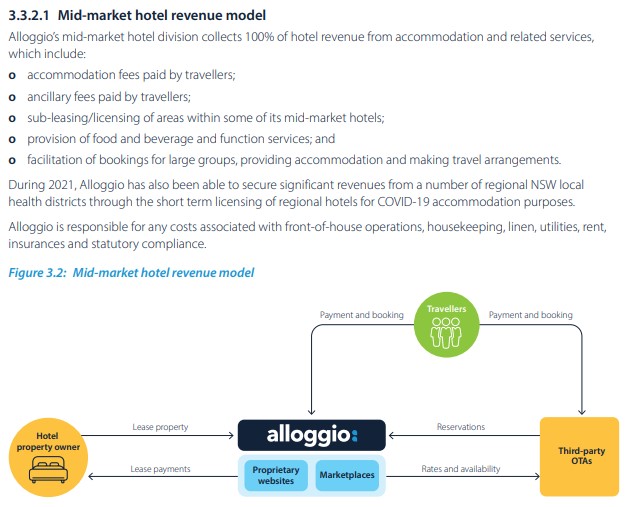

The pathways to revenue are shown in the below images from the company prospectus.

• Is the product offering diverse and therefore income generation diverse?

Alloggio only operates within the tourism and travel industry; this single industry focus is countered with a geographical spread as the company currently manages 1883 holiday properties and 428 hotel rooms across 3 states.

• Is the company a price maker or price taker?

Alloggio is a price taker. Alloggios margins on property management are driven by competition in the market and letting rates on holiday properties are

• Does the business generate recurring revenues? How reliable is this recurring revenue?

No. Revenue is based upon a fee for service

• Who are the core customers of the business?

Alloggios direct (hotels) and indirect (holiday properties) customers are traveller’s requiring short term accommodation

• Is the customer base diverse?

The customer base can be considered all travellers who may be looking for short term accommodation, whether it is business, domestic or international travellers.

Alloggio’s hotel leases are targeted at the budget end of the market, whereas the holiday properties are across a wider budget range.

• Is it easy to convince customers to buy the products/service?

If a holiday property in a popular destination has high ratings at a reasonable price, there is high demand for travellers for the product. Where this is the case, Alloggio will see low vacancy rates and good returns.

Where Alloggio are managing a hotel / property where they are not the owner of the lease or the management rights, the customer is the owner of the property who are also expecting the same outcome, high demand and high ratings for their property. If Alloggio can provide these outcomes with no headaches for the owners, then the ongoing management is an easy sell.

However..

• What is the customer retention rate?

I have been unable to determine customer retention rates as it is a bit of a tricky one to unpack, so as a proxy I have had a look at ratings from travellers on booking.com (third party booking portal)

First up the “mid-market” hotels, which did not come back positive. The general feeling I get is that the Alloggio “platform” minimises the onsite staff which means issues at the hotel in terms of maintenance and cleaning build up and are not dealt with immediately, generally impacting the guest experience. I’ve stayed in my fair share of roadside motels and generally haven’t seen reviews this bad. This is definitely a red flag that needs to be investigated further.

Alloggio Hamilton Brisbane Airport

Alloggio Bathurst

Alloggio Tudor Hamilto

Alloggio Hanbury Mayfield

• Does the company operate in multiple markets/countries?

Alloggio currently only operates in the Eastern states of Australia. According to a report by Frost & Sullivan, 82% of STRA properties in Australia are located in the NSW, QLD & VIC.

• Is there a history of launching new lines of business successfully?

In the FY22 results presentation Will Creedon provided an example of executing on adjacent business options for Alloggio. This was a hire car business to support their accommodations on Magnetic Island. Contributions from this weren’t seperated in the Revenue breakdown, so success of this example is hard to determine.

More broadly Alloggio has demonstrated that they are adhering to their strategy of acquiring attractive property leases and management rights and integrating them into the companies operations.

• Is the company disruptive and innovative in its field?

As Alloggio isn’t the only company offering software platforms to streamline holiday accommodation operations or providing accommodation in a different manner, I wouldn’t classify their business model as disruptive.

• Are the profit margins attractive (better than industry)?

Question for meeting. @Strawman

• What are the CAPEX requirements and are they ongoing?

Ongoing capex is required for the addition of new property leases, purchasing of management rights and development of properties. These will be a continuous requirement to drive growth as due to the nature of the business, i.e a room can only ever be let to one person at one time placing a cap on potential revenue.

• Has the business evolved for the better over time?

As the business has only been listed for a short time, it’s hard to get a clear picture on this at this time.

• Does the business have strong and supportive relationship over its suppliers?

Question for meeting. @Strawman

• To what degree is the business cyclical?

The business is cyclical to the degree that it is exposed to the high and low seasons for tourism in the areas it operates i.e school holidays and summer periods. Some of this is offset by the hotel operations.

• What extent does the business experience operating leverage?

The business will only ever be able to achieve small amounts of operating leverage as each new acquisition required to grow revenue also increases the amount of operating costs required.

• How does interest rate increase and inflation affect the business?

Increased interest rates work against Alloggio. Firstly, increased interest rates provide pressures on household budgets which may have impacts on the volumes of travel. Secondly as Alloggio continues to grow through utilisation of their debt facility, as interest rates increase, it will decrease the feasibility of future acquisitions.

There is some protection from inflation as CPI is normally built into the agreements.

• Is the company unknown or misunderstood by the market?

As the company is small and a recent IPO it is still reasonably unknown in the market shown by the fact there are only a few institutional names on the shareholder register.

There is still a bit of work to do there but a start. Next step would be to go back through all the available annual reports provided with the prospectus

Just some rough (and very brief) notes after Harley mentioned Alloggio as a 'buy' on today's call (see meetings page, and you can skip to the 48 minute mark)

Alloggio manages short term rental accommodation -- a mixture between AirBnB-style properties and hotel properties. In fact, they work with AirBnB as a partner based on what Harley was saying.

There's a lot of detail in last year's prospectus:

The company listed in late 2021, raising $16.5m. This was used to fund a couple of acquisitions.

There are 208m shares (accounting for options and escrowed shares), which gives a current market cap of $34m.

This puts it on a trailing PE of about 17x

It is founder led, with the founder Will Creedon owning 1/3 of the business.

I'll try and reach out to Will and see if we can get him to explain things in more detail.

Founded in 2015 by William Creedon, Alloggio in Italian is Accommodation. Alloggio is a recently listing. Alloggio is a holiday home property operator and cloud based technology platform offering an end to end management for holiday properties and mid-market hotels. Alloggio is a leading operator of short-term rental accommodation on the east coast of Australia with a current portfolio of over 879 holiday properties and 13 mid-market hotels which comprise of 428 hotel rooms.