Doing more scraping from Morgan Stanley. I'm only extracting the summaries for now

We see Enterprise + Altium365 take-up accelerating and lifting consensus expectations over next 1-2 years. Importantly ALU flagged it is entering a period of higher R&D investment due to competition and AI, we explore in this report and conclude it makes strategic and financial sense. Keep OW.

FY23 results robust + new FY24 revenue guidance implies 20-23% revenue growth, ahead of cons. expectations of ~16% heading into the print … and near double global peer average of ~12%. Enterprise Subscriptions outperformed our expectations, growing to 14.4k +76% pcp and spearheading Enterprise revenue growth +140%. When combined with an increasing share of new licenses being time bases, average Subscription seat value increased 22% to US$2,408 (US$1,988 in FY22). Octopart growth also beat expectations as average revenue per click grew by 32%, albeit the normalisation of supply chain post-COVID has lowered traffic and volumes. FY24 EBITDA margin guidance of 35-37% fell short of consensus of ~38%, however, the rationale of further investment in Altium365, enterprise and Octopart is compelling, especially in view of ALU's industry best practice profitability.

Key debate: Does ALU have to lift R&D to compete with global peers? In the near-term we think ALU continues to have a competitive advantage over peers, due to its focus on the small and medium enterprise (SME)/Mid-stream market, customer diversification, low pricing … and further upside to come with momentum in Enterprise + monetisation of Altium365. However our channel checks/industry discussions always show risks from competitors with larger capital budgets, especially now harnessing Artificialintelligence e.g. Cadence Allegro X AI (April 2023). As such we view ALU's investment in R&D as strategically sound.

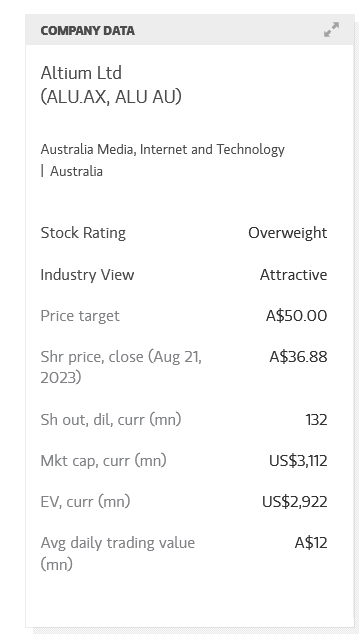

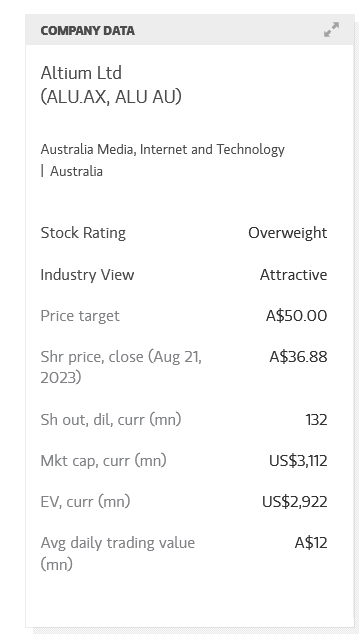

Attractive valuation: ALU shares are +7% YTD, underperforming AU software peers WTC +70% and XRO +65% YTD. ALU trades on 12mf 10x sales and ~25x EV/EBITDA, which is below the mid-point vs global peers (page 9).New guidance sees ALU scale at ~60% on the Rule-of-40 vs. XRO ~33% and trades on similar multiples.

[held]