AIRTASKER - POTENTIALLY A $9B PLUS COMPANY

WHAT IS “AIRTASKER”

I am sure most people have heard of Airtasker. It is an online market place (platform) where tasks are quoted for by Taskers to get services done. They charge a commission of around 16.5% on jobs completed.

It’s a founder led business with Tim Fung at the helm. It was started in Australia over 10 years ago and listed in March 21. He is extremely passionate and seems to be building an amazing team around him to take ART global.

WHY USE AIRTASKER

Getting quotes for different jobs can be very time consuming. You need to call different trades/providers to get quotes and meet up with them. You don’t know how good they are a lot of the time until you try them. Airtasker solves this problem by allowing tasks of any type to be detailed on their website and for Taskers to quote on them.

Advantages include -

- Saves loads of time as you normally get multiple quotes in minutes. Average time to get a quote for a job on ART is 2 minutes.

- You can get any job done and it doesn’t have to fit into a category. There is no other open marketplace like Airtasker of this nature anywhere in the world. (spider removal, trampoline erection, write a business plan etc)

- You can check out the reviews of the Tasker’s to see how good they are

- Because more than one person is quoting on the job quite often pricing is very competitive

- The tasks only get paid through the platform when completed to the customers satisfaction.

- Paying through a platform/third party gives the parties added security. Insurance is also covered by ART.

- Generally work gets carried out to a high standard as reviews are left on the platform, similar to eBay.

Disadvantages include -

- Airtasker take a 17% commission, so some might see it as expensive

- You choose a person online and don’t get to meet them face to face most of the time.

- From an investment case there is some debate as to the quality of ART, as it’s unlikely that once a Task is completed the two parties will engage through the platform again, as phone numbers will be exchanged and both parties will likely go direct to save fees to Airtasker. I agree with this, but I have used ART several times for different jobs and am a repeat customer for the reasons detailed above. ART have also added a feature now where customers can engage with previous Taskers and they only charge 1.9%. I think this is pretty enticing as it covers payments and insurance.

WHERE IS AIRTASKER TODAY

Airtasker was established in 2012, but really only started to get traction in 2015 in Australia. Whilst over 80% of their business is in Australia, they do operate in the UK, Ireland, NZ, Singapore and the US. The majority of their business outside Australia is in the UK.

When Airtasker listed in March 21, it had revenue of $24.5m roughly and a market cap of $255m and a share price of $0.65 and was 5x over subscribed. It was listed at roughly 10x revenue. There was a lot of excitement the first few days and weeks with the share price almost reaching a high of almost $2. Today ART is on a revenue run rate of around $40m (excluding the Oneflare aquisition) and a revenue multiple of around 5.2x at a share price of $0.475, so it’s trading at half it’s listing revenue multiple. I don’t like using revenue multiples, but in this case I think it is a fair comparison, when comparing ART’s value to listing. They have exceeded their prospectus guidance, so the sell off in share price is purely sentiment driven.

GROWTH DRIVERS

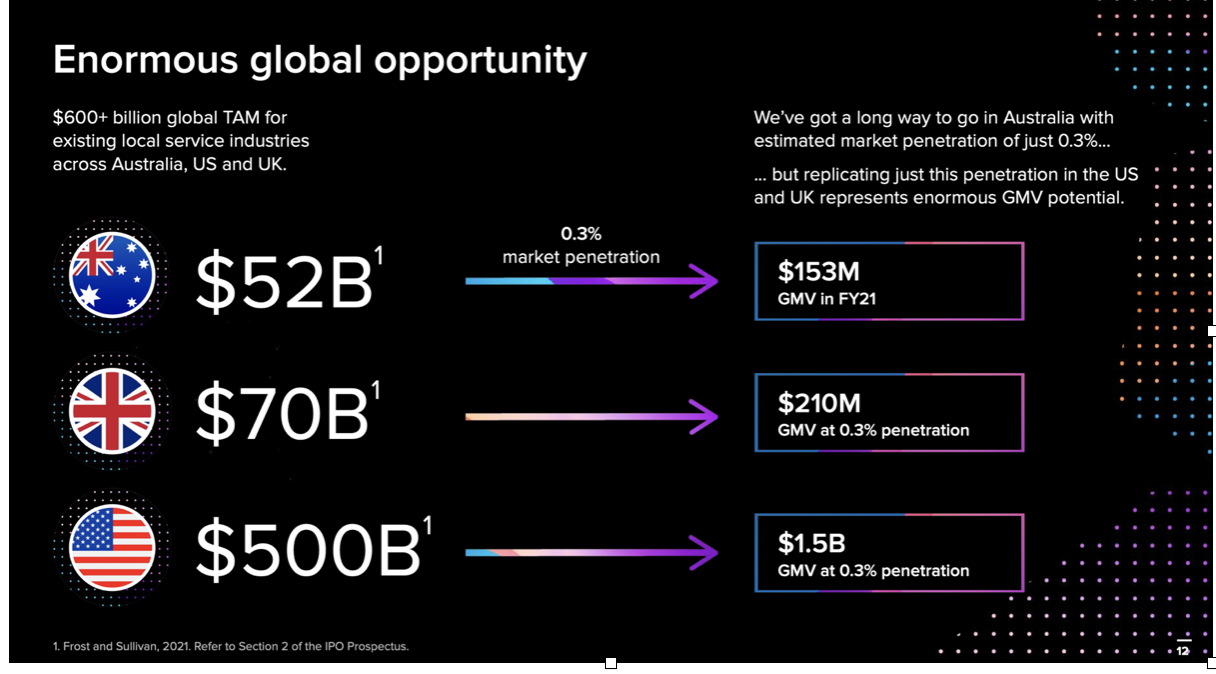

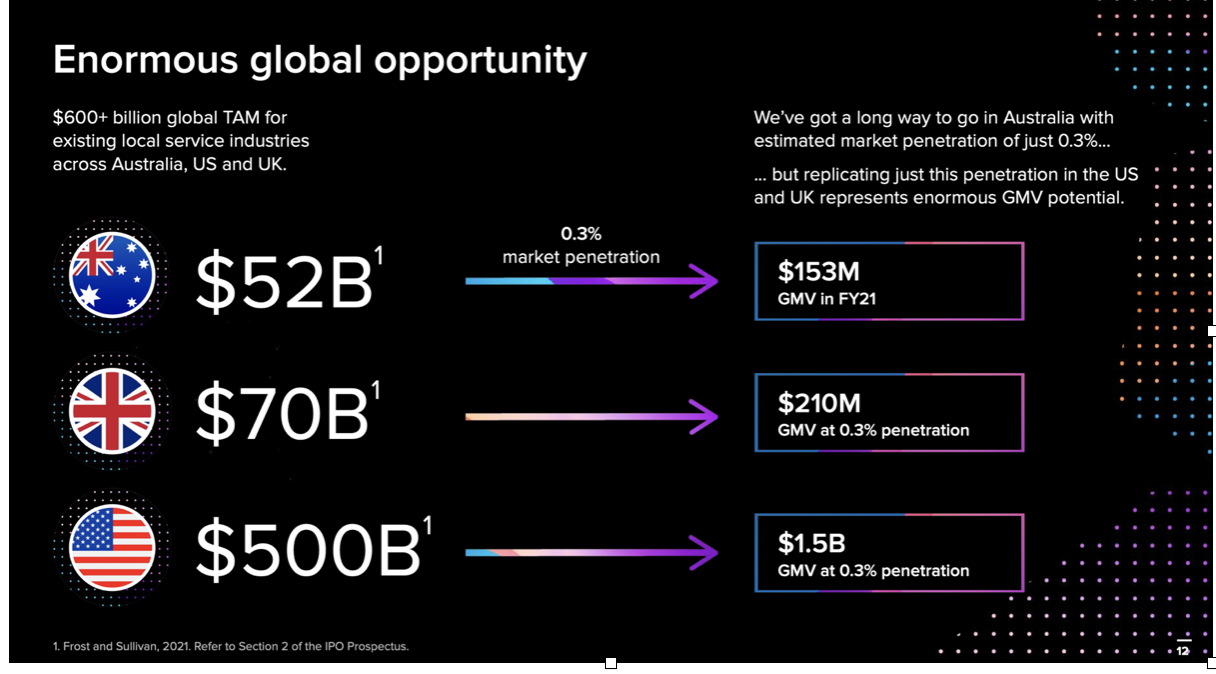

By far the biggest growth driver is overseas expansion with the UK market almost 1.5x bigger than Australia and the US is massive and 10x the Aussie market.

They have added other features including contacts where Taskers can be re-booked through the platform for just 1.9%

Taskers are also able to list their services on the platform and specified prices.. I think this is a great way to get customers thinking about all the different services on the platform, but we are yet to see how much traction it gets, as its very early days.

HOW TO VALUE AIRTASKER

If you take out the international business, Airtasker would have operating cash flows of around $10m per annum. They proved this in the March 2021 quarter with $2.1m operating cash flows and their Australian business has grown significantly since then. So it would be fair to assume that the business could trade on at least a 20 times multiple, which would equate to a $200m enterprise value. Taking into account their $30m cash balance, I would then estimate a share price of $0.52 would be justified, but that is just the Aussie business excluding the recent OneFlare acquisition which adds 30% in client numbers.

Airtasker is currently running at a loss, as they have been investing in people and marketing to take advantage of the huge international market opportunity. This is exactly what you would want them to do. The US is 10x the size of Australia’s and a $500b market and the UK is a $70b market.

Airtasker has announced that they are break even in the UK and need to invest in the US, as it’s very early stages.

It took ART around 10 years to achieve 0.3% penetration in Australia and if they can do the same in the UK and US they would have GMV (Gross Marketplace Volume, the value of work going through the platform) of $1.863b and around $307m in Revenue, 16.5% of GMV. Assuming overheads come in around double current levels at $80m, ART would be profitable to the tune of $227m. I believe if successful they would trade on around a 40x EBITDA multiple conservatively or a market cap of $9b and a share price of around $24 or around 50x its current value, share price is currently of $0.475. It’s a high multiple but for a business with such a large market and proven success, it's actually quite reasonable maybe even conservative. Sounds crazy doesn’t it, but that’s the opportunity.

I don’t think it would take them 10 years to achieve 0.3% penetration in the US and UK as they have benefited from the huge learning curve in Australia and can implement their playbook. They have the platform, a better marketing team and systems as well as more capital to grow.

They look to have de-risked significantly in the UK and are scaling nicely there, so there is a very good chance they will be successful. Assuming they aren’t successful in the US, but able to get the UK business to the same size as the Australian business, then a share price of over a $2.00 would be justified in my opinion, as the business would be more than double the current size. I am assuming costs go up to $60m and revenue of $100m, so EBITDA of $40m and a multiple of 20-25.

The market is likely to re-rate ART as soon as they prove they are getting decent traction in the US. This could take a couple of years or it may be a lot sooner, but any indication that it’s happening would see the share price up significantly in my opinion, due to the incredibly large opportunity over there. The market is almost certainly going to price this in to some degree.

DIRECTOR OWNERSHIP

Aligned director interests are extremely important to me these days. I have found my investments where there is significant director skin in the game have way out-performed my other investments.

In the case of ART, it’s founder led by Tim Fung who has lived and breathed this business for over 10 years. He owns around 11% of the company and didn’t sell any of his share holding at listing. If you listen to many of the podcasts he has been featured in, you can sense that he is extremely passionate about ART and the positive contributions it can have by assisting people to find work opportunities. Directors combined own around 40% of the company.

Interestingly in the last cap raise, directors took up most of the shares to fund the Oneflare acquisition, putting in $3.55m of their own money at $0.43 They obviously see the opportunity ahead for Airtasker.

CAPITAL/CASH FLOW

The market is selling down any company that is burning money and this explains the reason for the weakness in the ART share price. However, they have stated that the business will be cash flow positive in the very near future. This is great news as it means the Aussie business will be funding overseas growth. Further, they have over $30m of cash and equivalents currently. They did well raising over $20m at $1 two months after listing to fund the acquisition of Zaarly and US growth. The recent cap raise to fund the acquisition of Oneflare, the third largest services platform in Australia at $0.43, was through directors mainly.

They may need to raise again, but I believe this would only happen if they needed to make further acquisitions for international expansion not for organic growth.

RISKS

ART is a risky investment, as they may not be able to scale the business as well in the UK and the US as they have in Australia. Many Aussie start up’s have tried to expand overseas without success. Currently they are loss making, as they are investing in growth. New more capitalised competitors could come into the market, as the opportunity is so large. There are also regulatory issues and work place regulations to consider. Key people could always leave, but I believe this risk is very low.

CONCLUSION

I believe that ART could be a life changing investment. They simply need to achieve the same success in the UK and the US as what they have in Australia. They are well capitalised and have an amazing team of people who are passionate and believe in their mission of creating flexible working environments for everyone. Of course it’s a risky investment, but with the huge upside, what investment isn’t. Now that the craziness has come out of the share price since IPO, I believe this could be the perfect time to invest in this business with a 5 to 10 year investment horizon.

I’m particularly bullish for the following reasons -

- great platform serving a genuine need in the community

- massive addressable market with next to no direct competition

- extremely good margins at scale

- founder led with lots of skin in the game and recent director buying

- no debt and plenty of cash to grow for the forceable future

- market has been advised that they plan on being cash flow positive in the near future and will fund own growth

- inexpensive for the market opportunity, below IPO price and massively below its all time high.