This update is placed at the top of the straw so members don't have to scroll all the way to bottom to read the new info.

CBO reported today and it was good one, though the recent run up in the SP had pretty much anticipated these results.

Here are the highlights:

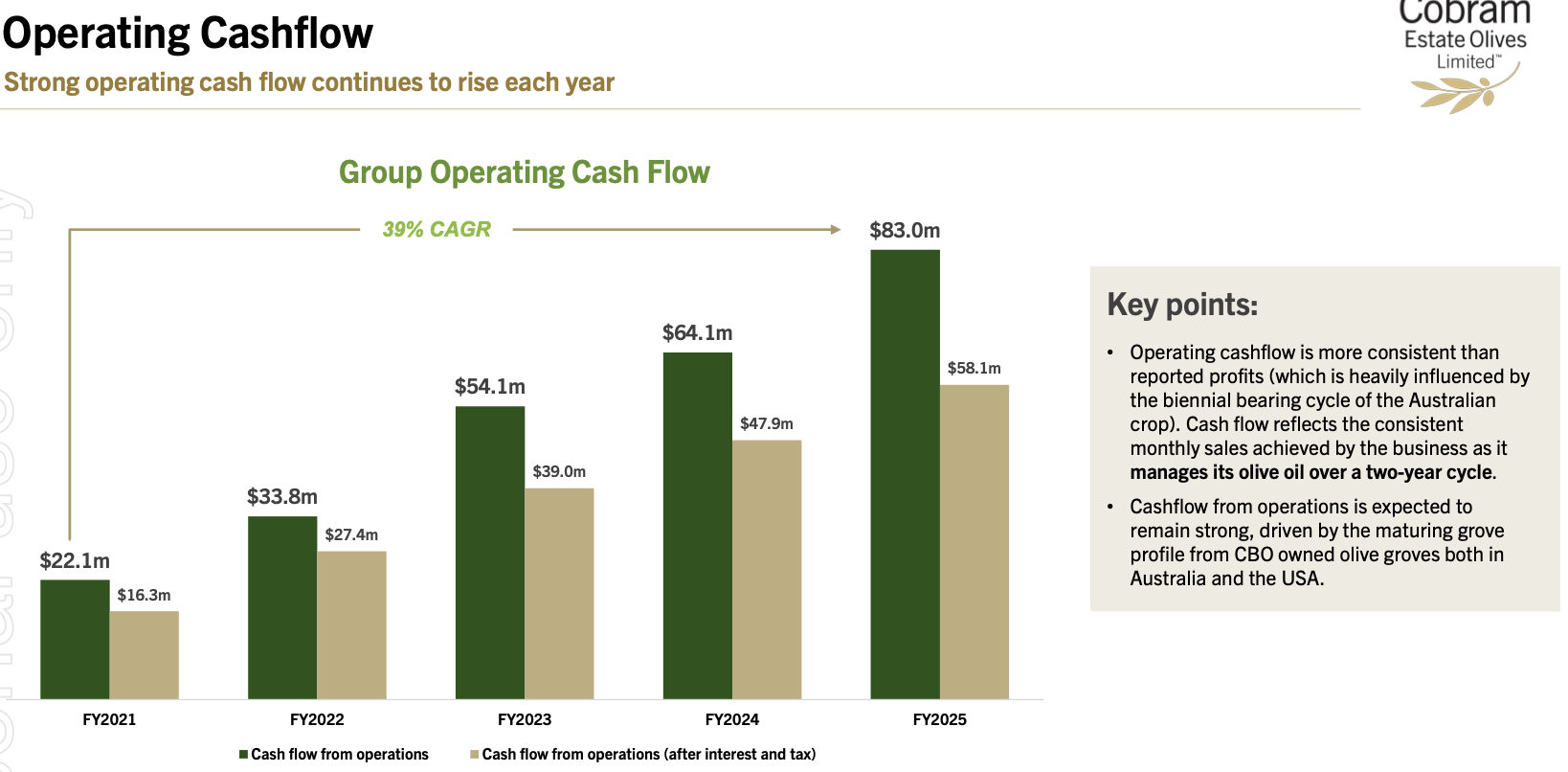

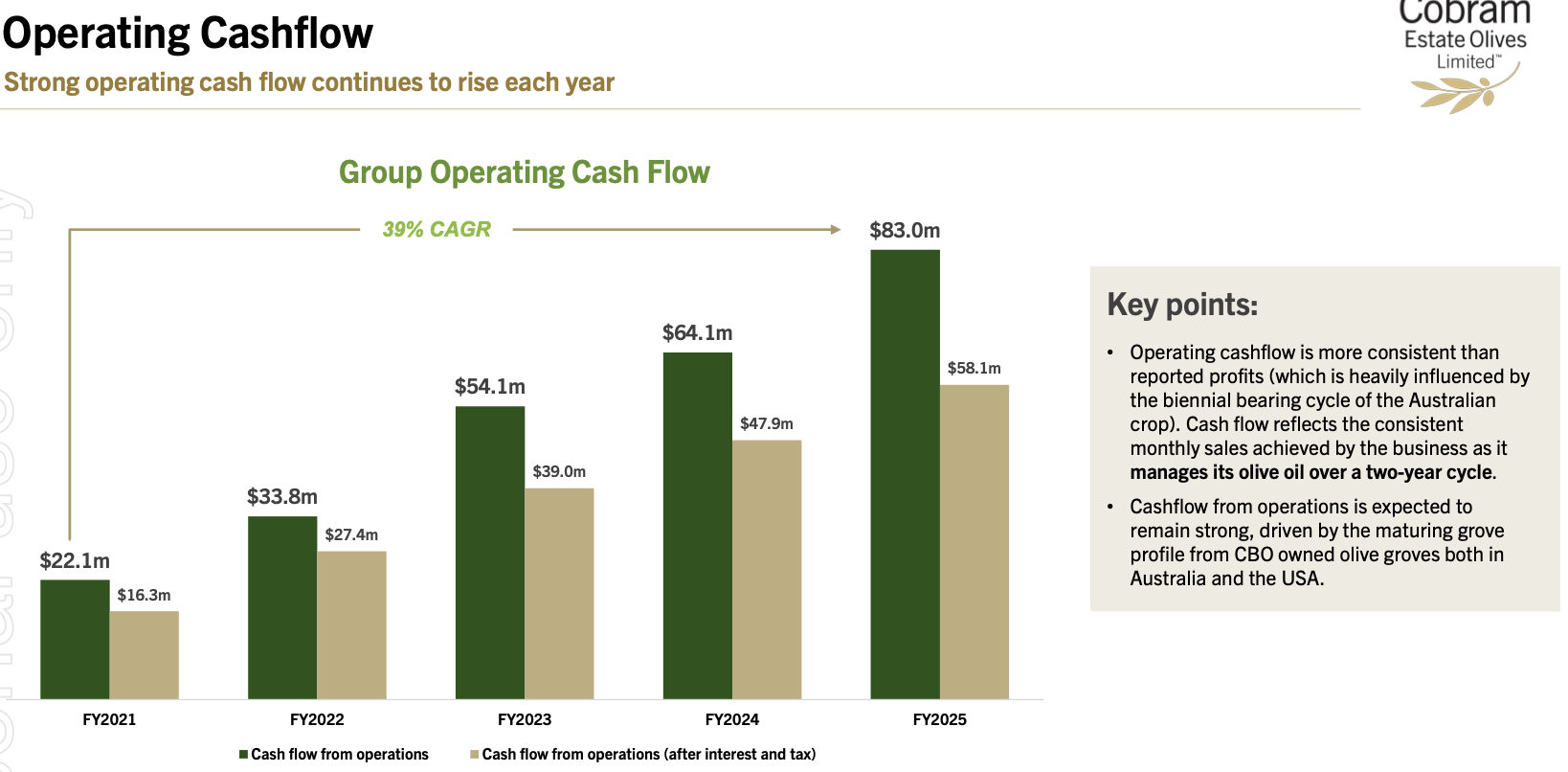

Because the oil is harvested once a year (in each country) and for accounting reasons they need to report the market value of the oil on the date it is harvested, not as it is sold, FCF is a better and more accurate measure of progress. As per above that is growing at a healthy 39% p.a.

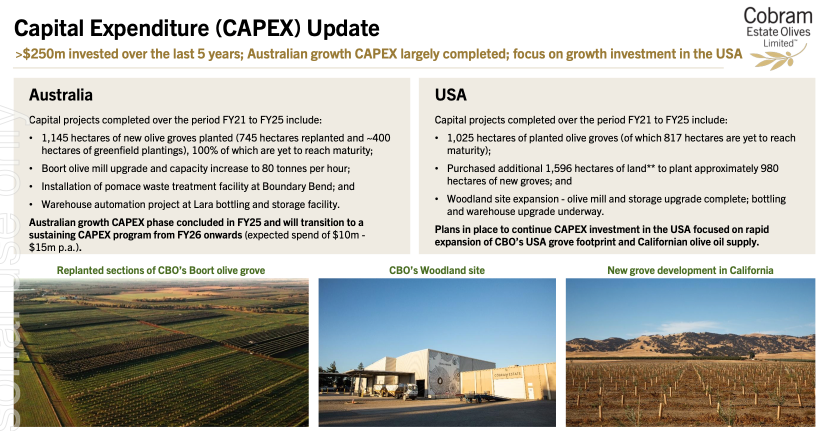

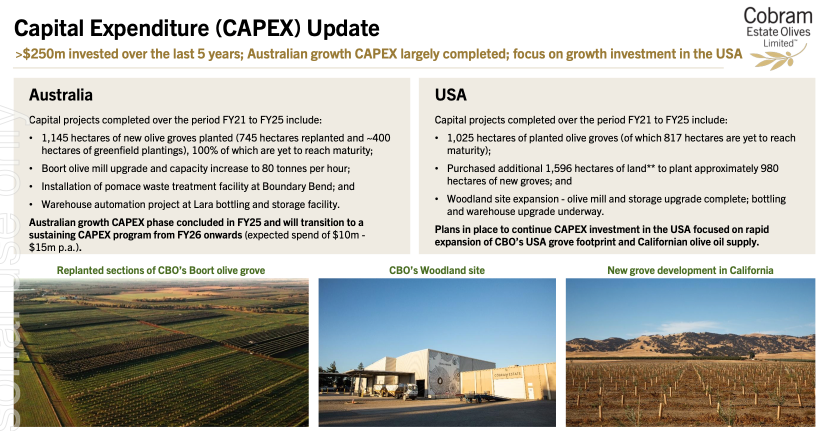

They have a reasonable amount of debt to support their aggressive growth and upgrade plans but interestingly, they are basically done with CAPEX in Australia and will be on maintenance CAPEX for the foreseeable future meaning $10-15m pa

For the Australian business, as the immature trees transition to mature trees, that extra yield will drop to the bottom line. How much are we talking about? An extra 40%.

The US is still in its infancy but will be half the size of the Australian operation in a few years: they are picking up land parcels at reasonable prices and developing this in a measured way as debt and FCF allow them to. There is a long runway to go.

I mistakenly told @Karmast last night that they are the #3 olive oil brand in the US. That was wrong, they are #9, but were #3 in California (now #2). They are the leader in Australia by some margin. They are now the largest vertically integrated olive oil company in the world.

Interesting macro snippets from the call

- regarding the US olive oil market - 95% is imported (mostly from Europe), which will of course now be subject to tariffs.

- the olive oil commodity price has doubled in 5 years

- Spain (Europes largest producer) has had another bad year which will likely impact prices once more

I fully anticipate a sell off in 12 months time as it will be an off year in Australia and they are somewhat constrained by a lack of 3rd party growers/suppliers in the US this year which will crimp the US result.

Excitingly, FY 2027 will herald a large increase in harvest yield both in AU and US trees and will likely be a cracker.

See valuation for 2027 which I believe is conservative.

Held IRL and SM

--------------------------------------------------------------------------------------------------------

CBO reported last week and it was a really good result. The summary of the big numbers is:

Of particular note, this is an "off year" in Australia where the bulk of the crop comes from. Olive trees have a biennial harvest: on years produce a much larger crop than off years. On years in Australia are 2021,2923, 2025 etc. The US has the opposite.

The company is relatively early in its return from an earlier period of significant capex - they have spent up large planting groves, building processing and bottling plants and branding the new US business (66m this year). This process is still ongoing and they have increased borrowing to 225m from 191m last year, This gives a gearing of 25%, but it will be worth keeping an eye on debt serviceability, but the cashflow trend is pretty good

The other thing that needs to be noted is how early on we are assessing this company in the life and productivity of the trees they own:

Australia:

USA:

The big picture is of a company that is currently profitable with a a rapidly improving profitability and a long runway for growth.

So far they are executing well, the US business is now selling as a higher margin branded product rather than as bulk oil and gaining market share in US supermarkets. The Australian business has the number 1 supermarket brand.

RISKS

Currently olive oil prices are increasing rapidly benefitting CBO, because of poor climate and olive tree infestations in Europe. Being an agricultural company, this risk could also cause a catastrophic collapse of the industry here in Australia as well. We have brilliant border security but recently Varroa mite arrived on our shores which will decimate the bee keeping industry. Other exotic pests cannot be discounted.

I think it is a reasonable time to buy into CBO. They have demonstrated that his is business that could scale rapidly and very profitably.

The numbers for next year are likely to fantastic being an "on" year in Australia. The SP is likely to wobble around a fair bit with the biennial production until the US production catches up with the Australian one, so there may be further buying opportunities along the way.

See valuation straw for a very rough sketch