Really enjoyed reading the well-balanced Straws here from Wini et. al.

From my limited understanding, there are a lot of shares now in the hands of employees who have resigned since the escrow release.

This includes Serafin, Tomlinson and Deuter who have all left the company. In addition, Dunow has ceased being a KMP.

After many loyal years to the company, it appears that they are cashing in, perhaps for lifestyle reasons.

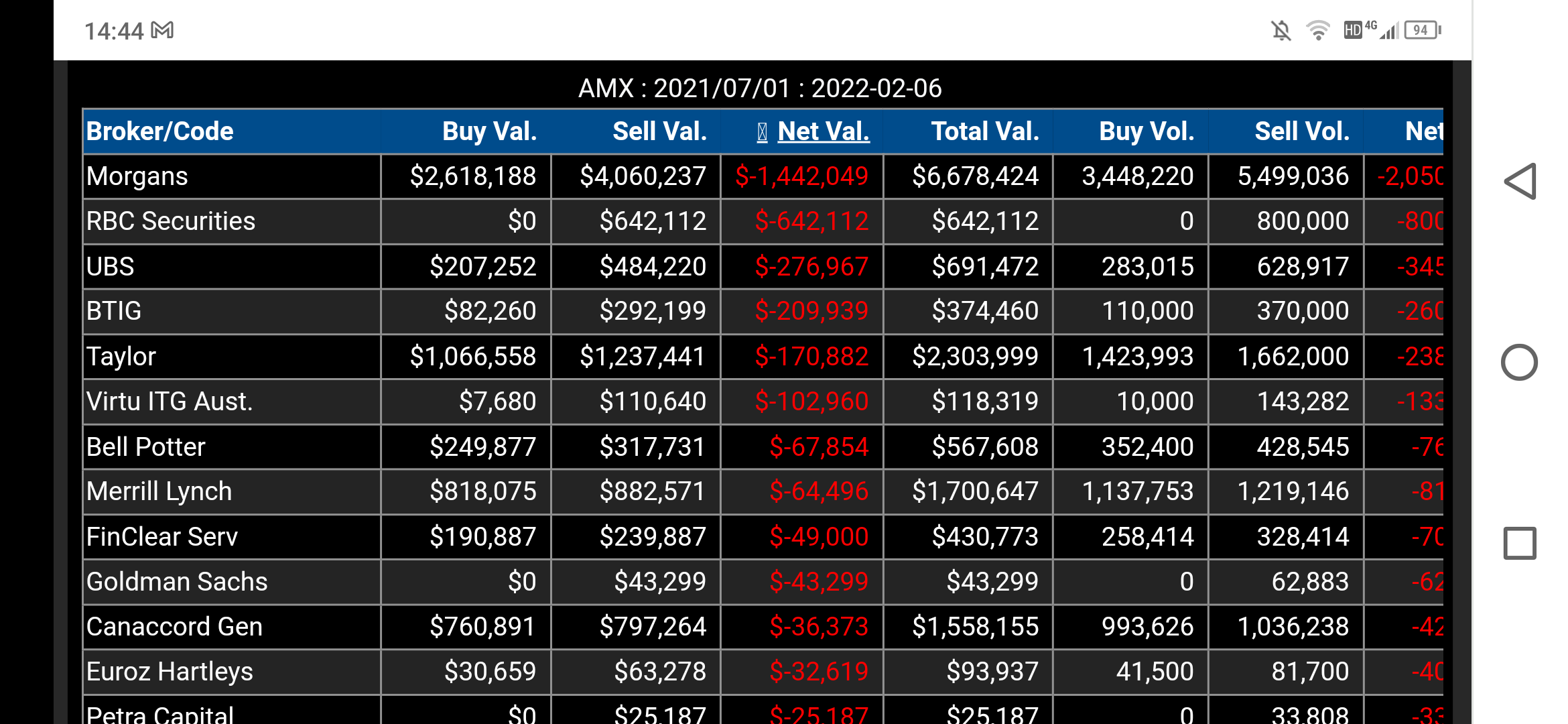

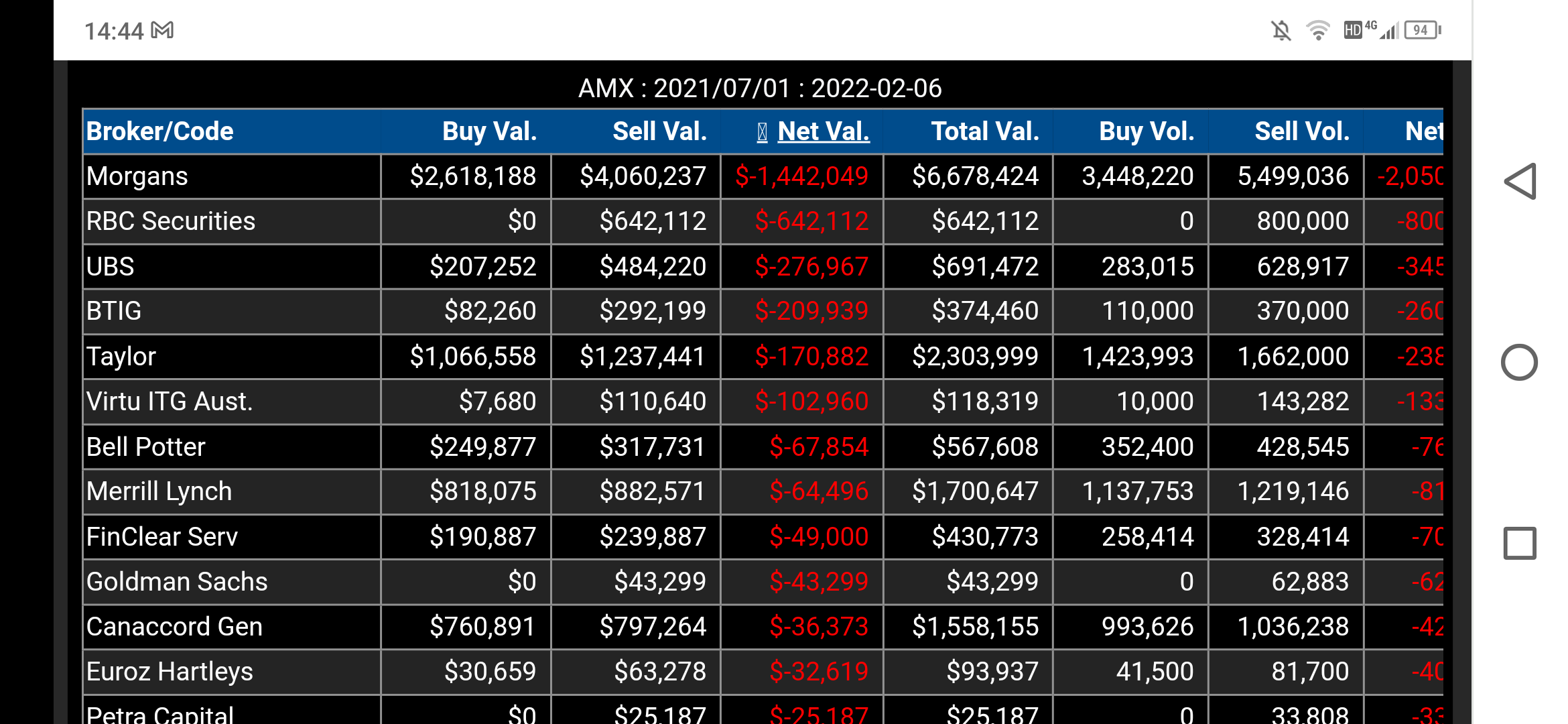

Unfortunately, this has put enormous pressure on the share price, and it is likely to continue for a while yet, with Morgans remaining the main seller (broker data below).

The other main risk that I can see is that the market size is not significant, in Australia at least, with a domestic TAM of circa $130m.

Once selling pressure eases, it looks primed for a rebound, assuming the fundamentals remain intact but the risk of further selling remains.

Another way to value this business might be with an ARR multiple; AMX is currently trading on around 10x ARR ($6m ARR), although this doesn't reflect the sizeable non-recurring revenue base that has been established.

Remains on the watchlist for me for the moment.

Would love to get perspectives from anyone who has been following the shareholder registry evolve over the last 6 months as to when selling pressure might be likely to ease.