Took a glance at BirdDog the other day, half hoping it was a Genetic Splicing company. It is not. Noddy74 gives a great run down on what BirdDog. Take a look at their IPO Prospectus for more information.

BirdDog listed on the ASX December 20 2021. Personally, I wait at least six months before thinking about taking a position. This rules lets the 'hype' of the IPO wane away and gives me time to see how the company is performing, Only time I will 'ignore' this rule is if. company releases a PROFIT UPGRADE. Then all bets are off.

I had a look at BirdDog's December Quarter Appendix 4C, focusing on Operational Cash Flow (OCF) and then the company's first half FY22 results.

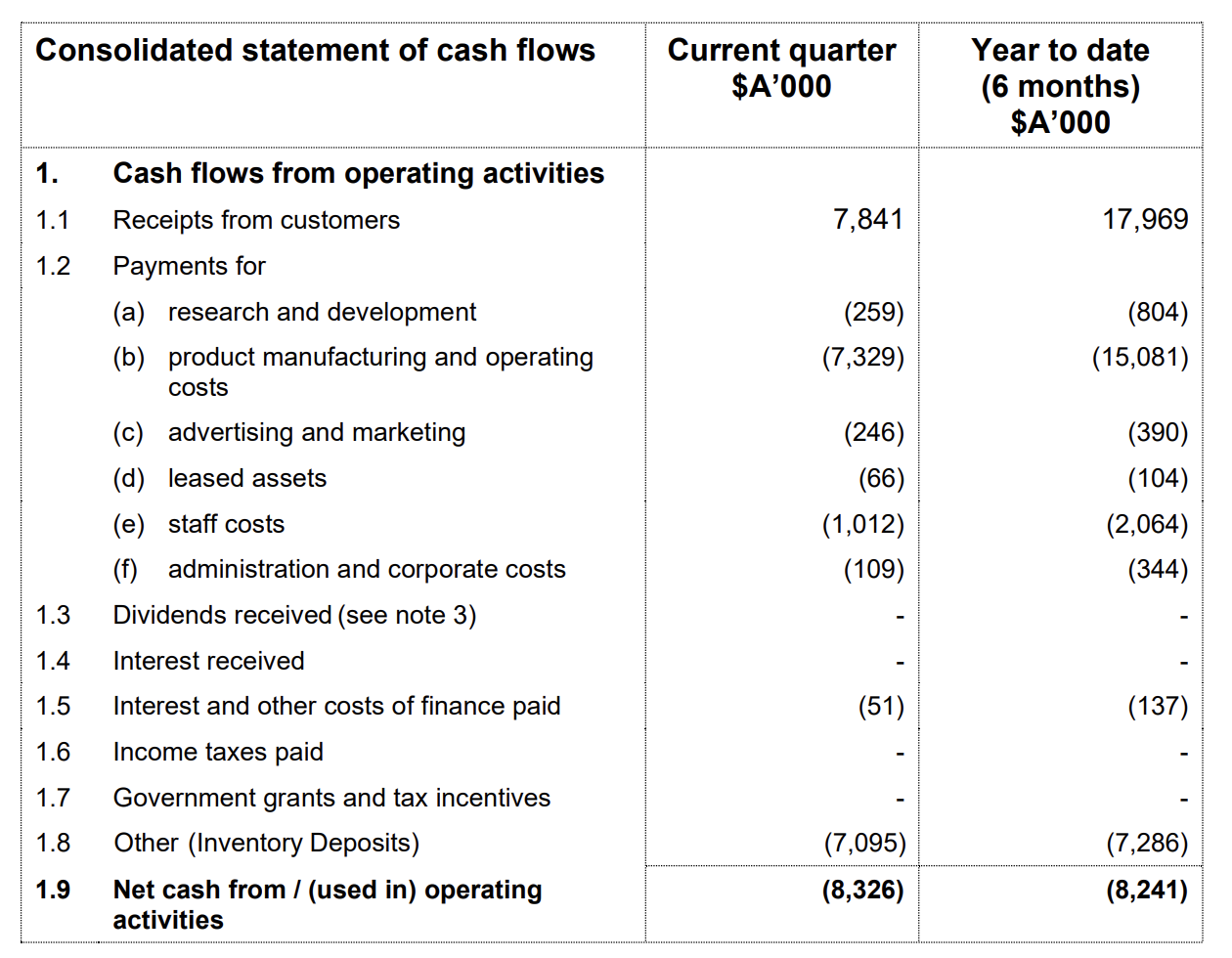

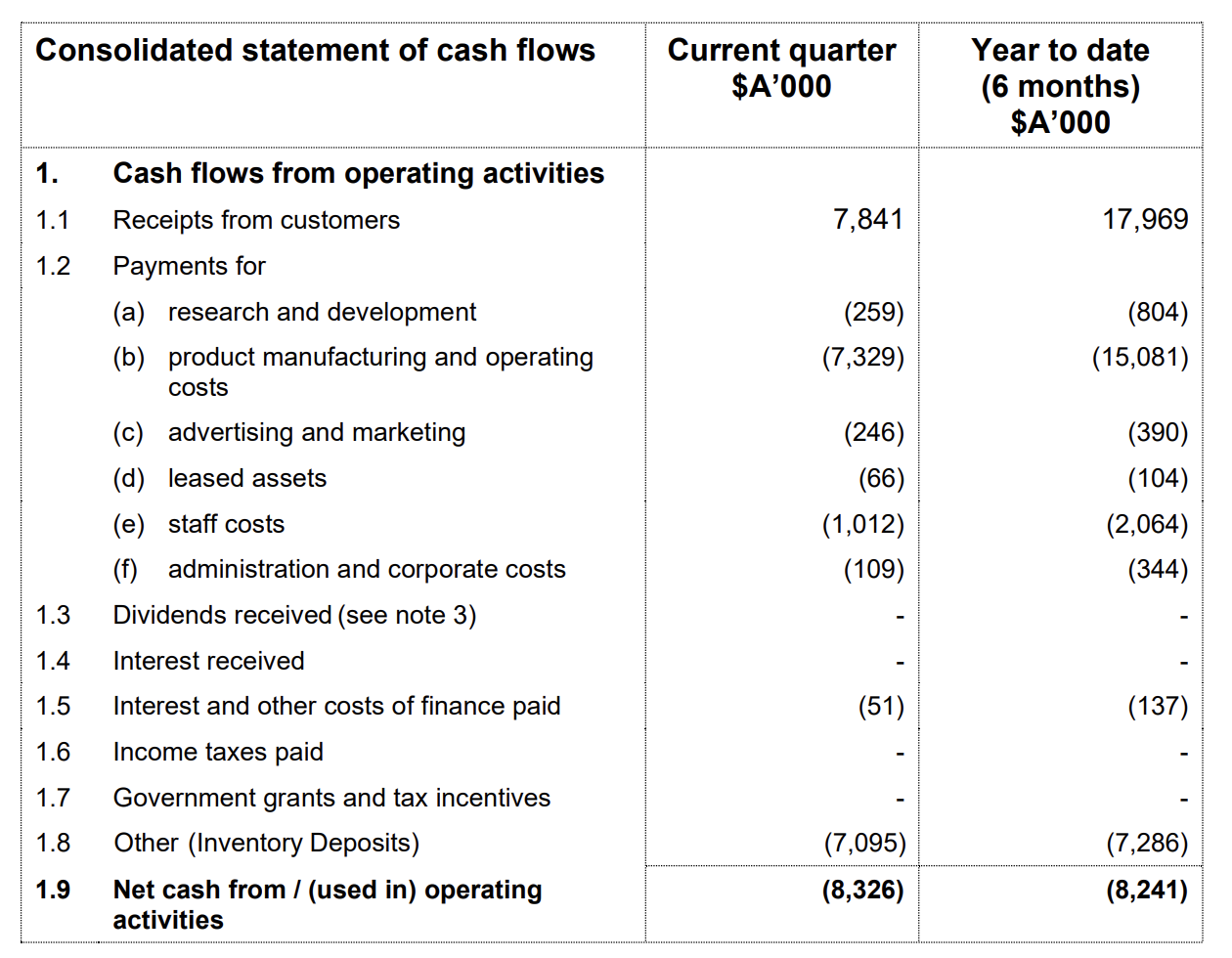

December Quarter Appendix 4C - Operating Activities:

- First thing I do with Appendix 4C is look for upward trajectories in cash receipts. To determine this I prefer at least 8 quarters of history.

- Hard to gauge how the company is performing based off one quarters results, but as Noddy74 mentioned, revenue growth has been growing phenomenally the last few years, increasing from $2 to $40m.

- In saying that, we actually have two quarters of cash receipts because we can infer the first quarter receipts ($10.1m). So receipts fell from last quarter $2.3m. This means nothing. It is no trend. Could be seasonality? Differences in cash payables/receivables.

- OCF negative by $8.3m includes $7m of inventory deposits. Building inventory. This is not a bad thing.

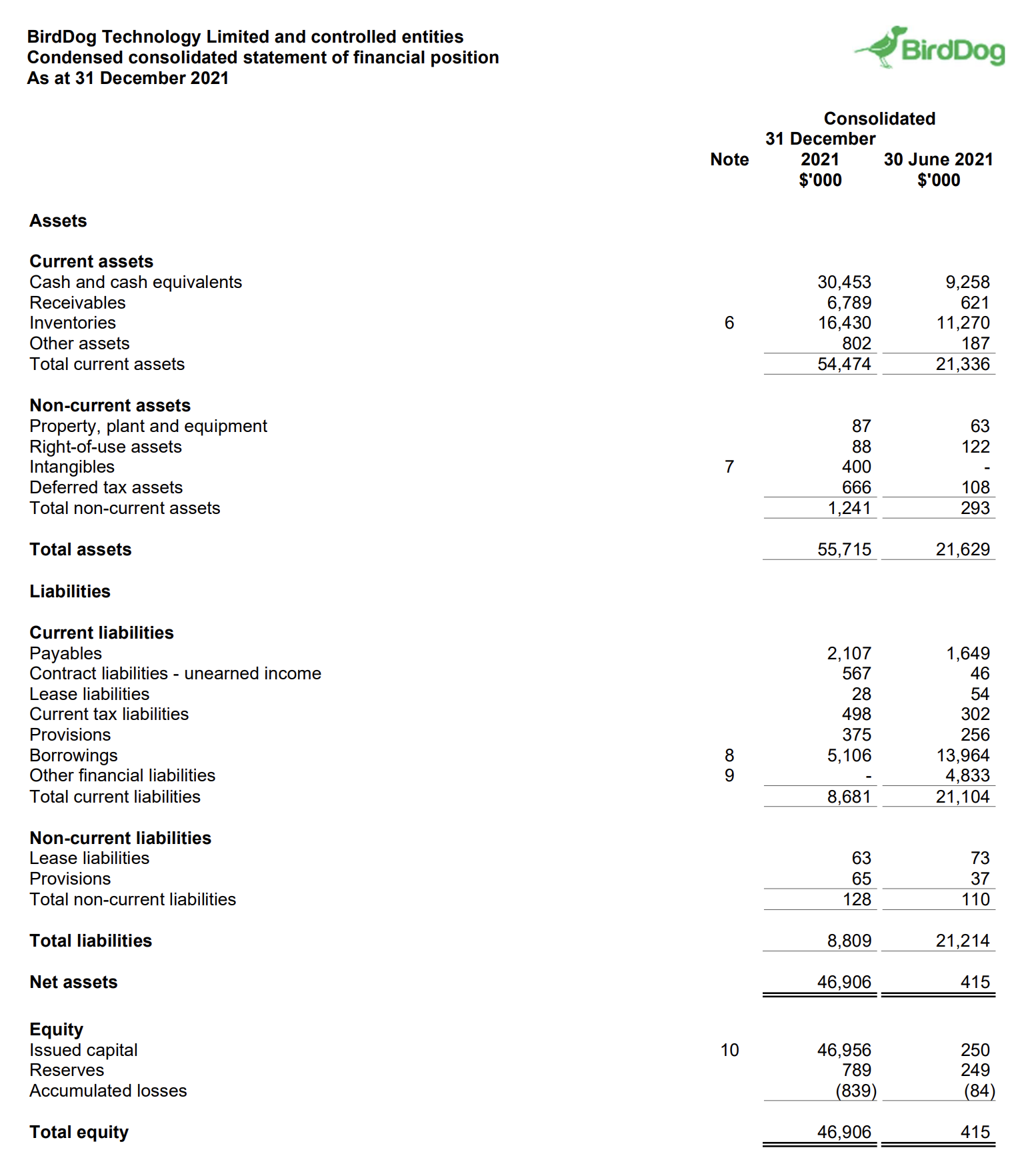

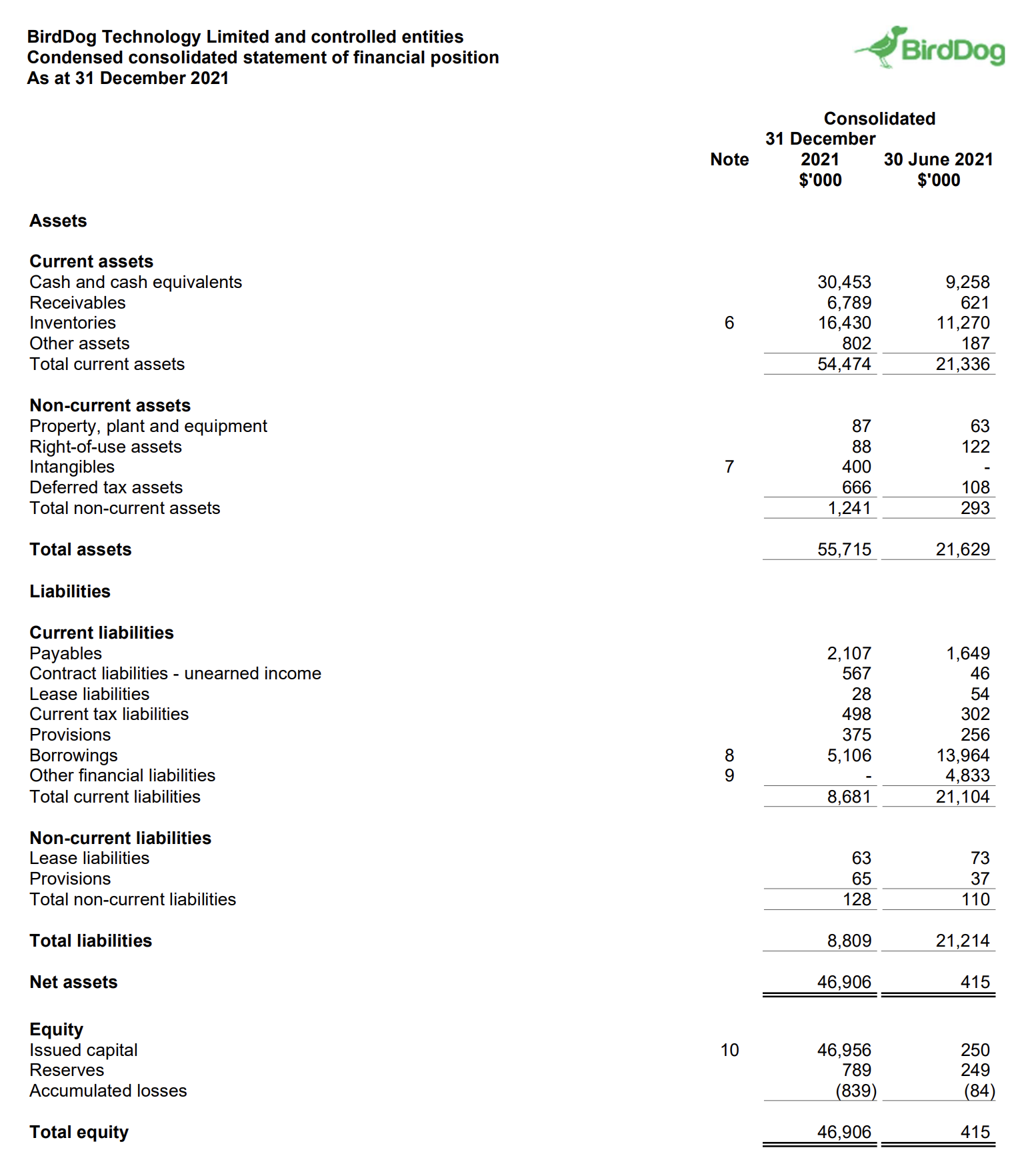

Half Yearly: Balance Sheet

Impressed with the Balance Sheet.

1) Working Capital increased from almost nothing to $46m. Cash increased to $30m thanks to the IPO. Receivable increased from 600k to $6.5m and Inventories increased by $5m to $16m

2) Meanwhile, current liablities decreased because of the repayment of debt

3} the Balance Sheet looks really healthy and allows the management more flexibility to grow the company. This is without the reason why the company IPOed.

4) Didn't get much out of the Cash Flow and P&L statements.

Other Factors:

Didn't know anything about BirdDog until yesterday when it became time to have a glance at their first Appendix 4C.

Lots of SKIN IN THE GAME with co-founders owning over 50%.

Impressive revenue growth, but the question becomes will the company continue to generate high/good growth levels over the next few years.

Current market cap has BirdDog sitting at around $65m (share price 32c) but with $25m of net cash, the enterprise value (EV) sits at $40m giving the company a EV/Sales of 1.

Horrendous sentiment with share price falling from 70-75c at IPO to current share price of 32c. Share price is in a short-term downtrend. One of my rules is NEVER buy into a company in a downtrend or with negative sentiment. Don't know how low the share price will fall and can always buy if sentiment shifts.

Will put BirdDog onto one of my watchlists and I will be paying attention to sentiment/trend shifts AND the news flow from the company. If any entiment/trend shifts co-incides with a PROFIT UPGRADE that could be a tempting buy