This is an interesting and very recent IPO I came across in the past fortnight. Essentially Birddog gets most of its revenue from selling video cameras. There’s more nuance than that but I don’t want to lose you too early.

What can they be equated most closely to?

Probably Audinate (ASX:AD8) but with a video focus. A bit like Audinate they target the production-quality market. Also like Audinate – at least my understanding of Audinate, I’m not a shareholder - their technology leverages a specific protocol to share the content.

They also cite Atomos (ASX:AMS) as a competitor. My understanding of Atomos (I’m also not a shareholder of this) is they target the ‘Prosumer’/Influencer/Out-and-About market so not exactly the same part of the market, but I’m sure there is a fair bit of cross-over. Perhaps this is one of the reasons for Atomos’ recent share price weakness.

So basically just video cameras?

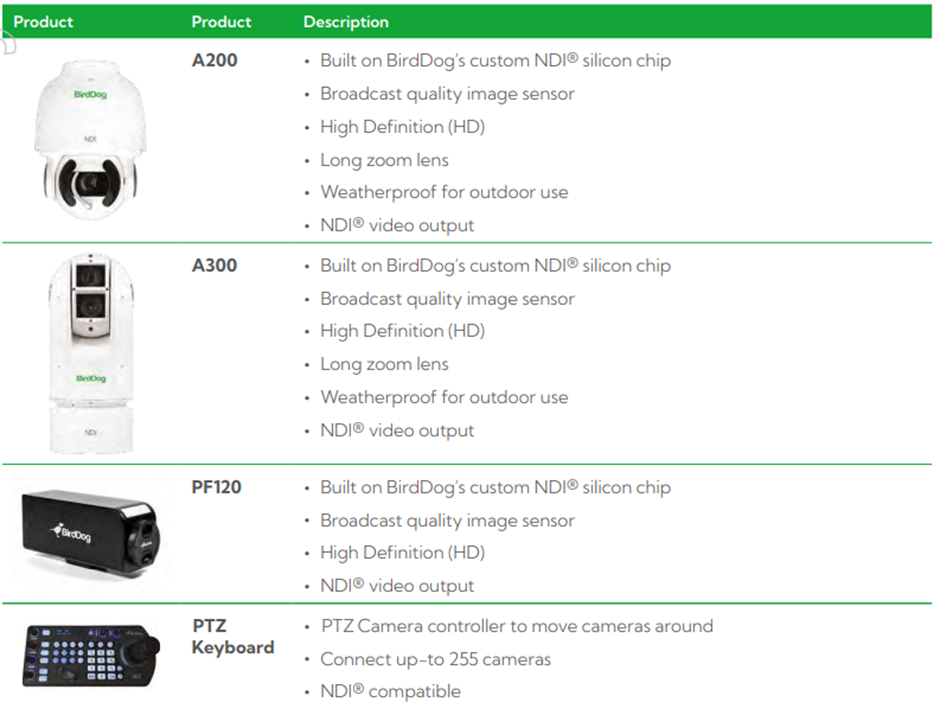

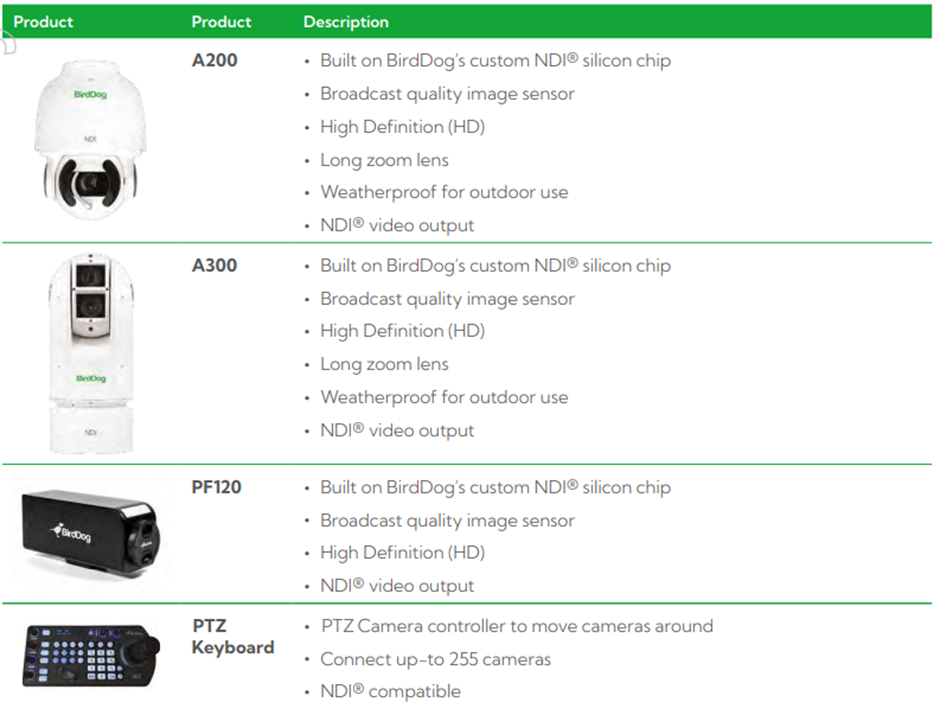

Not just cameras. They have over 30 products that all utilise the NDI (Network Device Interface) protocol to enhance the quality, speed, flexibility and shareability of video. So - cameras, converters, controllers, display modules and software. But 85% of their revenue in FY21 came from cameras and converters – in particular, PTZ Cameras, which stands for Pan-Tilt-Zoom i.e. can be controlled remotely. Their cameras retail from USD$1,495 to $7,995.

What does this protocol mean?

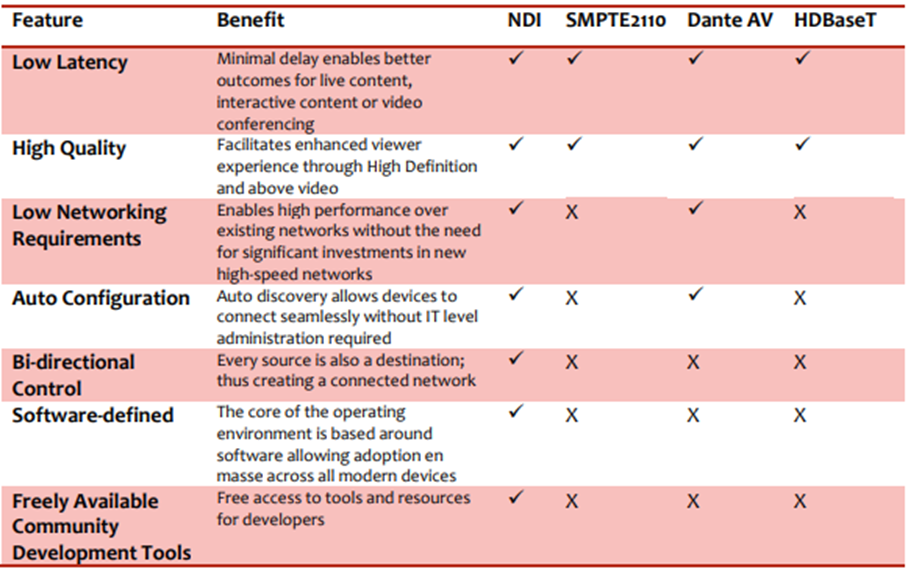

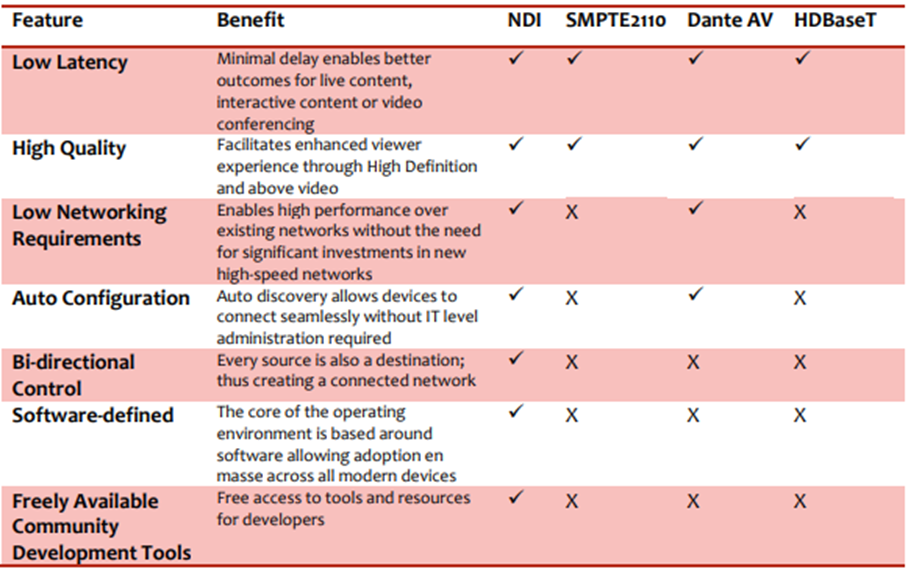

Here’s what they say versus other protocols:

I don’t claim to be a video/sound engineer so I’m going to bow out of a debate as to whose protocol is best pretty early. However, I have spent some hours listening to Birddog product reviews online by people who are qualified to give their opinions and they all get pretty frothy about the NDI protocol whenever it comes up.

One thing I do know about NDI is that Birddog don’t own it. It’s a royalty-free software standard developed by a Texas-based company called NewTek Inc. Birddog have negotiated a licence agreement with NewTek to use the protocol. The exact terms aren’t disclosed but for the past two years they’ve paid roughly 5% of revenue to NewTek as a licensing fee.

If it’s royalty-free why do they need to pay?

From what I’ve read a royalty-free licensing fee typically means you pay once but not per use. I can’t say much more without knowing the specifics of the agreement but a payment per sale might be a way of reducing this agreement as a risk given that NewTek are also a competitor.

Who buys their stuff?

Broadcasters do. But so does the education sector (I would imagine higher ed in particular), churches (big U.S. ones), corporates and then the AV contracting industry that supports all of these. The PTZ camera stuff is interesting as it points to a growing movement away from having a camera operator sitting behind every camera. Potentially you can satisfy the demand for more angles and more in-depth coverage at the same time as reducing your operating costs by being able to install multiple cameras and control them remotely.

Is their stuff any good?

Like I said I’m no expert but I chewed through plenty of video reviews from people who are and they all liked them. Having said that my experience of tech dudes is that they always love the latest gizmo or shiny new toy. I couldn’t say they’d have longevity when someone else brings out the latest new product or implements a better protocol.

One thing they do love is the simplicity of it. Things like making changes to colors/hues/depth and preview the impact of changes in real time. Also, the ability to run everything – video/audio/power/tally/control - all in one ethernet cable.

How far are they from profitability?

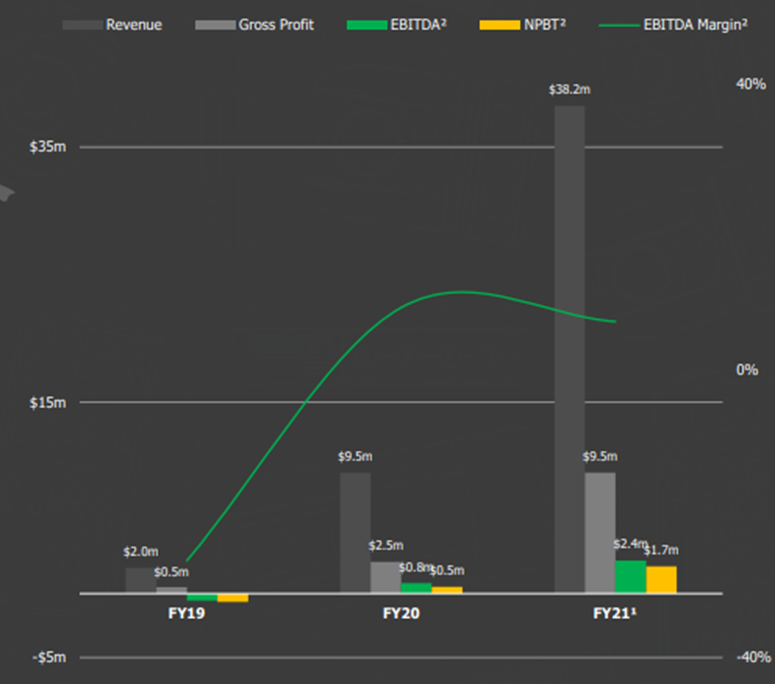

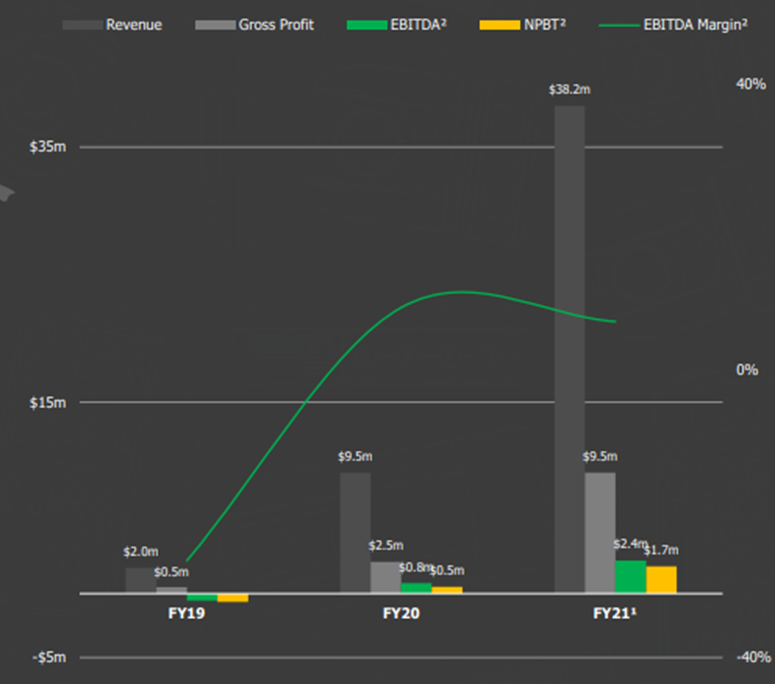

Surprisingly they were profitable in FY21.

How fast are they growing?

Fast. Really really fast.

They aren’t as big as Atomos in terms of revenue but they’re catching up. Their gross margin is mid-20s but they believe 30% is realistic. That’s still well below Atomos who regularly deliver a GM of 40% plus. Where Birddog gets one back is via SG&A, which is a fraction of Atomos. Birddog really seems to punch above its weight in terms of getting bang for buck from SG&A generally, and R&D specifically. They also appear to expense R&D, which keeps the balance sheet clean. Kudos for them.

Is that growth sustainable?

Surely not. If it was I’d be buying with my ears pinned back. They do acknowledge a degree of COVID demand pull forward, particularly in churches and education. To what degree is that driving the numbers and to what degree is it a permanent shift? Frustratingly they haven’t given any kind of update beyond FY21, nor have they provided any phasing of FY21 demand. I think that’s disappointing given they only listed in December and most companies will at least have given some sort of indication of FY22 YTD to the market at least once this year.

What about management?

Plenty of skin in game. Insiders are keeping about 50% ownership and not selling during the IPO. They look a little light on for listed-company experience from my reading. John Dixon is the non-exec Chairman and probably meant to be the steady set of hands from that perspective, having been GM of Linfox and held other board appointments.

Am I buying?

Nup. It’s an interesting company but the lack of any FY22 YTD update or HY/FY guidance is too much of a red flag to me. Their incentive is to maximise the IPO price and if they were able to report even modest growth in FY22 I think they’d justify a much higher price than the 3.2x sales multiple they listed at. Having said that I’m very keen to read their half year update and will be happy to jump in belatedly if I’m being too cautious.

Not owning NDI and having to re-negotiate licensing agreements is a notable risk, particularly given NewTek is a competitor. But not one that would prevent me from hitting the Buy button.