Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

With Altium gone, these are the only ones left. From RBC Capital Markets

Although with a much higher market cap, Cadence looks interesting but has fallen from recent highs due to the recent market downturn while ALU remained near the offer price. But Cadence is a name to consider if you still miss Altium I think and don't mind going overseas.

.

Thanks for the good times & memories IRL. Shall be holding to the very end to juice every last cent out of it.

Looks like overwhelming support from the proxies.

Happy to have made a motza on this one, but sad to lose it from the portfolio.

But then again, not sad, ... because Renesas is paying well above my upper limit on value. (Emotions need to managed!)

I've pre-sold c. 75% of my holding, but left some to squeeze out every last cent.

22-March-2021: I purchased some ALU in one of real life portfolios today (@ $27.56), as I noticed that earlier this month (March 2021) they were actually trading at $25.50, lower than the $26 they got down to last year in the depths of the COVID-19-induced panic. In fact the last time they were trading at those levels ($25.50) was in early February 2019, just over two years ago. I understand that the market was underwhelmed by their 1st half report (in Feb) and that there has been a tech sell-off, put I see both of those issues as temporary, not structural, and as such I see this as an opportunity.

Altium has strong tailwinds and a very good position within their industry. They are also a high quality company with good management and up until the last year and a half, they have done exactly what they said they would. With the benefit of hindsight they shouldn't have set such lofty expectations because anything can happen, and in 2020 it did. However, I'm prepared to back Altium's management to get back on track again. They're still in very good shape. They just failed to deliver on their 2020 revenue target of US$200m. Their revenue was actually US$92.8m in the 2nd half of FY2020 and US$89.6m in the 1st half of FY2021, so was US$182.4m for calendar year 2020.

They have since announced new 2025 targets of US$500 million in revenue and 100,000 subscribers, ex-TASKING (after announcing the sale of their "TASKING" division). The market appears to be very skeptical that they will achieve that, based on the recent sell-off.

Even if they just get close to those numbers, as they did to their 2020 target of $200m in revenue, they will be a much bigger and more valuable company at that point than they are today, and 2025 is only 4 years away.

I'm locking in $37 as my 2-year price target for ALU, so by March 2023, and a 5-year PT of $57 - so by March 2026.

23-Sep-2021: UPDATE:

I'm still happy with that $37 PT that I set that in March when they were trading at around $25 to $27/share. The unsolicited takeover offer from Autodesk in June caused them to rocket up to my price target and they hovered around that level or just above until around mid-July. They look like they're trying to reach it again lately... Despite saying "No thanks!", twice, to Autodesk.

My first thought was to leave the PT at $37, but there's no fun in that. I already had a 5 year PT (from March 2021) of $57 PT for ALU to be achieved by March 2026, so today I'm setting a new 2.5 year $47 PT to be achieved by March 2024.

I still hold ALU in RL, however I sold them from my SM portfolio at $35.09 in August to free up some cash to buy something else. The upside from $35 to $37 was/is only +5.7%, whereas from $25.79 to $35.09 was +36%, so I locked that in at the time (in August) after buying those Altium shares on the 4th and 5th March at an average price of $25.79/share. In real life I'm happy to play the long game and hope they meet their 2025 targets of US$500 million in revenue and 100,000 subscribers, or get close to those targets. If they do, they'll be trading at higher prices than where they are today (and higher than my $37 price target also). $37 was my 2-year price target for ALU, so by March 2023, and I still have a 5-year PT of $57 - so by March 2026.

For a point of reference, have a look at the 10-year price chart for Technology One (TNE). That is what meeting your growth targets looks like in terms of the share price reaction to that growth. I also hold TNE in real life, and it's a larger position than ALU. Altium have had some setbacks, and Covid-19 hasn't helped them in terms of their 2020 target (discussed above in a previous update), but they've passed that US$200m revenue target now, albeit a report or two later than they had hoped to, and they're confident of hitting that US$500m revenue target by 2025. TNE have performed brilliantly simply by doubling the size of their business every 5 years, as a minimum, so double the revenue, double the profits, as a minimum. They've now done that 3 times over a 15 year period and expect to do it again. ALU want to go further, in 4 years, with a +150% revenue increase. If they can do that, and I think they can, where do you reckon their SP will be? I'm tipping it will be somewhat north of where it is today.

05-June-2024: Update:

Japanese company Renesas taking Altium out at A$68.50/share.

05-June-2024: After market close (5:39pm): Outcome-of-First-Court-Hearing.PDF

Good-o, all going to plan so far. Here's the indicative timetable from the second page of today's announcement.

Looking forward to getting the cash for this one - average price paid was $27.20 over various buys - and the takeover is at $68.50, so there's not too much Arb up here (they closed at $67.00 today), but a decent outcome for longer term holders considering we've seen the odd approach knocked back by the ALU Board over the journey - they clearly held out for something better - and they got it in the end.

$ALU has announced their 1H FY24 results this morning.

From a quick reading, I've breathed a sigh of relief to have the $68.50 takeover price locked in, as I think the market would have reacted quite negatively to the result, given the SP run-up ahead fof the takeover offer.

For context 1H23 the eps growth was 29% and FY23 was 19.4%. So this morning's 1H 24 11.2% is a distinctly softer result, and below consensus (if I have done the FX correctly).

Within the softer number, sales in the enterprise segment grew 60% to $20.4m - albeit from a small base.

Nice to get the $0.30/share dividend, as a last hurrah.

Life's too short for a more detailed analysis. I just need the deal to complete.

Financial Highlights

Disc: Held in RL and not on SM

I hoped to hold this one for years to come but I can't complain too much. It's a good price and seems inevitable an acquisition was going to happen one way or another.

The market price is still below the takeover price, plus there is the possibility of an interim dividend. According to the announcement:

Altium has certain rights to pay dividends under the terms of the SIA. An interim dividend for the financial half year ending 31 December 2023, remains at the discretion of the Altium Board. If paid it will not be deducted from the Scheme Consideration. Any additional dividends, beyond any interim dividend, will be deducted from the Scheme Consideration.

I'll hold for now:

- It looks like a serious & considered offer, so I think it will go through at 68.50. Market price should increase to reflect that

- There's a possibility of an interim dividend which would be a small but welcome bonus.

Returning to strawman after leaving premium some months ago, working where to put the Altium money.

Reflecting on previous small cap mistakes, the once popular (3DP, ALC, EVS), and the more recent medium to large spectacular successes (AD8, MP1, CTT, ALU) and still running PNV, I am thinking of a mix of downtrodden still forecast to grow stocks IEL, RMD and TYR.

Silly question to ask on a service with a ranking system, but what are everyone’s best ideas as to what to do with the proceeds of such a high conviction portfolio staple?

Wow $68.50 acquired and approved by the board.

I feel very fortunate it is one of my largest holdings but goodbye to one of the best ASX tech stocks by the looks of things. ALU has been an absolute wealth winner for many years.

whether ALU would have grown into its share price over time but you need to back management that they have made the right call. They knocked back autodesk takeover during the Covid period which at the time looked a decent bid given where the share price was at and where it slid after rejecting the offer. Turned out to be a great call.

lets hope a counter offer occurs. I never know what to do in these situations where it’s likely the offer will be approved. Do you sell some at this price or just hold and hope for a better offer to come for a high quality tech stock.

Altium agrees to be bought for $68.50a share:

A little bit sad at this news. I don't own it but they're one of the highest quality growth stocks on the ASX. There aren't a great many of them and it's likely there will be one less now...

Back in August Altium released a an update, sending prices soaring from $37 > $46.

However, since then the share price has come back to near where it was at the time of announcement. There has been no bad news.

However directors have been buying parcels ~40k worth at prices around $42.

Just an observation

Intrinsic Value of $38.71 based on blend of 3 scenarios. The best scenario is management achieve their goal of $500m Revenue in FY26. I have assumed 25% net margins share count increase at rate 0.005%. To achieve management goal of $500m Altium will have grow at 24% for the next 3 years, I personal think the likelihood of this occurring to be fairly low (If it were to occur I came up with discounted value over $50). Other two scenarios I have assumed growth of between 15-20%. Blended together I come up with $38.71. Would look to buy if the share price went below $30, giving a margin of safety.

We sometimes discuss on here how useful or otherwise analyst reports are. Of course, such a general, sweeping statement blends and over-simplifies a wide range of very different products and authors. However, I recently clicked on a link to get some weekly posts of free analyst reports from a well-known local broker. This is presumably a marketing effort to cultivate me as a client. Now, I don't like shit-posting, so I won't name the house nor the author (they may be a member here, after all!), but when I read the report, I was stunned and thought I'd share (just to get it out of my system).

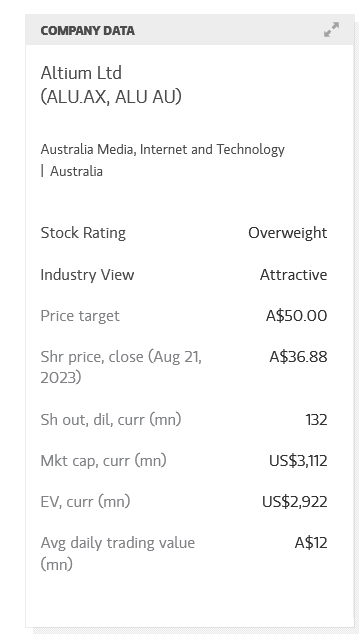

The report is an updated recommendation of $ALU published on 22-Aug, the day after $ALU posted its stunning result, which has been well-covered here on SM. For reference, the SP has risen 30% since the close of the day before the result, from $36.88 to $48.21.

OK. Now to the point of this straw.

Conclusions are: $40 PT (12 month); PT reduced from $42.50; HOLD

Key take-outs

- Small beat in revenue

- Small miss in EBITDA

- Small beat in NPAT

- Weaker than expected cashflow

- Final dividend above our forecast

There is absolutely no reference to the annouced major enterprise deal, no reference to the trends in $/seat, growth of Pro and Enterprise sales over Standard, nor any comment on the trend in Octopart transaction values, nor is there any reference to the CEO's description of what is going on within the company that is driving these results, including the step-up in R&D, and how this is expected to play forward.

To be clear, I'm not complaining about the PT itself, (even though I think it will be outside my range of scenario valuations when I update my model, so I recognise my predisposition here.)

What irks me is that the recommendation appears to be driven entirely by some extrapolation of plusses and minuses of the last year's financials and a judgement on the FY24 guidance.

Wow. Wow. Wow. We've talked here about "time horizon arbitrage" but I don't often come across it so blatantly as this.

Someone who holds a licence and has passed financial analysis exams, is making an investment recommendation and providing a valuation based on this report, presumably signed off by a Head of Research, and under the brand of a well-known institution. And, moreover, this "Research" goes into the weighting of the market consensus, which many of us consider.

I think this is an even worse report than one I saw a few years ago that recommended $ARX over $PNV based purely on revenue multiples!

To be clear, I am not using this example to denigrate analyst research generally; some I find is very good. But a lot is demonstrably not.

So, its times like this that I am truly grateful for the SM Community. Any number of members here publish far more insightful research and analysis.

OK - rant over, back to work.

Doing more scraping from Morgan Stanley. I'm only extracting the summaries for now

We see Enterprise + Altium365 take-up accelerating and lifting consensus expectations over next 1-2 years. Importantly ALU flagged it is entering a period of higher R&D investment due to competition and AI, we explore in this report and conclude it makes strategic and financial sense. Keep OW.

FY23 results robust + new FY24 revenue guidance implies 20-23% revenue growth, ahead of cons. expectations of ~16% heading into the print … and near double global peer average of ~12%. Enterprise Subscriptions outperformed our expectations, growing to 14.4k +76% pcp and spearheading Enterprise revenue growth +140%. When combined with an increasing share of new licenses being time bases, average Subscription seat value increased 22% to US$2,408 (US$1,988 in FY22). Octopart growth also beat expectations as average revenue per click grew by 32%, albeit the normalisation of supply chain post-COVID has lowered traffic and volumes. FY24 EBITDA margin guidance of 35-37% fell short of consensus of ~38%, however, the rationale of further investment in Altium365, enterprise and Octopart is compelling, especially in view of ALU's industry best practice profitability.

Key debate: Does ALU have to lift R&D to compete with global peers? In the near-term we think ALU continues to have a competitive advantage over peers, due to its focus on the small and medium enterprise (SME)/Mid-stream market, customer diversification, low pricing … and further upside to come with momentum in Enterprise + monetisation of Altium365. However our channel checks/industry discussions always show risks from competitors with larger capital budgets, especially now harnessing Artificialintelligence e.g. Cadence Allegro X AI (April 2023). As such we view ALU's investment in R&D as strategically sound.

Attractive valuation: ALU shares are +7% YTD, underperforming AU software peers WTC +70% and XRO +65% YTD. ALU trades on 12mf 10x sales and ~25x EV/EBITDA, which is below the mid-point vs global peers (page 9).New guidance sees ALU scale at ~60% on the Rule-of-40 vs. XRO ~33% and trades on similar multiples.

[held]

Update 26/08/2023

Updating on the back of FY23 results (note these are USD):

- FY23 Revenue = $263.3m

- FY23 EBITDA = $96.0m

- FY23 NPAT = $66.3m

Management reaffirmed aspirational targets of $500m revenue by FY26 (3 FY's away now)

Using the same calculations as below, FY26 NPAT would come in at around $125m.

Converting this back to AUD at a historical average of around 75c gives us NPAT of around $167m AUD. And assuming SOI increases to around 140m, would equal an EPS of $1.19.

If targets are reached in FY26, then this would mean an NPAT growth rate of around 23.5% pa. I believe the market would be willing to pay a 40x PE if this were achieved which would equate to an FY26 target price of around $47.71 which discounted back 10%pa to today would give us a valuation of $35.85.

Now there has been some talk of Altium potentially reaching these targets by FY25, which would mean a growth rate of 37.3% pa for 2 years. If this were achieved then I think a PE of 60x wouldn't be unreasonable in FY25. EPS would be around $1.19 assuming around 140m SOI and a discounted price of $59.15

I can see the reason why there has been such big moves in the market the last week after results released given the discrepancy between my own valuations.

I think if we see a pullback to under $40 I'm going to start opening a position.

Disc: Not held.

Original Valuation

Very brief look at their 1H FY23 results.

- Aspirational revenue target of $500m (I'm guessing its USD) by FY26

- At around 25% net margins would equate to $125m NPAT ($180m AUD)

30x PE at FY26 and then discounting back would give valuation of $30.82.

If they were to achieve their targets this would be equate to around 23% CAGR for the next 4 years (from FY22).

I think at around $30 would provide a better risk reward proposition than the current share price (around $38)

Disc: Not held.

Why I think yesterday's $ALU update was significant

I've always understood $ALU as one of several leaders in the market for software to aid design of PCBs, focused on the mid-market. This market is very large covering moderate complexity designs for PCBs used in a wide range of consumer and industrial devices, which typically have moderate to large production volumes.

However, in yesterday's results release and in the presentation CEO Aram made reference to a multi-year, multi-million dollar "enterprise deal" with Renesas Electronics, a A$45bn market cap Japanese chip and IC manufactuer to be their standard design software platform, signalling a more explicit targeting of the high value enterprise market.

This is significant because the enterprise market is characterised by high-end design solutions, with greater scale and complexity and reliability requirements (think aerospace, large-scale medical imaging systems, self-driving.) This is a market where $ALU's much larger competitors, like Cadence Design Systems (Market Cap $US60bn; Sales $US4bn), are more at home. For $ALU to become the design standard of a large enterprise customer is significant.

It is arguably also necessary. As we appear to see Moore's Law flattening (pending the commercialisation of quantum technology), the design process is becoming more integrated, to optimise the design from the chip right through to the integrated assembly in its end application.

I'm not a microelectronics engineer and I've never used Altium Designer, but it would seem to me unlikely for $ALU to be able to win the Renesas deal without the ability to apply itslelf to these more complex design, simulation and verification challenges.

Aram reinforced this in saying "Of course, we would like to be more competitive against Cadence in the higher end and we have been doing a lot of work that can't be seen but I expect us to do better in the enterprise against Cadence in years to come."

More generally, it was impressive to hear on the call reference to a number of imipressive customer logos including Aram rattling off:

"We closed large multimillion dollar deals with customers such as Tesla, SpaceX, Texas Instruments, Bosch, Acuity and Xylem and many other significant deals with leading brands such as Mercedes, Meta, Amazon, Rivian, Lockheed, Volvo, TE Connectivity, Magna, iRobot, Hitachi, Infineon and Thales. These enterprise accounts and many more provide us with plenty of opportunity to grow our enterprise business in years to come."

Although the PCB design market is also having its slowdown, this is in the context of an industry that is forecast to achieve compound annual growth from 2023 to 2032 of 11-12%. The software market for PCB design is worth >US$4bn globally, and the broader market for design from the chip to more compex systems is materially larger.

I found it very encouraging that $ALU continues to be well positioned to ride this growth not only in its natural mid-market home, but increasingly in the enterprise space. This indicates that we will continue to see double digit growth in "seats" but importantly continuing strong growth in the value per seat.

The value per seat has risen strongly over recent years and in Q&A Aram made clear that this wasn't from price increases as such, but because designers are accessing increasing functionality, which drives revenue. Altium Designer is being made progressively more capable - again, supporting the story of now positioning for the enterprise market.

The next question for which Aram put markers in the sand yesterday, is the extent to which $ALU can get its customers to migrate more of their related workflows (beyond just the IC design) into the $ALU ecosystem,... think procurement and manufacturing. The building out of Octopart is key to that part of the strategy, and Aram gave us the markers to track that progress over the near term when he said:

"We're investing in bolt-on M&A for Octopart and 365, we will expect second half to be the beginning of the upswing and '25 and '26 when we will be hopefully seeing the same effect going from transformation to performance mode, which we've seen with our mid-market and recently with enterprise, and this is the third front I'm expecting for us for this transformational move of having Octopart and 365 connected to not only drive their value up significantly, but also we're going to be getting more volume of traffic."

The "upswing" he is referring to, is arresting the decline of Octopoart, which shot upo during the pandemic, when everyone had to redesign their IC's to get around chip shortages, and where Octopart was being used actively to source scare chips.

I will be interested to see how the analysts consider yesterday's results. But for me, the overall communication was strongly supportive of the thesis.

Disc: Held

$ALU have just released their results, with the investor call at 5:00pm.

Their Highlights

My Quick Analysis

Top and bottom lines generally advancing around 20% marks a solid year.

Results vs. Market consensus were:

- Revenue: US$246m consensus vs. US$263m result

- NPAT: US$0.49 consensus vs. US$0.504 result

So a minor beat on revenue and a very minor beat on eps.

The strength of the result lies in the outlook. $ALU are holding to their long-standing FY26 $500m revenue goal, but the kicker is that they are now forecasting that this can be achieved with only 75,000 of the 100,000 aspirational seats, due to increasing value of subscription seats AND that they are holding to the aspirational seats target (upside? - need to hear what CEO ARAM says in the presentation.)

In line with this goal, FY24 revenue target is 20%-23% growth, and they are holding to an EBITDA range of 35%-37%.

My Key Takeaway

Overall - a rock steady performer. (Slow-down? What slow-down?)

SP is just under consensus, so depending on what NASDAQ does overnight, could see a modest lift tomorrow.

Time to go on the call.

Disc: Held in RL (3.8%) not on SM

Altium

Revenue:

Customer Reciept

Total Expense

For a fairly significant development, this one flew under the radar quite a bit (and I missed it too - must have been one of those extra busy days at work etc.).

On June 8, long-standing chairman Sam Weiss announced his intention to resign at or prior to the company's AGM on 16/11/2023.

Personally, I'm sorry to see him go, despite him being ripe for it after such a long tenure. He has done a stellar job by all acounts, and these will be big shoes to fill.

Valuation (8/3/23)

Altium has been an anchor position in my portfolio, a great quality company that I trust to do well over the long term and grow at solid rates. However, I have just worked the valuation and it seems clear that I will underperform the market holding at this price.

Valuation: A$30.77 (taking management FY26 forecast/Aspirational targets of US$500m in revenue and EBITDA margins of 38-40%)

The current price (A$39.30) requires EBITDA margins to improve to 52% by FY26 on the same sales…

Hence, I have started to trim what has ended up as my largest position. I don’t see any rush to reduce and may not sell out completely, because I retain the view that it’s a long-term winner – but that looks to be priced in and then some…

Looking at SM valuations and they seem to be ballpark around my valuation – so I will have a lot of company for a collective groan if the price goes to $50 in the next 6-12 months!

Altium Acquisitions/ Divestments

· December 2020 Divest TASKING business for US$100m. https://www.asx.com.au/asxpdf/20201214/pdf/44qx8rhqvxlyrc.pdf

· August 2017 Upverter the developer of the world’s first fully-cloud, fully-collaborative electronics design system. This transaction will augment Altium’s cloud-based competencies and drive further differentiation and growth for Altium in the market for next-generation electronic CAD software. https://www.asx.com.au/asxpdf/20170828/pdf/43lt5y1mslmxbc.pdf

· August 2015 Octopart a leading provider of electronic parts data and specialised inventory search. https://www.asx.com.au/asxpdf/20150814/pdf/430hqgjswtmdwd.pdf

· September 2010 Morfik Technology - Australian cloud-application development company. A scrip transaction with Altium issuing 13.3 million fully paid ordinary shares (representing approximately 14.9% of outstanding shares) for 100% of Morfik’s outstanding shares. https://www.asx.com.au/asxpdf/20100916/pdf/31sjnqg3tg2hkt.pdf

Altium valuation based on Financial Results for the Year to 30 June 2022 released to the market on 22nd August 2022.

23% Revenue Growth, 37% Margin and Provides Positive Outlook for FY23

Altium outperformed all expectations and exceeded its financial targets for revenue and margin.

Highlights for the year include:

• Strong revenue growth of 23% to US$220.8 million.

• Strong underlying EBITDA margin of 36.7% (up from 34.3%).

• Recurring revenue of 75% of total revenue, with 31% growth in ARR.

• Double-digit revenue growth for Altium PCB business of 12% to US$169.3 million.

• Record revenue growth of 85% for Octopart to US$50.0 million.

• Acceleration of term-based licenses; up by 63% (33% of all new licenses).

• Strong Altium 365 adoption with almost 24,700 monthly active users at year end (up from 19,700 in February 2022) and over 9,300 monthly active accounts at year end (up from 7,700 in February 2022).

• Strong growth in Profit After Tax of 57% to US$55.5 million.

• Earnings Per Share (EPS) grew by 57% to US$42.2 cents.

• Final dividend of AU 26 cents (AU 47 cents for full year up 18%)

Highlights for the first half include:

Revenue grew by 28% to US$102 million.

Altium core PCB business grew by 16% to US$79 million.

Record revenue growth of 105% to US$22 million for Octopart, backed by tailwinds from the global electronic parts shortage.

Double-digit revenue growth from all regions, except China, which grew by 6% as it felt the temporary impact of regional COVID lockdowns.

Term-based licenses (TBL) growth was 132% and made up 30% of all new licenses sold.

Strong ARR growth of 43% for the half compared with first half last year with recurring revenue now 74% of total revenue compared to 65% in the same period last year.

Strong adoption of Altium 365 with over 19,700 monthly active users (up 54% since August) and over 7,700 monthly active accounts (up 29% since August).

Reported and underlying EBITDA margin of 34.1% was up 11% over the first half last year underlying margin of 30.6%.

Operating cash flow up by 78% to US$33 million and Profit After Tax up by 38% to US$23 million.

Earnings Per Share (EPS) up by 37% to 17.41 cents.

Altium CEO Mr Aram Mirkazemi said, “Altium delivered a strong performance for the first half of fiscal 2022. Momentum has returned to our core PCB business and our business model transition is going smoother than expected with minimal headwinds. Our Octopart business is performing at its all-time best and the adoption of our cloud platform Altium 365 exceeds our expectations”.

Mr Mirkazemi added, “The overwhelming response to Altium 365 from our customers and the broader engineering software industry is most heartening. We are picking up pace toward market dominance and accelerating our transformative vision to digitally connect electronic design and manufacturing to the broader engineering ecosystem.

“While I am very pleased with our first half performance, we must maintain intensity and focus in the second half, as our first half performance should be compared to a low-base last year that was impacted by COVID and the business and organizational model changes that we made as we pivoted to the cloud”.

Altium is upgrading its revenue guidance for fiscal 2022 to the high-end of the range. The margin is likely to be at the low end of the guided range or thereabouts, as Altium plans to scale up its leadership recruitment including new cloud and enterprise sales roles in an increasingly competitive talent market:

Revenue between US$213 million to US$217 million (18-20% growth).

Underlying EBITDA margin of 34-36%.

ARR growth of 23-27%.

Disc: Not held but on watchlist

18-Nov-2021: Altium are holding their AGM today, and their AGM Presentations look and sound excellent. Normally you could locate links to those from the following webpage: Investor Presentations | Investor News | Altium

As of now (10:56am Adelaide time) they have not yet uploaded today's presso's to that page.

However, using the ASX site, you can view their main AGM Presso here and their AGM Management Presso here.

The market reaction has been quite positive so far, with ALU trading over +3% higher today, so now at over $41/share.

I strongly recommend reading through the Management Presso if you're an ALU shareholder or are interested in the company as a possible investment. I have never read a more positive overview of a company by their own management.

Disclosure: I hold ALU shares.

30-Aug-2021: Altium have reported this morning, and the numbers look reasonably good. The dividend has been increased once again, this time to 21 cps, and 15% franked (previously 0% franked). In their results announcement, they start with the title, "Altium Returns to Double-Digit Growth in the Second Half with a Positive Outlook for Fiscal 2022"

However, "Due to unforeseen delays in the finalisation of the annual audit process amplified by the impact of the COVID-19 pandemic in NSW, the release of Altium’s audited accounts has been delayed. Altium expects the audit process to be completed and its audited results to be released within a week. Altium does not expect there to be any material difference between today’s release of unaudited financial statements and the audited financial statements to be released shortly.

Altium delivered strong revenue growth in the second half of fiscal 2021 of 16% to achieve full year guidance at US$191.1 million. The Group delivered an underlying EBITDA margin of 36.1% for the full year. Highlights include:

- Strong growth in annual recurring revenue (ARR) of 29%.

- Recurring revenue of 65% up from 59% one year earlier, with strong growth in term-based licenses, a positive for future recurring revenue.

- Second half continuing business revenue increase of 16%.

- Strong Altium 365 adoption with almost 13,000 monthly active users and over 6,000 monthly active accounts.

- Record revenue growth of 42% by Octopart to US$27.0 million for the full year.

- Strong second half growth in China of 47% to deliver full year double-digit growth.

- Solid growth of 7% in the subscription base to 54,394 subscribers.

- 100% increase in cash balance of US$191.5 million as a consequence of improved operating cash flow and sale of TASKING.

- Final partially franked (15%) dividend of AU 21 cents (AU 40 cents for the financial year up 3%)"

Their results presentation can be accessed from here: https://d2ns91cgb08z5o.cloudfront.net/sites/default/files/2021-08/Investor%20Presentation%20Full%20Year%20FY21%20-%20FINAL.pdf

Disclosure: I hold ALU shares, in RL and also in SM. Happy with this result. Progress seems positive. They are still on track to meet their stated target of $500m in revenue by FY26, although they have noted today that, "The target revenue of $500M may include 10-20% from future acquisitions."

They have also clarified that their target of $200m in revenue that they set in 2016 and have just achieved - in FY21 - "...includes the annualized revenue of TASKING based on the achievement of earnout."

One of the reasons Altium was sold down last year was that they missed their $200m revenue target, mostly due to Covid-19 impacts, however they have achieved that target this year and still have that ambitious $500m revenue target by CY2025 or FY2026. If they can hit that target, I expect they will be trading at higher prices than they are today. It's a big ask, but they have the track record that suggests that they CAN achieve that $500m revenue target.

19-July-2021: I haven't got time to elaborate - have to leave for work, but Altium have just announced that the report in the AFR about the $40 offer from Autodesk is false - they've said, "In response to media speculation today, Altium Limited advises that it has not received any further offer from Autodesk. All details relating to the Autodesk offer have been disclosed by the Company in its ASX announcement released to the market on 7 June 2021."

19-July-2021: Altium shares fell -10.45% this morning in early trade to $32.73/share before they called a trading halt. The AFR reports that Autodesk has upped their takeover offer from $38.50 to $40. Here's a little excerpt from that AFR article (by Anthony Macdonald and Yolanda Redrup):

American software company Autodesk has had another nibble at ASX-listed Altium.

Four weeks after its $38.50 a share indicative bid was rejected, it is understood Autodesk went back to Altium to talk about a deal at $40 with the same set of conditions attached.

Those conditions included customary conditions in Australian M&A - a request for formal due diligence and a board recommendation, should it be able to turn $40 into a binding offer.

However $40 was still not enough for Altium and Autodesk was sent packing, again.

Fund managers will be scratching their heads and wondering at what price Altium would be willing to deal.

--- end of excerpt ---

[Disclosure: I hold ALU shares.]

Altium provided a trading update, reaffirming that it expects to deliver FY21 revenue and margins at the low end of previous guidance.

Specifically, US$190-195m in revenue and a margin of 37-39%.

That compares to US$189m in revenue in FY20, which had an EBITDA margin of 40%.

So for FY21 we can expect EBITDA to drop by around 8% or so.

Not what you want to see for a business on 18x sales.

However, you do need to account for the divestment of their Tasking segment and the fact the the first half was impacted by covid.

Altium did reiterate its 2025 revenue target for US$500m in revenue, which represents ~27% compound growth from the end fo FY21. That factors in additional growth from acquisitions. On an organic basis, the revenue target is around US$384m (at the midpoint), or about 19% compound growth.

(Growth is very much skewed to the back end of that; for example revenue growth in FY22 expected to be circa 10%)

They've always come close to their long term targets, and it's certainly possible they achieve that. The question is how much of that is priced into the current price.

Shares are currently trading at almost 8x the forecast revenue of 2025. Assuming a 20% net margin (it's a bit higher at present, but will likely come down), shares are trading on almost 35x FY25 net profit.

In other words, for shareholders to do well at the current market price, you need to see these (ambitious) targets being exceeded, and/or the market multiples to remain quite high in the future.

EG to get a 10% average annual return from here, and assuming Altium hit's its targets in 2025, you need shares to be trading at a PE of 50 at that point in time.

Not saying that's not possible, only that your returns seem quite dependant on Mr Market being happy to sustain high multiples (which may be harder in another 4 years if inflation and interest rates are higher by then).

I really like the business. But just doesnt seem to be much upside in the price -- even when you take ambitiopus growth targets at face value.

You can read the latest update here.

18-June-2021: Altium Investor Presentation and Trading Update

Also: Investor Presentation-A Winning Strategy for Value Creation

Key Takeaway:

Trading Update

Altium anticipates revenue for fiscal 2021 to be at the low end of the guidance range of US$190 million to US$195 million and margin to be at the low end of the guidance range of 37-39% on an underlying basis (excluding one-off acquisition costs and write back of the SolidWorks minimum contractual amount due to termination of the agreement with SolidWorks).

Altium CFO, Mr Martin Ive commented “momentum has returned to Altium’s business with double-digit growth in the second half, however, after a slow first half due to the impact of COVID and our pivot to the cloud, the full year is likely to be at, or slightly below, the low end of our guidance”.

Mr Ive further noted, “Altium’s renewal business is strong, Octopart is set for a record performance and China is delivering a solid performance. Demand is growing for Term Based Licences (TBLs), which is a positive for future recurring revenue, however, Altium’s perpetual licence sales have underperformed relative to our expectations in the key markets of the US and EMEA as our sales organization works through its transition of our new sales model”.

Adoption of the Altium 365 cloud platform has increased and there are now more than 13,100 monthly active users and over 6,300 monthly active accounts.

--- end of excerpt ---

Could be an interesting market reaction to this guidance downgrade today, right after they knocked back a takeover offer priced at A$38.50/share.

Altium anticipates revenue for fiscal 2021 to be at the low end of the guidance range of US$190 million to US$195 million and margin to be at the low end of the guidance range of 37-39% on an underlying basis (excluding one-off acquisition costs and write back of the SolidWorks minimum contractual amount due to termination of the agreement with SolidWorks).

Altium CFO, Mr Martin Ive commented “momentum has returned to Altium’s business with double-digit growth in the second half, however, after a slow first half due to the impact of COVID and our pivot to the cloud, the full year is likely to be at, or slightly below, the low end of our guidance”.

Mr Ive further noted, “Altium’s renewal business is strong, Octopart is set for a record performance and China is delivering a solid performance. Demand is growing for Term Based Licences (TBLs), which is a positive for future recurring revenue, however, Altium’s perpetual licence sales have underperformed relative to our expectations in the key markets of the US and EMEA as our sales organization works through its transition of our new sales model”.

Adoption of the Altium 365 cloud platform has increased and there are now more than 13,100 monthly active users and over 6,300 monthly active accounts.

In an investor presentation released separately to the market, and on an investor call hosted by Altium CEO Mr Aram Mirkazemi, Chairman Mr Sam Weiss and CFO Mr Martin Ive will explain the Company vision and strategy to unify and to transform the electronics indust.

It was a great day for Altium shareholders today with an intraday high of $38.26, up over 40% on Friday's closing price. Is it time to take some profits?

While Altium has a wonderful future the share price is now well above the average Strawman intrinsic value.

Altium's fundamentals and guidance have not changed because of the Autodesk $38.50 aquisition offer. However, in the space of few hours Mr Market has revalued Altium 40% higher!

Autodesk might raise it's offer, or it could walk away from the negotiation table. What happens then?

At $38 Altium is trading on a forward (2023) PE of 80 (average consensus of 9 analysts on Simply Wall Street) With forecast growth of 17% per annum over the next 3 years, a forward PE of 80 seems quite high to me.

I am happy to take profits at $38 (sold part today) and buy back under $30. I'm also happy to hold part of the holding in case Autodesk increase their offer. Either way, if you hold Altium shares, 'time is your friend'!

Disc: hold shares

07-June-2021: Altium (ALU) is up over 33% so far today on the back of a takeover offer from Autodesk Inc priced at A$38.50/share. ALU management have rejected the offer as they believe it significantly undervalues the company and its prospects. I hold ALU.

22-Mar-2021: I bought a position in ALU today. I missed the lows last year - they got down to $26/share in March 2020 - but I note they got even lower than that earlier this month - to $25.50. I regard anything under $30 as a good buy zone for Altium, so I pulled the trigger on them today in one of my RL portfolios.

Their 12-month chart looks ordinary, but their 5 year chart (see below) puts that into some perspective. They are rising, but with some sell-offs now and then which present buying opportunities. This latest one was prompted by an underwhelming 1st half report coupled with a big tech sector sell off in the US (including a technical correction with the NASDAQ, the quickest -10%+ drop NASDAQ's history actually) which spilled over into our tiny little tech sector here on the ASX.

That all seems done and dusted now however, with a new low point appearing (to me at least) to have been made. So I regard this as a good entry point for me for ALU. I've always wanted to own ALU shares, but they always looked too expensive. However - at under $30 - not so much.

03-Mar-2021: From Marcus Padley's EOD (end of day) newsletter today:

"China has big plans in the Chip market. Beijing had set aside at the start of its last five-year plan around 1 trillion yuan ($155bn) for potential investment in semiconductors over five to 10 years. Taiwan looks interesting then. Big M&A option there."

Surely Altium should benefit, as a leading provider of chip design software. They do not feature in the graphic below, but perhaps they should.

Pivot to the Cloud With Growing Momentum for a Stronger Second Half

Sydney, Australia - 15 February 2021 - Electronic design software company Altium Limited (ASX:ALU) has announced its results for the half year ended 31 December 2020.

After eight consecutive years of double-digit revenue growth, Altium experienced a decline in first half revenue for fiscal 2021 of 4% to US$89.6 million, compared with the same period one year earlier (pre-COVID).

This atypical decline reflects the economic slowdown caused by extreme COVID conditions in the US and Europe, and a challenging environment, post COVID in China, for license compliance activities.

Additionally, Altium undertook its hard pivot to the cloud. Boards and Systems revenue for the second quarter was, however, stronger than first quarter revenue and that trend is continuing with early signs of growing momentum into the second half of fiscal 2021.

Highlights for the first half included:

~ Strong adoption of Altium 365 continues with over 9,300 active monthly users and 4,400 monthly active accounts (up 83% and up 69% respectively since July).

~Octopart grew strongly by 19% to US$10.8 million, as electronic manufacturing rebounded during the half.

~Altium subscription business grew by 12% year-on-year to reach 52,157 subscribers.

~ Term-based license more than doubled over the half, which bodes well for Altium’s goal of 80% recurring revenue by 2025.

DISC : Previously held

ALU is down $1.295 to $29.365 at 3:18pm

Altium has said it expects a 3% decline in first half revenue to US$89.6m due to extreme covid conditions in US, Europe and tough conditions in China.

That being said, the company is maintaining its full year guidance, saying it has seen positive signs in Q2.

Read the full announcemenet here for more detail, but if we dont see a materially stronger second half I'd expect a lot of downside. Shares are on a PE of 72 and very much priced for growth.

A Challenging First Half But Enough Positive Signs to Maintain Full Year Guidance

Sydney, Australia - 12 January 2021 - Electronic design software company Altium Limited (ASX:ALU) updates the market on its unaudited sales and revenue for the half year ended 31 December 2020. Altium experienced a decline in first half revenue for fiscal 2021 of 3% to US $89.6 million due to extreme COVID conditions in the US and Europe and challenging economic conditions, post COVID in China, for licence compliance activities.

14-Dec-2020: Altium Divests TASKING for Future Investment in Altium 365

Altium Divests Non-Core TASKING Business to Support and Enable Future Investment in Altium 365

Electronic design software company Altium Limited (ASX:ALU) has entered into a Definitive Agreement with FSN Capital to sell the assets of its TASKING business for US$110 million. The transaction will be settled in cash with US$100 million up front and US$10 million conditional upon achieving revenue targets in Fiscal 2021 post divestment. The transaction is expected to close in the first quarter of calendar 2021, subject to customary closing conditions and regulatory approval.

Altium Chairman Mr Sam Weiss commented, “we are generating real momentum with Altium 365, the world’s first cloud platform for PCB design and realization, and we believe that Altium 365 is critical to enhance long term shareholder value. The divestment of TASKING enables us to singularly focus on our transformative vision and to fast track the building and acquisition of complementary assets.”

Altium CEO Mr Aram Mirkazemi commented, “the strategic divestment of TASKING combined with our recent organizational changes and hard pivot to the cloud marks an inflection point for Altium in its pursuit of industry transformation. While TASKING is a great business, it does not play a central role in our design to realization strategy for the electronics industry, which is being delivered through our new cloud platform Altium 365. The divestment of TASKING will free up organizational capacity and allow Altium leadership to focus on our main game, which is to expand Altium 365 and accelerate its adoption.”

This transaction will have a one-time positive impact on Earnings Per Share (EPS) in Fiscal 2021 reflecting the profit on the sale of the business. First half Fiscal 2021 results will include TASKING as the transaction will close in the second half. Altium’s first half performance remains solid, however, the effect of this transaction combined with ongoing COVID lock-downs in the US, will have a marked impact on our historic first half/second half 45/55 revenue split. Altium remains confident of achieving full year guidance adjusted for the sale of TASKING whose results will not be included in second half revenue and earnings.

FSN Capital is a European private equity firm with a successful track record in software and technology investments. FSN Capital Partner Mr Robin Muerer commented, “TASKING is a market leader in embedded software for the automotive safety space. We are excited to work with TASKING’s management team as we see opportunities to expand TASKING’s product range and continue its strong partnership with Infineon Technologies.”

The full impact of the divestment will be disclosed as part of Altium’s half year results, including the impact on on-going operations.

--- ends ---

About Altium: Altium (ASX:ALU) is a multinational software corporation headquartered in San Diego, California, that focuses on electronics design systems for 3D PCB design and embedded system development. Altium products are found everywhere from world leading electronic design teams to the grassroots electronic design community.

With a unique range of technologies, Altium helps organizations and design communities to innovate, collaborate and create connected products while remaining on time and on budget. Products provided are ACTIVEBOM®, ActiveRoute®, Altium 365® , Altium Concord Pro™, Altium Designer®, Altium NEXUS®, Altium Vault®, Autotrax®, Camtastic®, Ciiva™, CIIVA SMARTPARTS®, CircuitMaker®, CircuitStudio®, Common Parts Library™, Draftsman®, DXP™, Easytrax®, EE Concierge®, NanoBoard®, NATIVE 3D™, OCTOMYZE®, Octopart®, P-CAD®, PCBWORKS®, PDN Analyzer™, Protel®, Situs®, SmartParts™, the TASKING® range of embedded software compilers, Upverter®, X2®, XSignals®, PCB:NG®, and Gumstix®.

Founded in 1985, Altium has offices worldwide, with US locations in San Diego, Boston, Dallas and New York City, European locations in Karlsruhe, Amersfoort, Kiev, St Petersberg, Moscow, Munich, Markelo and Zug, and Asia Pacific locations in Shanghai, Beijing, Shenzhen, Tokyo and Sydney.

For more information, visit www.altium.com. You can also follow and engage with Altium via Facebook, Twitter, LinkedIn and YouTube.

Altium has reported a 10% lift in revenue. As forshadowed in June, this was below prior expectations and certainly well below the average top-line rate over the previous 3 years of ~22%.

The group did manage a record EBITDA margin of 40%, which helped net profit grow by 12%, though this too is well below prior year's growth rates.

Altium is targeting (at the midpoint) revenue from existing operations of AUD$596m (at current FX rates), with EBITDA of AUD$253 by 2025 -- which represents annualised growth of 17% and 19% resepctively, and excludes any additions from acquisitions.

That's still very attractive -- especially in the context of their balance sheet strength ($US93m cash / no debt) and their high levels of high margin recurring revenue.

But then again, all this would seem to be "in the price".

EPS in Aussie dollars (normalised for a one-off tax adjustment) = 0.59c, which puts shares on a PE of 55. Shares are now on a P/S ratio of 16x. However, assuming they can maintain an (outstanding) 30% net margin and hit US$450m in revenue by 2025, the company could be generating an EPS of AUD$1.47 by 2025.

If shares could sustain a PE of 35 at that time, you could consider shares fairly valued. Of course, anything less than these assumptions would undermine shareholder returns.

There's a lot of detail in these results -- which you can dig into here -- but for me I'd like a bigger margin of safety before taking a position.

18/02/.2020

Hard to be too displeased with the latest set of numbers. As shareholders have come to expect, revenue grew strongly (up 19% on the half), margins improved, license numbers increased etc

The business is still debt free and has over $80m in cash.

HOWEVER, Net profit did fall -- for the first time in a long time, dropping 2%. The reason for this was that Altium was previously applying a large deferred tax asset, which has now been fully used. As such, Altium paid US$8.7m in income tax for the first half, comparted with just US$2.3m in the previous corresponding half.

That being said, pre-tax profit was around 23% higher (see attached image)

The company did reiterate full year revenue guidance of between US$205-215m, with an EBITDA margin of between 39-41%. BUT, the coronavirus in China and an underperformance of Octoparts (revenue grew just 2% in the half), mean that they expect to come in at the lower end of this guidance.

That suggests a full year NPAT of ~US$50m, which on a per share basis in AUDs is about 56c. So although shares have fallen today, the PE is still ~65x (at time of writing)

Management reaffirmed the longer term revenue target of US$500m by 2025, which is 2.5x the current level. So a premium is certainly warranted if you think this is achievable, especially if you give extra points for business quality (as I do). It's just a question of how big a premium you think it deserves.

I really like the business, but feel a lot is already priced in by the market.

Results presentation is here