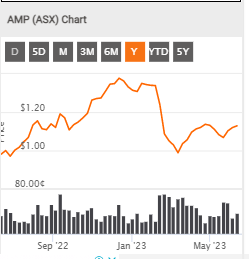

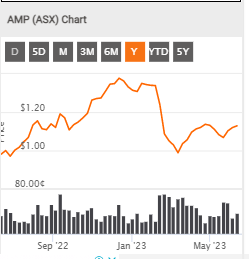

AMP Notice of Meeting 2023 (HSF comments XX.1.23) a return of an old relic of a stock ( Return of the Jedi..lol )

Back on 27 February 2023:

Return of capital and dividends AMP remains well-capitalised and has a strong balance sheet, which enabled us in August 2022 to confirm a return of capital to shareholders of $1.1 billion subject to completion of the AMP Capital transactions, and any required shareholder and regulatory approvals. This included the immediate commencement of a $350 million on-market share buyback, of which $267 million is already complete. As part of our commitment around capital returns, AMP will return a further $400 million via a FY 22 final dividend of 2.5 cents per share, franked at 20%, and other capital management initiatives in 2023. A further $350 million of capital management initiatives will be announced following completion of the remaining AMP Capital transaction

DEBRA HAZELTON Chair, AMP Limited

Return (inc div) 1yr: 20.13% 3yr: -10.68% pa 5yr: -18.36% pa